The new rules, designed to lower the risk of Covid-19 being reintroduced from other countries, mean that passengers arriving in the UK by aeroplane, ferry or train - including UK nationals - after 08-Jun-2020 will have to provide an address where they will remain for 14 days. There is a £100 penalty for anyone found to have not filled in this ''contact locator'' form and fines of up to GBP1,000 if they fail to self-isolate.

But it has not been well received by the country's airlines and airports which are currently working on the resumption of services. Virgin Atlantic Airways has said it will defer any resumption until Aug-2020 as the rule will diminish any green shoots in demand, while Ryanair Holdings' CEO Michael O'Leary has described it as having "no basis in science or medicine".

Manchester Airports Group (MAG) CEO Charlie Cornish has stated that "for as long as it lasts, a blanket quarantine policy will be a brick wall to the recovery of the UK aviation and tourism industries, with huge consequences for UK jobs and GDP".

There are alternative options like adopting a targeted approach that recognises that many countries are already low risk, or developing what has been described as travel bubbles where restrictions do not need to necessarily be as strong.

AIRPORTS IN THE COUNTRY

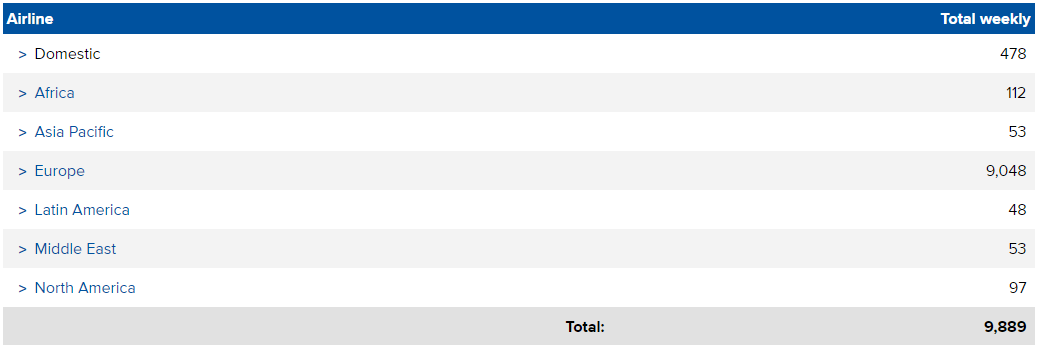

SCHEDULE MOVEMENT SUMMARY (w/c 25-May-2020)

