Summary:

- Under new ownership, Hannover airport is seeking to add new European and long haul routes;

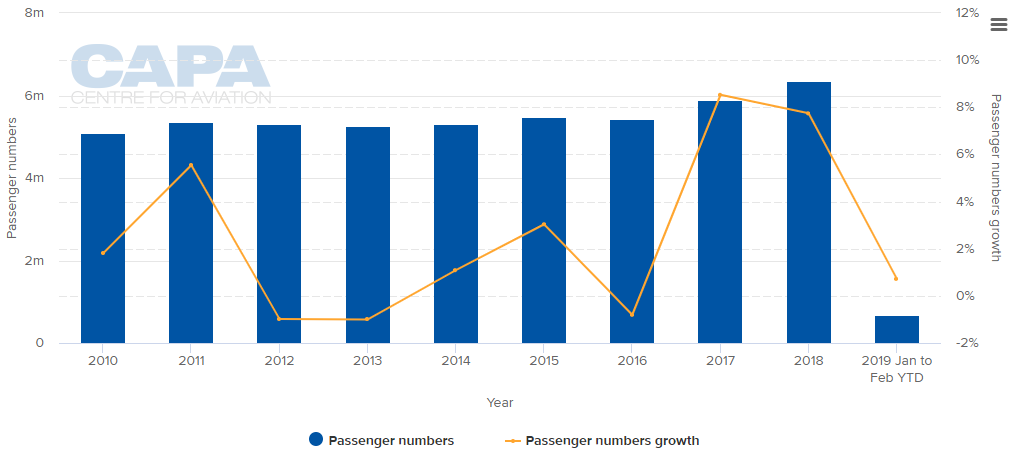

- Passenger traffic declined by 0.8 percentage points in 2018, and by a full seven percentage points in the first two months of 2019;

- Unable or unwilling to attract LCCs in the past new routes will be determined by its business offer ranging from exhibitions and symposiums to the automobile and insurance industries.

The airport has changed hands in the last nine months, from long-time operator Fraport to the British iCON Infrastructure Group, an investment firm specialising in infrastructure investments and for which this transaction marked its first entry into the airport sector.

SEE RELATED REPORT: A new moon as Hannover Airport stake sale delivers an industry rarity - a UK investor buying into a foreign airport

At the time, Fraport's CEO said "Hannover airport is a solid business with a bright future", which prompted the question, "Why sell it?" The airport featured in a previous The Blue Swan Daily article, in Aug-2018 in which the city's and airport's credentials were outlined, highlighting its commercial fairgrounds - the world's largest - and its location at a major road and rail crossing point between Berlin, Hamburg and the industrial Ruhr region, acted in its favour.

SEE RELATED REPORT: A helping hand for Hannover - rare opportunity may arise to buy into regional German airport

The airport's claims to fame are few but it has two runways, one a very long one of 3,800 m, and that is unusual for an airport of this size. Its two original, compact terminal buildings, both still in use, were the original model for Moscow's Sheremetyevo airport and a third one has been added. There is a good mix of business types - low-cost, full-service- etc -and both passenger and cargo growth statistics were positive at the time of the sale.

Here we look to identify any operational improvements since the takeover, ponder what the "fantastic potential" is for the airport and identify the new short- and long-haul route targets. The headline data is that passenger growth declined in 2018 by 0.8 percentage points, and by a full seven percentage points in the first two months of 2019. But, there has been little time for the new owners at Hannover to influence route development as yet.

CHART - Hannover has seen a slowing in traffic growth after peaking at +8.5% in 2017 Source: CAPA - Centre for Aviation and Flughafenverband ADV (German Airports Association)

Source: CAPA - Centre for Aviation and Flughafenverband ADV (German Airports Association)

On the cargo side available payload increased by 7.9% in 2018 and early signs are that it could increase again in 2019. At the time of publishing the airport has 58 non-stop destinations, considerably less than the 76 recorded last August but that was in the very peak of the season. A large slug of the seat capacity (35.4%) is shared by Lufthansa and Eurowings, almost equally.

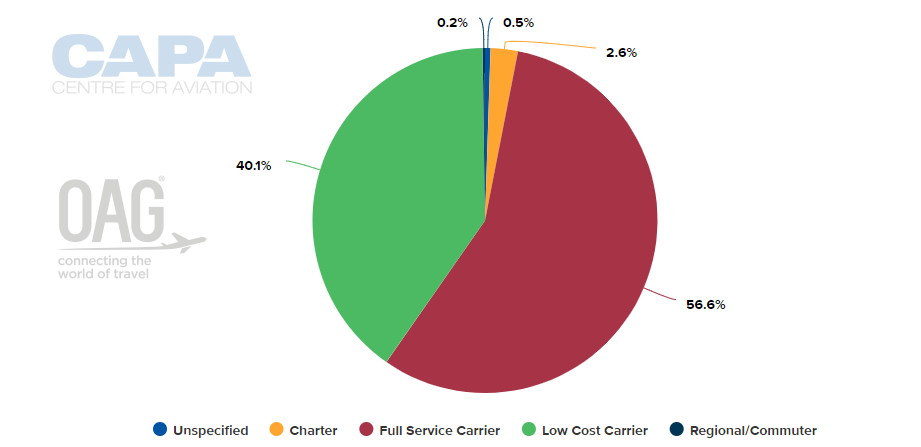

A more telling statistic perhaps is the increasing share of full-service carrier seats and a consequential reduction in low-cost seats. That is important because Hannover, while it has some tourist attractions, especially cultural ones, is predominantly a business city with over 60 international and national exhibitions every year together with many congresses and symposiums.

CHART - As a predominantly business destination it is no surprise that full-service carriers dominate in Hannover Source: CAPA - Centre for Aviation and OAG (data: w/c 15-Apr-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 15-Apr-2019)

Hannover has tried to attract LCCs over the years without much success. It seems more sensible now to focus on full-service carriers, while not forgetting that TUI AG, the world's largest travel and tourism company and which (as TUIfly) has 10.7% of capacity at the airport, is actually headquartered in the city.

Looking at the existing route map, opportunities to develop it may lie with the two main industries which dominate the city together with the exhibition sector, namely automobile (Volkswagen and Continental Tyres) and insurance/re-insurance).

MAP - The Hannover route map currently spreads to 58 non-stop destinations, but can grow by a further third during the summer peak Source: CAPA - Centre for Aviation and OAG (data: w/c 15-Apr-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 15-Apr-2019)

In the short-haul domain those opportunities could include markets such as Dublin, a Scottish city (Glasgow), a second French city after Paris (Lyon or Marseille), Madrid, Milan or Turin in northern Italy, and Stockholm (Hannover is also home to the audio company Sennheiser and Stockholm is a leading centre of the global music industry in which Sennheiser participates).

In the long-haul domain the opportunities are not so clear and are less dependent on the needs of industry. Most airports will seek to secure New York as the first trans-Atlantic destination for the prestige of the route even though there are better US hubs offering onward connectivity, while in Asia Pacific a hub that is the most appropriate to incoming trade delegations to exhibitions seems most appropriate with Hong Kong or Singapore probably top of that list. Dubai or Doha will always enter that equation though, on the strength of its transit offer, both outbound and inbound.