Summary:

- Flybe is to end jet operations from Cardiff, Doncaster-Sheffield, Exeter and Norwich as part of a fleet realignment programme;

- Some of these markets will be harder hit than others as there aren't that many carriers to fill any gap should there be any future network cuts;

- Any future cuts could send shock waves as significant as the collapse of Monarch Airlines in Oct-2017 across the UK market, although spread more widely and thinly.

The airline is currently adjusting its winter 2019/2020 schedule to reflect the end of jet operations from Cardiff, Doncaster-Sheffield, Exeter and Norwich airports, but says "connectivity and Dash 8-Q400 operations remain strong".

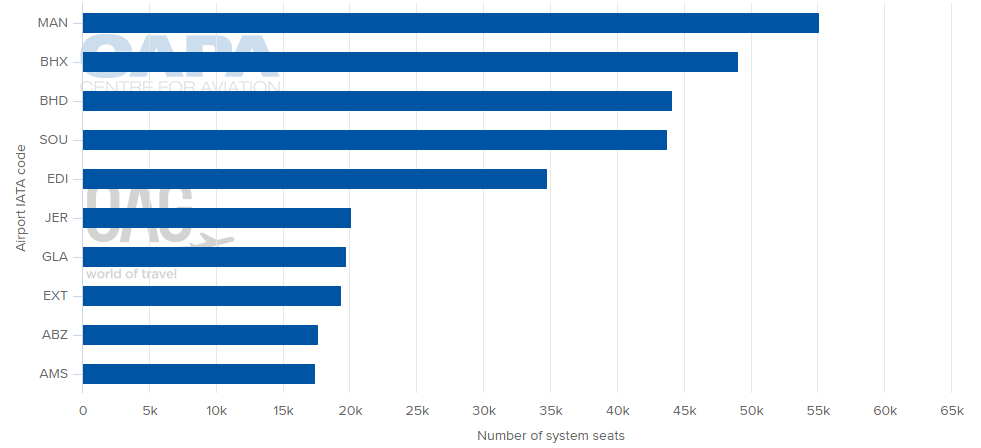

Flybe currently operates from 28 UK airports, with two main hubs at Manchester and Birmingham where it has the greatest capacity. It has become the de facto British flag carrier for the regions and has no services at London Gatwick or Stansted airports though it does operate at Heathrow and City airports. At Heathrow it has recently increased its presence with new Guernsey, Newquay and Isle of Man links, the latter supporting the opening of a two Q400 aircraft base.

CHART - Manchester and Birmingham are Flybe's largest operations with Belfast City, Southampton and Edinburgh making up the top five by system seats Source: CAPA - Centre for Aviation and OAG (data: w/c 08-Apr-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 08-Apr-2019)

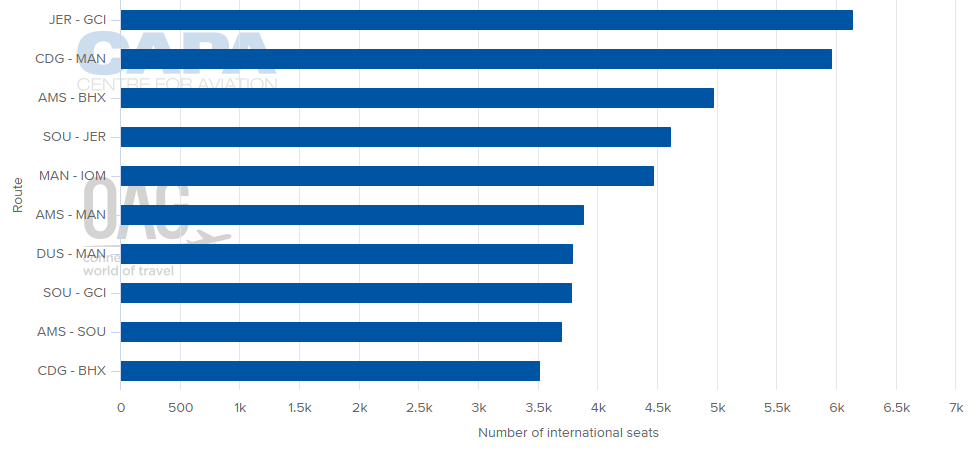

Despite the mocking epithet of 'FlyMaybe' it has attracted from some business travellers latterly following recent flight cancellations attributed to staff shortages, Flybe has provided the corporate world with essential services connecting major regional British cities and frequently being the sole UK representative on many international routes into western Europe.

