That puts the US carrier in a strong position, albeit Mr Christie acknowledges that, like all others, the ULCC will still be impacted by the pandemic and "may be…smaller than we had planned before the current economic situation developed".

However, Mr Christie said he believed the carrier "will emerge from this crisis even better positioned than we were previously", with the post Covid-19 environment to provide "plenty of new market opportunities to support our growth once demand begins to recover, including perhaps some opportunities in constrained markets that didn't exist before".

"Demand will return and we believe that our product and cost structure will be key drivers of our performance during the recovery phase," he said, and that is already appearing evident in the airlines proposed flight schedules.

Spirit Airlines now plans to operate an average of 380 flights per day in Aug-2020. Mr Christie has confirmed there is "clearly a segment of the travelling public who is ready to go" and mentioned the carrier is also "seeing strength throughout the network…It's not just localised in any one particular geography".

ABOUT

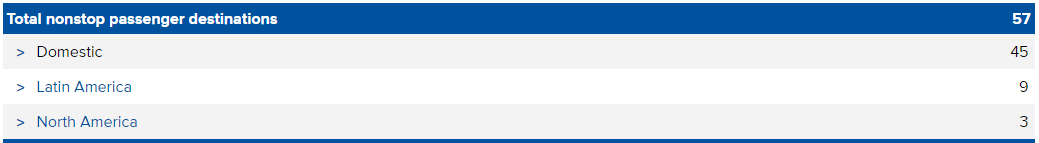

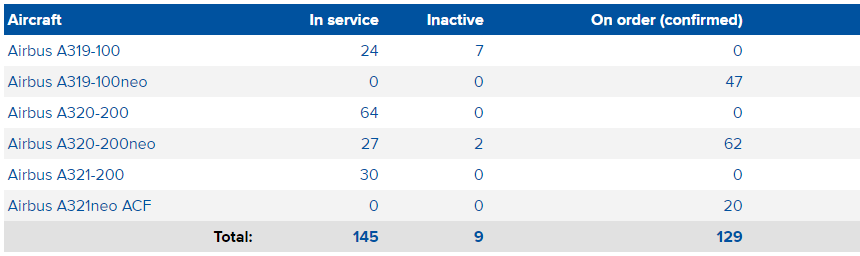

Established in 1993, Spirit Airlines is an ultra low-cost carrier headquartered in Miramar, FL. The carrier is based at Fort Lauderdale-Hollywood Airport, operating services to over 50 destinations across the US and the Caribbean. Spirit Airlines operates with a fleet of Airbus narrowbody aircraft.

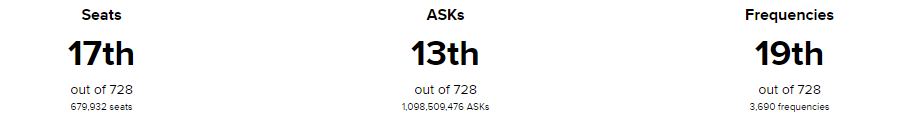

GLOBAL RANKING (as at 20-Jul-2020)