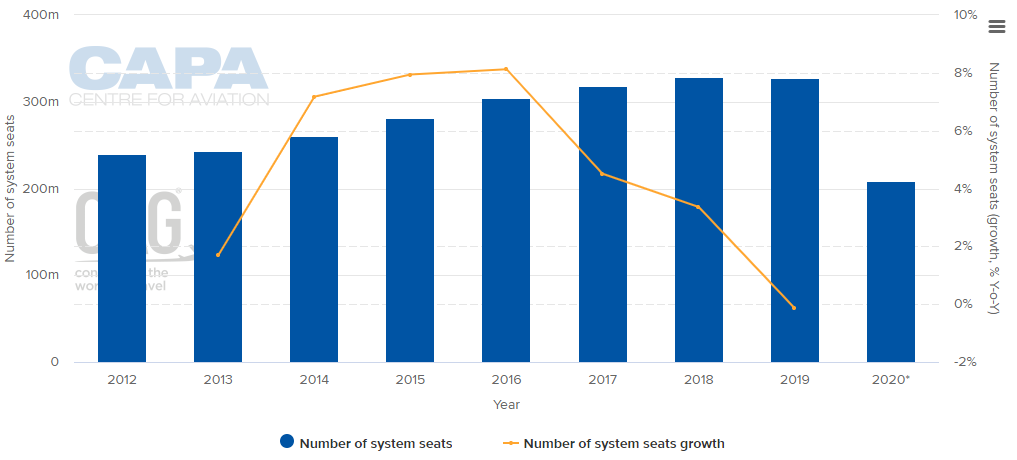

ANNUAL CAPACITY (2012 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

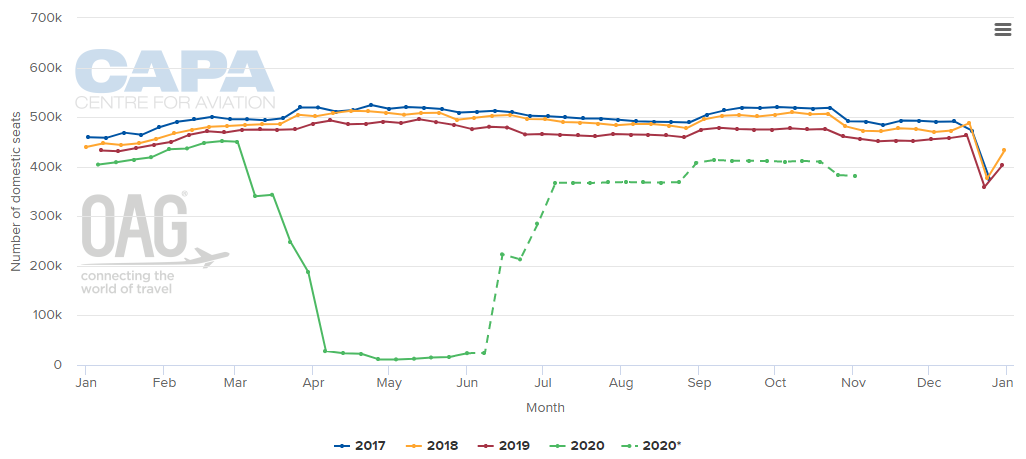

WEEKLY DOMESTIC CAPACITY (2017 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

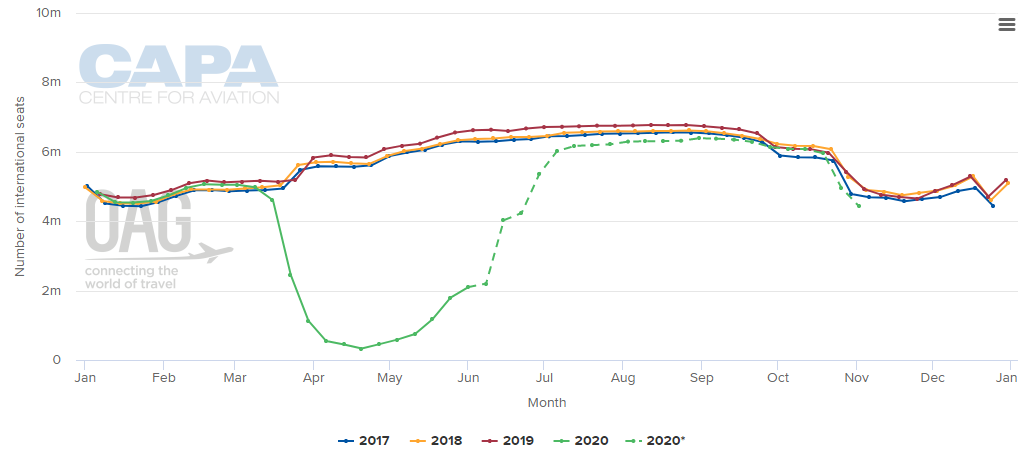

WEEKLY INTERNATIONAL CAPACITY (2017-2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

