ICAO says the airline industry was expected to end 2018 with another record operating profit, this time of around USD57 billion and with an operating margin of 7%. Net profit is expected to reach USD34 billion, with nearly half of this being generated by North American carriers.

It noted average jet fuel prices increased by approximately 31% year-on-year in 2018 but remained notably lower than the prices observed for the 10 years prior to 2015. The low fuel cost coupled with solid increase in traffic helped airlines maintain a relatively high level of profitability in 2018, albeit slightly lower than 2017.

Air travel growth has eased in comparison to the strong upward trend seen in 2017. Even so, a total of 4.3 billion passengers were carried by air transport on scheduled services in 2018. This indicates a 6.1% increase over 2017. The number of (aircraft) departures rose to approximately 38 million globally, and world passenger traffic, expressed in terms of total scheduled revenue passenger-kilometres (RPKs), grew solidly at 6.7% and reached approximately 8.2 trillion RPKs performed. This growth represents a slowdown from the 7.9% achieved in 2017.

However, air traffic growth remained solid in 2018, underpinned by the global economic conditions throughout the year. Despite recent softening, world real gross domestic product (GDP) growth is projected to be at 3.1% in 2018 before slowing gradually over the next two years, according to World Bank estimates. Advanced-economy growth will decelerate and the recovery in major commodity-exporting emerging market and developing economies will level off. Financial market stress, escalating trade protectionism and heightened geopolitical tensions continue to cloud the outlook.

International scheduled passenger traffic expressed in terms of RPKs grew by 6.4% in 2018, down from the strong 8.4% recorded in 2017. All regions posted slower growth than last year, with the exception of an improvement in North America driven by the stronger US economy and continued international expansion of Canadian carriers. The region carried a 12% share of world international RPKs and recorded a rebound from the 4.9% in 2017 to 5.2% in 2018.

Asia-Pacific, the second largest international market with a 30% RPK share, remained as the fastest growing region with an increase of 7.3%, albeit a moderation from the robust growth of 10.5% in 2017. Europe recorded the second highest growth at 6.7% and was the largest international market with a 37% share. This was followed by the 6.6% and 6.5% growth in Latin America-Caribbean and Africa, which accounted for the smallest RPK share of 4% and 3%, respectively.

Carriers in the Middle East managed 14% of world international RPKs, and became the slowest growing region with a growth of 4.7%, impacted by a number of factors such as the competitive environment - competing hubs and more point to point services, low oil prices and geopolitical tensions.

Increase in air travel demand outstripped the industry's capacity expansion. Total capacity offered by the world's airlines in 2018, expressed in available seat-kilometres (ASKs), increased globally by around 6.0%. As a result, overall passenger load factor improved by 0.6 percentage points and reached a record high of 81.9%. Two regions, Latin America and the Caribbean and the Middle East, posted a decline in load factors, as being under pressure with the slowing trend in traffic growth. Load factor varies by region, ranging from 71.8% for Africa to 84.5% for Europe.

Over half of the world's 1.4 billion tourists who travelled across international borders last year were transported by air, ICAO says, but it notes that the stimulus of lower air fares to travel demand has reduced due to the higher fuel prices from the last two years, reflecting the moderation in growth momentum.

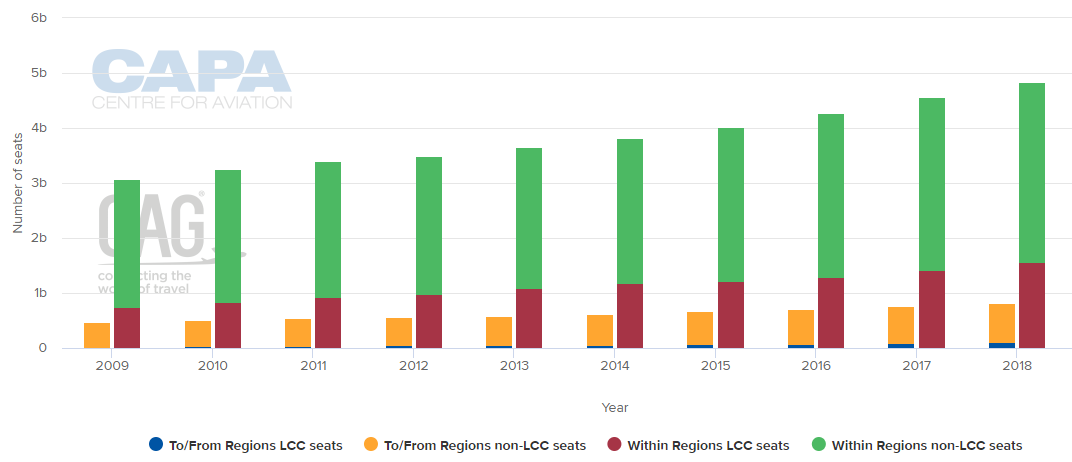

Nevertheless, LCCs consistently grew at a faster pace than the world average in 2018 and LCC market share continued to increase, both in advanced and emerging economies. LCCs handled around 1.3 billion passengers in 2018, accounting for 31% of the world total of scheduled passengers. Market share of LCCs was highest in Europe at 36%, followed by Latin America/Caribbean with 35%, North America with 30% and Asia Pacific with 29%.

CHART - LCCs are consistently growing at a faster pace than the world average and LCC market share continues to increase both in advanced and emerging economies Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

In the freight segment, air transport now carries around 35% of world trade by value. Around 90% of cross border Business-to-Consumer (B2C) e-commerce was carried by air transport. After the sharp pick-up in air freight growth during the inventory restocking in 2017, air cargo traffic growth moderated in 2018. This coincides with the softening demand drivers impacted by the trade tension and declining import and export orders.

World scheduled freight traffic, measured in freight tonne-kilometres (FTK) grew modestly by 4.5% in 2018, compared to the 9.5% recorded in 2017. The international segment of freight traffic which represents nearly 87% of total air freight grew by around 4.6% while the scheduled international freight load factor remained at a similar level to last year at around 55%.

If there is a dark side to the ICAO statistics it comes in the area of safety, with a huge increase in fatalities over 2017, which was one of the least bad years on record for airline safety with no incidents involving commercial jet aircraft. The main safety data for 2018 comprises... accidents: 78 (-8 year-on-year); accident rate: 2.10 (-0.15%); fatal accidents: eight (+3); fatalities: 491 (+441).