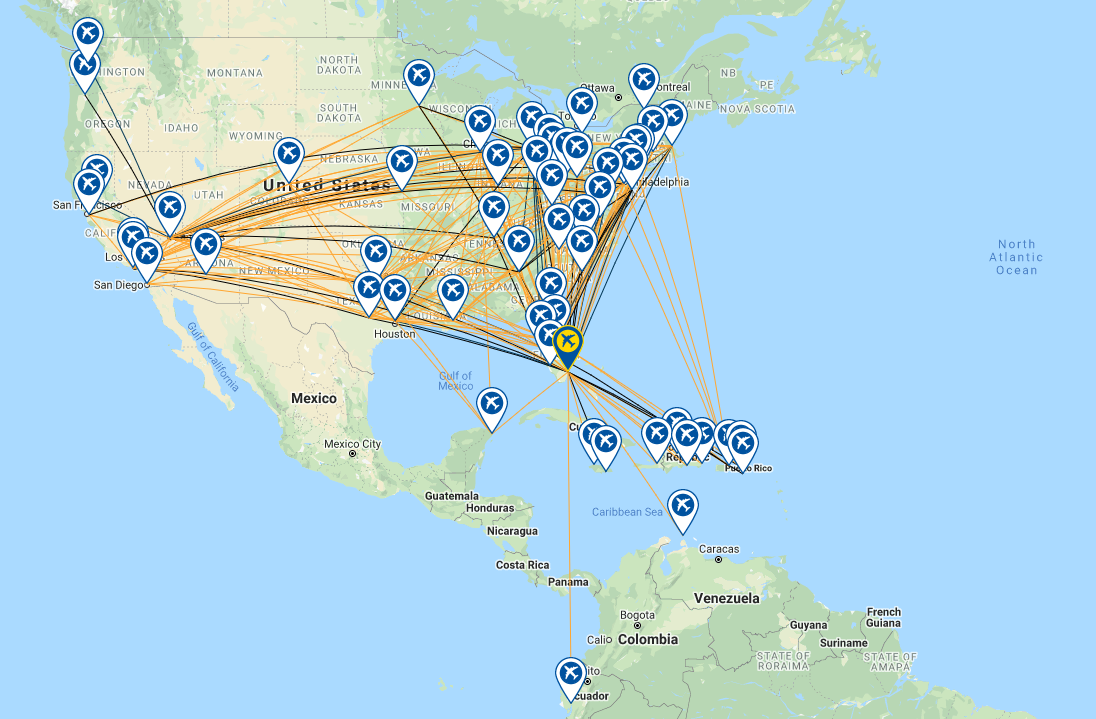

NETWORK MAP (as at 20-Jul-2020)

DESTINATIONS (as at 20-Jul-2020)

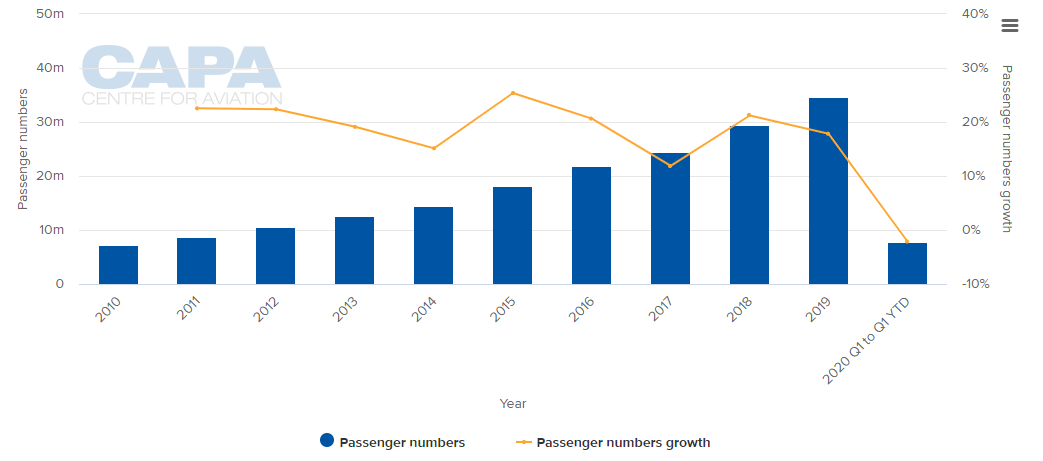

ANNUAL PASSENGER TRAFFIC (2010 - 2020YTD)

CAPACITY SNAPSHOT (versus same week last year)

