The scale of Russia is immense, where a domestic flight from east to west can take as long as nine hours. But, its aviation system is highly Moscow-centric. The decision late last year to adopt a more liberal approach to air services in Russia's second city of St Petersburg could see its connectivity rise to a scale that matches its status.

The award of seventh freedom rights to foreign airlines from 30 countries from 01-Jan-2020 is a wake-up call for Russian airlines and will deliver significant economic benefits to the city. It is a model that will be watched carefully by strategists elsewhere, and not only in Russia.

Already European carrier Wizz Air has confirmed plans to introduce four new routes from Pulkovo International airport in St Petersburg from Bucharest (Romania), Sofia (Bulgaria), Vilnius (Lithuania) and Bratislava (Slovakia), which will commence in Jun-2020 and Jul-2020, and other links are sure to follow.

ABOUT

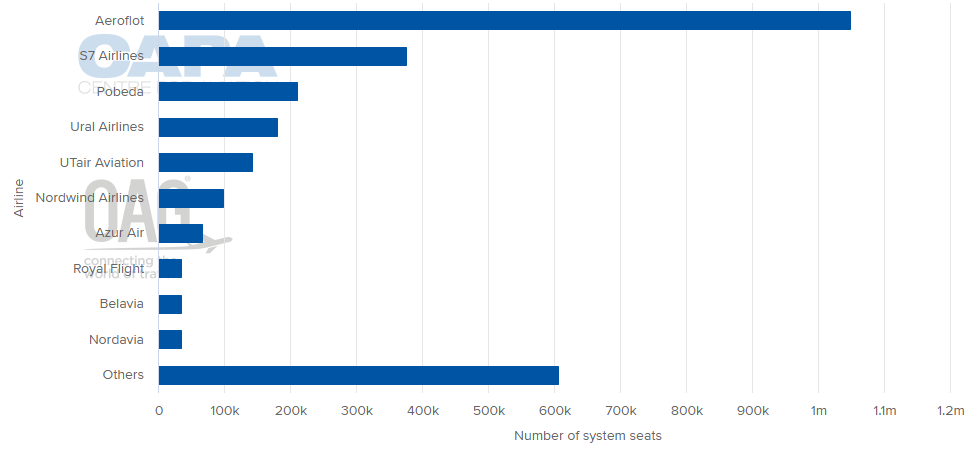

The passenger air transportation sector in Russia can be characterised by significant competition. Aeroflot is majority owned by the Russian Government and is the flag carrier and largest airline of the Russian Federation. The three major airports serving Moscow are Sheremetyevo International airport (SVO), Domodedovo International airport (DME) and Vnukovo International airport (VKO). Aeroflot dominates the domestic passenger market in Russia, however other airlines also provide frequent national and international services and they include S7 Airlines, UTair Aviation as well as VIM Airlines and Nordavia. The Federal Agency for Air Transport of Russia is the government agency that is responsible for rendering governmental services and managing governmental property in the sphere of air transport (civil aviation) and the usage of air space over the Russian Federation.

