Summary:

- Plans for a major extension to the main airport terminal building at Leeds Bradford Airport (LBA) have been approved by Leeds City Council;

- It allows construction of a two/three storey extension to the main airport terminal building to provide an improved arrival experience and departure gate facilities;

- The city-region is economically successful but the airport does not mirror that success and it continues to live in the shadow of the much larger Manchester Airport.

One way or another there is a lot going on in Leeds, the UK's third largest city by population, The city-region has one of the most diverse economies of all the UK's main employment centres and has seen the fastest rate of private-sector jobs growth of any UK city. It also has the highest ratio of private to public sector jobs of all the UK's Core Cities, with 77% of its workforce employed in the private sector.

Leeds claims to have the UK's largest legal and financial centre outside London, worth GBP13 billion to the city's economy with more than 30 national and international banks located in the city. It is also the UK's third-largest manufacturing centre with around 1,800 firms. All-in-all, the fourth largest UK urban economy. Even the football team looks like it could be promoted back to the Premier League.

It compares well with the likes of Manchester and Birmingham, both of which have similarly-sized metropolitan areas. And yet it does not score highly in global rankings.

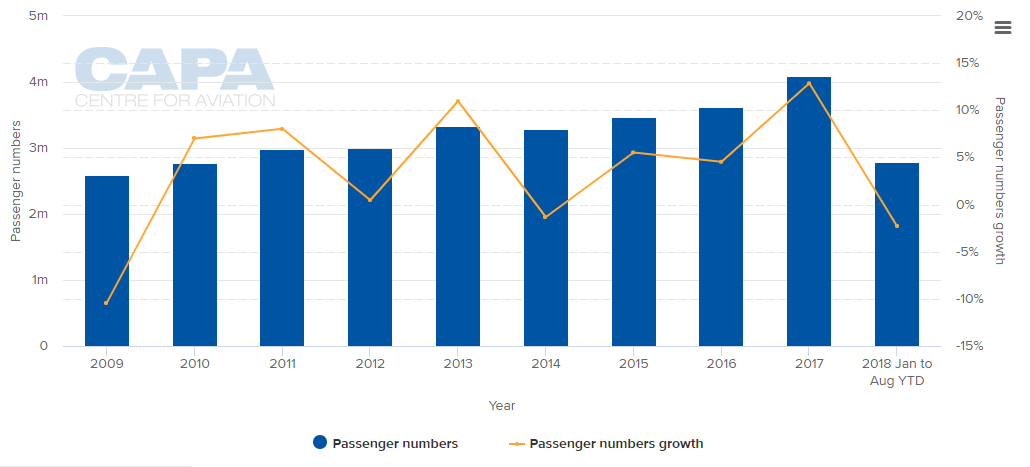

The most damning indictment is that in 2017 there were only 4.1 million passengers at Leeds Bradford Airport, although that did represent an increase of +12.9%. In the first eight months of 2018 the growth rate plummeted to minus -2.3%. In contrast Birmingham handled almost 13 million passengers in 2017 (+11.5%) while Manchester Airport, 50 miles down the M62 motorway, recorded 27.8 million (+8.5%).

CHART - Leeds Bradford has seen healthy passenger growth in recent years, peaking at +12.9% in 2017, but traffic has actually declined across the first eight months of this year Source: CAPA - Centre for Aviation and UK Civil Aviation Authority

Source: CAPA - Centre for Aviation and UK Civil Aviation Authority

The airport has been under private ownership (allowing for an unspecified 'special interest share' held by five local councils to protect their interests) since May-2007. Firstly by private equity firm Bridgepoint Capital and then, since Oct-2017, by AMP Capital, which owns airports in Australia, and has a part share in Newcastle Airport, 100 miles to the north, and in the concession which operates London Luton Airport.

