Latin America reopens and airlines try to gauge demand

Latin America is slowly beginning to open up, and some border restrictions are easing as the region and the world adjust to the reality that COVID-19 will remain a part of everyday life for the foreseeable future.

The next few weeks will be an important gauge for demand in markets that have recently opened up, including Peru, Colombia and Argentina, which is itself working to restart commercial aviation operations sometime in Oct-2020.

Brazil, meanwhile, which never completely shut down its commercial airspace, continues to see a steady increase in demand; but obviously that increase is off historic lows, and a return to normal levels for the country is at least a year away.

TO READ ON, VISIT: Latin America reopens and airlines try to gauge demand

Zurich Airport International declining new investments for now

For some time developing countries have looked to established airport operators, mainly in Europe but also in Asia and Latin America, for technical assistance, management expertise and funding to enhance their airports. Those operators have been happy to oblige, not only for the sake of 'status' and 'bragging rights' but mainly because air travel was growing so quickly that a healthy return on investment was almost guaranteed.

COVID-19 has put paid to that, and Nepal is one of the first countries to learn that the good old days are over: Zurich Airport, to which it offered the deal for the development and operation of the new Nijgadh International Airport, will not be going ahead with it, preferring to concentrate on existing airports and to eschew any new investments for some time into the future.

The question is, is this a one-off situation, or can all developing countries now expect to find themselves in the same boat?

TO READ ON, VISIT: Zurich Airport International declining new investments for now

Airlines flock to promising US-Mexico transborder market

Although international travel generally remains depressed, airlines are ramping up services in the US-Mexico transborder market, hoping that the urge to travel for pleasure, coupled with less rigorous travel restrictions, will further bolster leisure demand.

And as capacity remains significantly down between the US and other countries, the decreases are not as intense in the Mexican transborder market.

As new service is added and other flights resume, the transborder market could be one of the more interesting regions to watch in order to gauge if pent-up demand will materialise into concrete bookings.

TO READ ON, VISIT: Airlines flock to promising US-Mexico transborder market

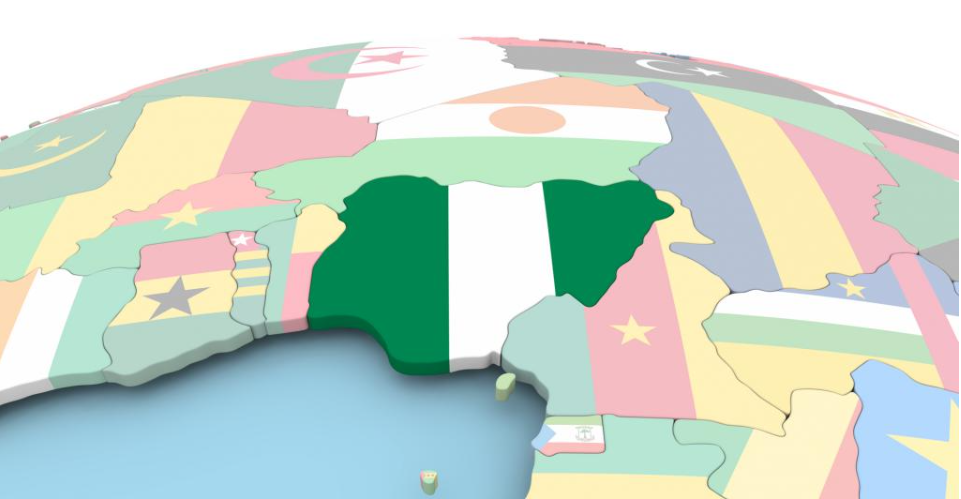

Nigeria's airport concession scheme still opposed, and drags on

The prospect of airports in Nigeria being privatised has rumbled on for three years at least, attracting widespread opposition from trades unions in the country.

Now the government, which has benefitted from Chinese loans to provide for infrastructure improvements, is virtually begging the opposition to let a privatisation procedure go ahead, but limited to concessions, possibly with strict time constraints before they are handed back.

What is more - they are promising to add other airports to such a scheme beyond the 'big four'. But the opposition really wants to privatise those loss-makers first, as if being a loss-maker is attractive to an investor.

This report covers some of the laborious events of the past few years and asks, in the light of apparently better handling of the virus pandemic in Africa than elsewhere, whether this might be the time for the opposition to give some ground on this matter.

TO READ ON, VISIT: Nigeria's airport concession scheme still opposed, and drags on

US airlines: will tests jump-start demand to slash cash burn?

Airlines in the US are bracing for what could shape up to be one of the worst winters in the industry's history. The country's airlines continue to temper capacity as overall demand, while showing some slight improvement, remains solidly depressed.

The near term goal for US airlines and operators worldwide is achieving a break-even cash burn, but IATA does not believe that will occur on a global level until 2022. In the meantime, airlines are working to jump-start demand, a key element to reaching positive cash flow, through the roll-out of COVID-19 testing in order to boost traveller confidence.

Obviously, it will take time to determine how effective the testing is in pushing the needle on demand, but there are signs surfacing that support the theory that pent-up demand exists.

But critically, there is no guarantee that the desire to travel will materialise into firm bookings.

TO READ ON, VISIT: US airlines: will tests jump-start demand to slash cash burn?

SPECIAL REPORTS: Aviation Sustainability and the Environment

This regular weekly CAPA report features a summary of recent aviation sustainability and environment news, selected from the 300+ news alerts published daily by CAPA. This week's issue includes: Emirates president: Coronavirus pandemic will not weaken environmental pressures on the industry; easyJet collaborates with Wright Electric to develop an all electric aircraft programme; Metropolitan Washington Airports Authority announces new sustainability plan; Consortium of European airports wins EUR12m tender to develop sustainable airport technology; and Red Rock and Shell sign SAF agreement for cellulosic fuel based on waste woody biomass.

TO READ ON, VISIT: Aviation Sustainability and the Environment

SPECIAL REPORTS: COVID-19 Insight: Canada aviation stalls as restrictions remain

The latest edition of CAPA's Coronavirus and Aviation global COVID-19 update helps our industry navigate through this crisis. The report contains a small selection of news briefs and CAPA commentary from around the world, including Canada aviation stalls as restrictions remain in place; ICAO: Global RPKs declined 79.8% in Jul-2020; US Treasury closes loans with seven US airlines for financial aid under CARES Act. Following the aviation summaries, the report contains the latest coronavirus data, globally and by country.

TO READ ON, VISIT: COVID-19 Insight: Canada aviation stalls as restrictions remain