Summary:

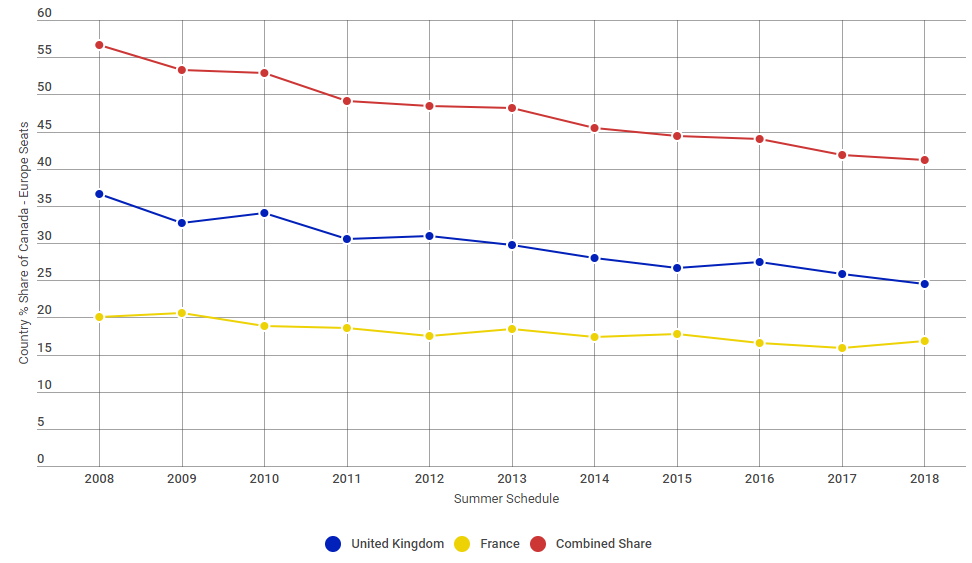

- The United Kingdom and France remain the largest European markets from Canada, but their share of this market has declined from over 55% to just 41.2% over the space of the past ten years;

- Overall seat capacity from Canada to Europe this summer is up +9.1% versus the same period in 2017, the fifth consecutive summer period of year-on-year growth;

- The United Kingdom's share of European seat inventory from Canada has fallen from 34.0% in summer 2010 to just 24.4% this year, despite a +13.9% growth in capacity;

- France is actually closing the gap on the UK with capacity up +15.0% in summer 2018, by far the fastest rate of annual growth in this market this decade.

Our analysis of OAG schedule data for the current summer schedule that runs until 27-Oct-2018 shows that overall seat capacity from Canada to Europe is up +9.1% versus the same period last year. This is the fifth consecutive period of year-on-year growth in summer capacity following two successive years of declines in 2012 and 2013. In total, system seats from Canada to Europe have grown by more than half (+58.5%) this decade. This is an average annual growth of +6.1% and a compound average growth rate (CAGR) of +5.9%.

The United Kingdom remains the largest European market from Canada and this summer still accounts of just under one in every four available seats (24.4% share). The number of seats on offer during the schedule is up +3.0% on summer 2017 to deliver a decade growth figure of +13.9%. Nine markets in Canada are linked to seven in the UK, including the return of flights into London Stansted after an eight year break and which are being delivered by Primera Air as part of its trans-Atlantic low cost long haul evolution.

CHART - The United Kingdom and France remain the largest European markets from Canada, but their share of the market is declining Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

The changes in the Canada - Europe market and the increase in the number of city pairs being served are being driven by adapting airline strategies. Air Canada now has its Rouge leisure business that can perhaps more effectively serve some of these markets, WestJet has expanded outside of the Americas with flights into Europe and will also seen head in the opposite direction to Asia, while Primera Air has also included Canada in its new trans-Atlantic strategy to use latest technology single-aisle airliners to fly across the Atlantic.

Other LCC specialists are also active in the market, but account for just 5.2% of the capacity from Canada, albeit that is growing, from 5.1% last year, 4.5% in summer 2016 and just 0.9% in summer 2015. WOW air offers one-stop options from Canada into Continental Europe via its Keflavik International Airport hub in Iceland, a routing also provided by Icelandair, that while not a LCC has a highly competitive pricing strategy.

Similarly, Aer Lingus, while also not a LCC, it is widely recognised as a low-fare specialist across the Atlantic. Things could all get even more competitive with Norwegian approved to start flights into Canada, albeit it has deferred its launch following delays securing its licences and with aircraft deliveries.

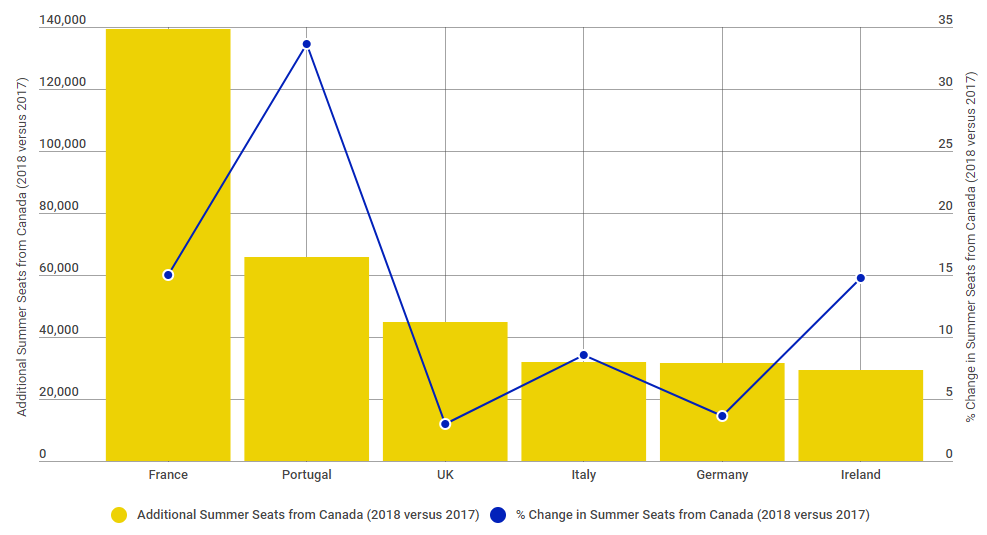

France is closing the gap on the UK as the largest European market from Canada with capacity up +15.0% in summer 2018. The is by far the fastest rate of annual growth in this market this decade and brings total growth since 2010 to +40.9%. While France's long-haul network is generally Paris-centric, Canada is the exception with links being offered from five airports in the country to eight in France.

The Blue Swan Daily investigation shows that four countries (Czech Republic in 2014, Hungary and Croatia in 2015 and Romania in 2018) have been added to Canada's departure board for the first time this decade over the past couple of years (albeit they have been served previously), while this year has seen the return of summer flights between Canada and Ukraine for the first time since 2012. New markets for 2018 include Bucharest, Kiev, London Stansted and Shannon.

The summer Canada is linked non-stop to 21 countries in Europe with Denmark the only nation where there is a reduction in seat inventory and then only a modest -2,4% decline. Capacity into Croatia is more than three times the level recorded last summer (+211.1%), while alongside France, double-digit capacity rises will be recorded into the Czech Republic (+63.1%), Hungary (+46.2%), Portugal (+33.7%), Republic of Ireland (+14.8%), Spain (+13.3%), Switzerland (+12.2%) and Greece (+10.7%).

CHART - France will see the largest rise in European seats from Canada in summer 2018 with more than double the additional seats on offer than any other country Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG