Summary:

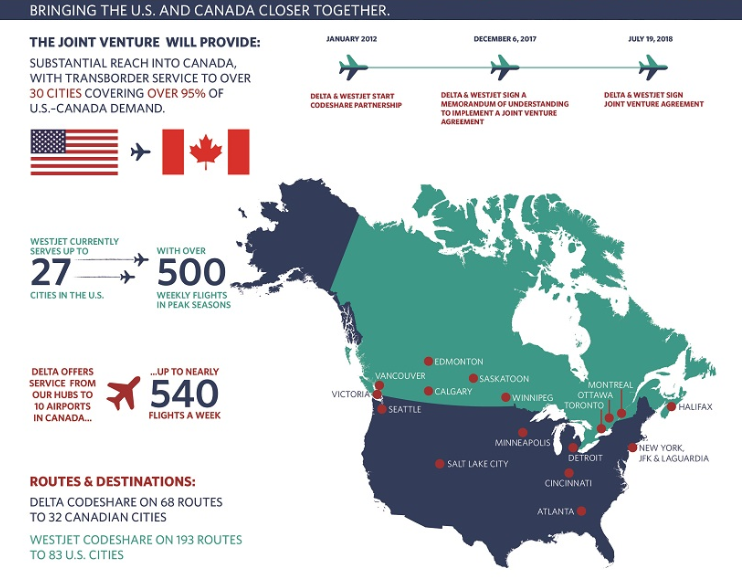

- Delta Air Lines and WestJet have committed to create a trans-border USA-Canada joint venture, building on an existing codeshare arrangement;

- The proposed joint venture will provide service to more than 30 cities, covering more than 95% of US-Canada demand;

- WestJet and Delta are currently the second and fourth largest operators in the US-Canada market by system seats with a 16.4% and 10.4% share during the first seven months of this year;

- The positioning of the two carriers in the USA-Canada market suggests that regulatory approval will be forthcoming with little or no impact on their current operations.

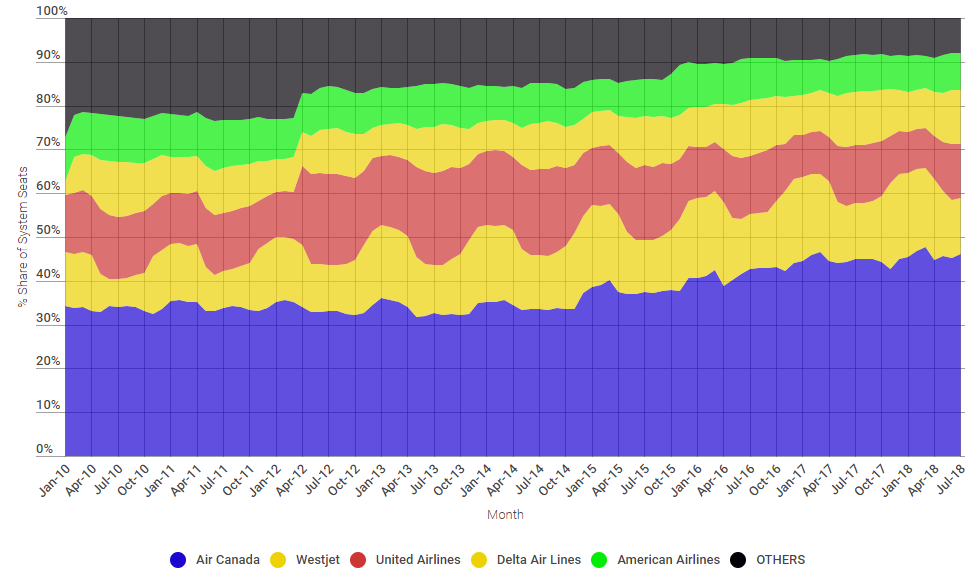

The proposed joint venture, which remains subject to regulatory approval in both the US and Canada, will provide service to more than 30 cities, covering more than 95% of US-Canada demand, according to the partners. However, when it comes to their capacity offering in the trans-border market the airlines remain a long way behind Air Canada which holds a dominant 46.0% share of international seats year-to date (Jan-2018 - Jul-2018), according to OAG schedule data. This has actually risen 12.4 percentage points this decade from a 33.6% share in 2010.

