The US has opted levy tariffs up to to USD60 billion on Chinese imports of aerospace products, robotics and information technology. In response, China has opted to place levies on US imports including cigars, soybeans, whiskey, aerospace and automobiles.

Although the agency does not project any immediate affects from the trade spat, it is warning "borrowing for capital programmes may be curbed somewhat should the [US] Federal Reserve continue to raise interest rates. However, high concentrations of fixed -rate debt in the transportation sector should offset any ripple effect higher interest rates could create".

US manufacturer Boeing will be watching developments closely. Aircraft and their parts are the largest single category of US exports to China and its initial retaliation to the US import tariffs has been to introduce its own import tariffs on aircraft weighing between 15,000 and 45,000 kilograms. A clear flexing of muscles it appears as interestingly this category includes up to the Boeing 737-800 but falls short - by less than 100 kilograms - of the 737MAX-8 and Boeing's widebody portfolio.

CHART - Any change to import tariffs could put Boeing at a disadvantage to rivals in placing aircraft in China which already has outstanding orders for just over 150 737-800s (top) and has more than 270 737MAX-8 aircraft (bottom) on order, plus a handful of larger MAX-9s and MAX-10s with over 100 further aircraft not allocated to a variant

Source: CAPA - Centre for Aviation Fleet Database (data: as at 05-Apr-2018)

Source: CAPA - Centre for Aviation Fleet Database (data: as at 05-Apr-2018)

According to a Reuters report, China Eastern Airlines has said the brewing trade war could prompt it to adjust capacity and frequency on associated routes in the expectation that it may impact passenger travel and cargo. It said it has set up an internal group to monitor any impact on trade that could result in aircraft downgauge or a reduction in flight frequencies across the Pacific.

As uncertainty over a potential trade conflict swirls, Fitch projects passenger traffic at US airports will moderate in 2018, with growth of 2.5% to 3.5%. International hubs will lead that growth, and Fitch cited several strong performers including Newark, Fort Lauderdale and Boston.

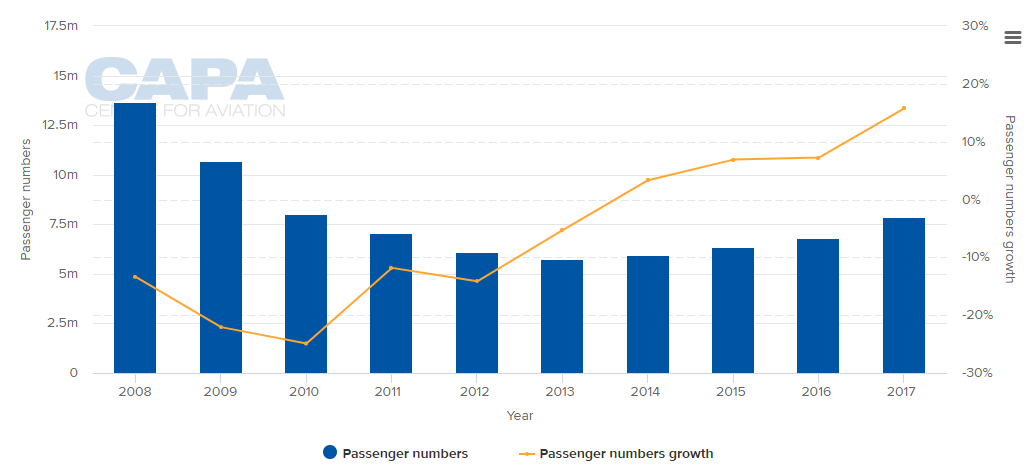

Airports with typically lower enplanements are also seeing surges in traffic including Long Beach, Cincinnati, San Jose and Burbank. After its passenger growth contracted from 2010 to 2013, Burbank's passenger numbers jumped 14.4% to 4.7 million. Cincinnati, a former hub for Delta and now a focus city for the airline, recorded 15.8% passenger growth in 2017 to 7.8 million.

CHART - Cincinnati/Northern Kentucky International Airport witnessed double-digit year-over-year traffic growth of 15.8% in 2017 and that has continued into the first two months of 2018 which recorded a 15.5% year-over-year rise on the same period last year Source: CAPA - Centre for Aviation and airport reports

Source: CAPA - Centre for Aviation and airport reports

Delta recently announced new service from Cincinnati to Austin and Phoenix, as well as upgauging aircraft at the airport as part of its years-long initiative to upgauge its domestic fleet. According to WCPO in Cincinnati, Delta has logged 27 consecutive months of growth from Cincinnati airport.

Despite that solid traffic growth, Fitch is warning US airlines are seeing some unit revenue and cost pressure "that could lead to a softening of service additions".