The Blue Swan Daily analysis of OAG flight schedules each week highlights a notable resumption of flight capacity over Jun-2020 and Jul-2020, albeit still at levels well down on last year and heavily weighted to the domestic markets where there is increased freedom to travel. But, concern has remained that just because flight options are available, it doesn't mean demand will automatically follow.

While we have seen an upturn in demand, the 'build it and they will come' principle appears to have too many external factors impacting its delivery. This past week the European section of Airports Council International (ACI), the industry body that supports the airport sector, has warned that the return of travel demand has not been at the pace it expected despite the return of air services.

ACI Europe says passenger traffic across the European airport network still stood at -93% in Jun-2020 compared to the same period last year - a marginal improvement over the previous month (May 2020: -98%). Europe's airports welcomed only 16.8 million passengers through their doors in Jun-2020, compared to 240 million in the same month last year.

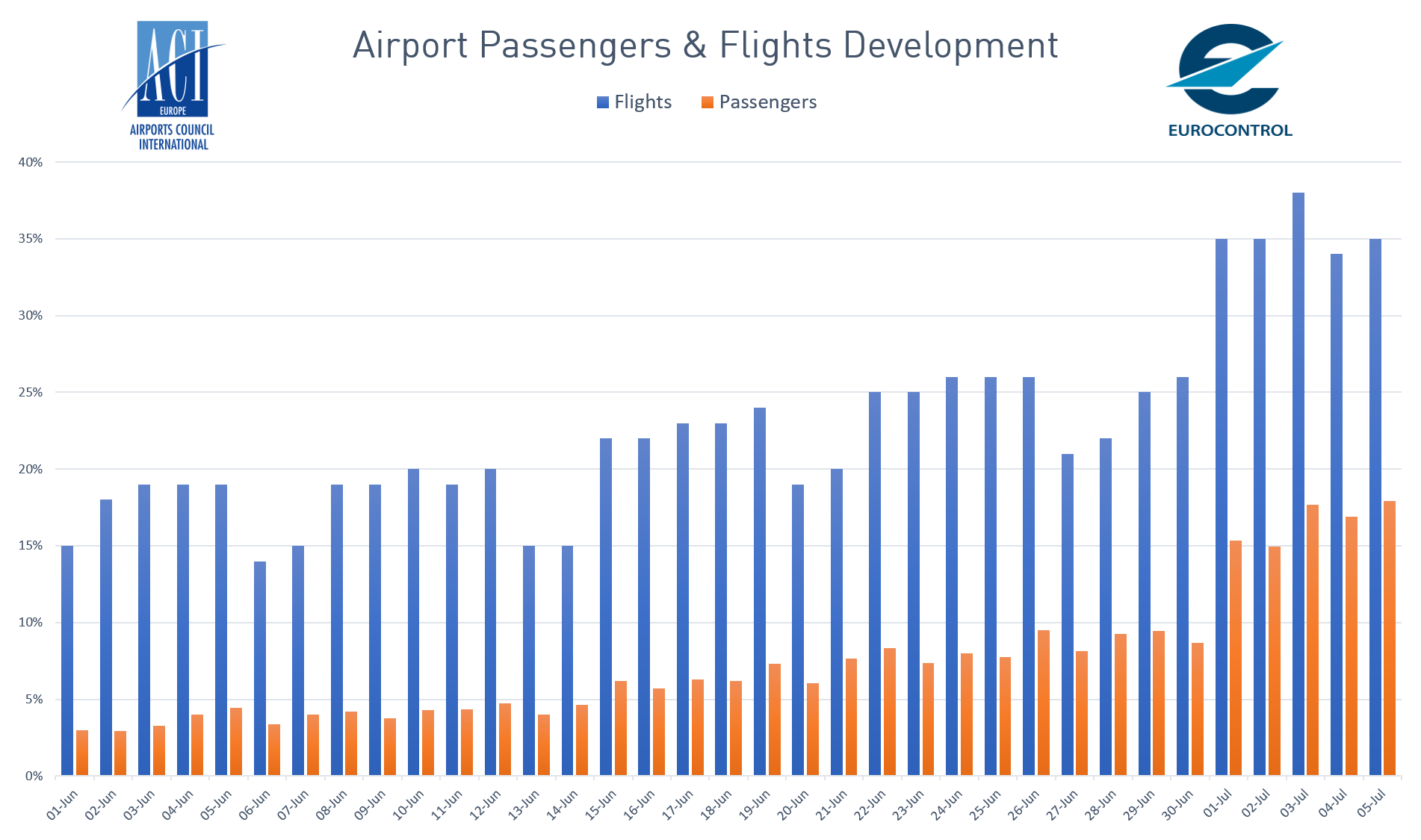

CHART - Flights may be returning at European airports, but passenger demand has been slow to recover Source: ACI Europe

Source: ACI Europe

Looking at the positives, the improvement over the preceding month reflects the progressive lifting of travel restrictions within the EU and Schengen area. As a result, the European airport network saw daily passenger volumes increasing nearly threefold from 267,000 passengers at the start of the month to 757,000 passengers at the end - But this is still a far cry from last year's daily average of eight million in the same month.