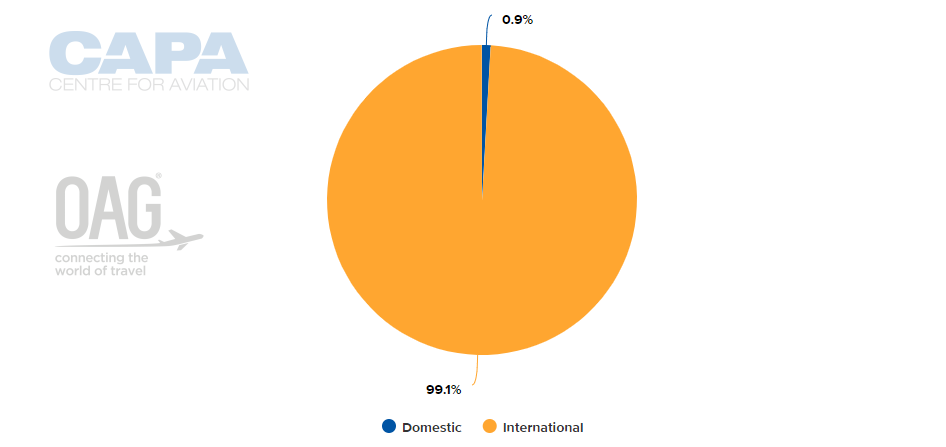

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 25-May-2020)

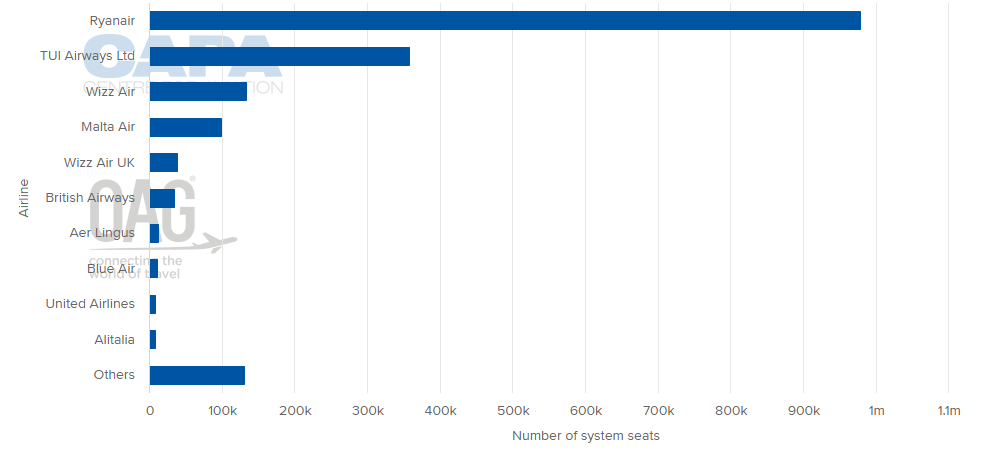

LARGEST AIRLINES BY CAPACITY (w/c 25-May-2020)

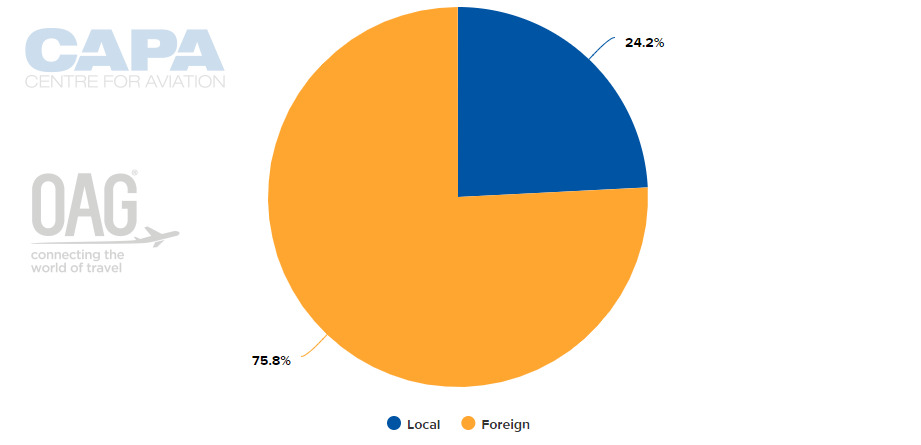

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 25-May-2020)

