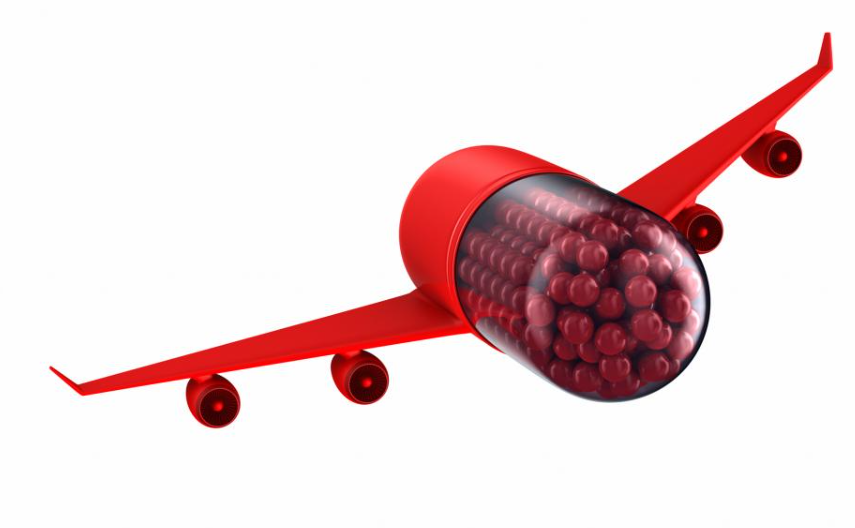

Global air cargo shipments of COVID-19 vaccine: the next challenge

Christmas is coming, the comet is coming, or so they say, and eventually, when COVID-19 vaccines have passed the essential testing procedures - so will they.

Developing them is only half the problem. Distributing them worldwide will be a logistical challenge on an unimaginable scale

Fortunately, some organisations are stepping up to the plate to make sure the best possible logistical arrangements are in place in advance of vaccine certification and, hopefully not long after that, the shipping of the vaccines. They are joined by individual companies such as the one featured in this report, WFS (Worldwide Flight Services).

But the challenge is huge, and we still await the intervention of global authorities to co-ordinate it. After all, there is not a single nation on earth that is unaffected by the virus.

TO READ ON, VISIT: Global air cargo shipments of COVID-19 vaccine: the next challenge

Eurostar-Thalys rail merger proceeds, challenges European air routes

With all the problems the air transport industry has at present, and those it will face again from the environmental lobby, it does not need any more. But a merger between two of the leading high-speed rail companies in northern Europe - Eurostar and Thalys, which was first mooted last year but considered unlikely to come to fruition soon, is pressing ahead.

What it will do is to present the aviation business with a genuine threat to its revival prospects across six very highly populated areas - Southeast England, Ile de France, Hauts de France, Belgium, the Dutch Randstad, and Germany's Ruhr. And even further, if other operators join as associates to form a regulatory area of their own and exiting experiments between France and Spain are continued.

But rail does not have it all its own way. Services have been decimated just as they have in the air, and there are some technical difficulties to overcome.

Nevertheless we are shaping up for an almighty war for business in some of Europe's most important regions.

TO READ ON, VISIT: Eurostar-Thalys rail merger proceeds, challenges European air routes

CAPA Live: American Airlines - long term optimism, short term realities

This report follows a discussion with American Airlines CEO Doug Parker, speaking at the recent CAPA Live October 2020 conference, on 14-Oct-2020.

US airlines are increasingly adopting a long term optimistic view, even as the harsh realities created by the COVID-19 pandemic force those operators to swallow a huge dose of short term realism.

In the current reality they face, airlines are celebrating small victories - what appears to be slow movement of demand trends in the right direction, and the shirking of gaping losses in revenue on a sequential basis.

And even as the general consensus is that it could take two years or more for traffic to reach pre-pandemic levels, American Airlines is bullish that it and its competitors have built up ample liquidity to survive the crisis - as long as demand steadily continues to rise.

TO READ ON, VISIT: CAPA Live: American Airlines - long term optimism, short term realities

British Airways' Alex Cruz takes the fall

When Willie Walsh became British Airways CEO some 15 years ago, his mandate was to drag the flag carrier into the 21st century. He did succeed in redirecting the ailing airline towards an ability to compete in the new world where LCCs occupied an ever increasing market share in Europe.

The cost-heavy airline had been staring down the barrel of inevitable decline if the changes were not made. His work was constantly dogged by the behaviour of unions and, often, politicians who continue to treat the company as if it were still a government department.

Luis Gallego took over from Mr Walsh as CEO of IAG only in Sep-2020. One of his first moves has been to replace Alex Cruz as CEO of British Airways with Aer Lingus boss Sean Doyle.

Mr Cruz, promoted by Mr Walsh from running IAG's LCC Vueling to leading BA in 2016, presided over the UK national flag carrier's most profitable years in history. But it was not all plain cruising. His cost focus and a number of unforced errors under his watch (IT glitches, customer data breaches, a pilot strike and cabin crew dissatisfaction although several of these were due to longstanding inherited issues), arguably weakened the BA brand and industrial relations.

Financial performance at BA has now plummeted to its worst ever, due to the COVID-19 crisis. This is true of every airline, but BA is heavily exposed to two key markets particularly hard hit by the crisis: the premium segment and the North Atlantic. Rebuilding will need a sensitive approach that restores employee and customer confidence.

The new face at the top of BA, Mr Doyle actually served 20 years at the airline before his two years leading Aer Lingus. It is to be hoped that he enjoys a challenge. Further extensive surgery at BA is not just desirable, it is inevitable.

TO READ ON, VISIT: British Airways' Alex Cruz takes the fall

Mexico's Interjet: airline's recovery plan lacks substance

Before the COVID-19 pandemic, Mexico's value airline Interjet was working to make 2020 a more positive year than 2019.

