But growth and development seem to be at different levels throughout the continent with some mega-projects underway at for example Algiers, Cairo, Nairobi, and Cape Town airports and new airports being built or planned in Kigali, Addis Ababa and elsewhere while at the same time there is no discernible development at all in some countries.

Summary:

- When it comes to airport investment there are perhaps two Africas, as emphasised clearly by recent development in Mauritius and Uganda;

- Mauritius has found it easy to attract Groupe ADP to help develop its primary gateway, Sir Seewoosagur Ramgoolam International Airport;

- Uganda is reliant on third party road shows to attract any interest at all in a new airport to service fast-growing Oil & Gas industries.

Financing is often the problem. There are glamorous places that attract tourists and, with it, plenty of spending money for airport shops, stores and bars. There are others that will never service any more than a local population with limited disposable income. Two recent announcements in Mauritius and Uganda underscore this dichotomy.

Construction on the new terminal at Mauritius Sir Seewoosagur Ramgoolam International Airport (MSSRIA) is expected to commence in 2019, doubling its annual capacity from 4.5 million to nine million passengers. Expansion plans should be ready by YE2018, after which Airports of Mauritius "will look at the financing" and select the contractors. The project will require an investment of USD250 million.

It is nice when the financing can come as an afterthought to the project. But Mauritius is a stable democracy with regular free elections and a positive human rights record. The country has attracted considerable foreign investment and has one of Africa's highest per capita incomes.

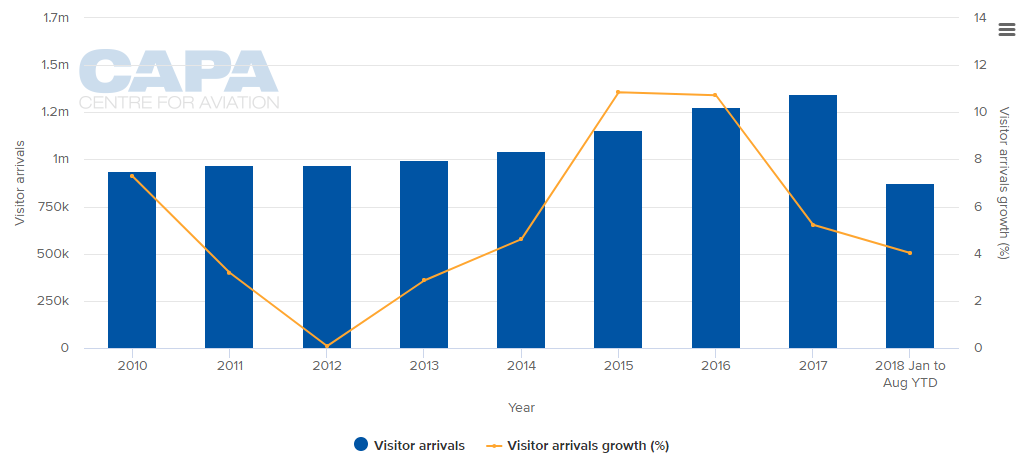

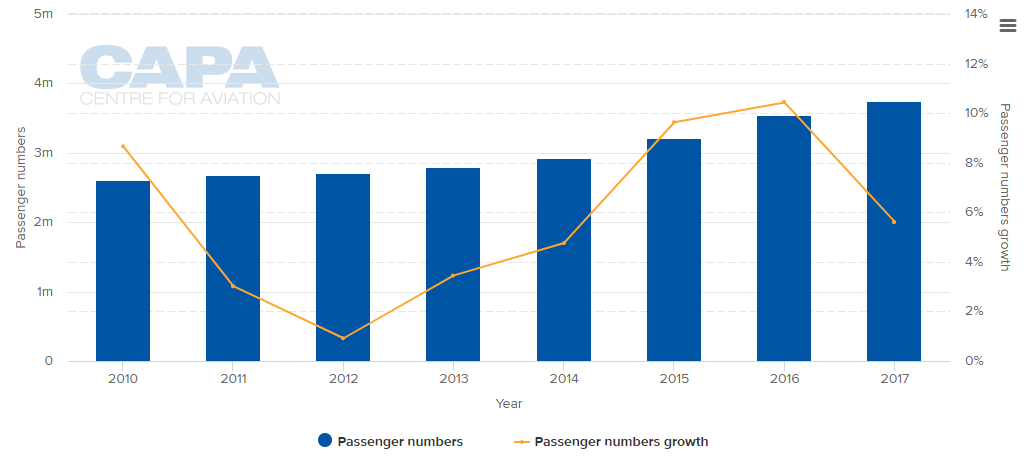

CHART - Mauritius has had consistent, if variable, tourism growth since 2010 (top) as it came out of the eye of the world financial storm, which has translated into similar levels of traffic growth at the airport, the country's primary gateway (bottom)

