Highlights:

- Thiruvananthapuram's Trivandrum International is one of six airports to be privatised by way of a P3 deal in India;

- The airport is about 200 km south of Cochin, India's very first P3 deal; now that airport wants to take on Thiruvananthapuram's concession;

- This is unchartered territory for both parties and raises a big question... is it a good idea?

Serving the city of Kochi in Kerala state Cochin International Airport was the first airport in India developed under a public-private partnership (PPP or P3) model and was funded by a variety of public and private sector shareholders including the Government of Kerala (the largest at 33.3%), Airports Authority of India (which remains a fixture in all the Indian airport privatisations), Air India, various banks and nearly 10,000 non-resident Indians from 30 countries.

In what is a more diverse concession ownership pattern than at any of the 'big four' of Delhi, Mumbai, Bangalore and Hyderabad, CIAL can be considered to have been a success. Cochin International Airport is the busiest and largest airport in the state of Kerala and in 2017 it catered for almost two thirds (63.86%) of all air passenger movements in the state. It is also the fourth busiest airport in India as measured by international traffic and the seventh busiest overall.

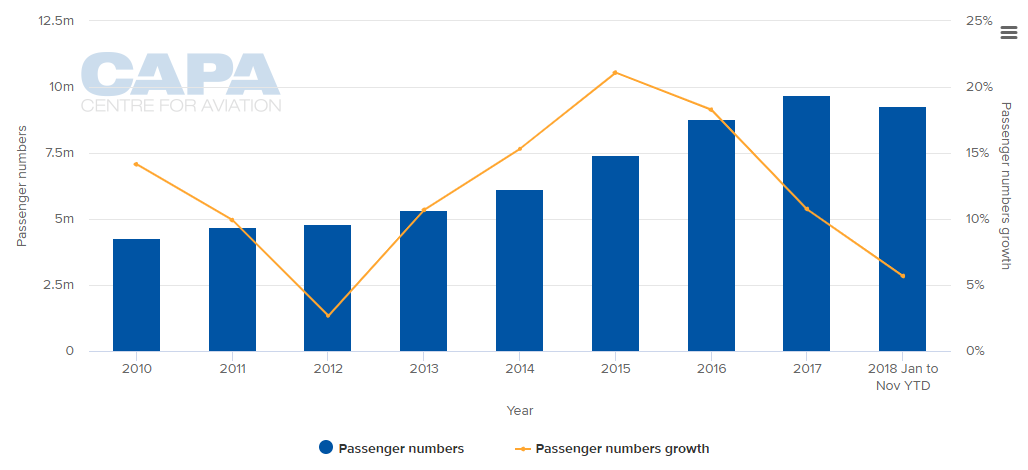

In 2017, the airport handled around 9.7 million passengers and will have passed through the 10 million barrier in 2018 despite the growth rate stalling and then reducing from a peak of 21% in 2015 to just 5.7% in the first 11 months of 2018. It is the major gateway to the tourist-oriented state both domestically and internationally.

CHART - Cochin International Airport annual passenger numbers have grown significantly this decade, albeit levels have reduced over the past couple of years Source: CAPA - Centre for Aviation and Airports Authority of India

Source: CAPA - Centre for Aviation and Airports Authority of India

The largest airline by capacity is Indigo, at over 40%. The LCC Air India Express, while a comparatively minor player, is headquartered in the city. The airport operates three passenger and one cargo terminals with Terminal 3 one of the largest terminals in India.

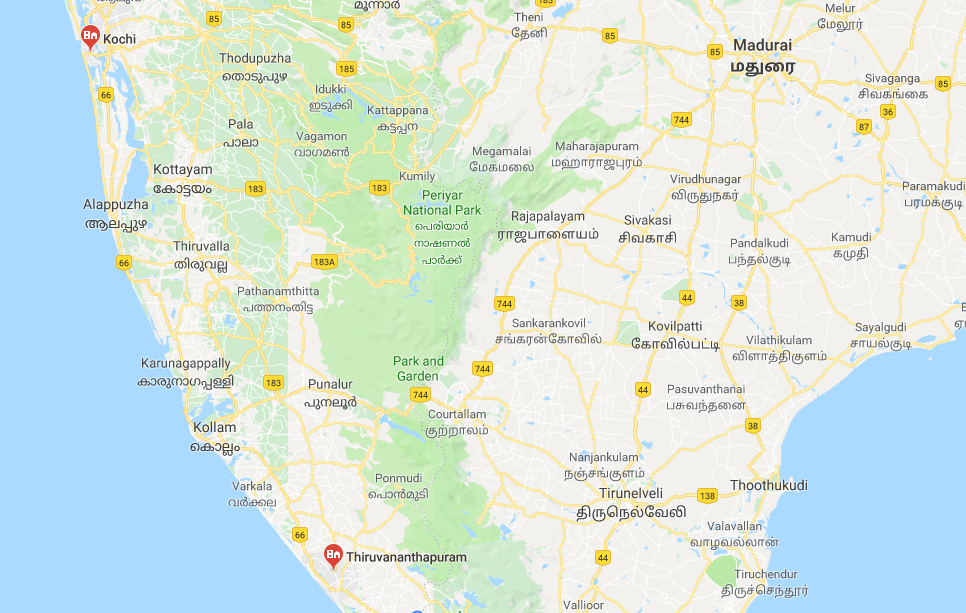

So CIAL's credentials for operating airports are well established but what could it bring to the Thiruvananthapuram Trivandrum International Airport (TTIA)? TTIA is around 200 km to the south of Cochin. Its passenger numbers are a little less than half of those at the larger airport. Passenger growth increased to over 14% in 2016 but has since slipped to 9.9% (2018 first 11 months).

MAP - Thiruvananthapuram is located around 200 km to the south of Cochin Source: Google Maps

Source: Google Maps

The Airports Authority of India-owned airport is the second busiest in Kerala after Cochin and the fourteenth busiest in India. One peculiar feature is that it is the closest to the sea of all Indian airports. While also serving tourism it is close to technological parks and to the Vizhinjam International Seaport which is under construction.

Its capacity on foreign routes is actually considerably higher, at 54.4%, than at Cochin (39.2%) and the distribution of seat capacity by airline bears similarities to that at Cochin. It lacks the same degree of impact from Emirates Airline, Etihad Airways and Qatar Airways but those services are in place along with selected Southeast Asian airlines. Scoot for example will replace Silk Air in 2019.

Thiruvananthapuram is one of six airports where long-term P3 transactions will be permitted following an about-turn by Airports Authority of India, as highlighed in the previous The Blue Swan Daily article. AAI will remain a participant and will benefit accordingly from the process.

https://corporatetravelcommunity.com/indian-government-commits-to-50-year-lease-concessions-on-six-airports

It is a peculiar situation and one that is typical in India where the red-tape-bound privatisation process is something of a mish-mash. If CIAL is successful it would leave both airports partially under the control of AAI and a variety of private sector organisations, with CIAL in overall control, and competing with each other for the same foreign tourist and business traffic.

While CIAL offers operational benefits such as its commitment to solar power (in 2015, Cochin International Airport became the world's first fully solar powered airport) this is a little bit like the nonsense that is Grupo Aeroportuario del Pacifico's concession on the Kingston airport in Jamaica when it already holds the concession on the competing Montego Bay airport, one that is already coming under close scrutiny.