Summary:

- Korean Air and Delta Air Lines joint venture could offer significant opportunities for Incheon International Airport to boost its transit activity;

- Incheon has seen its transit passenger ratio fall by more than a third from 18.7% in 2013 to 12.4% in 2016 and is offering incentives to airlines to boost connectivity;

- Korean Air has a strong operation between North and Southeast Asia and could deliver significant connection options for traffic to and from North America;

- Southeast Asia continues to grow as a major source of tourist interest for North American travellers, but nonstop connectivity is limited compared to links to/from North Asia.

Korean Air and Delta will offer reciprocal codeshares, while the JV addresses a fundamental concern expressed by South Korean authorities around Seoul Incheon Airport - the inconsistent growth/decline of transit traffic. Incheon aims to increase the number of transit passengers from 7.7 million in 2015 to 10 million p/a by 2020, and further to 20 million by 2030. However, its transit passenger ratio has fallen by more than a third from 18.7% in 2013 to 12.4% in 2016.

Supplementing the Korean/Delta partnership is a new transit traffic incentive plan by Incheon Airport, with airport management offering KRW186 billion (USD175.7 million) in incentives to airlines in 2019, representing a 22% increase over 2017 levels.

https://corporatetravelcommunity.com/airport-insight-seoul-incheon-international-airport/

So what does all this mean for competition on the trans-Pacific?

In an exclusive interview with CAPA TV, Japan Airlines' VP marketing and strategy research for the Asia and Oceania Region, Mr Akihide Yoguchi, hoped the venture would stimulate the market between North Asia and the United States as a whole. Mr Yoguchi exclaimed: "I think it's a good thing, but as us, trying to capture the demand from the Southeast Asia and North America, well, they are our competitor, so, we will compete, and we'll stimulate the airline industry to grow together".

While Mr Yoguchi envisages the partnership helping spur growth between North Asia and the United States, it would be difficult to deny that changes are coming in the entire trans-Pacific market due to the scale of the joint venture. Market leaders could see a shift. The new Delta/Korean partnership could actually supersede the American Airlines / Japan Airlines JV as the trans Pacific's second largest coalition, after United Airlines / All Nippon Airways which is ranked first in terms of capacity.

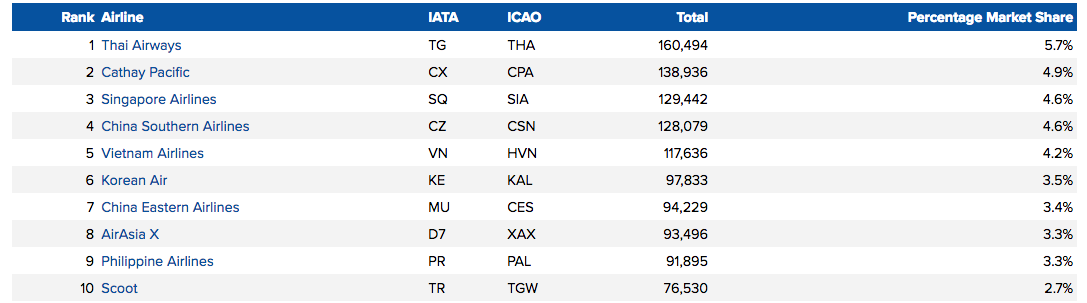

The main difference is Korean Air's access to Southeast Asia, which Mr Yoguchi notes JAL is also targeting. Korean Air ranks sixth for capacity between North and Southeast Asia, with just shy of 100,000 seats offered for the week commencing 30-Apr-2018 - JAL ranks 22nd!

TABLE - Korean Air ranks sixth for capacity between North and Southeast Asia, with just shy of 100,000 seats Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Southeast Asia continues to grow as a major source of tourist interest for North American travellers. Nonstop North America - Southeast Asia services, however, pale in comparison to the amount of nonstop North America - North Asia services. According to the CAPA Route Capacity Analyser, over 19,000 seats were offered on nonstop North America - Southeast Asia routes for the week commencing 02-May-2018. Only three airlines operate: Market leader Philippine Airlines, United Airlines and Singapore Airlines.

Over the same period, almost 430,000 direct seats were offered for North America - North Asia services. Over 20 airlines operate between the regions, with United Airlines standing out as the clear capacity leader with a seat offering just shy of 50,000 in a week. Even if a nonstop market was to grow, intermediate airlines and airports, such as Incheon, seem likely to sustain their strong position in the market, at least in the medium term.

In the fast growing Asia Pacific market, Korean Air's expansion into South and Southeast Asia could bring a defining element to Incheon's transit traffic, and the Delta JV as a whole. With the United / ANA and American / JAL JVs focusing much of their capacity towards China, Incheon and Korean Air could be well placed to launch an offensive based on unserved South and Southeast Asian markets.