Summary:

- ACI World reports continuing passenger air traffic growth in all world regions in Dec-2018, with Europe leading the way, despite economic uncertainty;

- North America is also doing well though US trade wars could have an adverse impact in the future - or they might not;

- Africa again posted the highest growth of all regions both in passenger and freight traffic;

- Freight results are not so good and almost all regions reported declines, the question is, will this freight downturn again be a harbinger of economic recession?

This might be considered an unusual result for Europe where several economies are at best standing still and some, including the biggest four with a combined GDP of USD5.5 trillion, are getting close to a position where they might slip into recession.

Both Germany, Europe's largest economy (GDP USD3.7 trillion), and Italy, Europe's 4th largest, and the eurozone's 3rd largest (GDP USD1.9 trillion) saw their economies slump into the end of 2018, while France continues in the doldrums.

In Germany for example the economy has been impacted by vehicle emissions tests - introduced in the wake of the VW scandal - and a reduction in car sales in China act as a drag on industrial output. Germany has just avoided going into recession by marginally avoiding a second successive quarter of negative GDP in 4Q2018. On the other hand jobs growth remained strong there, along with consumer confidence.

And looming over everything is the continuing saga of 'Brexit' and the possible extension of the UK's leaving date from the European Union, which would do nothing to quell "uncertainty".

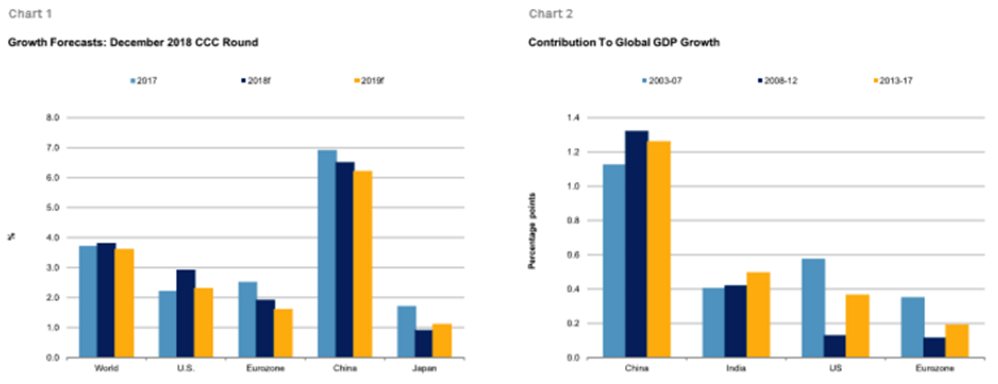

CHARTS - Global growth forecasts Source: S&P Global Economics

Source: S&P Global Economics

North America and Asia-Pacific posted comparable growth rates, at 3.9% and 3.8% respectively on a year-on-year basis. Here again, international passengers fuelled the major part of industry growth in both regions. The US economy is in a good place, with anticipated GDP growth in 2019 of 2-3% (the 'ideal range' to economists), high and growing employment figures and modest inflation. The so-called 'Goldilocks Economy' and probably for more than one reason now.

Looking to 2020 much will depend on the outcome of the trade war which has unfolded between the US and China. This is projected to reduce US GDP growth to 2% then 1.8%. But that assumes that President Trump loses that trade war. So far it has been China that has been the loser and should that continue to be the case then it is Asia Pacific air traffic growth that is more likely to be impacted negatively.

Africa posted the highest growth rate of all regions in Dec-2018, with 9.8%, while Latin America-Caribbean achieved 6.3% increase, the only region having benefited from an upsurge during the month. These are two regions that are often overlooked because traffic is relatively light anyway, particularly in Africa, but they continue to be the ones producing surprising results. The Middle East though, still experiencing the effects of multiple geopolitical challenges, grew by just 2% in December.

These December figures come at the end of a year in which, while global passenger traffic growth has moderated and is not of the same magnitude as in 2017, it has remained fairly robust overall. However, the downside to the ACI figures can be found in the freight segment.

Nearly all regions posted declines in airfreight volumes in Dec-2018, resulting in a 1.5% year-on-year decrease in global volumes, the larger decrease being International (-1.7%) versus -1% for domestic. Again, Africa bucked the trend with 18.7% growth. It does make you wonder why more airlines and airport investors are not revisiting their ingrained attitude towards the Continent.

North America (-1.2%) weathered the storm better than did Europe and Asia Pacific (both -2.5%), "as a consequence of the importance of domestic freight there", according to ACI. However, just how important is the domestic segment? According to the Bureau of Transportation Statistics, the total weight of shipments in 2015 by 'domestic air and air & truck' was two million tonnes, while the exports and imports (international) category accounted for nine million tonnes.

The Latin America and Caribbean market recorded a 0.8% decrease, which was "a major shift," according to ACI, while the Middle East market decreased by 0.9%, which ACI labelled "a continuation of a challenging trend" for the region in 2018.

ACI insisted the decline in airfreight needs to be recognised within the context of the increasing geopolitical instability and ongoing protectionism that has affected global traffic and trade. By geopolitical stability it is almost certainly referring to US trade policies, though they could change.

The more concerning question is, does this global freight downturn signal the onset of a global economic downturn, as has been the case before, and one that would inevitably impact on passenger growth six months or a year down the line?