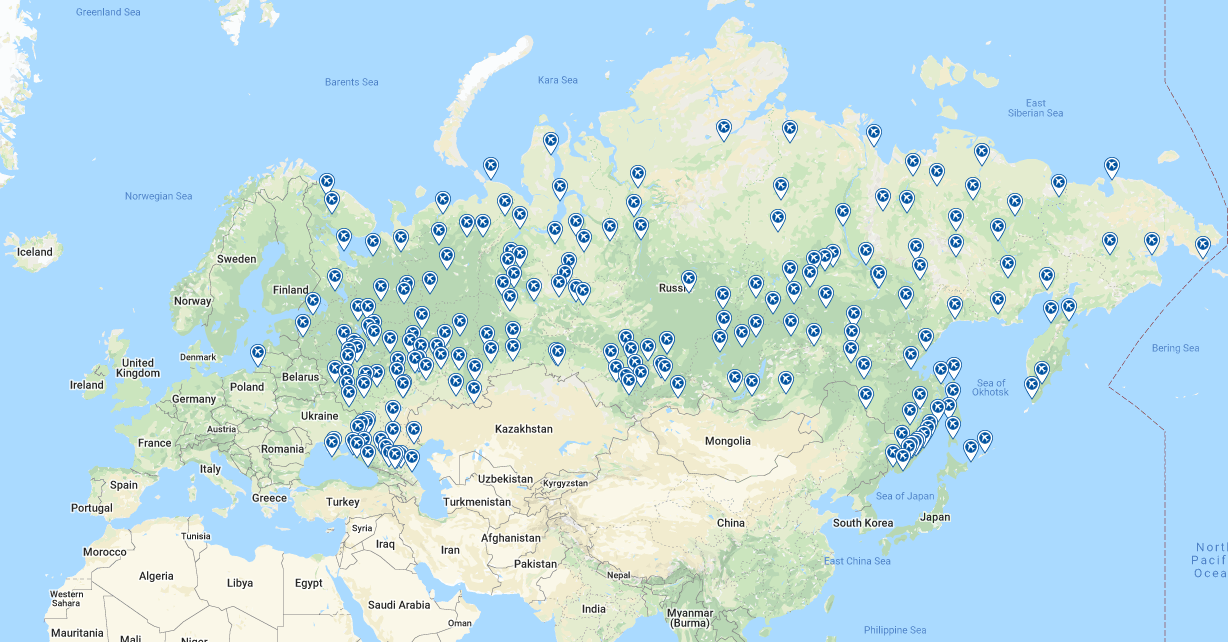

AIRPORTS IN THE COUNTRY

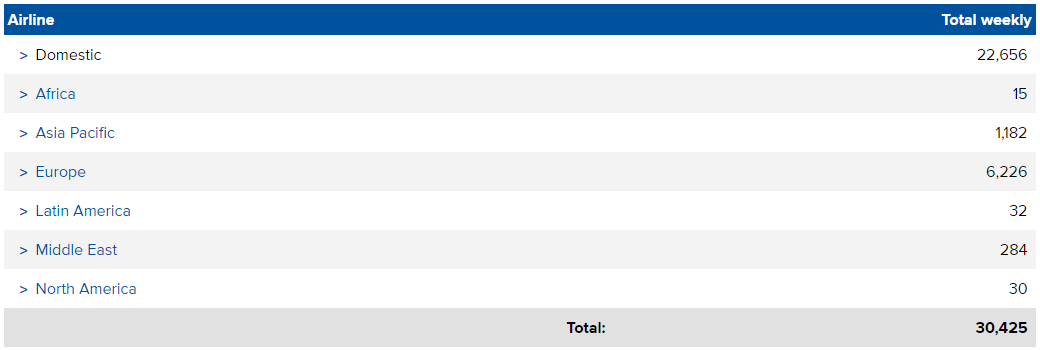

SCHEDULE MOVEMENT SUMMARY (w/c 20-Jan-2020)