AMP is thus more experienced internationally than Bridgepoint but that has made no fundamental difference to Leeds Bradford's fortunes. It still performs at the level associated with a secondary or tertiary level European city. It is not unique of course. In Germany for example, two cities of equivalent size, Düsseldorf and Dortmund, are situated just 71 km (44 miles) apart. Düsseldorf's airport, Germany's third busiest, hosted 24.6 million passengers in 2017 while Dortmund, the largest city in the 5.1 million population Ruhr industrial area, managed just two million.

IMAGES - The terminal extension at Leeds Bradford is part of the airport's 'Route to 2030 Strategic Development Plan' - which will grow annual passenger numbers from four million to seven million by 2030

Source: Leeds Bradford Airport

Source: Leeds Bradford Airport

There are winners and losers everywhere and Leeds continues to lose to Manchester, where critical infrastructure has always long preceded that in the Yorkshire city. In fact accessing LBA by public transport still means taking a bus.

With such lack of transport connectivity scheduled airlines are often loathe to try new services. (There is a geographical converse; airlines considering flying into Manchester will always know there is a market in the Yorkshire and Humber area). So when SAS commenced a twice-weekly weekend service from Copenhagen to Leeds Bradford in 2014 it could not compete with its own daily service at Manchester and could only cannibalise its own weekend traffic there.

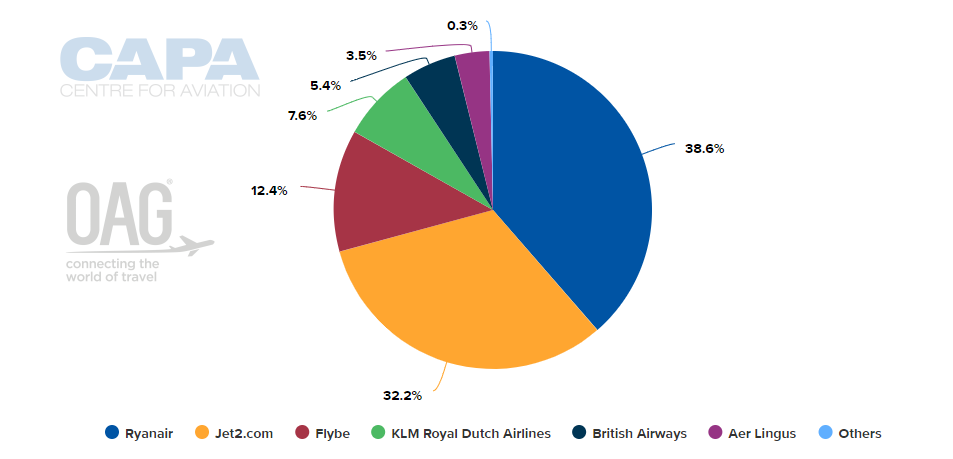

And that is what Leeds Bradford really needs - foreign network airlines that open up more European hubs beyond just London and Amsterdam. Jet2.com and Ryanair have a comprehensive range of services but even on the rare occasion they are to a major hub (e.g. Jet2 to Paris CDG) who wants to self-connect in a complex multi-terminal airport like that?

CHART - Ryanair and Jet2.com have the largest seat capacity at Leeds Bradford:, the largest foreign network carrier has just 5% Source: CAPA - Centre for Aviation and OAG (data: w/c 10-Dec-2018)

Source: CAPA - Centre for Aviation and OAG (data: w/c 10-Dec-2018)

Leeds Bradford is unlikely to acquire direct long-haul services bar its Christmas Shopping charters to New York with Jet2.com (even those to Pakistan that were supported by a large local diaspora have gone, consolidated into Manchester). Meanwhile, charter flights by TUI are dwindling - it will suspend six routes in summer 2019.

While Jet2.com will add 100,000 seats and reach 49 destinations next year, the number of sustainable routes will soon peak. If Leeds Bradford cannot attract major network airlines now then it will be increasingly harder in 2019 as economic woes in Europe are set to multiply.