In a competitive European market which has already been partly responsible for the collapse of Monarch Airlines in the UK, Flybe says "higher than expected" costs in the first half related to a detailed review of aircraft maintenance is the reason for the adjustment. This includes the charging of previously announced additional IT costs of around GBP6m in the period related to the development of a new digital platform.

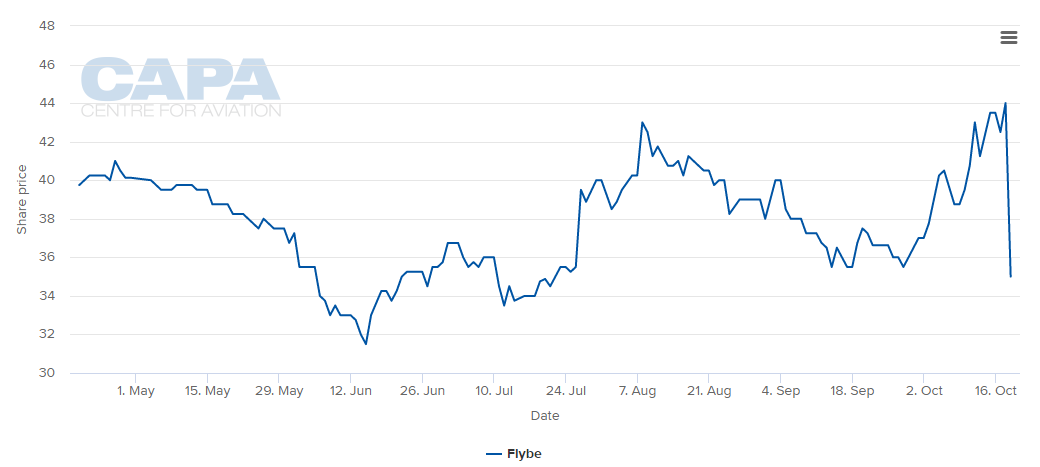

After closing the previous day at 44.00p, Flybe's shares opened the day's trading at 36.48p and despite recovering slightly to 38.55p during early morning trading, fell to 35.00p, closing the day down 20.5%. This is its lowest level since Jul-2017 after levels dipped after its full year results were revealed. The shares responded slightly in early trading on 19-Oct-2017 opening at 35.70p but had fallen again to 34.95p as this article was posted.

CHART - Flybe's share dropped dramatically on 18-Oct-2017 after another profits warning Source: CAPA - Centre for Aviation

Source: CAPA - Centre for Aviation

Earlier this year Flybe had warned it would make a loss for the previous full financial year rather than post a small profit before announcing a full-year pre-tax loss of GBP19.9m. Christine Ourmieres-Widener, who joined the airline as CEO at the start of the year says she remains confident the airline remains on a sustainable path to profitability. More details will be revealed when the airline announces its interim results on 09-Nov-2017.

"The increased maintenance costs are disappointing, but we are already addressing these in the second half and remain focused on improving our cost base and reliability performance. Our Sustainable Business Improvement Plan is delivering benefits with the fleet size now reducing, and consequently both yield and load factors are increasing," she adds.

The increased costs are part of a drive to further improve the reliability of its aircraft, particularly the Bombardier Q400 turboprop, and Flybe says improvements are "already being seen". A full review of the maintenance strategy has now been launched which aims at a significant improvement of aircraft performance and costs.

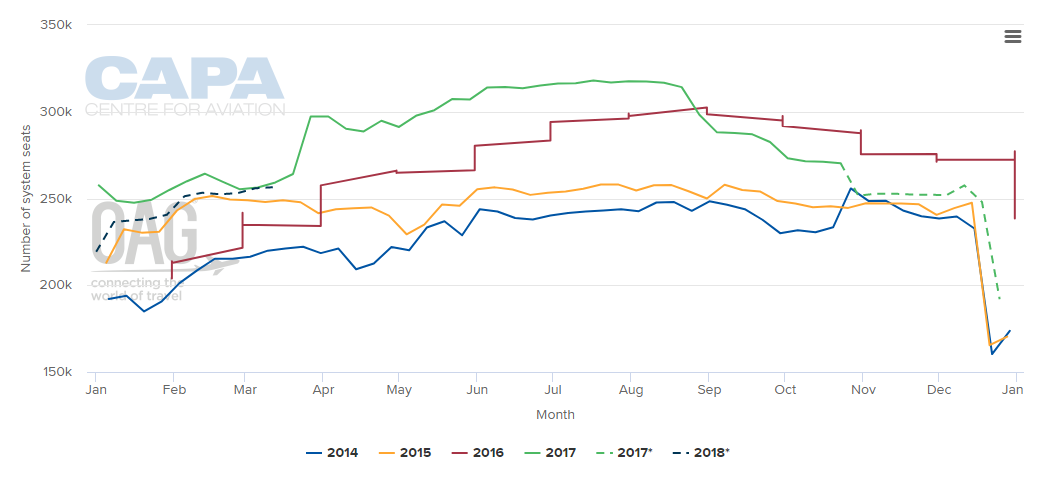

Flybe's business plan includes a network optimisation that will be based around a smaller fleet of aircraft moving forward. The airline says its fleet reached a peak this past summer and is set to fall by just under a fifth over the next three years. The previous increase in capacity had a negative impact on its load factor and unit revenue and had caused its fall back into the red.

CHART - Flybe has already begun to reduce its network capacity and adapt it more closely to demand, in an attempt to restore profits Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

CAPA - Centre for Aviation senior financial analyst Jonathan Wober says matters of this sort often come to light after a change of management, as the new CEO works to reshape the business.

"This is a short term hit to costs and the stock market doesn't like the unexpected, but Ms Ourmieres-Widener's business improvement plan should set Flybe on a more positive course, particularly if this winter's planned capacity cuts prove beneficial to yields," he adds.

CAPA reported earlier this year that in spite of operating a network that faces no competition from other airlines on the majority of its routes, and in spite of being comfortably Europe's largest regional airline - Flybe has regularly struggled to make a profit.

It said that the airline's thin/negative margins are evidence that, in fact, it faces significant competition, but from surface transport and also evidence that its unit cost is too high relative to the unit revenue that it is able to generate. This, said CAPA, has been exacerbated by excess capacity growth, but also partly reflects the high unit cost that is inherent in the regional airline model.

CAPA members can read the full insights analysis: 'Flybe plans post peak fleet profit progress; new CEO introduces a business improvement plan'.