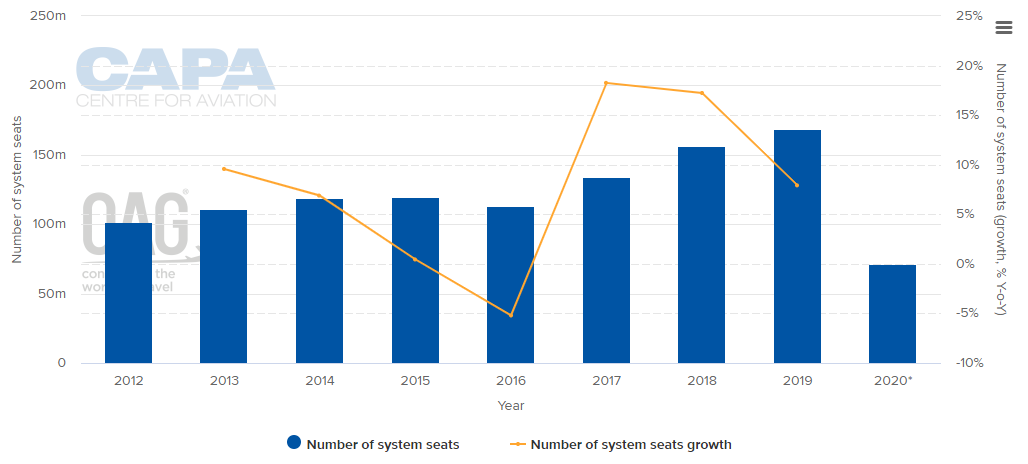

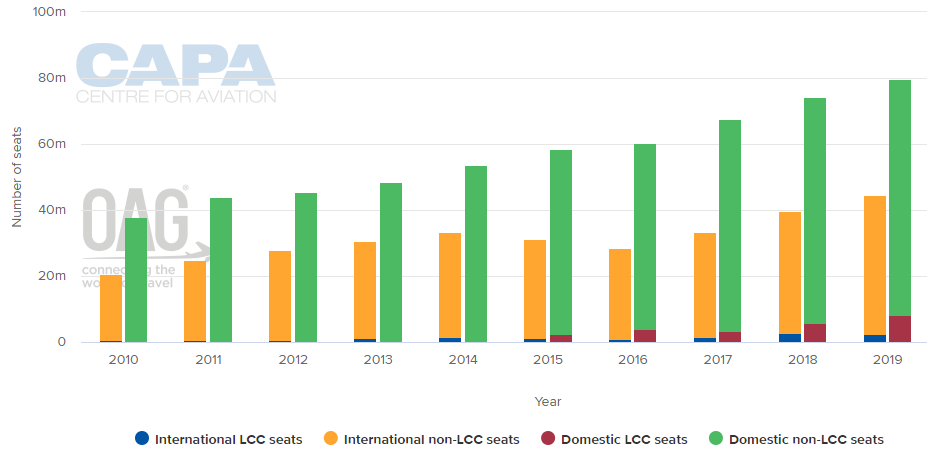

ANNUAL CAPACITY (2012 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

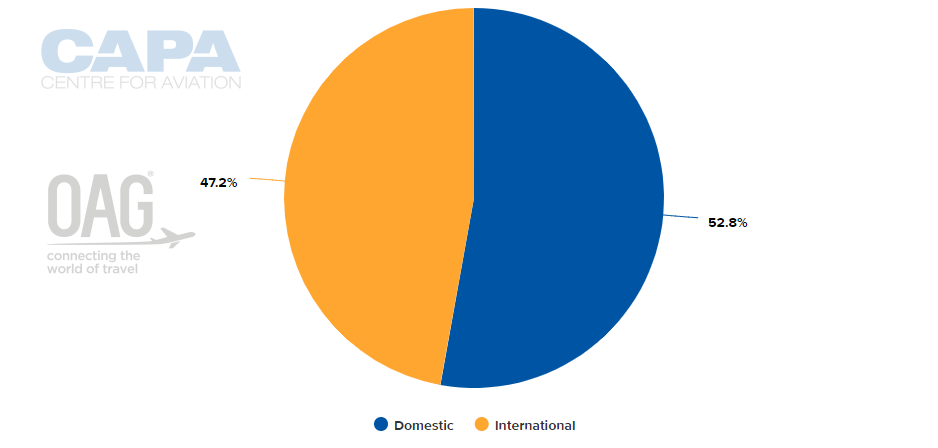

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 20-Jan-2020)

LARGEST AIRLINES BY CAPACITY (w/c 20-Jan-2020)

