Telsyte estimates 4.8 million smartphones were sold in the second half of 2017, up 6% from 2H2016. Android devices made up 55% of all units sold, mainly due to 2017 being a "replacement year" for Android users. There are now some 19.3 million smartphone users in Australia, with 8.6 million using iPhones and 10.3 million on Android (about 0.4 million use other platforms).

Mobile payments growing in Australia

Telsyte research also showed that one in seven (14%) have completed a mobile contactless payment transaction at a payment terminal in store at least once, an increase from 8% in 2016. The increasing adoption in mobile contactless payments is starting to influence Australian's banking decisions.

Telsyte research indicates Apple Pay has the most potential to change Australians' banking decisions as Android Pay is more widely supported by major banks in Australia.

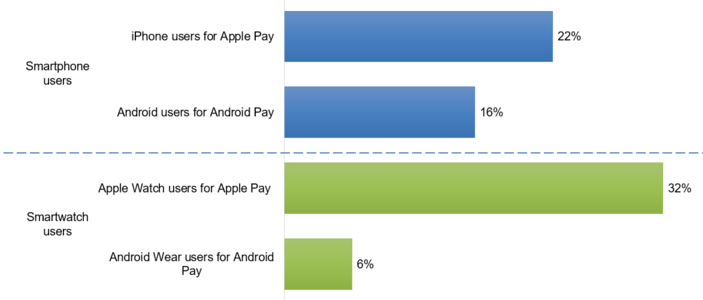

Telsyte senior analyst Alvin Lee, said: "More than half of Apple Watch users in Australia cannot use Apple Pay with their primary bank." This has resulted in around one in five (22%) iPhone users claiming they are more likely to bank with a provider if it supports Apple Pay. This figure increases to 32% for those who are also using an Apple Watch.

Survey question: Are you more likely to bank with a provider if it supports the following mobile payment services?

Source: Telsyte Australian Smartphone and Wearable Devices Market Study 2018

Source: Telsyte Australian Smartphone and Wearable Devices Market Study 2018

Currently, the ANZ Banking Group is the only one of the big four bank which allow its customers to use Apple Pay. A large majority of the smaller banks, including Macquarie Bank, ING Direct have all agreed to use the system, pay Apple a fee and to not pass that on to their customers.

Commonwealth Bank of Australia, National Australia Bank, Westpac Banking Corp and Bendigo and Adelaide Bank, who control two-thirds of Australian cardholders are yet to join the programme. Apple Pay is currently being offered around the world by 3500 banks in 13 countries.