Summary:

- The European Bank for Reconstruction and Development actively helps finance airport infrastructure in Europe, West Asia and other countries;

- It does so by way of loans, grants, guarantees and, rarely, equity investment;

- Although it is not exclusively European-owned some of its financing projects appear to act as a counter to adverse decisions taken by European government institutions.

Firstly, that concession has not yet been rubber-stamped. It will enter into force following a six-month period during which Vinci has to adhere to the conditions precedent detailed in the concession agreement. In the interim, project financing arrangements still have to be discussed and agreed. That airport wishes to build a long haul portfolio, and quickly.

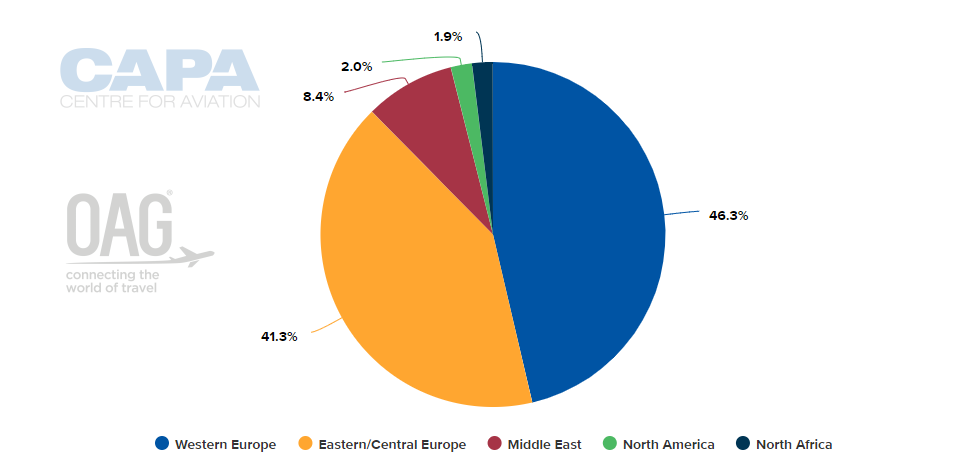

CHART - A look at the breakdown of weekly capacity from Belgrade shows how it lacks long haul connectivity with just over 12.0% of its non stop seat capacity to destinations outside of Europe Source: CAPA - Centre for Aviation and OAG (data: w/c 25-Jun-2018)

Source: CAPA - Centre for Aviation and OAG (data: w/c 25-Jun-2018)

Secondly, the EBRD, while classed as a multilateral developmental investment bank, is not an investor per se in that it does not necessarily expect a capital return on the money it lends. It is a financier which, despite its public sector status, provides funding for private sector enterprises, through grants and loans. It will also guarantee other organisations' loans and occasionally will make equity investments.

Loans for major projects are typically between EUR5 million and EUR250 million, with an average of EUR25 million. However, EBRD makes it clear that it does not subsidise projects, nor does it offer soft loans (i.e. with borrower-favourable terms).

The EBRD is an international financial institution founded in 1991. It uses "investment" as a tool to build market economies. Initially focused on the countries of the former Eastern Bloc, it expanded to support development in more than 30 countries from central Europe to central Asia. According to its website it has provided over EUR120 billion for more than 5,000 projects.

Besides Europe, member countries of the EBRD are from five continents (North America, Africa, Asia and Australia), with the biggest shareholder being the United States, so the name is somewhat of a misnomer. Headquartered in London, the EBRD is owned by 66 countries, the EU and the European Investment Bank. The EBRD is not to be confused with the European Investment Bank (EIB), which is owned specifically by EU member states and is used to support EU policy.

EBRD is and has been active in the financing of airports throughout Europe and into West Asia. Previous projects include Tirana Airport (Albania), Yerevan International Airport (Armenia), Tallinn Airport (Estonia), Skopje Airport (Macedonia), Tbilisi Airport (Georgia), the Greek airports identified for privatisation (clusters A [completed] and B [pending]), Kazakhstan's Atyrau Airport, Bishkek Manas Airport in Kyrgyzstan, Riga Airport (Latvia), Chisinau Airport in Moldova, the Montenegro Airports, St Petersburg's Pulkovo Airport (Russia), Khujand Airport (Tajikistan), Kiev Boryspil Airport in Ukraine and Uzbekistan's Tashkent Airport. Private capital is in place through sales or concessions in eight of the cases above.

Often the financing is in what might be described as mutually supporting infrastructure enterprises. For example, in May-2017 EBRD announced it would provide a USD4.7 million loan and USD500,000 in grant financing to Bishkek Manas International Airport for modernisation of the terminal. But this is only part of the USD770 million loaned in various sectors of Kyrgyzstan's economy, with projects in infrastructure accounting for a third of the total investment.

EBRD was also involved in financing the concession agreement between Fraport Greece and the Greek government by providing EUR186.7 million out of EUR1 billion in long-term financing to Fraport Greece in Mar-2017, the injection being earmarked for concession payments and the financing of development works at its 14 regional airports. In Mar-2018 the EBRD president proposed an extension of its financing mandate in Greece from 2020 to 2025, stating the organisation "would like to get involved in as many projects as the team here can come up with that makes sense".

Despite the "misnomer" mentioned earlier it is almost as though the bank was trying to make up for the impositions placed on the country by the 'troika' of the European Commission, European Central Bank and the IMF. One hand takes away from Greece (by insisting on higher taxes and the privatisation of government assets such as airports), while the other gives it back to help prop up concession payments.

EBRD was also involved in 2017 in a financial restructuring of Budapest Ferenc Liszt International Airport, with a senior note of EUR100 million; part of a wider package worth up to EUR1.3 billion, split between a privately placed senior note facility of EUR525 million and a banking facility of EUR795 million.

The operator of Budapest Airport holds a 75-year concession, and comprises AviAlliance GmbH (Germany/Canada), Malton Investments (GIC) Singapore, Caisse de Depot at Placement de Quebec (Canada) and Germany's KFW Ipex Bank.

The EBRD then is not a European financial institution as its name suggests but a global one which has funds available that can make the difference between almost financing a critical project and actually doing that. But it is no pushover, is a benchmark for other such development banks elsewhere in the world, and any airport that already has private capital supporting it is in a better position to benefit from its largesse than those that do not.