Airlines are now building on this platform to increase their domestic activity and in time introduce international air services. Airport operator Avinor predicts around a -70% decline in passenger traffic this summer. There has "not been lower passenger numbers at Norwegian airports since the 1970s," says a spokesperson.

Norway's Government opened the country's borders to and from other Nordic countries on 15-Jun-2020, albeit it will maintain quarantine rules and restrictions on entry for people arriving from regions where the level of coronavirus infection is high. By 20-Jul-2020, the government will consider changes to its travel advice and quarantine rules for certain other European countries, where the level of infection in each country will determine what changes are made.

Since Apr-2020 local budget carrier Norwegian has only operated eight aircraft on domestic routes within Norway. Now, with the revised guidance, another 12 aircraft will re-join its fleet and be put into operation across Scandinavia to serve our popular core destinations. From Jul-2020, Norwegian will operate 76 routes across Europe from the airline's Scandinavian hubs compared to the 13 domestic Norway only flights served currently.

To maintain essential domestic connectivity, Norway's Government plans to purchase air routes across Norway and proposes to increase the budget allocation for the purchase of domestic air routes by at least NOK1 billion (EUR94 million).

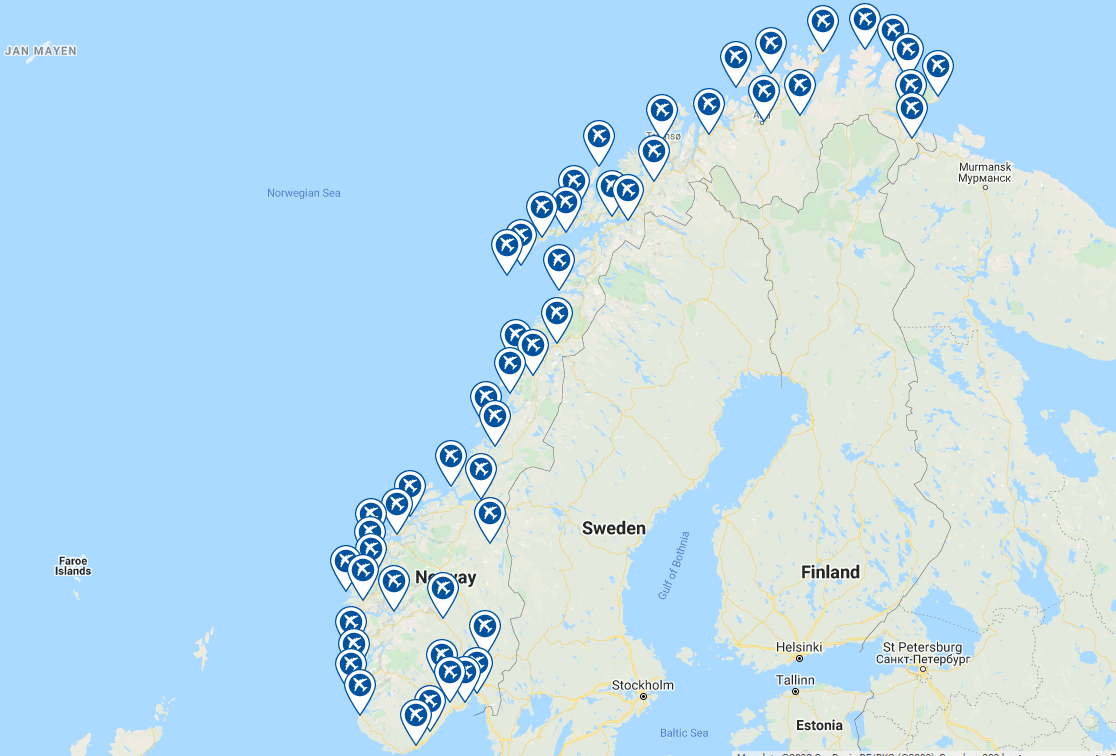

AIRPORTS IN THE COUNTRY

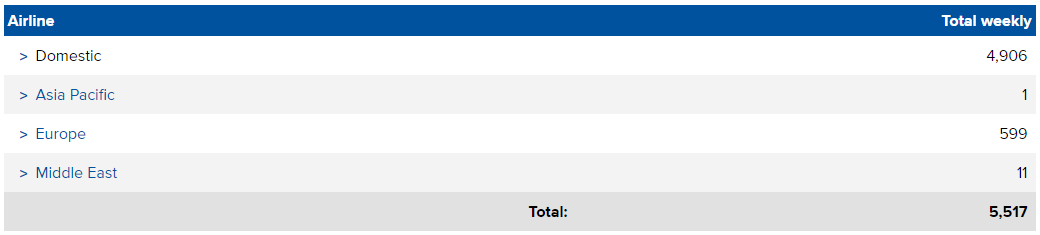

SCHEDULE MOVEMENT SUMMARY (w/c 22-Jun-2020)

