Summary:

- Delta Air Lines is working to drive direct distribution and is already seeing more than half all tickets now being sold via its website;

- The US major is seeing "huge shift" in booking patterns with strong demand for its premium product offering;

- Delta says it sees "no meaningful risk" from long-haul, low cost competitors despite their recent growth into the North American market;

- The airline's CEO Ed Bastian says previous low fuel rates created "a lot of dysfunctional behaviour," but spike in prices could cause a big impact on the low cost business model.

Speaking at a recent investor conference, Delta CEO Ed Bastian acknowledged in the past "the industry was rightfully criticised as having lost control of its distribution". But now with 50% of its customers booking directly at delta.com, "customers are coming directly to us, because they know they're going to get the best value from Delta as well as be able to tape into the various offerings..", including bundled fares and First Class.

Mr Bastian also stated the US airline industry has historically given its First Class product away, "it used to be all through upgrades". Any business model in which you're giving your best product away, "it's going to have some challenges to it", Mr Bastian remarked. But Delta is now at a point where "50% of our First Class seats are paid for, and that alone is a huge shift from where we've been. And you're gong to see more and more of that as we go forward".

Meanwhile, Delta says it sees no meaningful risk from long-haul, low cost competitors. Low cost operators Norwegian and WOWair have garnered meaningful attention during the last couple of years as they've bolstered their presence in the busy trans-Atlantic market, but Delta Air Lines believes rising fuel prices create formidable challenges for those operators.

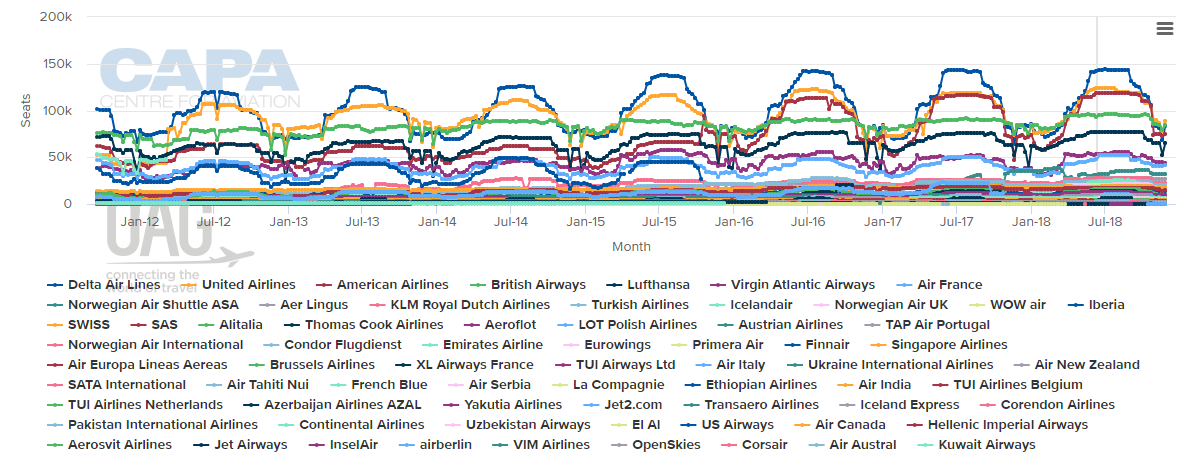

Delta and its SkyTeam JV partners Air France, KLM and Aliltalia hold a combined 24% seat share between the US and Western Europe, according to data from CAPA - Centre for Aviation and OAG for early Jun-2018. Delta and Virgin Atlantic, which also operate under an immunised JV, represent a 20% share.

CHART - It may be hard to see the detail on this chart but it clearly highlights the competition in the trans-Atlantic market and Delta Air Lines market leading position in terms of capacity Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Meanwhile, the Norwegian Group holds a combined share of roughly 5.4% and WOWair's share is 2%. However, just to illustrate the rapid growth Norwegian and WOW have undertaken, WOW's seats deployed between the US and Western Europe have jumped 84% year-on-year.

Speaking recently at the same investor conference, Ed Bastian remarked that "you'll always have sources of people trying to come into the market in terms of the ultra low cost guys...we're not looking for those customers. Customers that travel on those ultra low cost carriers are people that would otherwise would not be flying. They take their traffic from the couch...". .

Mr Bastian also noted fuel prices have jumped 50% during the last year, and the increases are causing a big impact on the low cost business model. "It is something that the bigger carriers, the more premium carriers can actually afford and can invest against to be able get the pricing where it needs to be", he concluded.

Fuel prices at USD30 per barrel created "a lot of dysfunctional behaviour", Mr Bastian concluded. But fuel prices ranging between USD70 to USD90 per barrel, "...is a much more sweet spot for the industry", because it creates a pause before operators put capacity into the market in terms of how they are going to be able to afford the price for it, he explained.

Delta's top-line trans-Atlantic revenues grew 15% year-on-year during 1Q2018, "so obviously it's not been hit too hard by the Norwegians and some of the ultra low-cost guys that you talk about", Mr Bastian concluded, simply concluding he sees no "meaningful risk" from low cost competitors in long haul markets.