The recovery in short haul travel though is still expected to happen faster than for long haul travel. As a result, passenger numbers will recover faster than traffic measured in RPKs. Still, recovery to pre-Covid-19 levels, however, will also slide by a year from 2022 to 2023, projects IATA.

Latest data for Jun-2020 shows passenger traffic levels that foreshadowed the slower-than-expected recovery. RPKs fell -86.5% compared to the year-ago period. That is only slightly improved from a -91.0% contraction in May-2020 driven almost exclusively by rising demand in domestic markets, particularly China. The Jun-2020 load factor set an all-time low for the month at 57.6%.

"Passenger traffic hit bottom in Apr-2020, but the strength of the upturn has been very weak. What improvement we have seen has been domestic flying. International markets remain largely closed. Consumer confidence is depressed," said Alexandre de Juniac, director general and CEO of IATA.

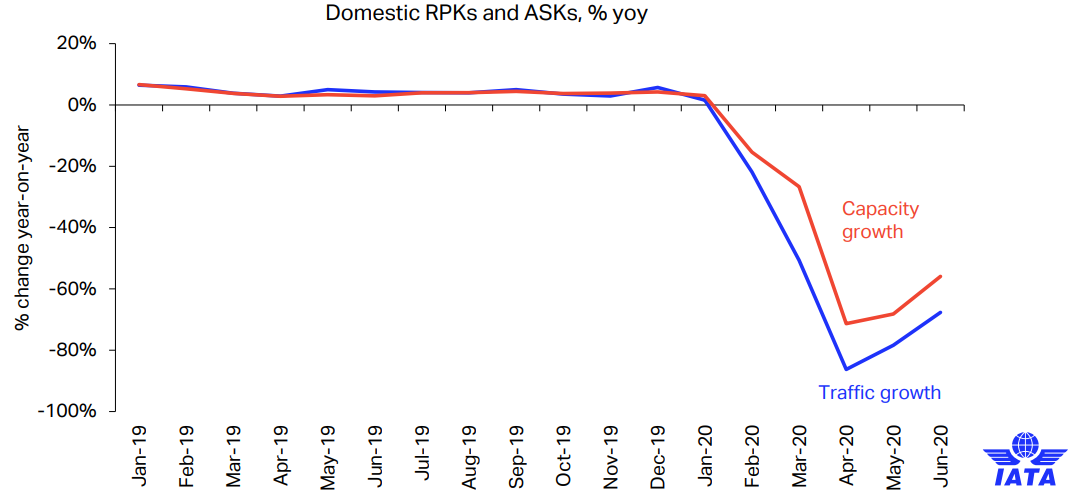

CHART - Traffic levels are not growing as fast as airlines are adding capacity meaning airline cash burn continues as load factors remain below breakeven levels Source: IATA Economics using data from IATA Statistics

Source: IATA Economics using data from IATA Statistics

Scientific advances in fighting Covid-19 including development of a successful vaccine, could allow a faster recovery, but at present IATA says there appears to be "more downside risk than upside". It is basing its more pessimistic recovery outlook on three key trends - slow virus containment in the US and developing economies, reduced corporate travel and weak consumer confidence. All of this points to a longer recovery period and more pain for the industry and the global economy," says Mr de Juniac.

Although developed economies outside of the US have been largely successful in containing the spread of the virus, renewed outbreaks have occurred. Furthermore there is little sign of virus containment in many important emerging economies, which in combination with the US, represent around 40% of global air travel markets. "Their continued closure, particularly to international travel, is a significant drag on recovery," says IATA.

Meanwhile, corporate travel budgets are expected to be very constrained as companies continue to be under financial pressure even as the economy improves. In addition, while historically GDP growth and air travel have been highly correlated, surveys suggest this link has weakened, particularly with regard to business travel, as video conferencing appears to have made some inroads as a substitute for in-person meetings.

While pent-up demand exists for VFR (visiting friends and relatives) and leisure travel, consumer confidence remains generally weak in the face of concerns over job security and rising unemployment, as well as risks of catching Covid-19. Some 55% of respondents to IATA's Jun-2020 passenger survey said they don't plan to travel in 2020 at all.

Owing to these factors, IATA forecasts that for the full year global passenger numbers (enplanements) are expected to decline by -55% compared to 2019, worsened from the Apr-2020 forecast of -46%. Passenger numbers are expected to rise 62% in 2021, according to its projection, off the depressed 2020 base, but still will be down almost 30% compared to 2019.

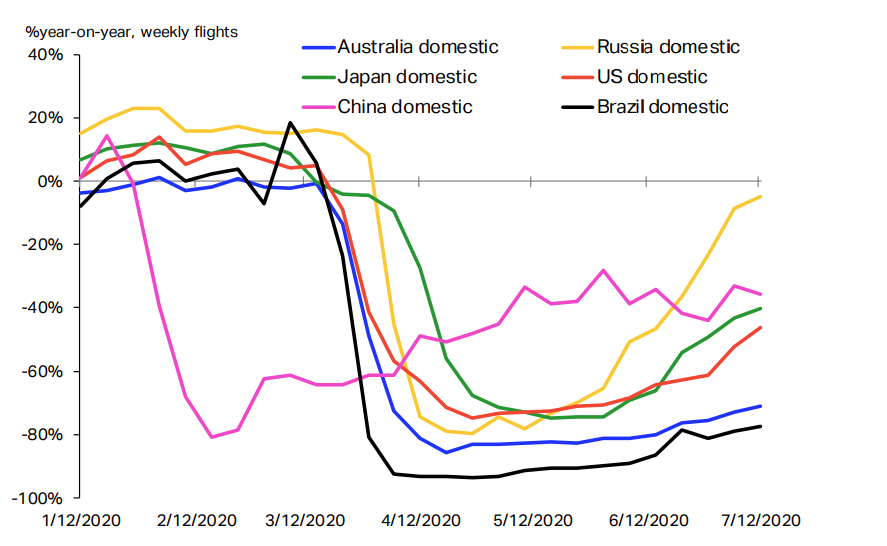

CHART - Domestic markets continue to drive the industry rebound as governments permit domestic routes to boost economic activity while still curbing international activity to limit potential virus spread Source: IATA Economics analysis based on data provided under license by FlightRadar24

Source: IATA Economics analysis based on data provided under license by FlightRadar24

The latest Jun-2020 data from IATA highlights the continued impact of the pandemic, particularly on international markets across all geographies. Total international traffic shrank by -96.8% in the month, compared to Jun-2019, only slightly improved over the -98.3% year-on-year decline in May-2020. Capacity fell -93.2% and load factor contracted 44.7 percentage points to 38.9%.

The Jun-2020 data also illustrates the improving domestic performance. Global domestic traffic demand fell -67.6% in Jun-2020, improved from a -78.4% decline in May. Capacity fell 55.9% and load factor dropped 22.8 percentage points to 62.9%.

Domestic traffic improvements notwithstanding, international traffic, which in normal times accounts for close to two-thirds of global air travel, remains virtually non-existent. "Most countries are still closed to international arrivals or have imposed quarantines, that have the same effect as an outright lockdown, explains Mr de Juniac.

"Summer - our industry's busiest season - is passing by rapidly; with little chance for an upswing in international air travel unless governments move quickly and decisively to find alternatives to border closures, confidence-destroying stop-start re-openings and demand-killing quarantine," he adds.