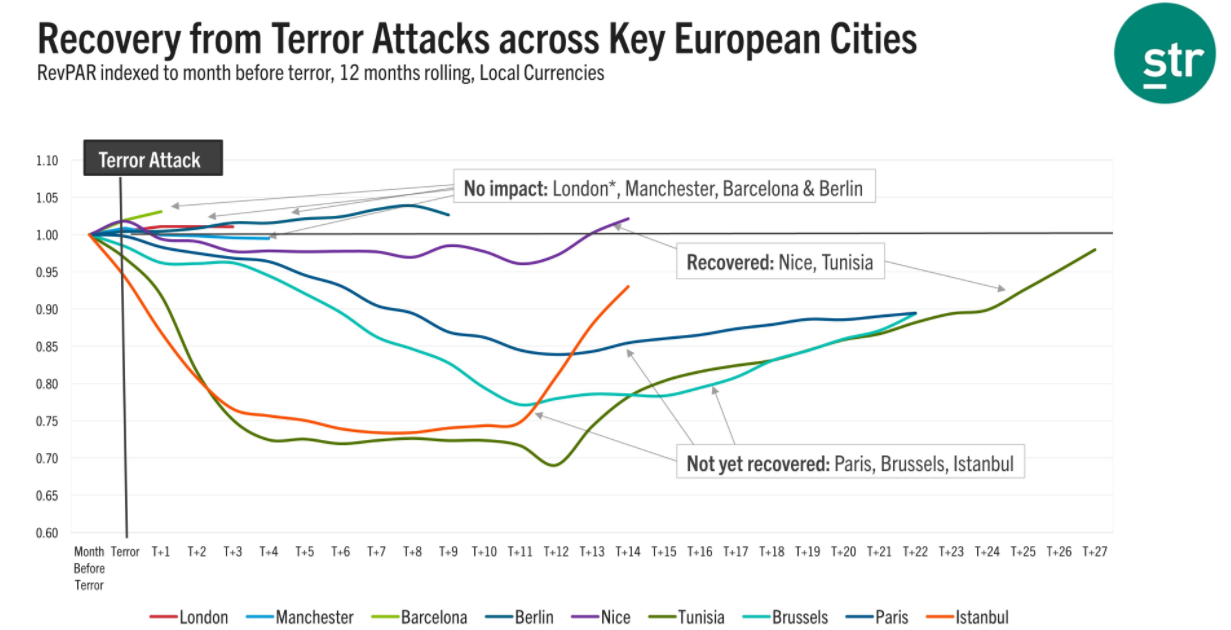

The performance highlights the resilience of the hotel sector, recovering quickly from challenges and in many instances even seeing very little notable impact from terrorist attacks as has been the case recently for Barcelona, Berlin, London and Manchester, STR notes.

For the September 2017 year-to-date time period, most major European cities recorded growth in revenue per available room (RevPAR) the data shows. Zurich was an outlier, with a 3.1% decline in the metric due to the strength of the Swiss franc against the European euro. At the other end of the spectrum, Istanbul saw the sharpest increase (+31.8%) due to recovery from an extremely low basis of comparison last year, when the market was significantly affected by terrorism and security concerns.

