Aviation sustainability: how effective is carbon offsetting?

As scrutiny and criticism of the global aviation industry continues to grow, JetBlue Airways' recent declaration that its US domestic flights will be carbon neutral in 2020 is the latest declaration by an airline that it is taking climate change seriously.

Airlines need to continue their work to reduce their carbon footprints, including operating newer, fuel efficient aircraft, using more fuel efficient navigation techniques, and eliminating single use plastics from their operations. Airlines also need to stay at the forefront of biofuel development.

But the pledges by JetBlue and others to become carbon neutral or decrease their carbon footprints result in questions arising over accountability and costs to airlines of their environmental programmes. Those questions will rise in importance as the industry works to demonstrate its commitment to battling climate change.

TO READ ON, VISIT: Aviation sustainability: how effective is carbon offsetting?

Bushfires, economy and now Wuhan slash Australia's air travel

In Australia, it seems "it never rains, but...". The widespread bushfires ravaging much of Australia's south and east coasts follow years of drought, rendering the usual expression incongruous.

For Australia's aviation (and tourism) the damage had already started in 2019, as a slowing economy and reduced competition hobbled air travel growth, both domestically and internationally.

Then the widely publicised fires across many hundreds of thousands of hectares of bushland, right into many popular tourism destinations, caused a sudden and much steeper drop; international tourists stayed away and many domestic travellers changed plans, right at the height of the domestic holiday season.

Now, with memories of 2003's catastrophic SARS impact almost faded from memory, the threat of an animal-originated pandemic rears its head again - just as the massive Chinese New Year holidays begin. China is Australia's largest international inbound tourism market, and as many Chinese now call Australia home, the two way flow has increased the overall volume of traffic.

TO READ ON, VISIT: Bushfires, economy and now Wuhan slash Australia's air travel

TAP Air Portugal SWOT: new ownership potential

For the first time in 2019 TAP Air Portugal entered the top 15 in CAPA's ranking of European airline groups by passengers. It carried 17.1 million passengers, up 8.2% year-on-year and double the number of 10 years earlier.

TAP's part-privatisation in 2015 has led to resurgent growth and investment in fleet renewal, including the acquisition of A321LR aircraft and the new route possibilities they bring. The leading airline in Portugal, an important leisure destination, TAP has natural strengths in Latin America and has also developed Africa and North America to give more balance to its long haul network.

However, the airline struggles to generate consistent profitability and faces increasing capacity constraint at its Lisbon hub, and there have been signs of discontent from David Neeleman, one of TAP's investors. If he sells out, further shareholder changes could result, possibly attracting interest from a major European airline. Meanwhile, TAP must continue to develop partnerships with Azul and JetBlue, two airlines with which Mr Neeleman also has strong connections.

This report considers TAP's strengths, weaknesses, opportunities and threats.

TO READ ON, VISIT: TAP Air Portugal SWOT: new ownership potential

David Neeleman's Breeze airline launch: is 2020 feasible?

Anything that David Neelemen does in the aviation industry will inevitably attract attention. One of the more interesting developments in US aviation during recent years has been his plans to launch a new airline in the country, focusing on secondary markets. Mr Neeleman's re-entry into the US domestic market will be very different from when he and his management team launched JetBlue, which made its maiden flight in Feb-2000.

Initially, the new carrier aimed to launch in 2021, but reports surfaced in late 2019 that the airline could accelerate its launch to 2020 with Embraer jets from Azul, of which Mr Neeleman is chairman of the board. So far, the airline has only announced that Salt Lake City will serve as its headquarters, and company executives are keeping specific network plans under wraps.

The new operators may not have a lot of direct competition on their routes but overall, Mr Neeleman and his management team will launch in a much healthier US aviation industry than when JetBlue made its debut nearly 20 years ago.

But the foundations of the strategy are equally important: the revolutionary potential role of the new small narrowbody aircraft now coming into the market, with the capability to provide longer haul and low seat cost (and low emissions) on very small city pairs.

TO READ ON, VISIT: David Neeleman's Breeze airline launch: is 2020 feasible?

