At Hilton Worldwide, president and CEO Christopher Nassetta is perhaps the most optimistic and speaking on a Q2 2020 earnings call this week, he said he believed that the impact of technology, travel restrictions will be short-lived and business travel confidence will return and will return to levels seen in 2018 and 2019 within a three year window.

Mr Nassetta says the company is already seeing a small rise in business demand, albeit the demographic has changed somewhat. "It's a little bit different makeup of business traveller than probably it was last year for the last decade or two or three… you are starting to see that come back not rapidly, but slowly. And I do think all things being equal as you get into the fall, you will see that continue," he explains.

"I think its two or three years to sort of get back to the demand levels that we were experiencing in '18 and '19. But I think it's sort of - that is sort of the broader trajectory we will be in this hopefully 45%, 50% range and then moving our way steadily, slow and steady up from there," he adds.

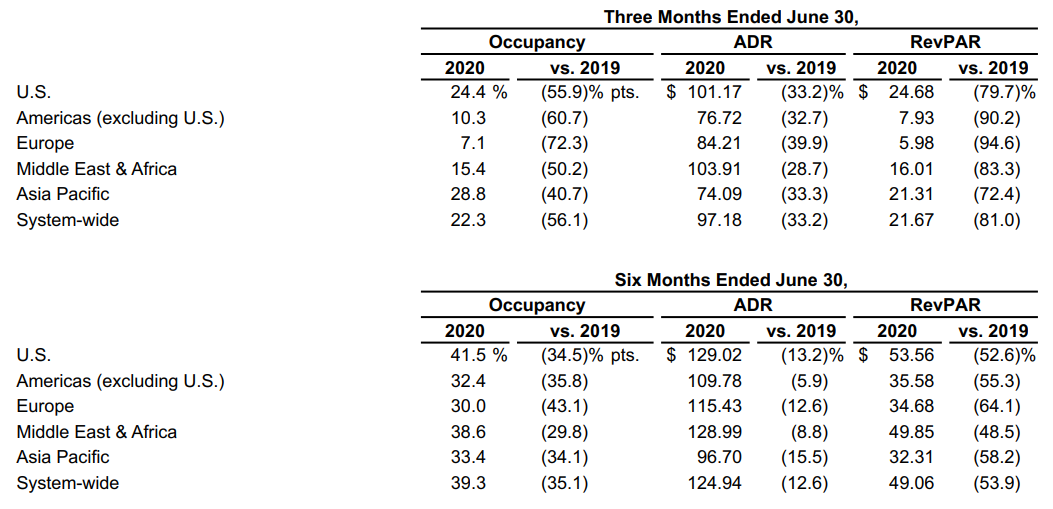

CHART - Hilton 2Q 2020 and 1H 2020 performance metrics by geographic region Source: Hilton Worldwide

Source: Hilton Worldwide

For the three and six months ended 30-Jun-2020, systemwide comparable RevPAR decreased 81.0% and 53.9%, respectively, due to both occupancy and ADR decreases. Additionally, management fee and franchise and licensing fee revenues decreased 77% and 50% during the three and six month periods. However, since April, all major regions have experienced month over month increases in occupancy and RevPAR with the strongest recoveries in the US and Asia Pacific with occupancy levels up approximately 20 percentage points and 15 percentage points, respectively, from April to June.

Still, in 2Q 2020, Hilton opened 60 new hotels totalling 6,800 rooms, and achieved net unit growth of over 5,500 rooms. Its pipeline as at the midpoint of the year included 414,000 rooms in 121 countries and territories, an 11% increase on the same point in 2019. Additionally, during 2Q 2020, it entered into an exclusive management license agreement with Country Garden to introduce and develop Home2 Suites by Hilton branded properties in China.

At Marriott International, president and CEO Arne Sorenson reinforces that leisure demand is undoubtedly outperforming other segments, but had a positive viewpoint on the corporate travel during its own 2Q 2020 earnings call. He says that corporate performance has risen five points in the last eight weeks in terms of the level of RevPAR year-on-year declines.

"So far in the recovery, every sector has gotten better in every month," he acknowledges, and puts the uptick in business demand mainly to travellers in smaller companies and mainly related to those where travel is mainly by road and less dependent on flying.

"I think a lot of us have a little more caution around the corporate traveller than we do around the leisure traveller based on the first few months of recovery here," acknowledges Mr Sorenson who is especially frustrated as decisions by big corporations about keeping offices closed for as much as the next year. "Frustrating to us because in a sense that's just sort of withdrawing from the economy," he says.