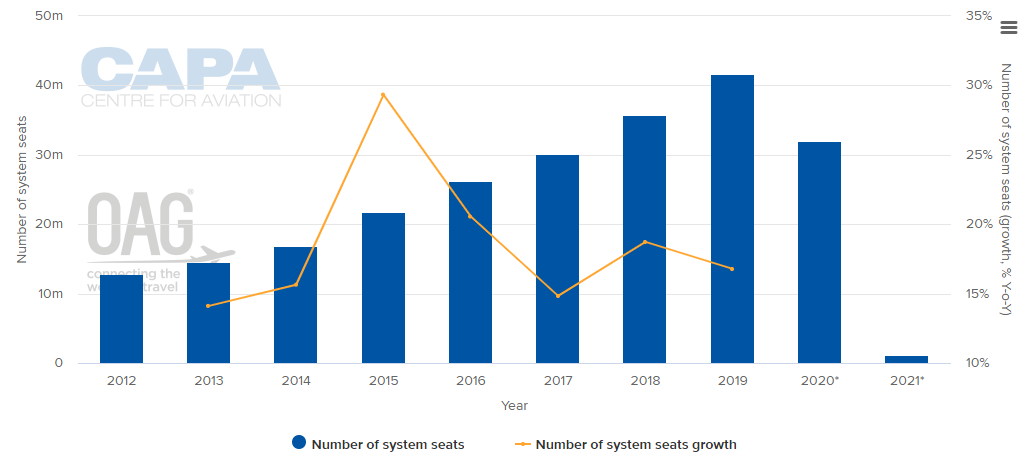

ANNUAL CAPACITY (2012-2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

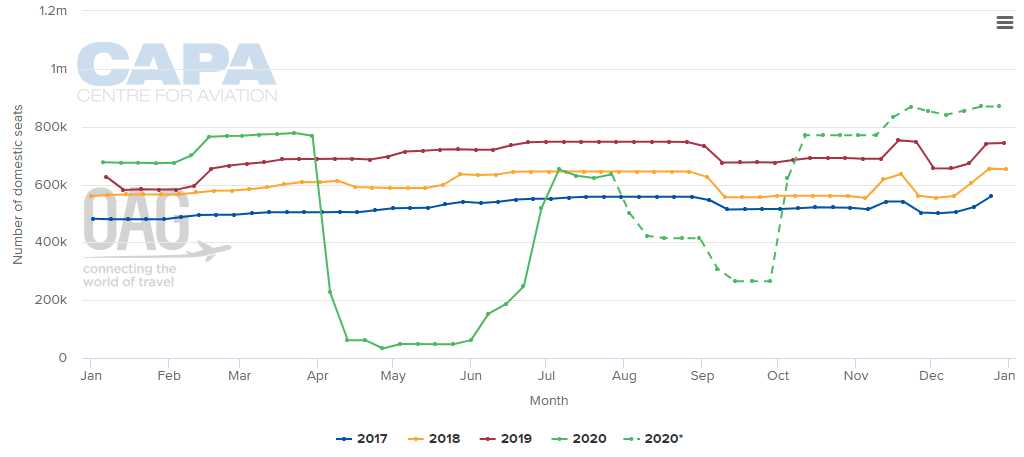

WEEKLY DOMESTIC CAPACITY (2017 - 2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

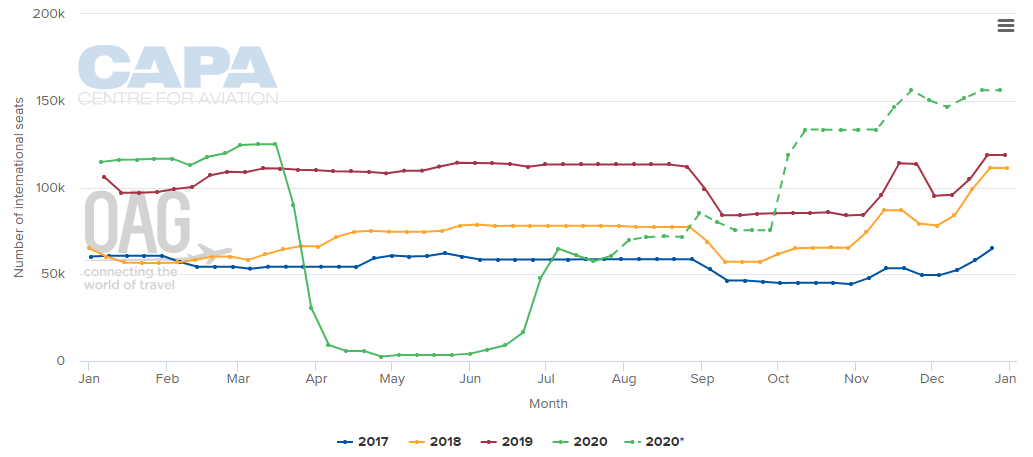

WEEKLY INTERNATIONAL CAPACITY (2017 - 2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

