Summary:

- Indian concession contracts have attracted 10 companies, most of them Indian;

- Unlike the 2005/6 concession arrangement there are fewer 'local companies' interested in only one airport;

- India's original sovereign wealth fund is a bidder but foreign firms are not so much in evidence this time.

Not much should be read into the number of bids received in each case. They merely reflect the relative size of the airports in terms of passenger numbers, Ahmedabad being the busiest and Mangalore the least busy. The largest and most experienced investors and operators may not be interested in the smaller airports.

It is the variety of the bidders which is of interest. They include established Indian ones such as GMR Infrastructure and the Adani Group. The former has interests at Delhi, Hyderabad, Nagpur and Goa Mopa airports, and at foreign ones such as the new Heraklion Airport in Greece. GMR is a 'major global investor' according to the classification of the CAPA - Centre for Aviation Airport Investor Database.

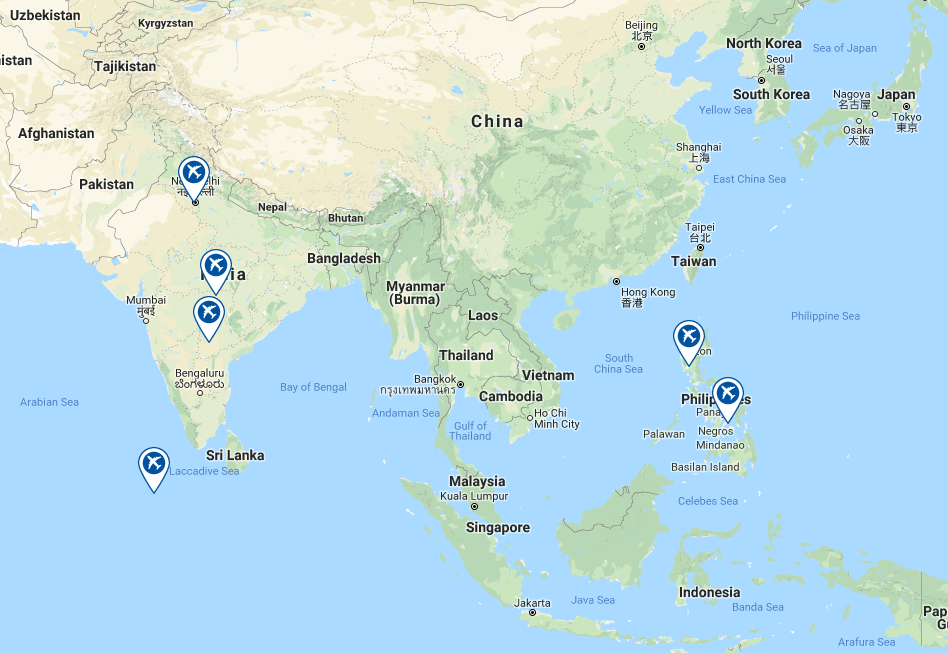

CHART - GMR Infrastructure are defined as a 'major global investor' with interests across India and across the globe Source: CAPA - Centre for Aviation

Source: CAPA - Centre for Aviation

Adani Group was a bidder in the aborted 2017 procedure along with Tata Group, which has not been mentioned this time around. It is a multinational conglomerate PLC active across many sectors including energy, mining, rail, shipping and ports. As recently as Nov-2018 the government of the state of Odisha signed an agreement with Adani Group subsidiary's Dhamra Port Company Ltd to develop Dhamra Airport in a USD70 million investment. That is its only airport investment to date.

Externally, another 'major global investor', AMP Investors of Australia, acknowledged in Jan-2019 that it was interested in this tranche. Outside of Australia, AMP's investments are in three UK airports but in Nov-2018 GVK Power & Infrastructure Ltd., the other well-known Indian airport operator and investor, received non-binding bids from AMP, together with two other entities for the purchase of a minority shareholding in Mumbai International Airport Ltd (MIAL), the operator of Mumbai Chhatrapati Shivaji Maharaj International Airport. Clearly AMP has identified India as a focus point.

The concessions comprise Ahmedabad Airport (with seven bids); Jaipur Sanganeer Airport (also with seven bids) Lucknow Amausi Airport and Guwahati Lokpriya Gopinath Bordoloi Airport (both with six bids); and Mangalore Bajpe Airport and Thiruvananthapuram International Airport (each with three bids).

The intriguing aspect of this process is the potential bidders who are coming into the frame for the first time. That happened with the Delhi, Mumbai, Bangalore, Hyderabad and Cochin concessions in the mid-2000s. Some stayed the course to be in consideration for further privatisations which never went ahead.

We could potentially have the same scenario with these bidders now, but all is not quite what it seems. They include Autostrade, which is a Mumbai-based subsidiary of an Italian infrastructure company with Italian directors. PNC Infra, as it has been referred to in the local Indian media, appears to be PNC Infratech, one of the premiere Indian construction companies, working in highways, runways, bridges, flyovers, and power transmission lines.

The Kerala State Industrial Development Corporation is the industrial and investment promotion agency of the Government of Kerala, for the promotion and development of medium and large scale units. It acts as the agency for foreign and domestic investments in Kerala, providing support for investors. As such, it is not clear what its role is as 'a bidder' and it may be involved with Cochin International Airport Ltd's desired bid.

SEE RELATED REPORT: Is it a good idea? One of the original Indian airport concessionaires now seeks to take on Thiruvananthapuram concession

The National Investment and Infrastructure Fund (NIIF) resides at the other end of the spectrum. NIIF is India's first sovereign wealth fund and was set up by the Government in Feb-2015. It has assets of around USD3.5 billion. The objective behind the creation of this fund was to maximise economic impact mainly through infrastructure investment in commercially viable projects, both green field and brown field. It will give Airports Authority of India no end of comfort to know that NIIF regards these concessions as commercially viable. Meanwhile, little is known of the final bidder Sanna Enterprises.

So the situation is different to that of 2005-6 and the bidders this time represent a broader range of Indian industry and commerce, representative of a more mature market. What appear to be missing, with the exception of AMP, are foreign investors. Even in 2017 Vinci Airports and Ireland's daa submitted bids. The 2005-6 processes attracted considerably more of them though one by one several withdrew as the goalposts appeared to be shifted.

AAI is scheduled to select the winning bids later this week (28-Feb-2019).