The global airline industry's fuel bill is estimated to have totalled USD180 billion in 2018 (at USD72 per barrel Brent), accounting for around 23.5% of operating expenses. This was an increase of 20.5% over 2017 and is almost double the USD91 billion fuel bill for 2005, when costs were USD54.5 per barrel Brent, but still accounted for 22% of operating expenses.

For 2019, the International Air Transport Association (IATA) forecasts the fuel bill to rise to USD206 billion, accounting for 25% of operating expenses at a cost of around USD70 per barrel Brent. But, market conditions and recent events could influence this prediction.

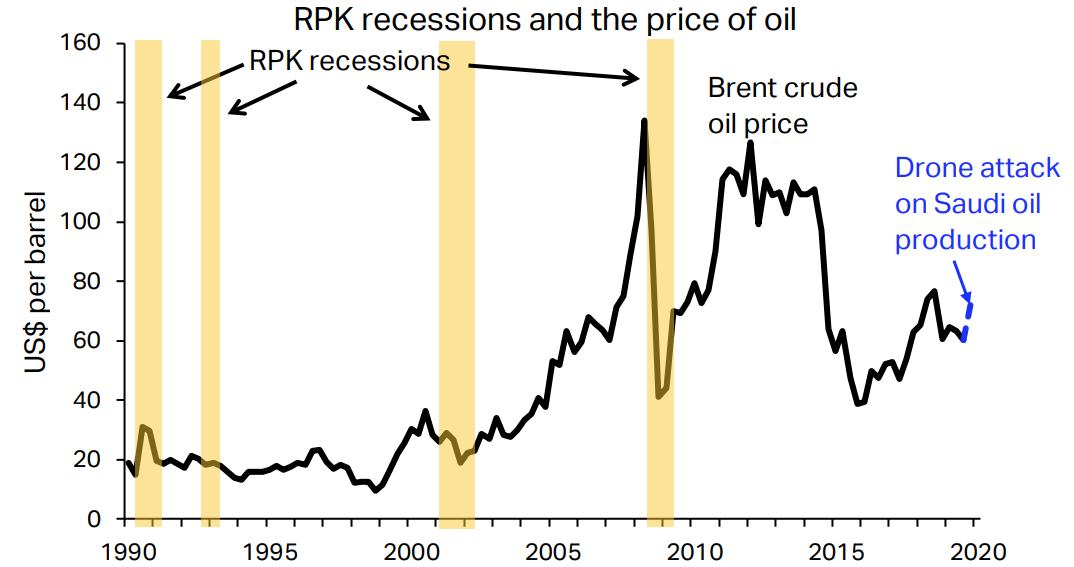

IATA reports that while the loss of oil production due to the recent attack on Saudi Arabia's refining capabilities could be partly compensated from storage facilities, oil prices are expected to remain under pressure as it is likely to take some time for production to return to normal.

IATA acknowledges the scale of disruption to oil supplies due to the closure of the Saudi Aramco facilities at the Abqaiq oil field in Saudi Arabia was "the largest ever", with the attack halting the supply of 5.7 million barrels of crude oil a day, representing some 5% of world oil supply. Oil and jet fuel prices rose sharply following the closure of the facilities with the scale of the oil supply disruption larger than the impacts of the 1990 invasion of Kuwait or the 1979 Iranian revolution.

According to IATA, the resulting increase in oil price is "not likely to trigger recession this time". The association stated the reaction of oil prices to the loss of 5% of world oil supply has been "remarkably muted", with prices up only USD5 per barrel than prior to the attack, and prices are still lower than they were at this time in 2018.

CHART - IATA Economics' chart of the week highlights that oil price is not likely to trigger a recession, at this time at least Source: IATA Economics using data from IATA Statistics, Markit and Thompson Reuters Datastream

Source: IATA Economics using data from IATA Statistics, Markit and Thompson Reuters Datastream

Sharply rising oil prices have in the past been associated with recessions. In fact, IATA explains that the major downturns in the airline industry since 1990 were generally preceded by significant oil price increases. However, in most cases there were other major factors that precipitated recession, such as the bursting of the dot.com bubble and the global financial crisis.

IATA believes the current market reaction to the Saudi Arabi drone attacks has been impacted by the transformation of energy markets over the past decade by the development of tight oil reserves in the US. In addition, it explains that the IEA countries have 1.5 billion barrels of oil available for release from emergence stocks, and inventories in the OECD are at 2-year highs. "With the availability of oil being so much higher today, the price impact of the supply shock has been much smaller - as is the risk that this will trigger a recession," notes IATA.

Obviously, the impact of the rise in oil prices on airlines will depend on individual airline hedging ratios. Many heavily hedge advanced fuel purchases to safeguard themselves against changing market conditions, while others more happily take the risk of fluctuating prices, which can ultimately also reduce. IATA warns that each USD5 per barrel increase in the price of jet fuel could reduce overall industry net profit margins by around 0.5% points.