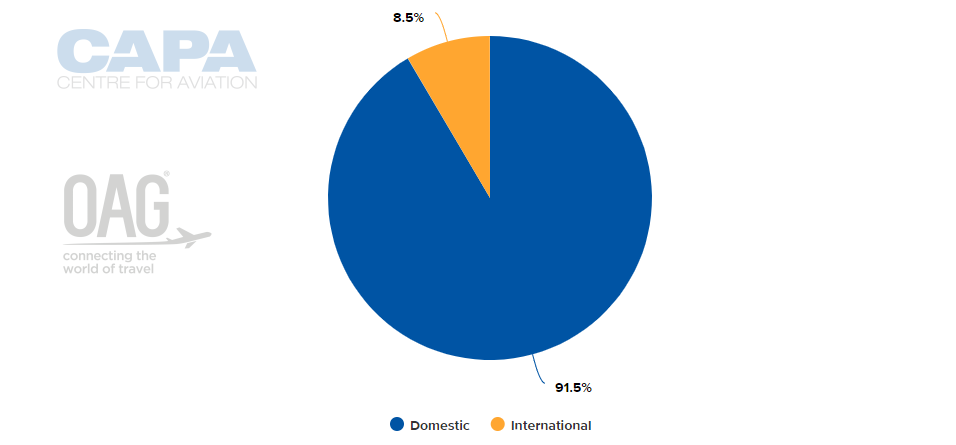

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 20-Jul-2020)

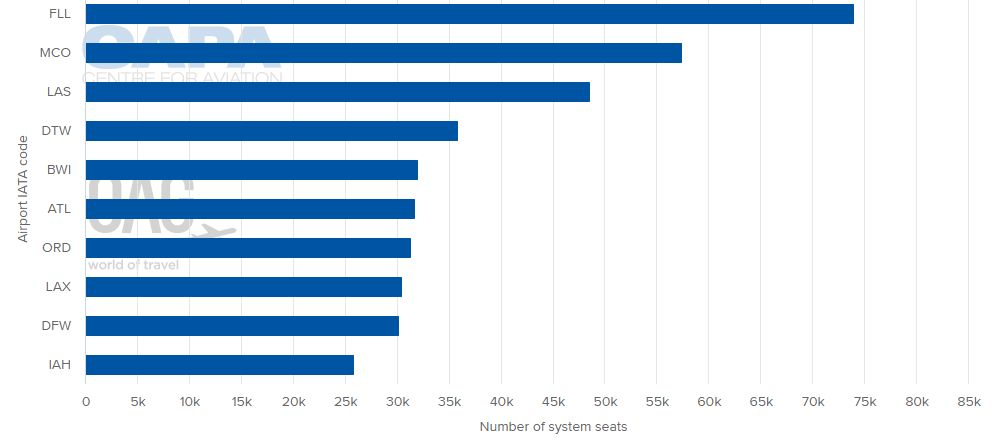

LARGEST NETWORK POINT (w/c 20-Jul-2020)

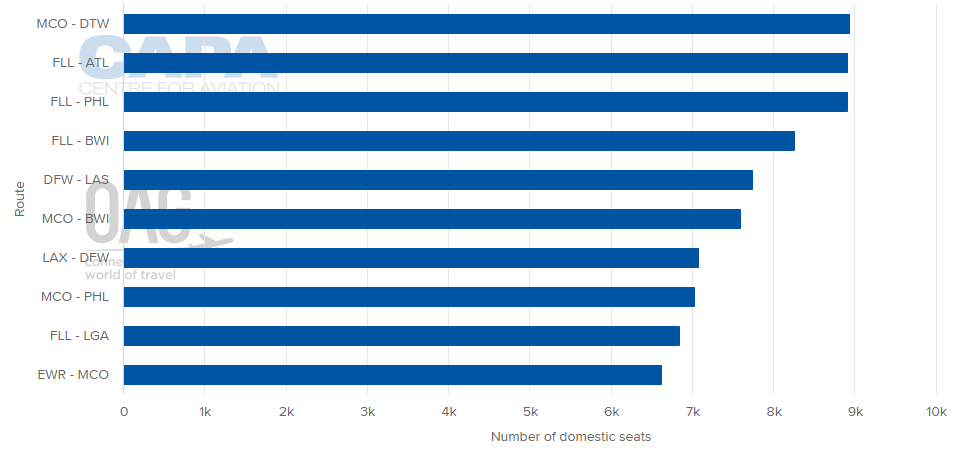

BUSIEST DOMESTIC ROUTES BY CAPACITY (w/c 20-Jul-2020)

