HVS says the demand for serviced apartment accommodation "remains vigorous" across Western Europe and the sector continues to innovate, with new brands being introduced and traditional brands being reinvented. Alternative concepts such as co-living, co-working, student accommodation and home-sharing are also merging with the serviced apartment concept, creating hybrids as a response to changing demand behaviours.

The report highlights that the development pipeline will continue to accelerate across Europe and is set to approach 23,600 additional units by 2022, making it one of the most active sub-sectors in the hotel industry. The UK and Germany represent the vast majority of the total pipeline (similar to the hotel pipeline), although the market continues to experience further diversification in secondary and tertiary cities.

HVS says lenders have reported that debt for serviced apartments is available, although primarily in gateway cities in Western Europe. While debt is available for acquiring existing serviced apartment businesses, the appetite for development financing is smaller; just over half of the participants in its lenders survey said they were willing to issue loans to such projects.

From its survey HVS identifies that serviced apartments account for roughly 10% of the total hotel loan portfolio in Western Europe. The lending criteria remains broadly similar to hotels, although lending parameters are somewhat different for serviced apartments outside of gateway cities.

Looking at the performance of the services apartment sector last year, both occupancy and average rate recorded year-on-year growth in 2018, resulting in a revenue per available room (RevPAR) increase of broadly +7.0%, versus +5.0% in the traditional hotel industry.

The London serviced apartment market saw a steady year-on-year increase in both occupancy and average rate in 2018, resulting in a RevPAR growth of around +4.0%, (compared to the performance of the hotel market at 3.0%). Meanwhile, the rest of the European markets (excluding the UK) recorded faster growth in both occupancy and average rate, resulting in significant RevPAR growth of 7.0% in 2018.

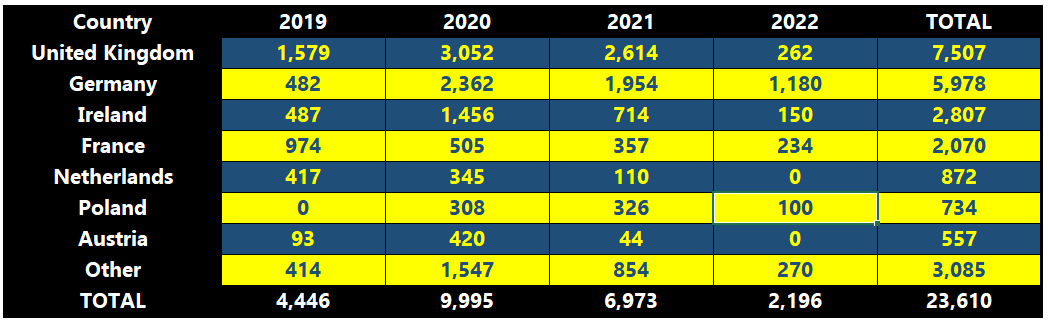

Looking forward and HVS identifies some 23,600 serviced apartment units in the European pipeline for the coming four years (projects that have been publicly announced). 4,450 units of the pipeline should be complete before the end of 2019, followed by a larger number of openings in 2020 (10,000), 7,000 in 2021 and 2,200 in 2022. The sizes of the planned projects vary from 15 to 457 units, with an average of 137 units.

TABLE - Similar to previous years, the UK and Germany represent the vast majority of the total pipeline, with a more than half share of future serviced properties Source: HVS Research

Source: HVS Research

Similar to previous years, the UK and Germany represent the vast majority of the total pipeline (32% and 25%, respectively). Unsurprisingly, London's pipeline represents 39% of the total UK pipeline, followed by Manchester with around 16% of the pipeline and Edinburgh and Cambridge with approximately 10% of the UK pipeline, respectively. This mirrors the overall hotel pipeline trends.

Germany's development distribution is well diversified, says HVS, and spreads across cities such as Frankfurt (20%), Berlin (15%), Hamburg (11%), Düsseldorf (10%) and Munich (9%). The serviced apartment market in Germany is experiencing a changing environment with increasing support from international brands marking their entry and expansion into the German market.

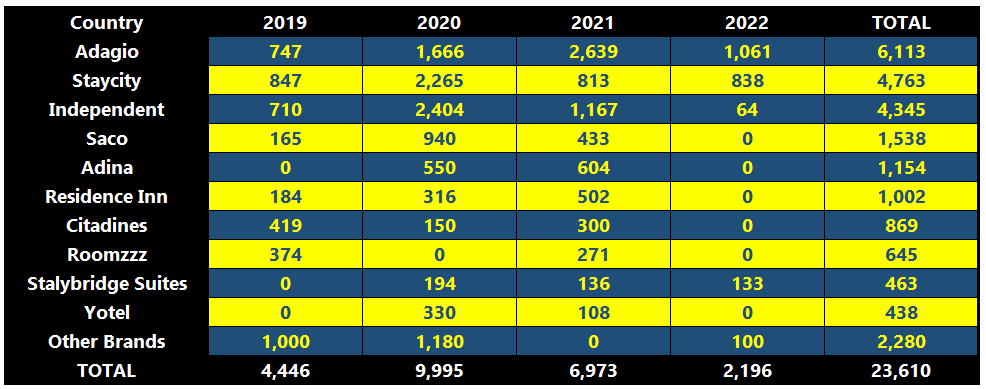

TABLE - Adagio is identified as having the largest pipeline with more than 50 hotel projects (just over 6,100 units) across Europe Source: HVS Research

Source: HVS Research

Adagio is identified as having the largest pipeline with more than 50 hotel projects (just over 6,100 units) across Europe. Staycity's pipeline is just under 4,800 units in Europe, primarily in the UK and Ireland, but also in Germany, France and Italy. These are followed by Saco (1,500), Adina (1,150), Residence Inn (1,000) and Citadines (900).

Interestingly, independent developments are gaining strong development momentum with more than 4,300 units in the pipeline, unsurprisingly primarily in gateway cities in the UK and Germany. Although branding is becoming more important for lending purposes, it is less so in key destinations with established, somewhat self-sustainable demand generators, according to HVS.

"The pipeline in the sector remains robust, with many large operators set to double their portfolios within three years. Our survey results confirm that the sector is becoming more mainstream. Debt is available for all project types, although primarily in Western Europe so far, leading to the increased popularity of serviced apartments as an alternative real estate investment," concludes HVS.