"The recovery in passenger traffic is proceeding at a slower pace than we had hoped for," acknowledges Olivier Jankovec, director general of ACI Europe. "This was the case in Jun-2020," he adds and concedes initial data for Jul-2020 also indicates the recovery of only 19% of last year's traffic rather than the 30% it had forecast.

"This is down to the still incomplete lifting of travel restrictions within the EU / Schengen area and the UK - as well as the permanence of travel bans for most other countries," explains Mr Jankovec. "The fact that EU and Schengen states have not yet managed to effectively coordinate and align over their travel policies does not help, as it is not conducive to restoring confidence in travel and tourism in the middle of the peak Summer season."

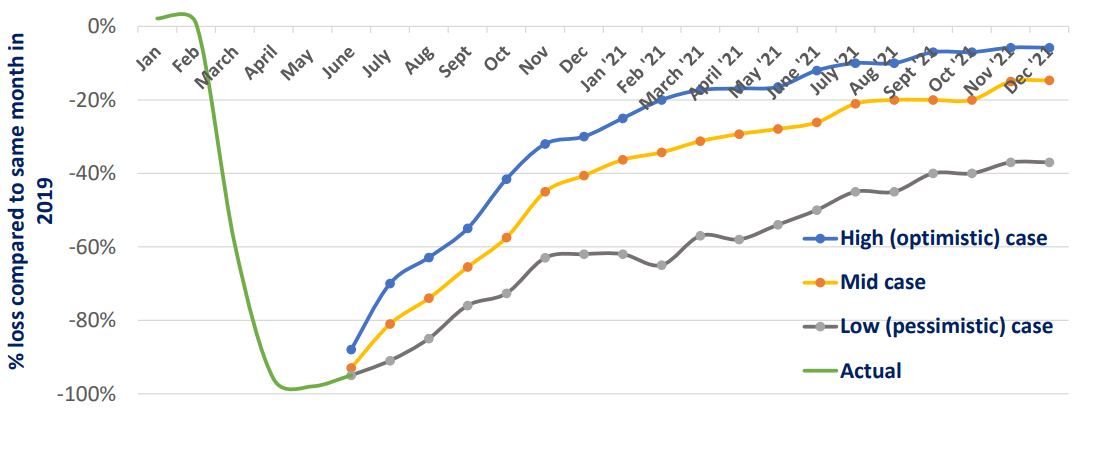

Taking stock of the developments as well as of the current epidemiological situation globally, ACI Europe has released a revised traffic forecast. Accordingly, it says a full recovery in passenger traffic to 2019 levels is now expected for 2024, rather than 2023 as per its previous forecast in May-2020.

An extremely high level of uncertainty remains around the recovery - 56% of airport traffic forecasters predict that full-year traffic levels in 2023 will exceed 2019 traffic; 88% predict that traffic in 2024 will exceed 2019 levels.

CHART - The latest forecast from ACI Europe suggests that European traffic levels will recover to between -30% and -62% of 2019 levels by the end of 2020 and between -6% and -37% by the end of 2021 Source: ACI Europe

Source: ACI Europe

Europe's airports are now set to lose -1.57 billion passengers in 2020, it indicates, a decrease of -64% compared to the previous year, while Europe's airports' revenues are now set to decrease by -EUR32.4 billion in 2020, down more than two thirds (-67%).

The airport body also warns that current recovery patterns come with significant diseconomies of scale for airports. With reinstated flights generally achieving low load factors, passenger volumes are trailing behind flight numbers. This is particularly impacting airports, "as their operating costs are driven by aircraft movements while the bulk (76%) of their revenues comes from passengers (through passenger charges for the use of their facilities and a wide range of passenger-driven commercial revenues - in particular retail)," explains ACI Europe. This means that the current recovery pattern disproportionately increases costs relative to revenues.

"The financial situation of airports is not significantly improving - with some even making more losses now compared to their situation prior to the restart," says Mr Jankovec. As concerning for the European industry is the fact that we are now well into the peak summer travel season which generally accounts for a large share of annual revenues and demand remains massively diluted.

With fears remaining over a potential second wave of Covid-19 infections as temperatures drop in the coming winter months there is an obvious real concern that liquidity will remain an on-going concern through the winter. Whatever the weather, it could be a bleak winter for Europe's airports, its airlines and travellers alike!