Summary:

- An Infraero IPO, which has been aired several times previously, is under consideration again, but other methods of disposal might also be considered;

- Infraero's value as an investment decreases with every divestment of an airport to the private sector under concession... and they keep coming;

- The total passenger traffic at these ten privatised airports in 2017 amounted to 118 million, a large proportion of the total air passenger traffic for the country;

- A forthcoming fourth tranche of Brazilian concessions involves 11 airports and will reduce its interests further.

The fundamental problem facing Infraero, one which has existed since the airport privatisation process began in Brazil in 2011, is that it is shrinking. Already, 10 major airports, including the largest ones in São Paulo, Rio de Janeiro and Belo Horizonte, along with the capital's airport (Brasilia) have been privatised by concession, with Infraero holding a minority stake in that concession, from full ownership previously.

TABLE - The first three tranches of airport privatisation in Brazil has seen ten airports placed under concession - 60% of air passengers in Brazil are now handled at privatised airports Source: The Blue Swan Daily and CAPA - Centre for Aviation Airport Privatisation and Finance Review 2018

Source: The Blue Swan Daily and CAPA - Centre for Aviation Airport Privatisation and Finance Review 2018

The total passenger traffic at these ten airports in 2017 amounted to 118 million, a large proportion of the total air passenger traffic for the country. Infraero's shareholding and participation in those airports is under review. A sell-off of its shares has been mooted but subsequently suspended in the case of the São Paulo Guarulhos and Campinas Viracopos airports.

In the recent past the government has spoken of "downsizing" Infraero or even "terminating" it by privatising its stakes in all the airports it oversees and/or is a shareholder in.

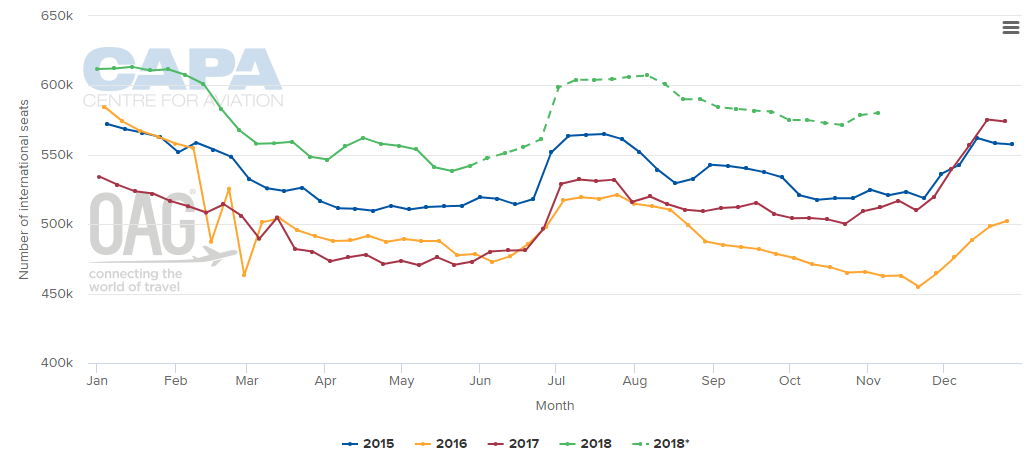

CHART - Capacity data shows that Brazil's international market (top) has returned to growth, but its domestic market (bottom), while up on previous years is still down on levels recorded ahead of its economic collapse

Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Indeed a privatisation-by-IPO scenario for Infraero has already been discussed, in 2017, involving a consultant (possibly the same one) and a suggestion that it might be privatised "like AENA" (which was partially privatised by an IPO and trade sales in Feb-2015).

Now those issues have been compounded by the forthcoming fourth tranche of Brazilian concessions, which will reduce its interests further. This next tranche involves 11 airports that the state will concede in 2H2018. In Nov-2017 the Ministry of Transport, Ports and Civil Aviation (MoTPCA) authorised eight consortia to commence technical, economic and environmental viability studies for the concession of those airports and three did.

The airports are arranged in three blocks - Northeast, Mato Grosso, and Vitoria-Macae - each with an 'anchor' airport in the way the Mexican airports were concessioned (the Brazilians have a phrase for it - "steak with bone", meaning something valuable along with the leftovers).

https://corporatetravelcommunity.com/brazils-airport-privatisation-merry-go-round-could-be-a-tv-soap-opera/

Leftovers or not, Infraero isn't expected to have much to do with these airports at all after the transactions are completed, which is perhaps why Latin American giants such as Corporación América, the Argentinean infrastructure and technology conglomerate that is involved with over 50 airports worldwide, have already shown interest.

At this rate, Infraero will be saddled with the leftovers of the leftovers, which begs the question why AENA would want to participate in any M&A activity and what it might bring to the table anyway. When AENA was partially privatised it is understood that there was faction that would have preferred a divestment of its smaller, loss-making airports, of which there are many. However, such an eventuality was not possible under the law - the DORA - by which the privatisation was authorised.

AENA certainly has the experience of operating large numbers of secondary and tertiary-level regional airports but whether it would want to assume responsibility for more of them is open to debate.

Further information on this subject can be found in The Blue Swan Daily report 'Brazil's airport privatisation merry-go-round could be a TV soap opera', while further insights will be available in the soon-to-be-published Airport Privatisation and Finance Review 2018, which includes a special feature on Brazil.