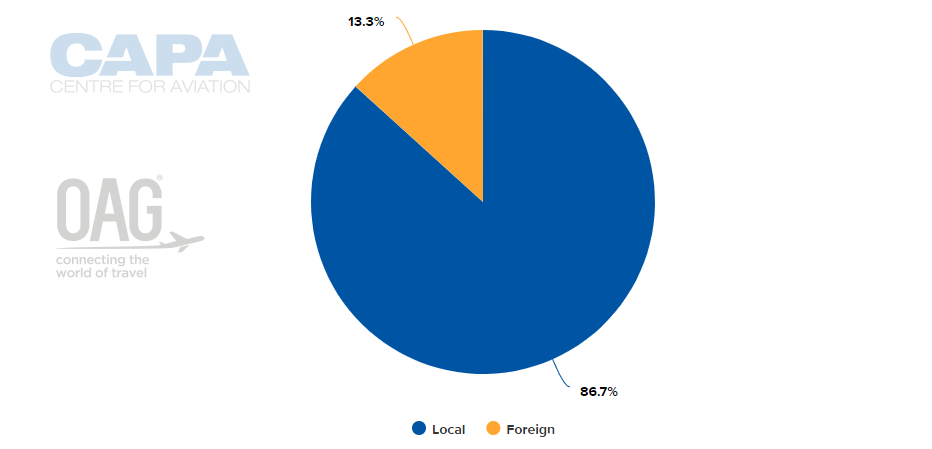

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 20-Jan-2020)

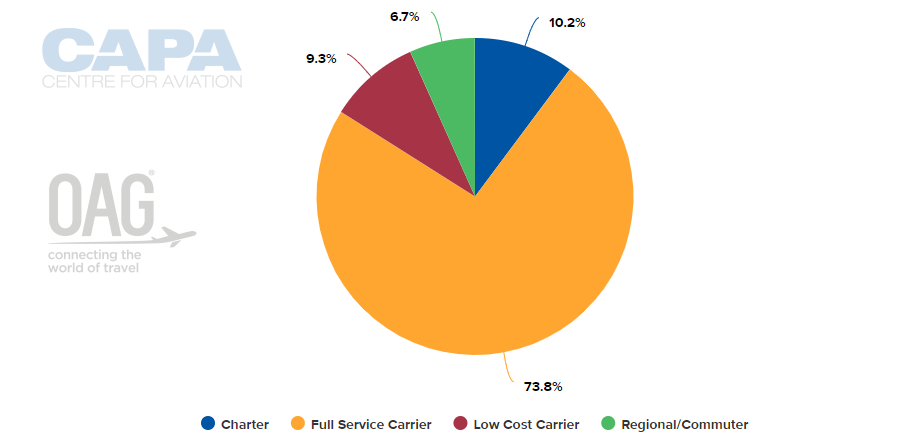

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 20-Jan-2020)

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

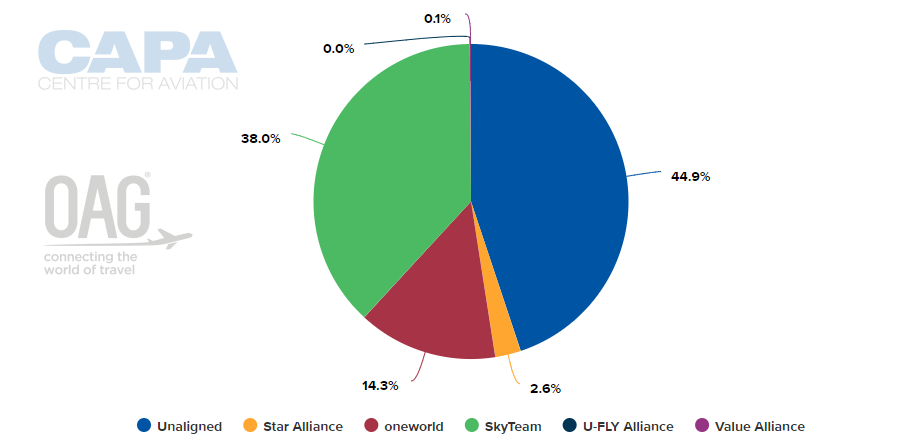

ALLIANCE CAPACITY SPLIT (w/c 20-Jan-2020)