CHART - Flybe's top 10 international routes by capacity, shows the significance of routes to Paris, Amsterdam and Düsseldorf. The former will be important under Connect Airways' ownership given Air France and Delta's stakes in Virgin Atlantic Source: CAPA - Centre for Aviation and OAG (data: w/c 08-Apr-2019)

Source: CAPA - Centre for Aviation and OAG (data: w/c 08-Apr-2019)

Looking at Flybe's impact at Manchester and Birmingham, it is the fourth largest by seat capacity at the former with an 8.5% share, which is similar to what Monarch had, and second largest at Birmingham with 17.6%. A withdrawal, partial or full, from either of those airports would be a body blow to them but that is highly unlikely.

Flybe has been gravitating towards major metropolitan area hubs for several years (including London selectively, from where it once did not fly at all) at the expense of its original focus region of southwest England. Moreover, that is where there are synergies with other carriers, such as new part-owner Virgin Atlantic (at Manchester) and where it already operates an established hub network.

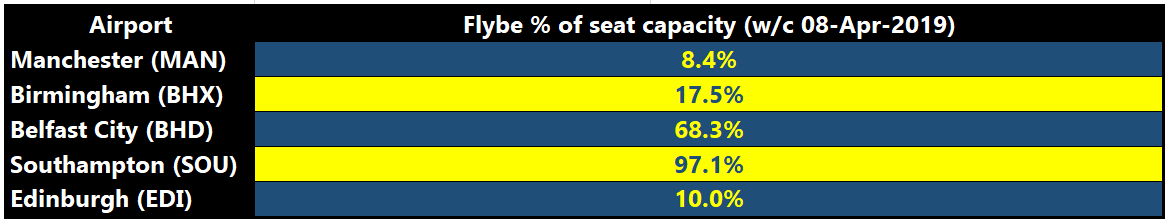

Other 'redbrick' major provincial city airports, such as Edinburgh and Glasgow have a similar exposure to Flybe as at Manchester. On the other hand, it is evident that there are smaller airports where Flybe is a big player, which means much effort will go into it retaining those services by the airport management. They include Southampton, Belfast City, Exeter, Jersey and Aberdeen.

TABLE - Looking at Flybe's UK activity it can be classed both as a 'big fish in a small pond' and a 'small fish in a big pond' with activities that spread across more than 20 airports, all varying in size Source: CAPA - Centre for Aviation Airport Profiles

Source: CAPA - Centre for Aviation Airport Profiles

The airports one might conclude that are most likely to be impacted negatively are those where (a) Flybe has a small presence; (b) there are jet aircraft servicing it (see below); and (c) its presence is not long-established.

Concerning jet aircraft, Flybe has an existing strategy to reduce its fleet and return all 118-seat Embraer E195 aircraft to its lessors. According to the CAPA - Centre for Aviation Fleet Database it has a total of 11 E175s and six E195 models, with four E175s on order (which may be cancelled). Alongside the six E-195s, being returned after the summer 2019 schedules, four E175s will also be returned to the lessor.

It also has 54 Bombardier DHC-8Q-402 and -402(NG) turboprops, which will be the mainstay, the backbone of the fleet now. They have lower fuel consumption, which more than offsets lower cruising speeds, shorter ranges and higher engine maintenance costs. They still have a range of over 2000 km which encompasses much of Flybe's network though, and the carrier has used them on high-density routes such as Manchester-Amsterdam and one of the few turboprop operations into London Heathrow.

it will now cease all jet operations at Cardiff, Doncaster-Sheffield, Exeter and Norwich from the start of the 2019 winter season, but will continue to serve these markets with Q400 turboprops. Cardiff and Doncaster-Sheffield have come off worst as they will lose bases as well, with Cardiff being particularly hard hit.

It took Cardiff a long time even to start to recover from the loss of bmibaby in 2011 and Flybe has been a major part of the turnaround there. Passenger traffic growth has been in double-digit or high single-digit figures for the last four years. Now, in the worst-case scenario, it could be back to square one.