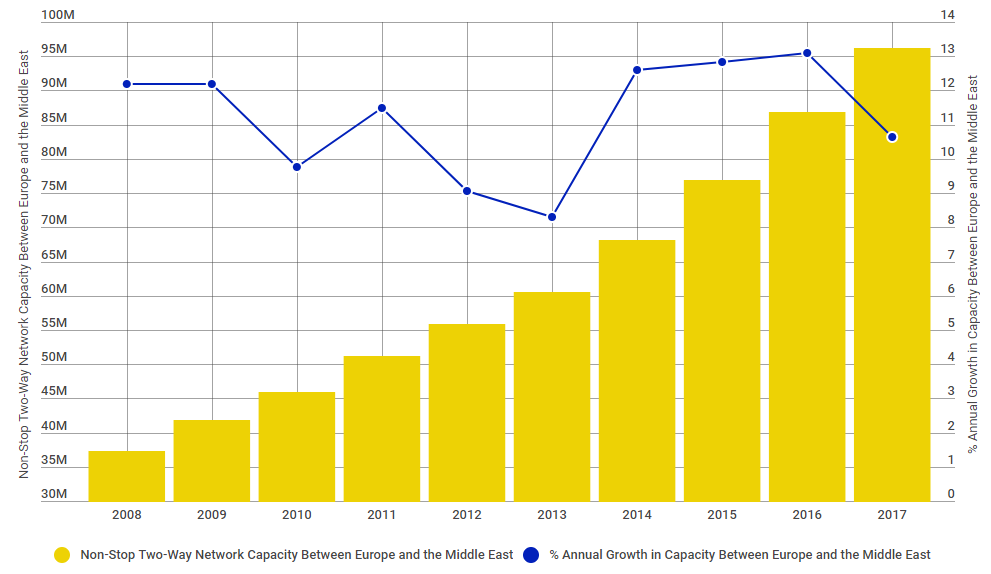

The rate of growth has been stable during this period and while this year's rise will be slightly below the ten year average (+11.2%) and down on 2014 (+12.6%), 2015 (+12.8%) and 2016 (+13.1%), at (+10.7%) it still represents a significant uplift adding 9.2 million seats, the second highest annual increase in capacity after 2016's stand-out growth.

CHART - Two-way seat capacity between Europe and the Middle East continues to show a strong performance even though the rate of growth will slip this year Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

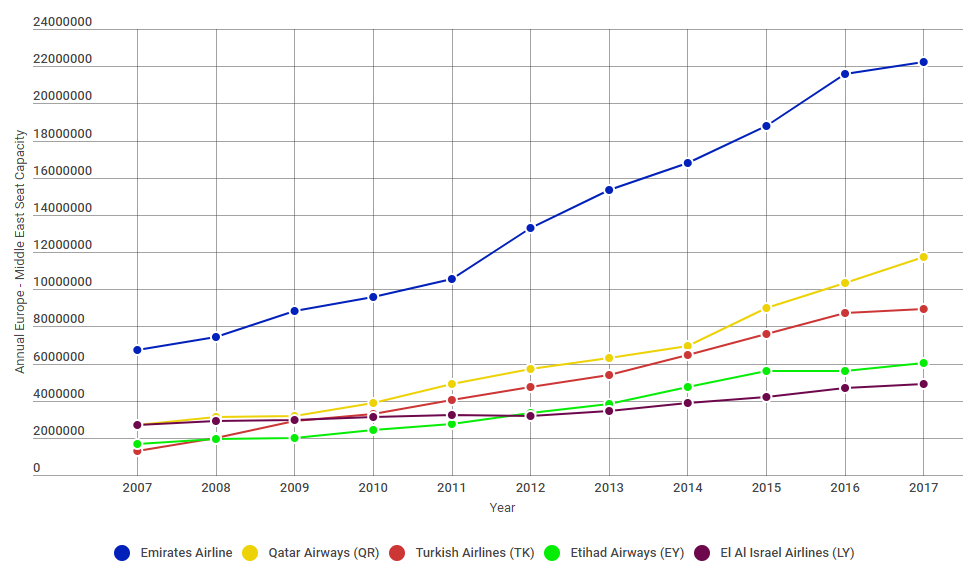

The growth in capacity is amazing. When you consider that back in 2007 El Al Israel Airlines was the second largest operator between Europe and the Middle East and has grown its own capacity by 80.5% since then, learning that it has dropped down to the fifth largest operator may be a surprise. This highlights the scale of the emergence of the big four carriers in this market over the past ten years: Emirates Airline, Qatar Airways, Etihad Airways and Turkish Airlines.

