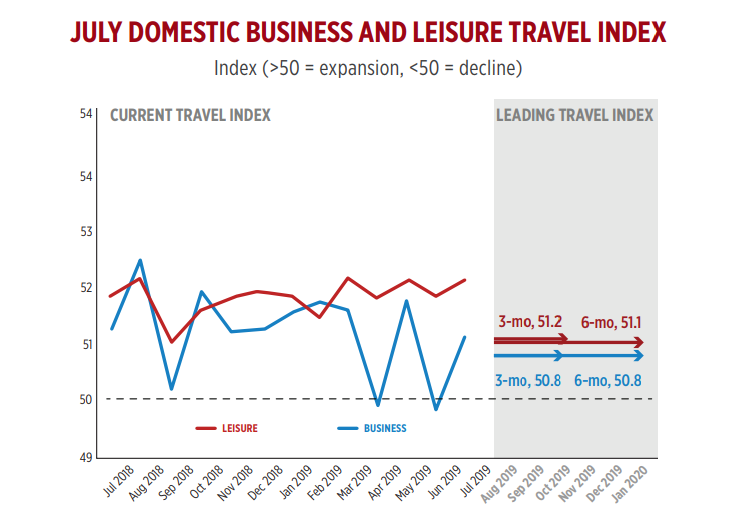

US domestic travel increased +3.8% in Jul-2019, driven by strength in both leisure and business segments, according to the association. Its data show that business travel rebounded from a -0.2% drop year-on-year in Jun-2019 to growth of +2.2% in Jul-2019, which did exceed the six month moving average by a small margin.

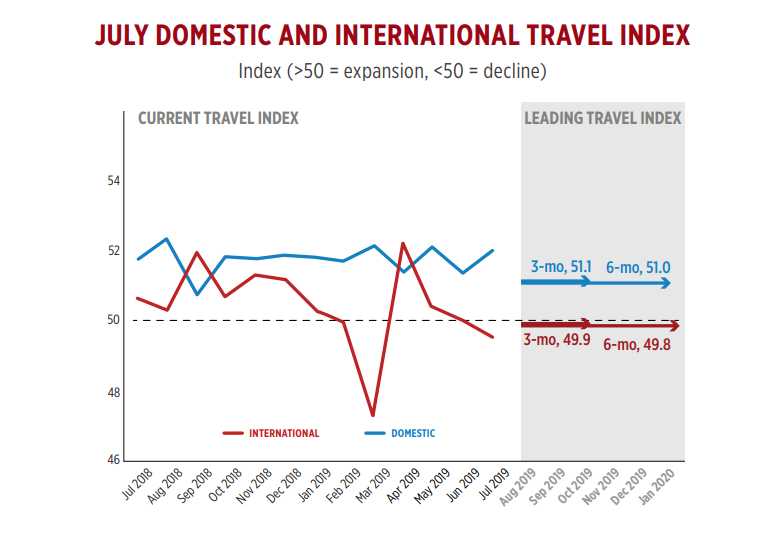

International inbound travel continued its slide in Jul-2019, falling -1.2% year-on-year. The US Travel Association's report stated that the international US travel segment has contracted four out of the first seven months of 2019, and should remain constrained by economic and policy factors during the coming months.

"The solid performance of the domestic leisure and business segments - which together account for 86% of the travel economy in the US - have kept the travel expansion on track through the first seven months of 2019 and have acted as a bulwark against the stagnant state of international inbound travel," said the US Travel Association's senior vice president of research, David Huether.

The association's leading travel index shows a reading of 50.9 during the next six months, indicating total US travel volume should grow +1.8% through Jan-2020. During that same period, domestic travel growth will slow to +2% while "the international inbound segment will, at best, remain stationary", according to the US Travel Association's latest report.

The worrying outlook for international inbound travel is consistent with the association's recent forecast, which projects America's share of the global long-haul travel market will fall from its current 11.7% to below 10.9% by 2022, despite a projected annual increase in volume of inbound visitors to the United States.

Factors contributing to the market-share slide include the continued strength of the US dollar, prolonged and rising trade tensions and stiff competition from rivals for tourism business.

Policy changes such as the long-term reauthorisation of the Brand USA destination marketing organisation, expanding the Visa Waiver Program to include more qualified countries and improving customs wait times can help reverse the decline, says the US Travel Association.