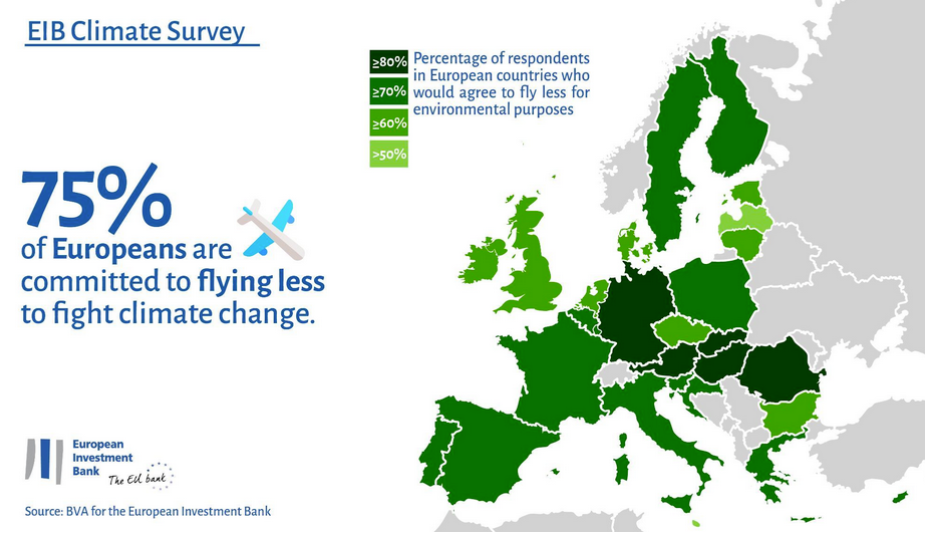

EIB: "75% of Europeans will fly less in 2020". Are you serious?

On 14-Jan-2020 The European Investment Bank (EIB) released a report, the "2nd EIB Climate Survey", based on research performed by a market research partner, BVA, was certainly good for a few headlines. But what else was it good for?

As the self proclaimed "biggest multilateral financial institution in the world and one of the largest providers of climate finance", it would be reasonable to expect a sensible contribution to the climate debate.

But the sheer nonsense of converting the percentages in its report to real numbers undermines what is otherwise undoubtedly a worthwhile cause.

93% of Chinese will fly less in 2020? Just translate that to actual figures. To be meaningful, assuming "less" means (1) they would otherwise have flown and (2) they will take at least one less flight, that is 1.3 billion less flights in 2020. In effect there would be no air travel at all in China in 2020.

TO READ ON, VISIT: EIB: "75% of Europeans will fly less in 2020". Are you serious?

Delta Air Lines' Pacific transition will take time to bear fruit

The first half of 2020 is a key time for Delta Air Lines in its Asia Pacific operations as it moves operations from Tokyo Narita to Haneda and begins operating from Beijing's new airport, Daxing. Although Delta believes those moves are critical for its long term success in the region, the airline is warning that the transition could create some short term uncertainty in its Pacific operations.

Delta could get some reprieve from tough conditions in the Asia Pacific out of the first phase of a new trade truce between the US and China, but there is still uncertainty about the effect that the tenuous agreement will have on overall global economic activity.

Concurrently, Delta appears to be indicating that it could take some time for the transitions occurring in its trans Pacific operations to reach their full potential.

TO READ ON, VISIT: Delta Air Lines' Pacific transition will take time to bear fruit

Ethiopian Airlines proposes an ambitious Addis Ababa airport project

While it is the case that airlines do sometimes build and operate new airport terminals, and very occasionally airports, the suggestion coming out of Addis Ababa, the capital of Ethiopia, transcends anything that has gone before it.

It looks as if Ethiopian Airlines' CEO Tewolde GebreMariam has committed the airline to building a brand new USD5 billion airport at Bishoftu, 40km south of Addis Ababa, to make the city the continent's leading hub. The 35sqkm airport would have a design capacity for 100 million passengers per annum, which would put it among the five largest airports in the world as things stand, and Mr GebreMariam has claimed that it will be Ethiopian Airlines' growth that will fill that airport in a few years' time.

By comparison, the current airport at Bole has a capacity of less than 20 million ppa; Ethiopian Airlines has 93.4% of the seat capacity and 98% of aircraft movements at Bole Airport (week commencing 20-Jan-2020) .

Ethiopia would have to become a major destination for both business and leisure and the primary destination in Africa in the way that the big Middle Eastern airlines capitalise on their hub cities.

Reading between the lines, the project at Bishoftu would be the biggest commitment by an airline to operating an airport, anywhere.

TO READ ON, VISIT: Ethiopian Airlines proposes an ambitious Addis Ababa airport project

LOT Polish Airlines/Condor: Europe's 14th ranked airline group

LOT Polish Airlines' owner, Polish Aviation Group, is to buy the German leisure airline Condor Flugdienst, subject to competition authority approval. The purchase will create a new airline group of almost 20 million passengers, ranking as Europe's 14th largest by passenger numbers, just behind Alitalia (based on 2019 data).

Investment by LOT will enable Condor to repay a bridging loan of EUR380 million from the German government. The loan was provided after Condor's former owner Thomas Cook Group went into liquidation in Sep-2019.

LOT plans to develop the Condor brand, which is decades old and retains historic ties with Lufthansa, once a shareholder in the airline before Thomas Cook became the sole owner in 2006. Condor has codeshare agreements with Lufthansa and participates in Lufthansa's 'Miles & More' loyalty scheme.

The two networks are geographically complementary and the deal should build on LOT's strengths. As with all acquisitions, execution will be crucial. It is certainly a strong signal of intent from LOT, only a few years after emerging from its own restructuring.

TO READ ON, VISIT: LOT Polish Airlines/Condor: Europe's 14th ranked airline group