WestJet and Delta are currently the second and fourth largest operators in the US-Canada market by system seats with a 16.4% and 10.4% share during the first seven months of this year, respectively. This combined share of 26.8% has grown from 20.0% in 2010 and in some individual months has peaked at more than 30%.

The joint positioning of the two carriers in this market suggests that regulatory approval will be forthcoming with little or no impact on their current operations. Alongside expanding their codeshare agreement the partnership will bring closer alignment of frequent flyer programmes with reciprocal elite benefits, while more seamless processing will be provided by co-locating resources in key airport markets.

According to Ed Bastian, CEO of Delta, the arrangement will enable the airlines to "offer more destinations to customers with an integrated network, superior airline products, improved airport connections and significantly enhanced frequent flyer benefits," while Ed Sims, president and CEO of WestJet, says working together will "benefit customers by bringing greater competition to the trans-border market".

CHART - Air Canada is the dominant airline in the US-Canada market and a combined Delta Air Lines and WestJet through a joint venture will still only see them account for just over a quarter of the trans-border system capacity Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

The US and Canadian markets are intrinsically linked and each are the number one source markets for tourism arrivals into the other. In Canada, US arrivals accounted for more than two thirds (68.7%) of visitors into Canada last year - its largest other country source market was the United Kingdom with just a 3.8% share. In the US, Canada accounted for 25.5% of total international visitor arrivals in 2016, just ahead of Mexico with a 24.8% share. Together these account for more than 33.5 million visitors.

The US-Canada market has seen capacity growth every year this decade at rates ranging from 0.4% in 2013 to 4.8% the year earlier in 2012. The last couple of years has seen above average rises for the period with 2.9% growth in 2016 and 4.0% last year, but this year is set to deliver a record performance with a predicted 5.1% rise, based on current published schedules.

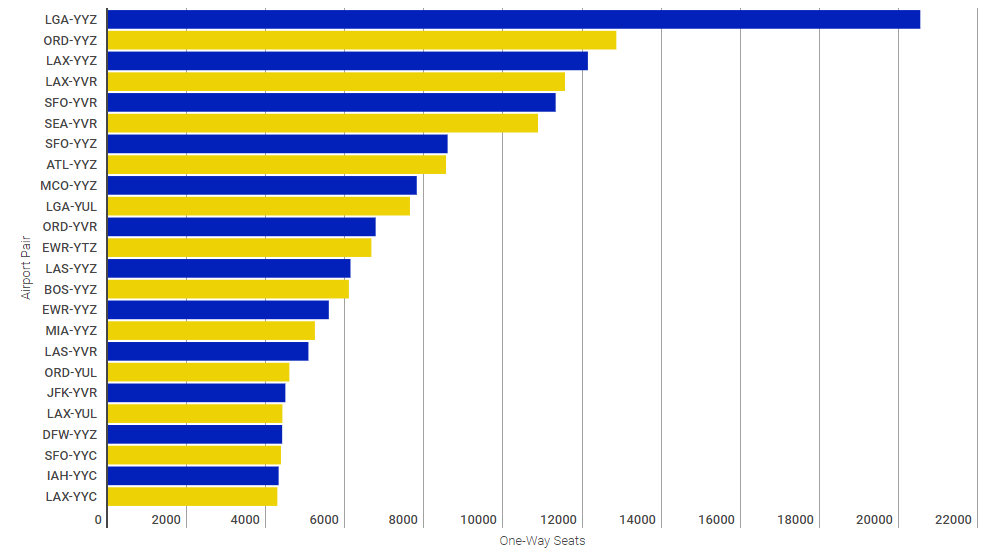

CHART - New York LaGuardia to Toronto Pearson is the busiest market between USA and Canada based on seating capacity, one of six airport pairs with more than 10,000 weekly seats in each direction Source: The Blue Swan Daily and OAG (data: w/c 23-Jul-2018)

Source: The Blue Swan Daily and OAG (data: w/c 23-Jul-2018)