The challenges the airline was aiming to put behind it included ridding itself of Sukhoi Superjet 100s and working to build confidence in its financial state.

Obviously, the world's public health crisis has upended Interjet's efforts to get back on track, and during the slowdown driven by COVID-19 the airline has not added back service as quickly as other Mexican operators. There also appears to have been a shake-up in Interjet's executive ranks at the highest levels, and its strategy - if there is one in place - is murky at best.

Until the situation develops further it is not known whether Interjet has the financial resources to withstand the ongoing shocks triggered by COVID-19; but its competitors are taking advantage of other airlines in Mexico that are shrinking during the pandemic, and Interjet could face challenges in working to regain its share.

TO READ ON, VISIT: Mexico's Interjet: airline's recovery plan lacks substance

European aviation continues to stall - COVID testing urgently needed

It is a sure sign that things are desperate when Europe's airlines, pilot unions and airports all agree.

Jonathan Hinkles, CEO of the UK regional airline Loganair argues that without testing at airports, UK aviation is "whirling around like a leaf in an autumn storm".

easyJet CEO Johan Lundgren says "Aviation continues to face the most severe threat in its history".

Virgin Atlantic CEO Shai Weiss warns that "without mass testing", the UK's economic recovery "will not take off".

British Airline Pilots' Association general secretary Brian Strutton believes "UK aviation is in a death spiral".

Augustin de Romanet, chairman/CEO of Groupe ADP, owner of the two main Paris airports, fears the "entire airline sector is slowly dying".

After reaching peak recovery in Aug-2020, Europe is now eight weeks into deepening year-on-year capacity cuts. Seat numbers are down -62.2% in the week commencing 12-Oct-2020. Only Middle East has a deeper cut, with -63.2%; Africa is -59.1%, Latin America -56.7%, North America -51.6%, and Asia Pacific is -39.0%.

The European aviation industry urgently needs standardised, consistent COVID-19 testing to replace the web of quarantine restrictions that are choking it.

TO READ ON, VISIT: European aviation continues to stall - COVID testing urgently needed

Hokkaido Airport Corp: operation of second seven airports begun

The Japanese airport privatisation juggernaut rolls on, regardless of the impact of the pandemic, which in any case has not been as severe at most of its airports as it has elsewhere.

In this instance a large, multi-member consortium of Japanese companies is putting its second airport, of seven, into operation, on the northerly Hokkaido Island. On 01-Oct-2020 Hokkaido Airports Corporation (HAC) announced that it had begun full-scale private operation of Asahikawa Airport on the Japanese island of Hokkaido.

It has a specific remit: namely, to boost LCC traffic and, along with it, tourism, to this comparatively remote area of Japan.

TO READ ON, VISIT: Hokkaido Airport Corp: operation of 2nd seven airports begun

CAPA Live: WestJet warns COVID-19 rules shift airline share

This report is based on an interview with Ed Sims, WestJet CEO, presented at CAPA Live on 14-Oct-2020. The next monthly CAPA Live will be on 11-Nov-2020.

There's been little indication from Canada's government for a time to ease or change strict travel restrictions that have been in place since Mar-2020, when the COVID-19 virus began spreading rapidly worldwide.

Aviation stakeholders continue to stress that those prohibitions are creating significant disadvantages for Canada's airports and airlines, and now WestJet is warning that Canadian operators are losing share to foreign competitors.

WestJet is also facing the reality that it is tough to determine what could drive the government to take a different approach on restrictions, and the company does foresee a reopening of the US border before the end of 2020.

Against that backdrop, Mr Sims continues to stress that testing and vaccines are key to jump-starting demand, which is crucial to reaching break-even cash burn.

TO READ ON, VISIT: CAPA Live: WestJet warns COVID-19 rules shift airline share

VINCI Airports: operator's global snapshot of pandemic impact

Any discourse on passenger numbers across its network offered by VINCI Airports, as one of the world's biggest airport operators and represented across three continents, must make for essential reading.

While the pandemic has adversely affected traffic at all its airports, it is notable that there has been a notable uptick where borders have been opened - as might be expected. Moreover, VINCI perceives the beginning of a recovery in Brazil.

But the investment made last year in London Gatwick Airport has - so far at least - rebounded on it.

TO READ ON, VISIT: VINCI Airports: operator's global snapshot of pandemic impact

SPECIAL REPORTS: Aviation Sustainability and the Environment

This regular weekly CAPA report features a summary of recent aviation sustainability and environment news, selected from the 300+ news alerts published daily by CAPA. This week's issue includes: IATA: Jordan and Israel's overflight agreement to reduce time in the air, fuel burn and emissions; IATA urges Portugal to pursue EU 261 and sustainability reforms under EU presidency; ElringKlinger announces fuel cell technology partnership with Airbus; VoltAero and Edeis announce framework to develop hybrid-electric aviation ecosystem; and Stockholm Skavsta Airport announces plans for solar power plant.

TO READ ON, VISIT: SPECIAL REPORTS: Aviation Sustainability and the Environment

SPECIAL REPORTS: COVID-19 Insight: UK capacity reductions continue

The latest edition of CAPA's Coronavirus and Aviation global COVID-19 update helps the industry to navigate through this crisis. The report contains a small selection of news briefs and CAPA commentary from around the world, including United Kingdom aviation capacity downward trajectory expected to continue; IATA welcomes US military report on low risk of catching COVID-19 on a flight; CAAC: Domestic pax recovers to 98% of 2019 level in Sep-2020. Following the aviation summaries, the report contains the latest coronavirus data, globally and by country.

TO READ ON, VISIT: SPECIAL REPORTS: COVID-19 Insight: UK capacity reductions continue