Summary:

- Two airports at either end of England have announced ambitious master plans that are governed by environmental considerations;

- Newcastle Airport seeks to handle 9.4 million passengers by 2035, Bristol Airport, with greater competition, looks to grow to 12 million passengers by 2050;

- Main threat to Newcastle's master plan assumptions comes from the cancellation of or reduction in Air Passenger Duty in Scotland;

- Bristol will take comfort from Emirates' decision to add flights to Edinburgh - close to Glasgow and Newcastle - as it seeks its own non-stop link into the Middle East.

Newcastle International Airport, the most northerly of all English airports (though only just once Carlisle Airport opens to commercial services in Jun-2018), and close to the Scottish border, launched its master plan to 2035 on 10-May-2018. The plan considers the impact of growth from 5.4 million passengers in 2017 (Britain's eleventh busiest) to 9.4 million in 2035, to ensure sufficient land is safeguarded and environmental issues are considered. The master plan will be open for consultation until 13-Sep-2018. While it is not exactly surrounded by built-up residential areas, environmental considerations are paramount.

MAP - Newcastle International Airport is the most northerly commercial airport in England and as such draws passengers down from the Scottish borders Source: Google Maps

Source: Google Maps

Key details within the Newcastle International Airport master plan include noise abatement and environment issues such as encouraging airlines to operate newer, quieter aircraft types; the operation of preferential air routes and procedures to minimise noise output, exploration of the possibility of alternative 'respite' flight paths; and consultation with local planning authorities to ensure sensitive developments are not built in future noise contours. The plan targets carbon dioxide reductions of 28% against 2010 levels and safeguarding for a possible runway extension if improvements in aircraft technology do not materialise.

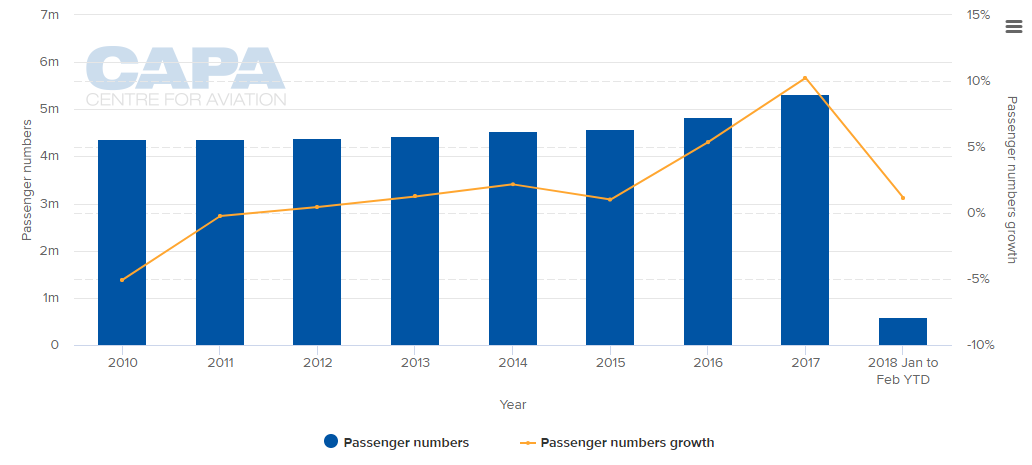

CHART - In common with many other UK airports, Newcastle's passenger growth has been strong during the last two years, rising to 10.2% in 2017, but fell back in the early months of 2018 to 1.2% Source: CAPA - Centre for Aviation and UK Civil Aviation Authority

Source: CAPA - Centre for Aviation and UK Civil Aviation Authority

The airport is heavily dependent on the low cost and charter segments, which account for almost 80% of seats. The full service segment is represented by British Airways (London Heathrow), Air France (Paris), bmi regional (Brussels) and KLM (Amsterdam) services which offer critical hub options for businesses in the area. Newcastle is an important regional centre that is as far away from London as it is possible to be in England.

A well-established Emirates Airline link to Dubai has been a boon to the area (passenger levels may be threatened by a new Emirates link to Edinburgh from Oct-2018), but there are currently no transatlantic services after United Airlines ended a short-lived New York flight following Great Britain's Brexit vote.

There is a little competition from the nearby Durham Tees Valley Airport, and more from the more distant Leeds-Bradford Airport (which is owned by the same Australian fund manager, AMP that part-owns Newcastle) and from Manchester Airport. The soon to open new Carlisle Airport in the west will have little impact.

The real threat to the master plan assumptions comes from the cancellation of or reduction in Air Passenger Duty in Scotland as Edinburgh Airport is within driving range of the Newcastle region and there are fast train/tram services.

Meanwhile, Bristol Airport in southwest England, the equivalent for that part of the world to Newcastle in the northeast, and again serving an economically significant region of the country, one that is actually bigger than Newcastle's even though it has more competing airports (including Exeter, Southampton, Bournemouth, Cardiff, Birmingham and even London Heathrow).