Source: CAPA - Centre for Aviation, Statistics Mauritius and MMSSRIA reports

Source: CAPA - Centre for Aviation, Statistics Mauritius and MMSSRIA reports

As a result France's Groupe ADP, which runs the Paris airports and which is involved with several airports in North Africa and the Indian Ocean area, has just signed an MoU with Mauritius to strengthen cooperation at the country's airports and specifically to develop Mauritius Sir Seewoosagur Ramgoolam airport.

The other side of the coin may be found in Uganda, where while the political position may be much improved, economic growth has slowed since 2016. The country relies on donor support for long-term drivers of growth, and only 22% of the country even in urban areas has access to electricity.

A second international airport is to be built in the country (the only one momentarily is Entebbe International Airport), the Hoima Kabaale Parish International Airport, the main purpose of which is to support the country's burgeoning oil and gas industry.

Oil revenues and taxes are expected to become a larger source of government funding as oil production starts in the next three to 10 years. Over the next three to five years, foreign investors are planning to invest USD9 billion in production facilities projects, USD4 billion in an export pipeline, as well as in a USD2-3 billion refinery to produce petroleum products for the domestic and East African Community markets. Furthermore, the government is looking to build several hundred million dollars' worth of highway projects to the oil region.

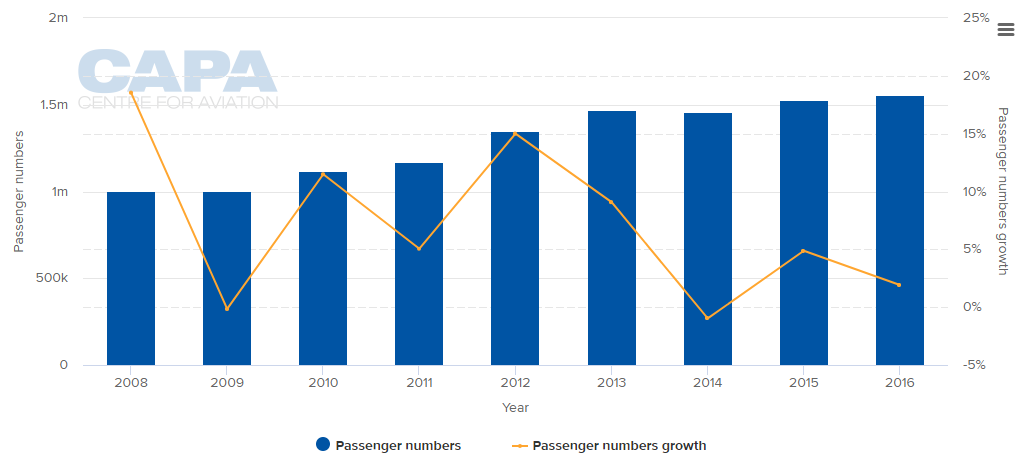

CHART - Passenger demand levels at Entebbe International Airport could be another reason for dampened investor appetite? Source: CAPA - Centre for Aviation and Entebbe International Airport reports

Source: CAPA - Centre for Aviation and Entebbe International Airport reports

One might have thought that the combination of oil products, highways (possibly toll ones) and an airport would have galvanised interest in this development, particularly from organisations active in both highway and airport financing. The oil and gas industries have certainly done that in Russia, where some airports exist solely because of it and where they are partly owned by industries in the sector, while India is another country where oil and gas firms take an active interest towards airports.

However it appears that this venture has had to fall back on support from UK Export Finance and the Department for International Trade, the UK being the old colonial power, while Colas UK, the British arm of the French road builder, has had to invite UK suppliers to "get involved" in the airport's construction at a London convention on 15-Sep. Colas and SBI International Holdings were awarded the contract to build the airport as a joint venture.