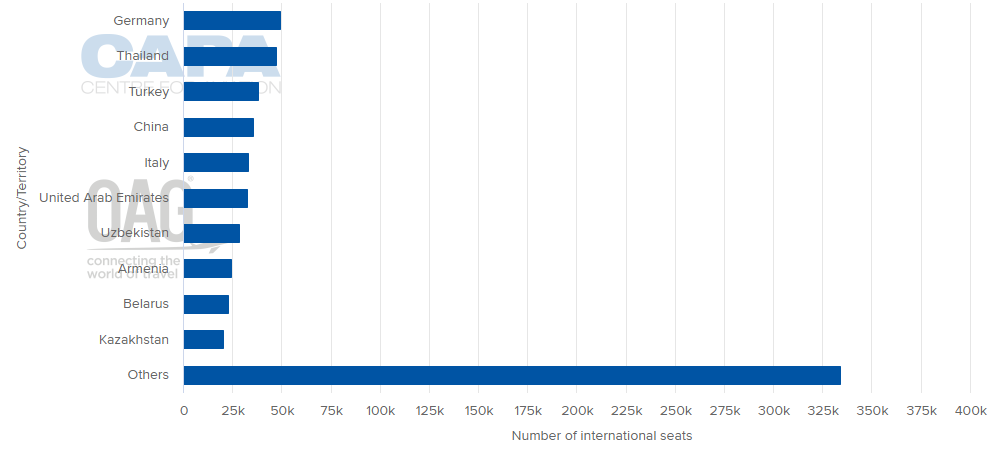

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 20-Jan-2020)

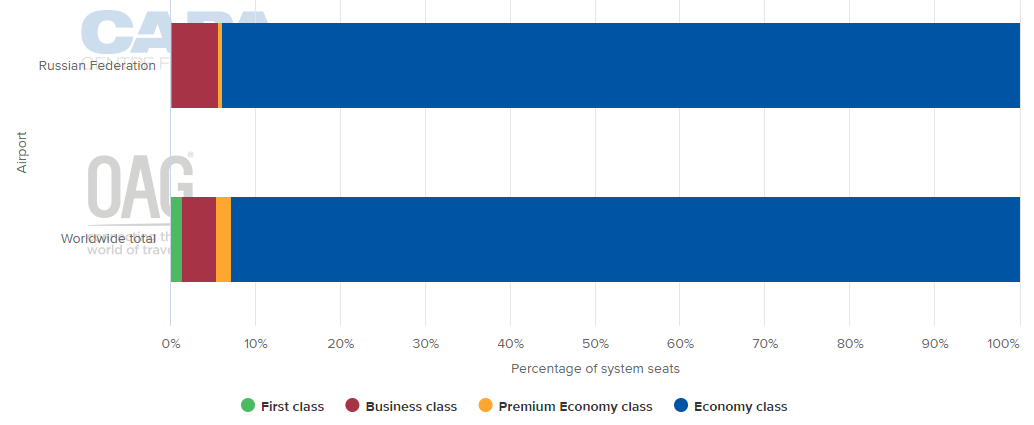

DEPARTING SYSTEM SEATS BY CLASS (w/c 20-Jan-2020)