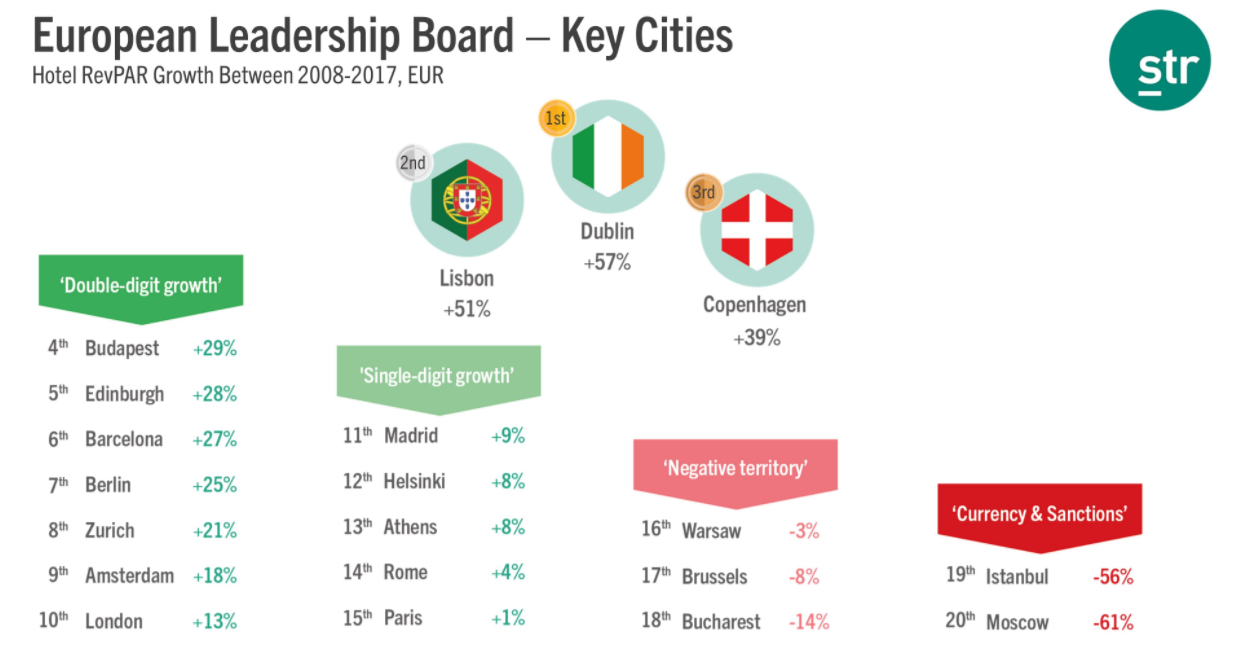

CHART - STR data shows that Dublin has seen the largest rise in RevPAR across Europe over the past ten years, while Moscow has seen the largest decline Source: STR

Source: STR

In addition to faster recovery from terrorism, Europe's hotel market has benefitted from strong growth in tourism business across Central and Eastern Europe as well as the Iberian Peninsula. Several key markets recorded double-digit RevPAR increases, including Kiev (+24.1%), Lisbon (+20.0%), Madrid (+19.1%), Budapest (+18.4%), Barcelona (+15.1%) and Warsaw (+11.3%).

Although Barcelona's performance remained quite strong through the August terror attack and September protests, substantial drops were seen after the 1-Oct-2017 Catalan Independence Referendum (see 'Catalan independence referendum disrupts strong hotel and flight performance into Barcelona').

CHART - STR data shows Barcelona, Berlin, London and Manchester saw little impact to RevPAR from terrorist attacks; Nice has now recovered; but Brussels, Istanbul and Paris are still to return to pre-attack levels Source:STR

Source:STR

The UK's hotel performance has been notably strong this year, in the wake of Brexit and the attacks in London and Manchester. STR data shows London has seen demand growth every month since last November, with the pound devaluation boosting both international and domestic tourism.

This position has been backed up by Tourico Holidays, one of the world's fastest growing wholesale travel brokerage companies. Working with 2,000 UK hotels and offering more than 50,000 rooms per night, it says its own hotel bookings for the UK market have risen 29% in 2017 versus last year.

Based on Tourico's latest hotel booking report, the USA increased its year-over-year bookings to the UK by 11%, while Canada increased its bookings by 35% . South America increased its bookings by 38% and the Middle East market by 22%. Asia-Pacific travellers continue to also grow into the UK, increasing by 31% overall - with arrivals from the emerging China market up 69% and more mature Australia market up 28%.

But, with the pound remaining relatively weak, Europeans, in particular, have been flooding to the UK, with an increase of 52% in Tourico bookings compared to 2016. Specifically, Scandinavia has increased its hotel demand by 17%, while Spain jumped 49%. Tourico's data also reveals that domestic hotel bookings or "staycations" within the UK have risen by 21% year-over-year.

However, year-over-year demand increases now appear to be waning as sterling has risen, and incoming supply growth could put pressure on London's occupancy levels in the near future. Intelligence provider ForwardKeys, which analyses forward bookings, warns that data for 4Q2017 indicates a significant slowing in demand, with long haul bookings currently standing 7.0% ahead of where they were at the equivalent point last year. This is down from 13.5% year on year growth recorded across the first three quarters of the year.

CHART - While long haul arrivals into the UK from Africa, the Middle East and the Asia Pacific remain resilient in Q4 traffic from the Americas is showing significant signs of slowing Source: ForwardKeys

Source: ForwardKeys

Most notably, it identifies the Americas, the UK's most important origin market by numbers and by value (they represent a 50% share of long haul visitors) as a key example of the slowing. Arrivals in the first three quarters of the year were up 16.9% on 2016 but bookings for the fourth quarter are currently just 4% ahead of where they were at this time in 2016, it reports.

The slowdown in bookings from the USA correlates with a decline in the relative strength of the US$ dollar against £ Sterling. Last October, Sterling hit a 5-year low of $1.22 but the rate has since recovered to over $1.30.

The ForwardKeys data also reveals a slight slowdown in growth of the long haul outbound market from the UK too in the latter stages of this year. In the first three quarters of 2017, departures were up +7.5% on last year. However, bookings for the last three months of 2017 are currently running +6.3% ahead of where they were at the same moment in 2016, according to the company.