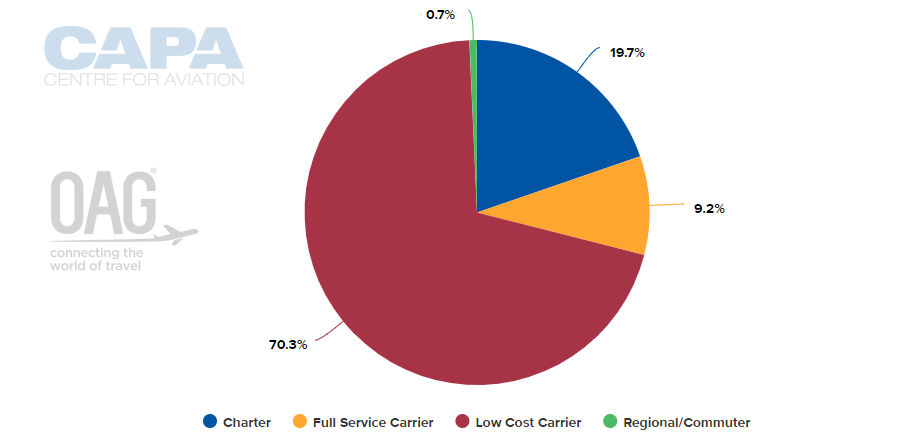

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 25-May-2020)

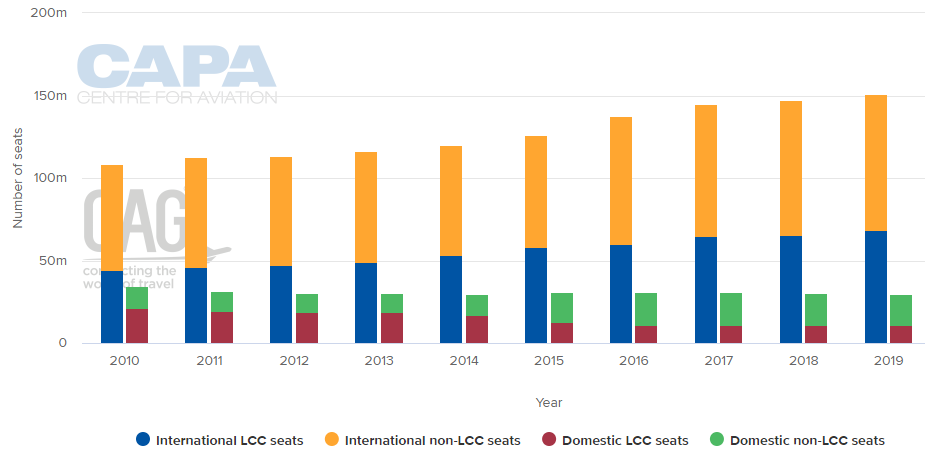

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

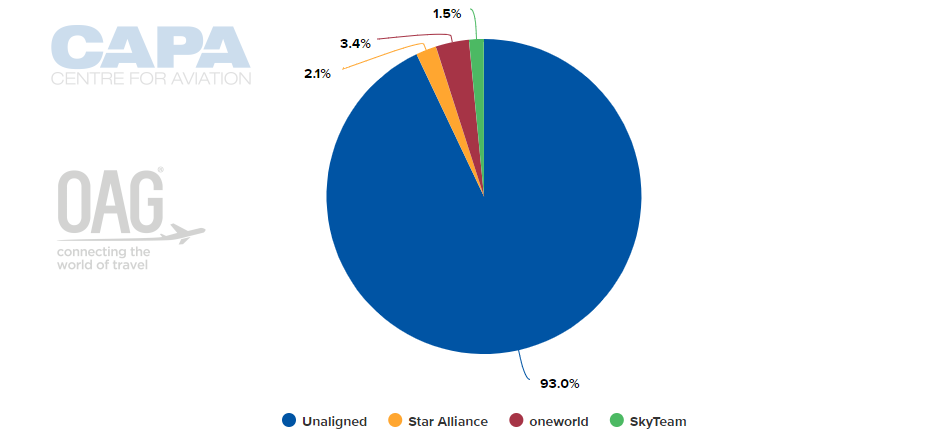

ALLIANCE CAPACITY SPLIT (w/c 25-May-2020)

