See predication: Who's on first? Who'll be first airline to add a fuel surcharge?

On 14-May-2018, Volaris announced an increase to its base fares for domestic and international operations due to the increase in oil prices. Domestic fares will increase by MXN50 (USD2.54) while international will increase by USD5, effective 17-May-2018. Volaris CEO Enrique Beltranena stated: "With the aim of consolidating our ultra-low-cost model in the face of the abrupt rise in oil prices and, therefore, the jet fuel that represents approximately 30% of our costs, we are forced to increase our base fares in a minimal way to guarantee that our costs are stabilized".

Overnight, Air New Zealand confirmed, via a communication to travel agents, that it will increase its domestic fares by 5%, also from Thursday 17-May-2018. In this instance, Air New Zealand is citing more than just fuel cost rises, instead insisting the increase is "in response to operational cost pressures, including labour, fuel, goods and services," which the airline believes it is unable to continue to absorb.

Are "fuel surcharges" justified?

Over the past three or four years, airlines have shared the benefits of lower fuel prices with travellers. The result has been a sweet outcome that airlines have generally made higher profits and their customers have paid less.

As a result, many travellers have been encouraged to fly when previously they wouldn't have - that is, either entirely new customers or existing flyers who take some additional trips. This generated higher traffic growth, but also created a more price sensitive market profile. That means that if fares go up quickly, the highly price sensitive tip of the iceberg will go away - that growth will disappear.

So, airlines have two basic choices: either forgo profits or risk losing passengers. The third and more likely possibility (which we are now seeing with both Volaris and Air New Zealand) is a bit of both, as well as raising prices/surcharges more steeply for the less price sensitive end of the market, business and corporate travellers. That way the acres of seats down the back can still be filled. Meanwhile, the headline fares can remain the same. And the fuel surcharge becomes just another ancillary, like paying for an extra bag or a meal; except that this one isn't optional.

Where will fuel prices go?

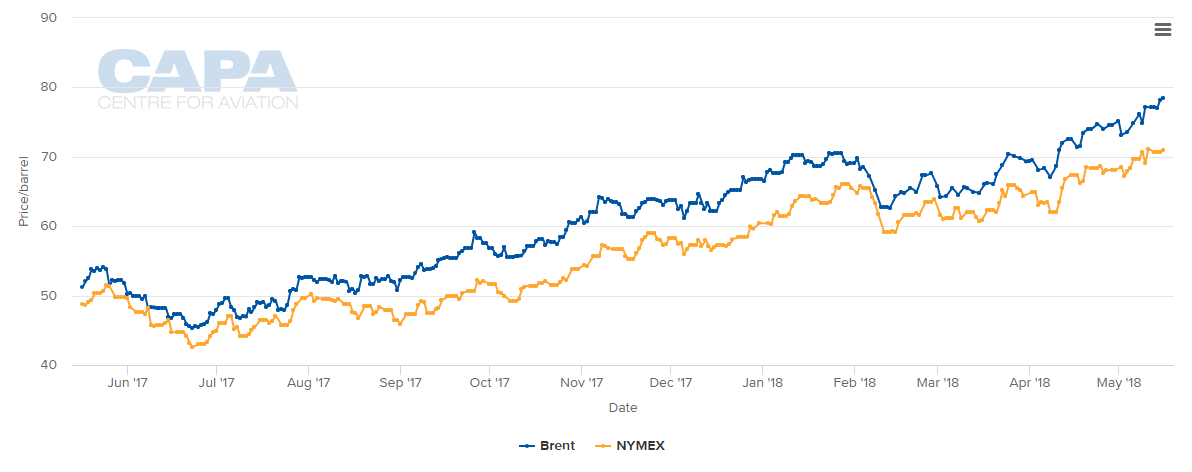

After a nice long period of low oil prices, the cost of a barrel of Brent Crude oil has gone through USD75, which literally changes everything. IATA's Nov-2017 industry profit projections for 2018 were based on a level of USD60 for fuel. That was the industry consensus at the time. Not any more.

Source: CAPA - Centre for Aviation and oil markets

Source: CAPA - Centre for Aviation and oil markets

Two years ago, Brent was USD50 per barrel cheaper. That tripling of prices hurts airline cost in a big way. A strengthening US dollar only adds to the cost pain, particularly for any airline whose revenues are not in USD.