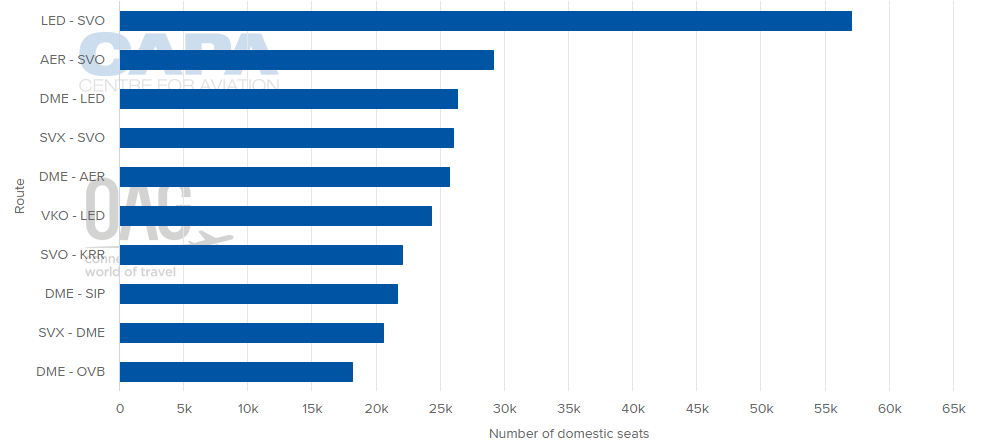

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 20-Jan-2020)

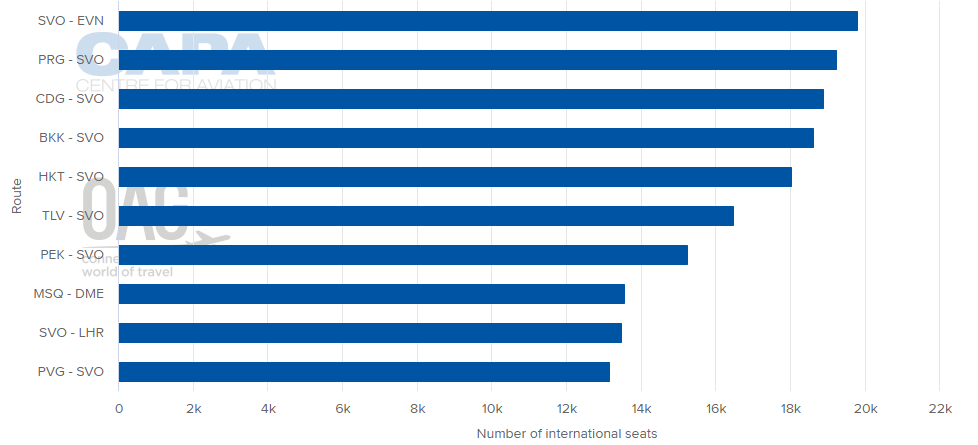

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 20-Jan-2020)

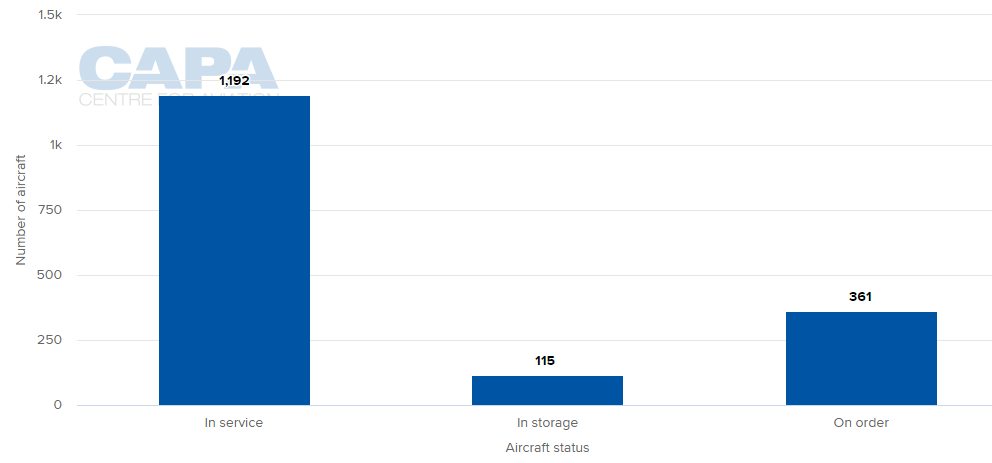

LOCAL AIRLINES' AIRCRAFT FLEET (as at 20-Jan-2020)