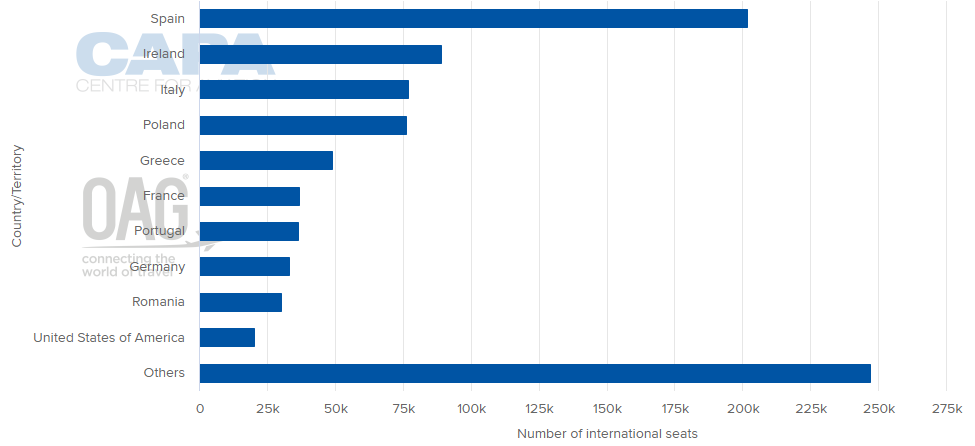

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 25-May-2020)

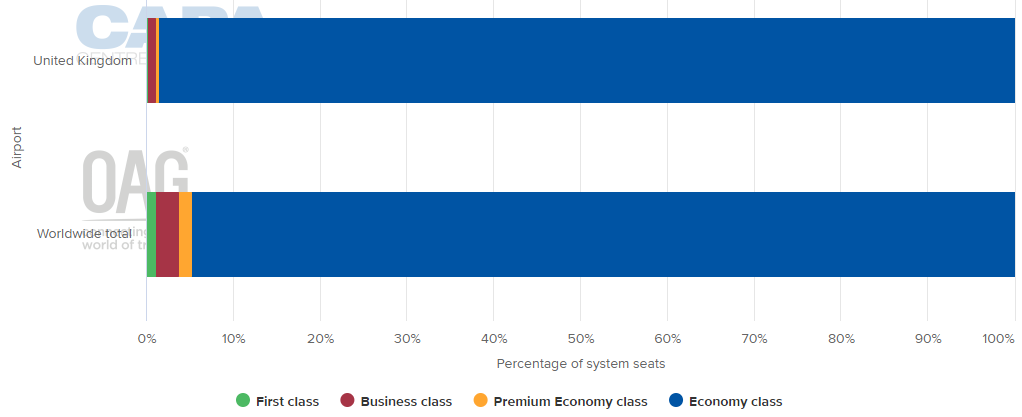

DEPARTING SYSTEM SEATS BY CLASS (w/c 25-May-2020)