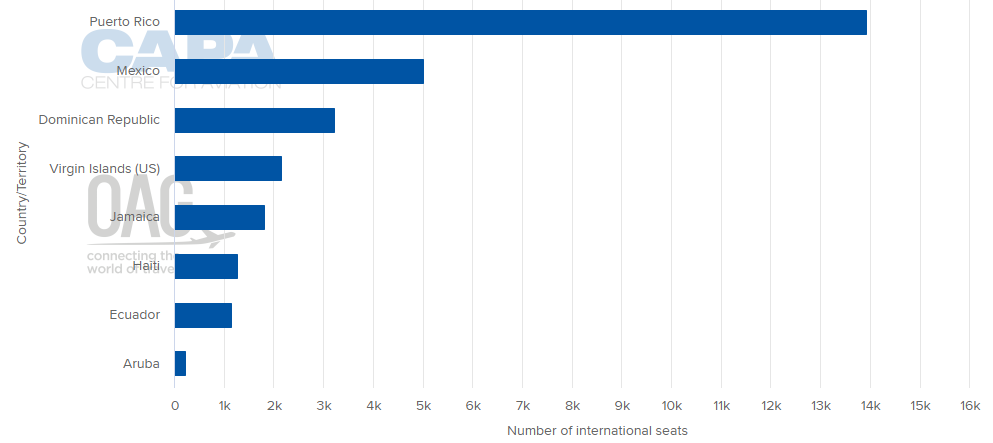

LARGEST INTERNATIONAL MARKETS BY COUNTRY (w/c 20-Jul-2020)

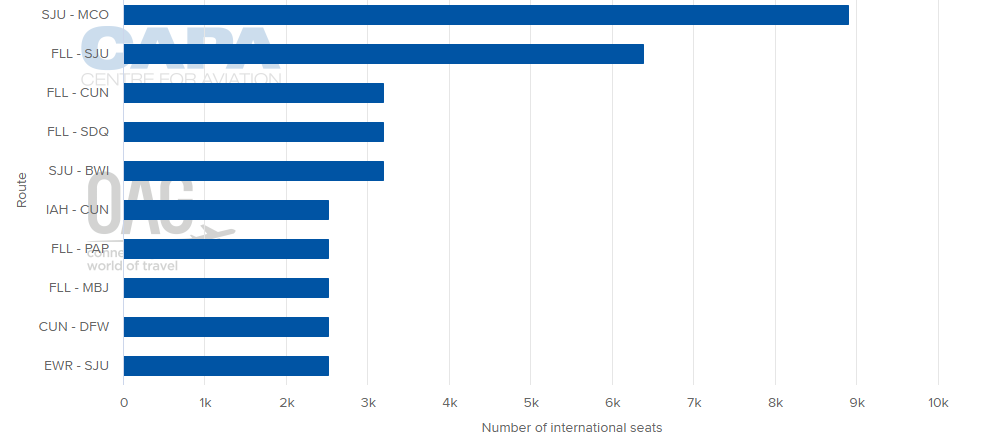

BUSIEST INTERNATIONAL ROUTES BY CAPACITY (w/c 20-Jul-2020)