Similarly, other airlines haven't stood still either: Aeroflot Russian Airlines has grown its Europe - Middle East capacity six-fold since 2007; Alitalia has grown at an average annual rate of 7.4%; while Middle East Airlines has delivered a healthy 7.2% average annual capacity rise.

Oman Air has emerged as a major player from its small roots in the last decade, flydubai and Pegasus Airlines have added low fare flights while Saudi Arabian Airlines is taking advantage of its huge home market and ethnic demand to increase its activities. But even a quadrupling of European capacity is to not enough to keep up with the Middle East's leaders.

CHART - Emirates Airline and Qatar Airways are the largest operators in the Europe - Middle East market with a combined 35.3% share of capacity in 2017 Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

With its fleet of almost 100 Airbus A380s Emirates Airline is the largest operator in this market with a 23.1% capacity share in 2017. This is up from 20.2% in 2007 as it embarked on its network growth, but down from a high of 25.4% in 2013 as rivals have increased their own activities at a faster rate. It has grown its capacity into Europe at an average annual rate of 23.1% since 2007.

Its main rivals have been growing at a faster average annual rate, but from a lower base. Qatar Airways now has a 12.2% share of the available seats after growing at an average annual rate of 33.6%, while annual growth of 58.7% and 26.4% at Turkish Airlines and Etihad Airways has boosted their capacity shares to 9.3% and 6.3% respectively.

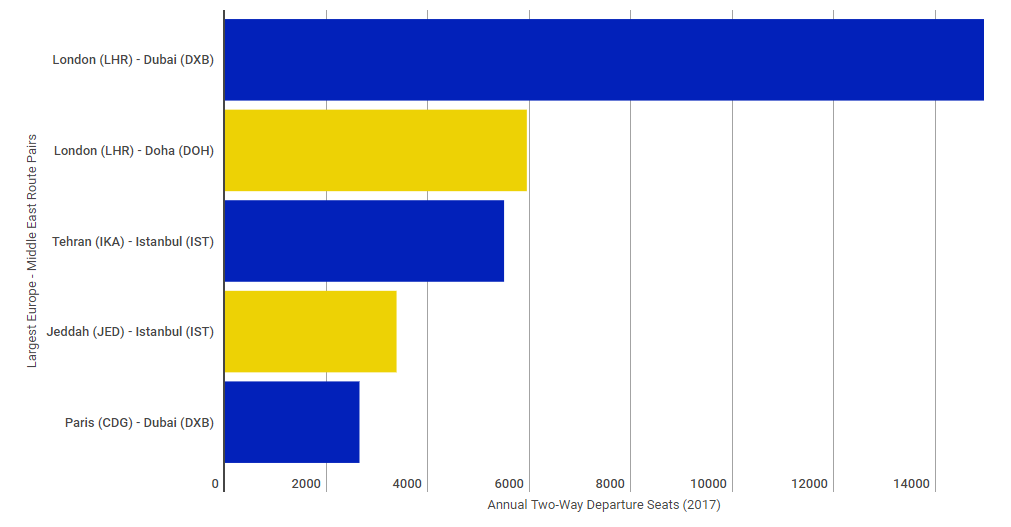

CHART - The London - Dubai market is the largest between Europe and the Middle East and will grow a further 1.5% in 2017 Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

The London - Dubai market is the largest between Europe and the Middle East, due to Emirates multiple daily A380 rotations on the route. A total of 3.8 million seats are available in 2017, an average of 5,200 seats per day in each direction. The London - Doha route is the second largest in this market, just ahead of Tehran - Istanbul, where capacity has grown 9.6% this year.

Engage with the greatest minds in aviation and business travel by joining the world's Airline Leaders and Corporate Travel Executives in London, 11-13 October 2017 at the Sofitel London Heathrow for the CAPA-ACTE Global Summit. Check out the planned agenda and sign up now!