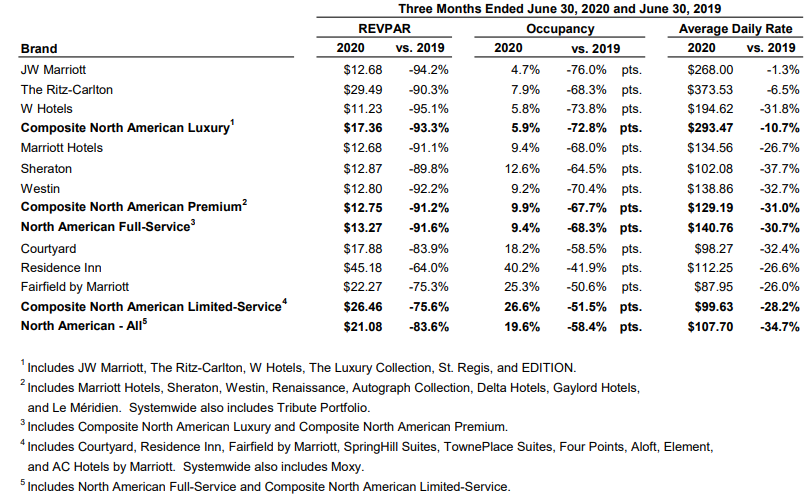

CHART - Comparable systemwide performance at Marriott International's North American properties during 2Q 2020 Source: Marriott International

Source: Marriott International

Marriott has recorded year-on-year RevPaR declines of -84.4% in 2Q 2020 with its performance in North America delivering slightly better results than the rest of the world. The full force of the downturn was felt in April when levels fell below -90%, but they are now back at around -70% and improving.

Mr Sorenson describes this all as the "toughest year-over-year comparison" in the company's history with occupancy levels declining by 57.4 percentage points to 18.2% for 2Q 2020 and ADR down -35.3% to USD104.97.

Greater China is leading its recovery with occupancy levels now reaching 60%, only slightly down from the average 70% levels recorded the same time last year, but a marked improvement from single-digit levels it recorded in February. While Greater China's recovery was originally led by demand from leisure travellers, particularly in resorts and drive-to destinations, Mr Sorenson acknowledges that there is now a "more widespread business demand, including some group activity".

"The improvement we have seen in Greater China exemplifies the resilience of travel demand once there is a view that the virus is under control and travel restrictions have eased," he explains. Our other regions around the world have also experienced steady improvements in demand and RevPAR over the last couple of months, though the pace varies and tends to be slower in regions that depend more on international travellers.

In the case of Accor, chairman and CEO Sébastien Bazin believes that business travel levels will be down by around 10% to 15% in the medium to long term. "The shock that our industry is experiencing is both violent and unprecedented," he says and while acknowledging that the peak of the crisis "is undoubtedly behind us," he warns that "the recovery will be gradual".

CHART - Accor performance by property segment in 1H 2020 Source: Accor

Source: Accor

Accor has seen 2Q 2020 RevPaR fall -88.2% year-on-year on a like-for-like basis to just EUR8, although during the quarter monthly levels did slip below the -90% figure. This all translated into a -59.3% year-on-year decline in 1H 2020 to EUR25. Occupancy for 2Q 2020 was down 56.7 percentage points on the same period in 2029 to 14.7% and for 1H 2020 was down 36.6 percentage points to 31%. ADR dropped -36.9% and -10.7% for the quarter and half year periods to EUR54 and EUR80, respectively.

Like others, Accor is observing signs of recovery in all regions, after a particularly hard-hit period in April and May, first in Asia-Pacific (RevPAR down -77.4% in 2Q) before gradually spreading to other regions, particularly Europe (RevPAR down -90.6% in 2Q). Still, during the first half, Accor opened 86 hotels offering 12,000 rooms growing the group had a portfolio as at the end of Jun-2020 of 747,805 rooms (5,099 hotels) and a pipeline of 206,000 rooms (1,197 hotels), 75% of which is in emerging markets.

In terms of business travel, Mr Bazin warns that the impact of conference and convention cancellations, the return of travel restrictions and general subdued travel demand means levels will remain impacted. "That will be probably the case until summer 2021, and we could probably know for a fact that we will never come back to the level of 2018, 2019," he explains.

In the short term, meaning "probably until summer of 2021," he sees levels "minus 25% to 30%, almost as a certainty". Longer term, his expectation is that "it's probably a permanent 10% to 15% impact. "It will never return to new normal. It's probably going to be like a 10% drop depending on, again, culture geographies, but the drop will be in place because many corporation will be much more astute, will go on Webex, on Zoom, those digital tools will prevail and will still be there," he adds. But "that could be weathered," he says, "we can substitute different offers, but we have to be lucid".