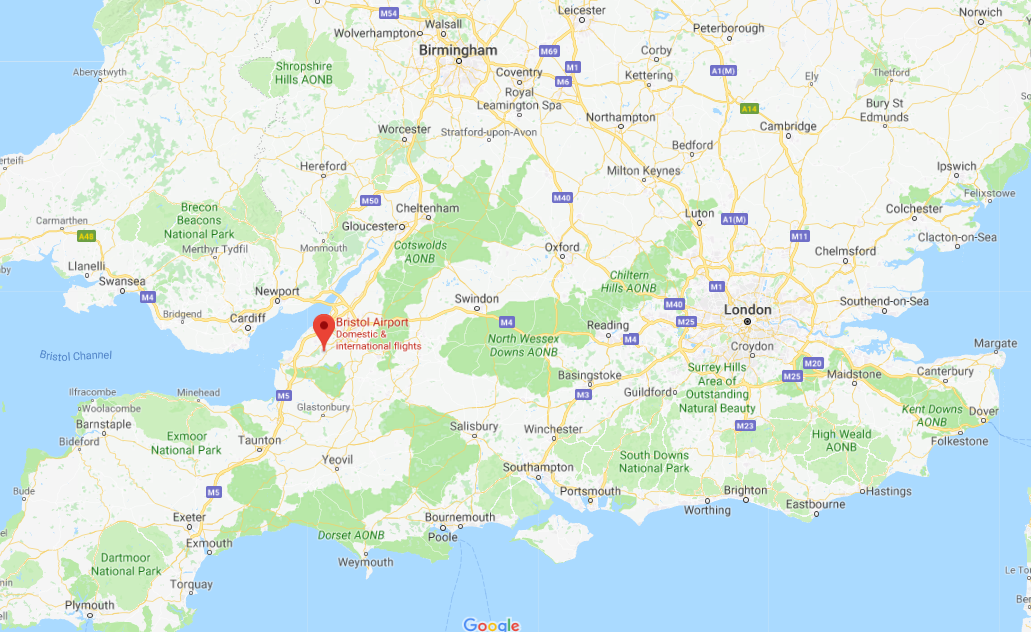

MAP - Bristol Airport faces direct competition from Cardiff Airport in Wales, and other regional airports along England's southern corridor Source: Google Maps

Source: Google Maps

Like Newcastle, Bristol Airport is owned by funds, in this case Canada's Ontario Teachers' Pension Plan (OTPP); and the New South Wales Treasury Corporation and Sunsuper Superannuation Fund, both of Australia, and which between them acquired 30% of OTPP's 100% holding in Bristol Airport in Jan-2018. OTPP also still part-owns Birmingham Airport, which is classed as a competitor to Bristol.

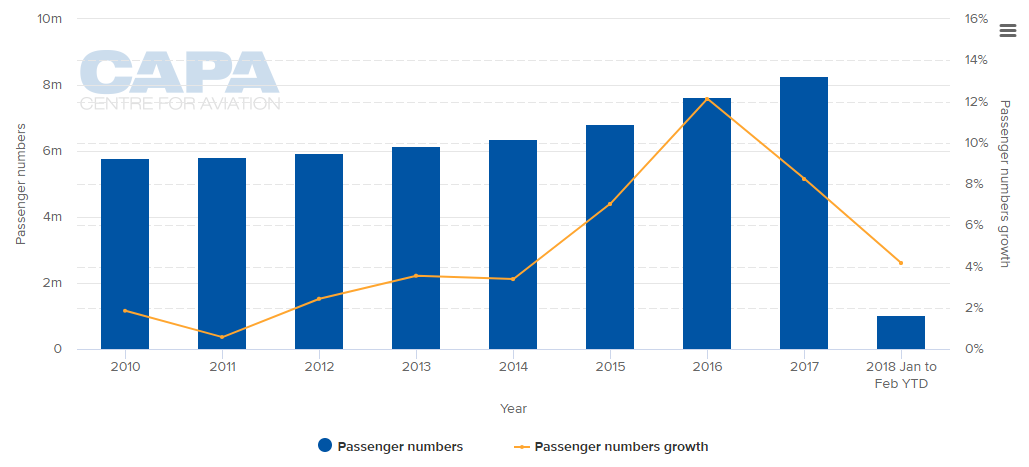

CHART - Bristol was the ninth-busiest UK airport in 2017 with 7.6 million passengers (+8.3%). The overall growth rate has been steadier than Newcastle's, peaking at 12.1% in 2016 Source: CAPA - Centre for Aviation and UK Civil Aviation Authority

Source: CAPA - Centre for Aviation and UK Civil Aviation Authority

As for Bristol's master plan, on 14-May-2018 it launched a public consultation on the latest proposals for the long-term development of the airport. The 'Towards 2050' proposal includes a Charter for Future Growth in five key areas including aviation, economic impact, Green Belt, sustainable growth and surface access.

The commonality with Newcastle where the environment is concerned is plain to see and environmental protection is set to become a critical element of every UK airport's master plan if it wasn't already. The environment aside, the airport also plans to submit a planning application to increase capacity to 12 million passengers per annum.

Bristol has a booming economy on its side, one that, alongside Manchester, is outperforming London by several economic measures. However, and perhaps surprisingly, the airport is more reliant on low-cost scheduled, and charter, flights (90% of seats) than is Newcastle and while there are Paris, Amsterdam and Brussels services there are no long-haul flights at all since Continental Airlines (now absorbed into United Airlines) ended its New York/Newark service in 2010.

It must rankle that the nearby Cardiff Airport (the two cities are 43 miles apart) landed the recently launched Qatar Airways daily Doha service. It would not though if Emirates was to commence a Bristol - Dubai service. With the recent announcement that Emirates will "double-up" in Scotland by flying into Edinburgh daily as well as its Glasgow flights (the two cities are 47 miles apart) there is no evident reason why it should not complement its Birmingham flights at Bristol and offer an alternative travel option.