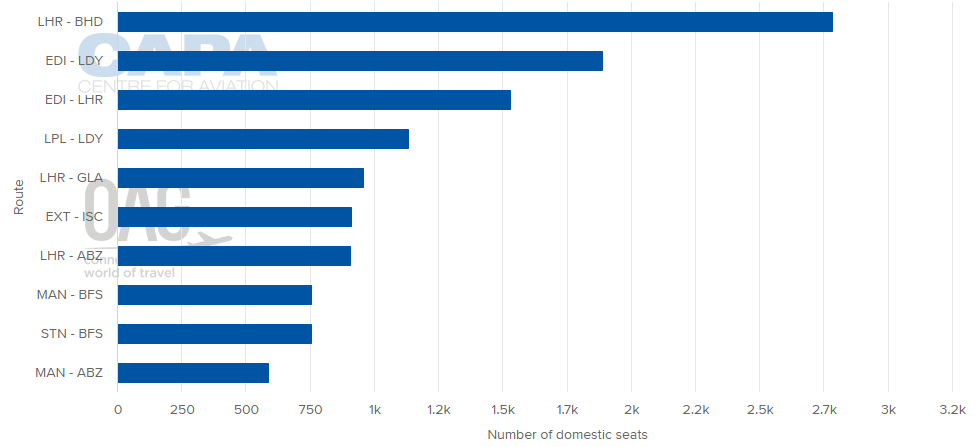

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 25-May-2020)

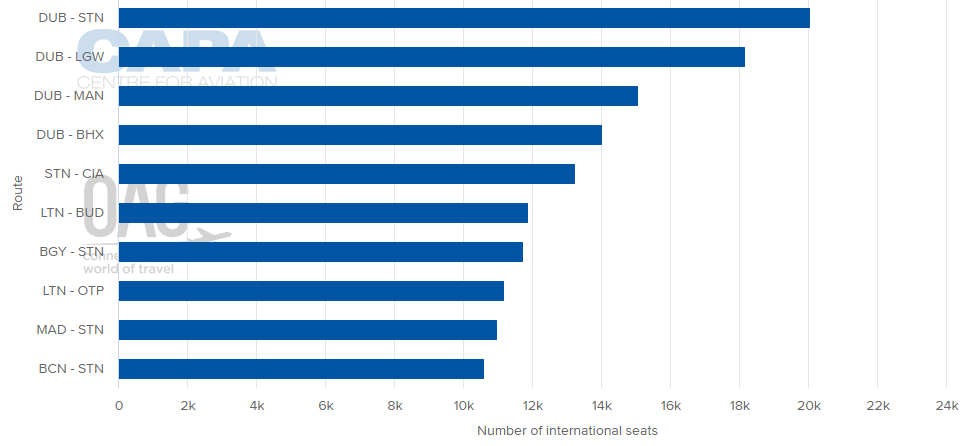

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 25-May-2020)

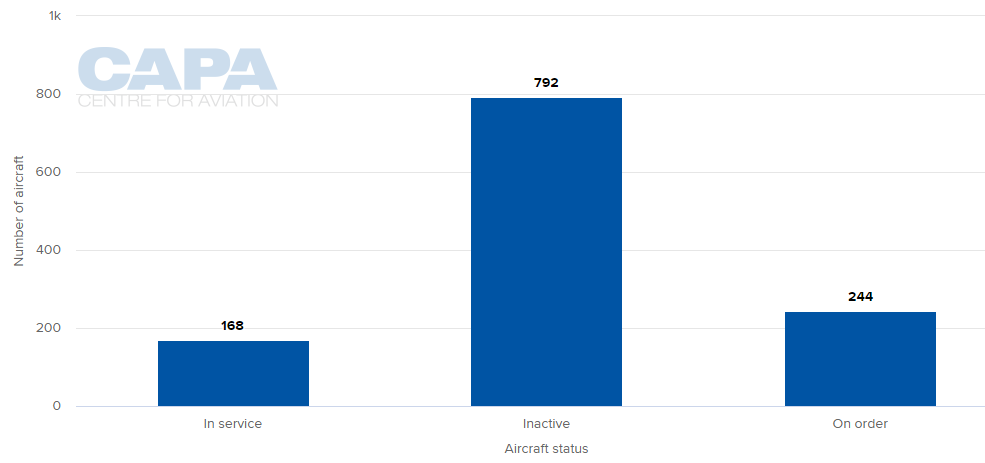

LOCAL AIRLINES' AIRCRAFT FLEET (as at 25-May-2020)

MORE INSIGHTS:

Europe's airline capacity begins slow climb

Norwegian, BA & Virgin's Gatwick exit would dent UK long haul aviation

Europe only manages a piecemeal approach to airline state aid

COVID-19: UK government should remain cautious on airline bailouts