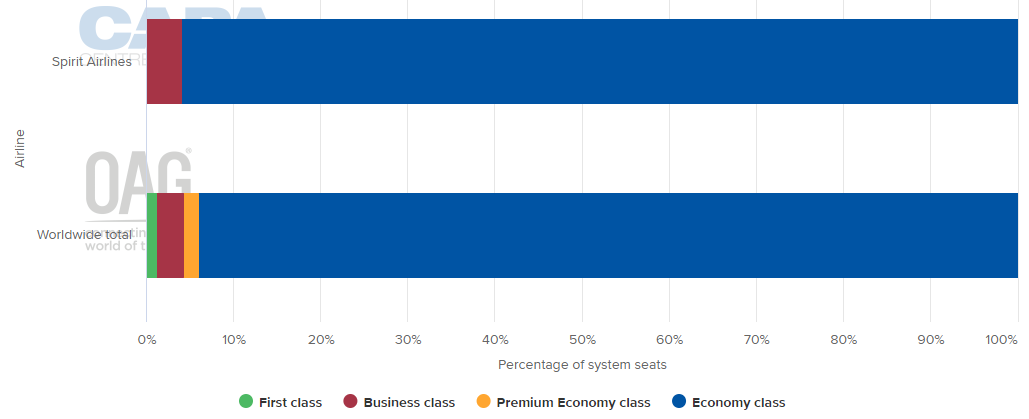

DEPARTING SYSTEM SEATS BY CLASS (w/c 20-Jul-2020)

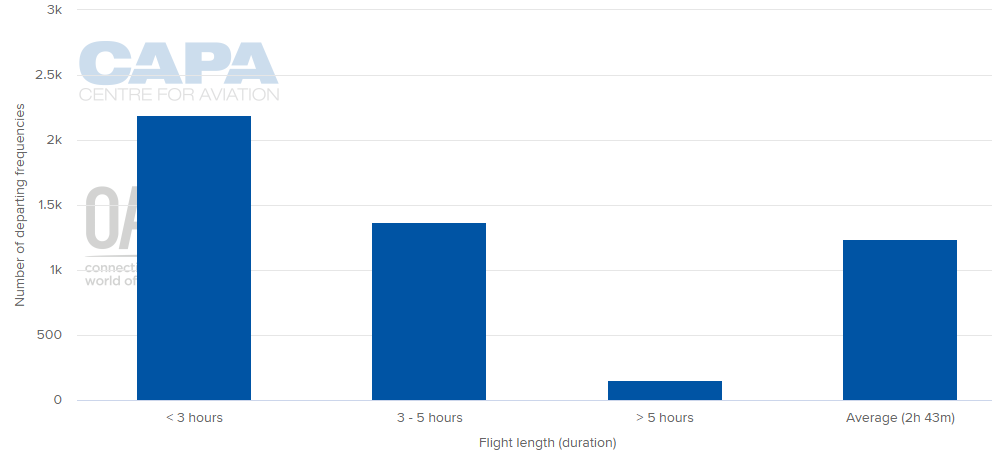

AVERAGE FLIGHT LENGTH (w/c 20-Jul-2020)

FLEET SUMMARY (as at 20-Jul-2020)

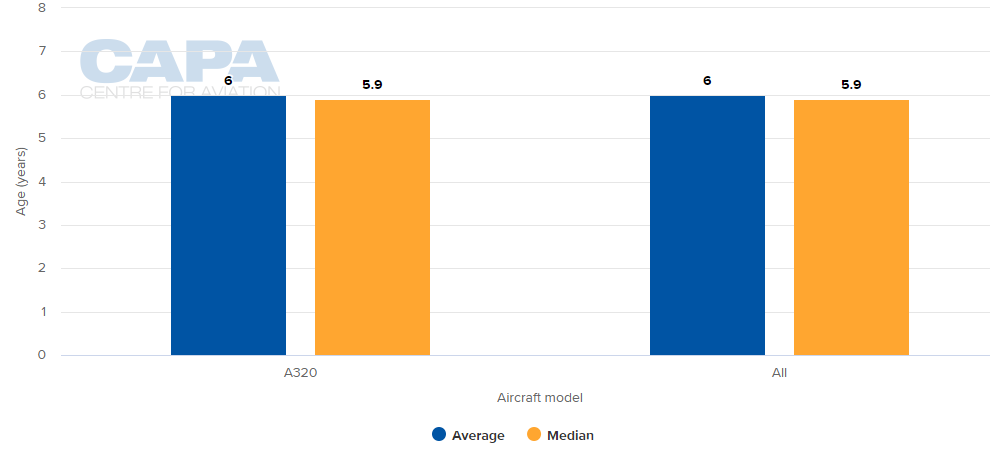

AVERAGE FLEET AGE (as at 20-Jul-2020)

MORE INSIGHT...

COVID 19: Florida's case spike casts shadows over summer travel

COVID 19: deteriorating US conditions cloud airline recovery

COVID 19: US low cost airlines - advantages over full service carriers