Summary:

- The Indian government will permit long-term P3 transactions on six airports, two of which have featured in previous attempts at privatisation;

- These comprise airports in Ahmedabad, Jaipur, Lucknow, Guwahati, Mangalore and Thiruvananthapuram;

- Airports Authority of India will remain a participant and will benefit accordingly from the process;

- The airports offer good prospects to domestic and foreign investors which are permitted to acquire up to 74% stakes.

This is the second stage of airport privatisation by concession in India and it has been a long time coming. In 2015 proposals for public-private partnership (P3) transactions were put forward by in respect of two of these airports, Ahmedabad and Jaipur, along with those at the bigger cities of Kolkata and Chennai.

The latter two were seen as the natural heirs to the 2006 procedures, which are now regarded as a success, having propelled the Delhi and Mumbai in particular into global prominence - Delhi's Indira Gandhi International was the 16th and Mumbai's Chhatrapati Shivaji Maharaj International the 29th busiest airports in 2017 and both have benefited from huge infrastructural improvements.

Those airports also score highly in service quality surveys by organisations such as Airports Council International. Much the same is true of the Hyderabad and Bangalore Kempegowda airports, and the Cochin Airport in Kerala, which was the first to be privatised.

With subsequent privatisation attempts the process lost momentum as AAI only wanted to partially privatise select areas of chosen airports and only under a 15-year concession. Such partial privatisation would severely restrict any private operator's ability to generate revenue. This has impacted the process for the airports in Ahmedabad and Jaipur.

AAI has now revised the terms of its tender for the operation and maintenance of select areas at Ahmedabad and Jaipur airports so that potential operators could increase revenue yields from the operation of the two airports, and managed to attract three and four bids respectively.

Apparently learning from this volte-face, the other four airports have now been added to the package for modernisation under the P3 revenue sharing model. AAI will remain an active participant as it has done before. While it will probably hold a minority stake as has been the case previously, the selected private company or consortium could hold a 74% stake (as in the case of Delhi and Mumbai airports) or possibly more.

As a benchmark, GMR shares 45.99% of its Delhi revenues with AAI and GVK shares 38.7% of those at Mumbai. To date, AAI is believed to have earned around Rs 1,000 crore (USD150 million) in lease rental fees from these companies without having made any investments itself.

The Public Private Partnership Appraisal Committee (PPPAC) will handle the privatisation project, and issues beyond its scope would be dealt with by an empowered group of secretaries.

At the same time AAI has been approved to acquire a 51% stake in Dholera International Airport Corporation (DIAC), which will develop and operate the new Ahmedabad Dholera International Airport, along with the Gujarat government (33%) and the Delhi-Mumbai Industrial Corridor Development Corporation (16%). Meanwhile, the Kerala government is adamant that it will retain a stake in Thiruvananthapuram Trivandrum airport. It wants to see the same model used as in the case of Cochin Airport.

There is a great deal of pressure on the government to get these transactions right. The revised terms and conditions are prompting the media to worry about the prospect of higher charges being passed on to passengers.

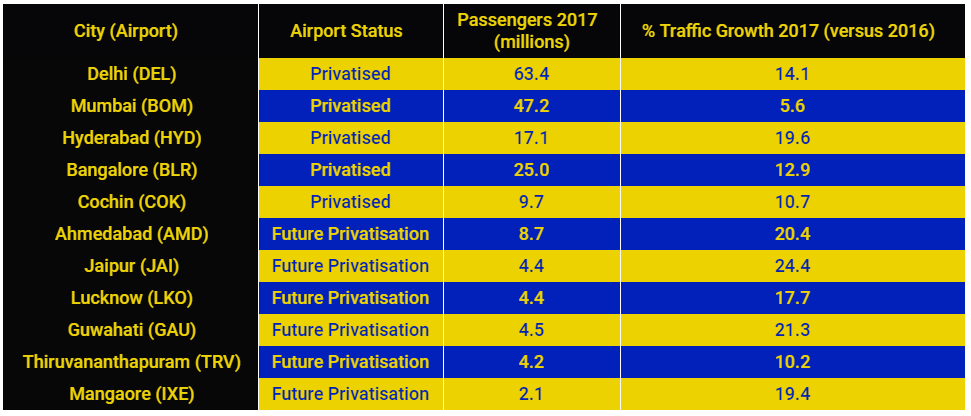

TABLE - How the already-privatised Indian airports compare with those planned for the new tranche of the process Source: CAPA - Centre for Aviation Airport Profiles

Source: CAPA - Centre for Aviation Airport Profiles

The amusing thing is that even though they are smaller, these to-be-privatised airports are in some cases 'out-performing' the already-privatised ones, in their growth rate. That is partly a result of their smaller size; it is always easier to grow quickly from a small base. The private management is needed now they have reached an optimum size for further growth.

For now, that growth will attract investors. In the longer term AAI will benefit from the revenue-sharing and can, if it wishes, distribute that income to much smaller airports elsewhere. Apart from the potential hike in charges impacting on passengers, it can be seen as a belated win/win.