Summary:

- The Introduction by Qantas of non-stop flights between Perth and London mean 2018 has been a landmark year for the Kangaroo Route, one of aviation's most competitive long-haul air corridors;

- Latest research from UK aviation consultancy MIDAS Aviation for The Blue Swan Daily shows that estimated passenger demand was up +8.3% year-on-year in H1 2018;

- The data shows new non-stop flight helped boost direct itineraries up by a fifth with Qantas' own direct demand levels rising by just over a quarter;

- But, Dubai International Airport is increasingly more popular as a transit point between Australia and the UK, boosting its share of indirect traffic to 27.5% in H1 2018.

From a nine stop 'hop', via a one-stop 'skip' via an Asian or Middle East Hub to the new non-stop 'jump', the popular Kangaroo Route linking Australia and the UK is one of aviation's most competitive long-haul air corridors. Now almost a dozen airlines are actively pursuing the around two million annual passengers flying between the two countries with itineraries routing via new emerging hubs across the globe.

When scheduled Kangaroo Route air services commenced between Australia and the UK back in 1947, it took four days and six stops. Qantas inaugurated flights between Sydney and London on December 1, 1947 using a Lockheed Constellation that carried 29 passengers and 11 crew with stops in Darwin, Singapore, Calcutta, Karachi, Cairo and Tripoli. The Perth-London operation brings the quickest journey between the countries down to below 16 hours.

There may be increasing talk about China as a trading partner in the South Pacific, but the UK is Australia's third largest inbound market for visitor arrivals and the second largest market for total visitor spend and visitor nights. Visitors from the UK generated AUD3.7 billion in total expenditure in 2016 and Tourism Australia's Tourism 2020 strategy estimates that the UK market has the potential to grow to between AUD5.5 billion and AUD6.7 billion in overnight expenditure by 2020, and enhanced air connections will help achieve this.

But things are changing on route. The Qantas - Emirates partnership dominates, but the Australian flag carrier's new non-stop connection has seen its other daily UK flight route via Singapore rather than Dubai, leaving the United Arab Emirates (UAE) behemoth to dominate the flows via its Dubai International Airport, flying either under the EK or QF codes.

The Chinese airlines are pushing harder for traffic with competitive fares via the likes of Beijing, Guangzhou and Shanghai, Royal Brunei Airlines has enhanced its own offer by dropping an en route stop in Dubai and even though Virgin Atlantic no longer serves the Australian market, the Virgin Group has become one of the lowest priced brands for travel currently using a codeshare on Virgin Australia's new Sydney-Hong Kong flight.

Others are notable players, including Singapore Airlines via Singapore Changi, Etihad Airways via Abu Dhabi, Qatar Airways via Doha, Cathay Pacific via Hong Kong and Malaysia Airlines via Kuala Lumpur. Turkish Airlines is expected to enter the market with a competitive offer via the new Istanbul Airport when it launches flights to Sydney by Jun-2019, while Garuda Indonesia is taking a step back as it ends its own non-stop flights between Jakarta and London and increases its flight time in the market.

Latest research from UK aviation consultancy MIDAS Aviation for The Blue Swan Daily reveals some interesting trends in the UK-Australia market over the first six months of the year, based on MIDT (Marketing Information Data Tapes) 'passenger traffic' data of GDS bookings from OAG's Traffic Analyser analysis module.

It shows that estimated passenger demand was up +8.3% across the period, versus H1 2107 with the number of passengers flying on direct itineraries up by a fifth (+20.0%), no doubt boosted by the Perth-London link. In fact Qantas' own direct demand levels rose by just over a quarter (+25.2%) in H1 2108.

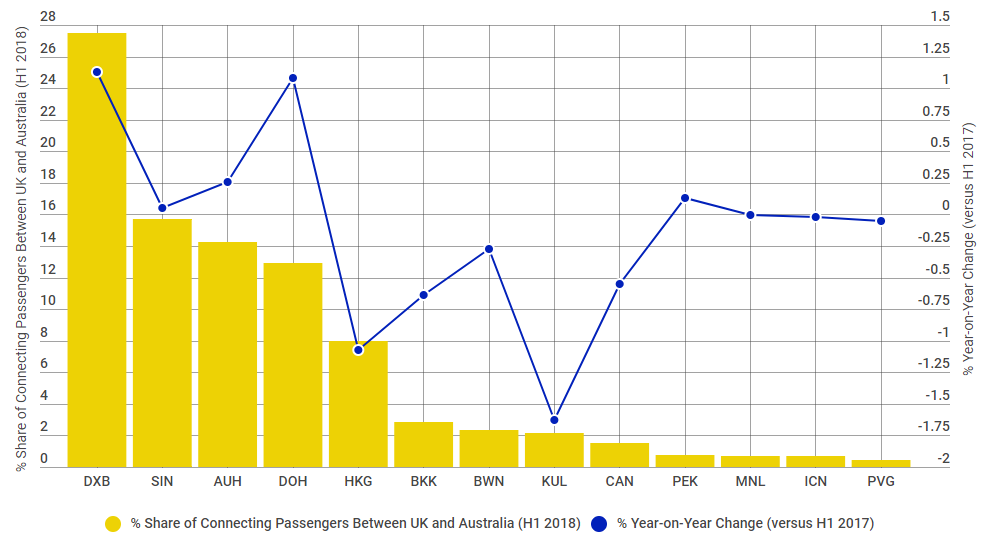

Indirect demand grew at a slower but still very healthy year-on-year rate of +7.1% in H1 2018, according to the data. The changes to the schedules seem to have elevated Dubai International Airport's position as the main transit point for passengers, boosting its share of indirect traffic by one full percentage point, rising from 26.3% in H1 2017 to 27.5% in H1 2018 and translating to around 25,000 additional passengers.

Abu Dhabi International and Doha International have also gained market share, while traffic via Singapore Changi International has remained flat despite the new Qantas flight routing. Kuala Lumpur International has been the main loser, but Hong Kong International, Bangkok Suvarnabhumi International and Guangzhou Baiyun International appear to have also seen their share of indirect transfer traffic in this market decline by more than -0.5 percentage points.

CHART - The Gulf hubs of Dubai, Abu Dhabi and Doha account for more than half of the indirect passengers flying between the UK and Australia, and that share has increased in H1 2018 Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG