Summary:

- Canadian carrier WestJet is to be acquired by Onex Corporation and will become a private company in a transaction valued at CAD$5 billion including debt;

- WestJet is in the midst of several significant changes - most notably placing Boeing 787 widebodies into long haul service and maturing its ULCC subsidiary Swoop;

- WestJet is also in the midst of establishing a transborder joint venture with Delta Air Lines and this deal could pave the way to a future investment from the US major.

WestJet is in the midst of several significant changes - most notably placing Boeing 787 widebodies into long haul service and maturing its ULCC subsidiary Swoop. Those initiatives along with others have pressured its financial targets. For example, WestJet's ROIC for 1Q2019 was 4.5%, significantly below its stated target for 13% to 16%. The company's ROIC has been in the 4% to 6% range for the past year; for the 12M ending Sep-2018, WestJet's ROIC was 5.5%.

Senior executives at the airline have stressed that they were not looking to be acquired, but the Onex purchase, if approved, gives the company significant breathing room to execute its long term strategy. Its CEO Ed Sims essentially offered that approach after the acquisition was announced. "We now have the ability to focus on our long term strategy to deliver against the lifetime of our assets", he said.

The airline is ordering aircraft with a 20 to 25-year life span and the company's CEO stressed, "we need to have business strategy that allows us develop an economic return on those assets for the life of those assets".

Instead, WestJet has been reporting quarterly results, and has essentially been held accountable for executing the transformation under way at the company on a quarter by quarter basis. Given that most of the airline's initiatives are more long term and strategic, in that context, "there are tremendous benefits by operating in conjunction with a partner like Onex", Mr Sims added.

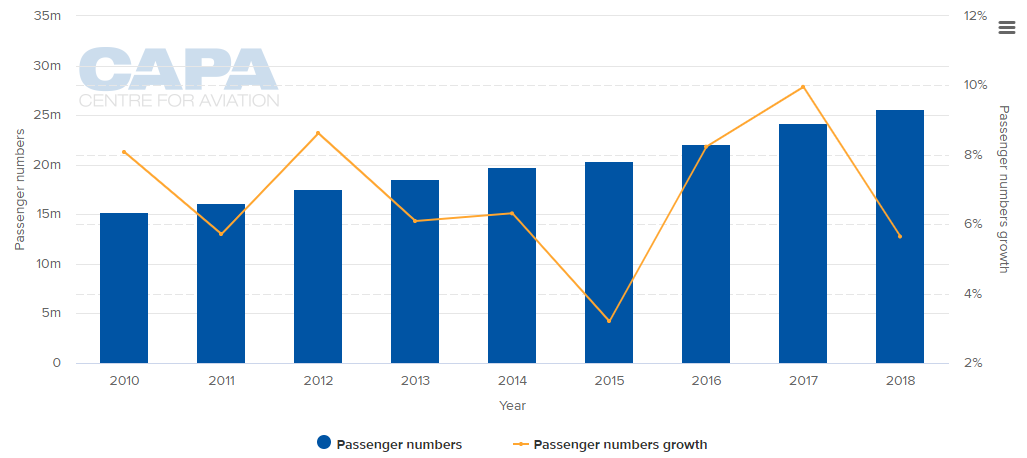

CHART - WestJet has significantly grown its passenger traffic over the current decade, peaking with a +10.0% year-on-year growth in 2017 Source: CAPA - Centre for Aviation and WestJet reports

Source: CAPA - Centre for Aviation and WestJet reports

There is little doubt that WestJet welcomed Onex's interest and worked quickly to reach an optimal deal for both sides. It is likely not the beginning of a trend for airlines to go private, but the Onex-WestJet deal has materialised after speculation in early 2019 that Berkshire Hathaway could be eyeing a takeover of Southwest Airlines.

Even if no additional private equity deals surface in the near future, the Onex-WestJet deal shows that perhaps airlines are becoming more attractive to private equity, and some airlines could welcome the same opportunity WestJet is capitalising on to escape quarterly scrutiny and focus on the long term.

WestJet is also in the midst of establishing a transborder joint venture with Delta Air Lines, and Delta has opted to take stakes in many of its JV partners. At this point, Delta has made no public declarations to invest in WestJet, but Onex's purchase of its partner could change Delta's calculus.