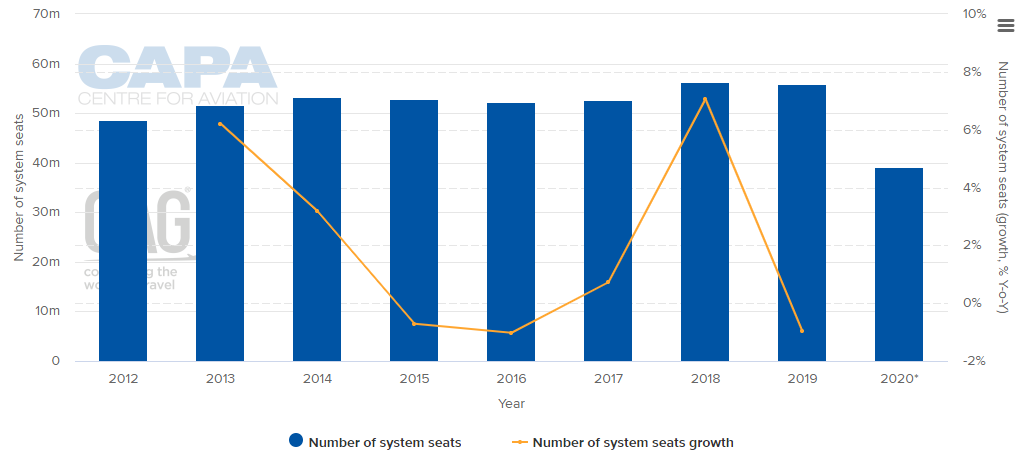

ANNUAL CAPACITY (2012 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

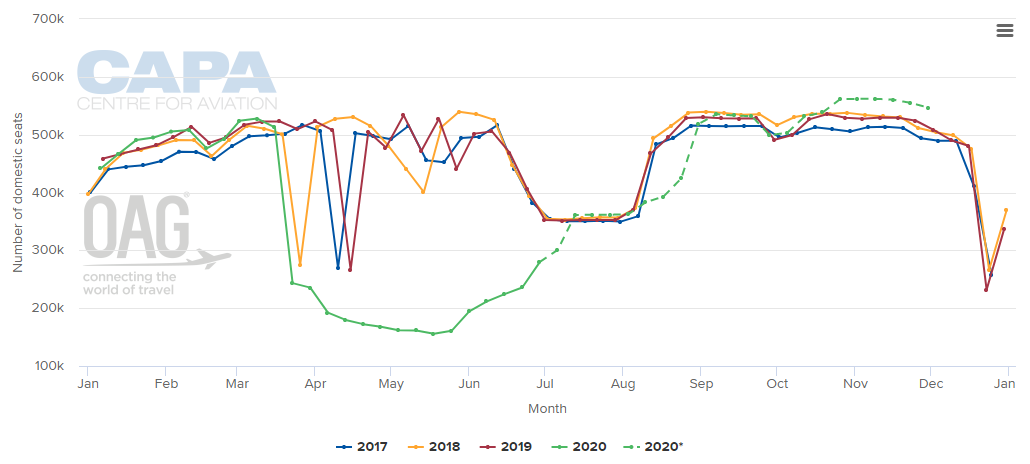

WEEKLY DOMESTIC CAPACITY (2017 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

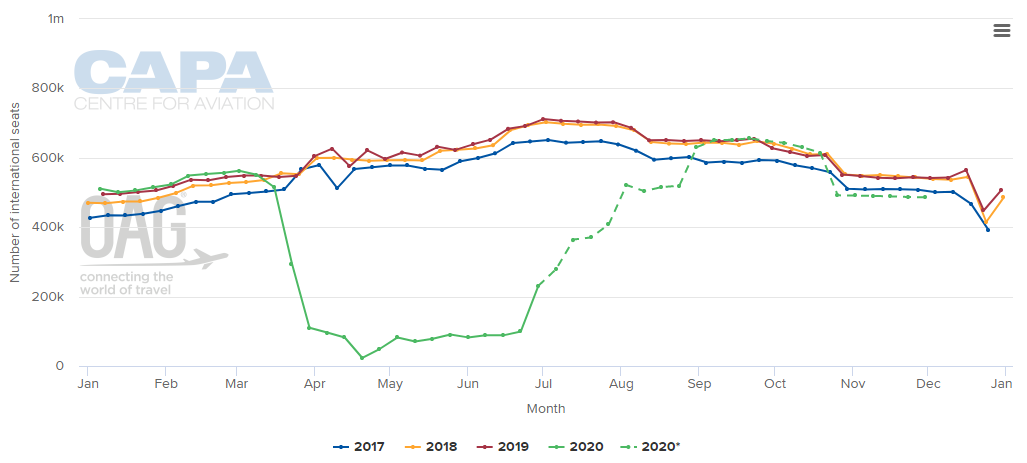

WEEKLY INTERNATIONAL CAPACITY (2017-2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

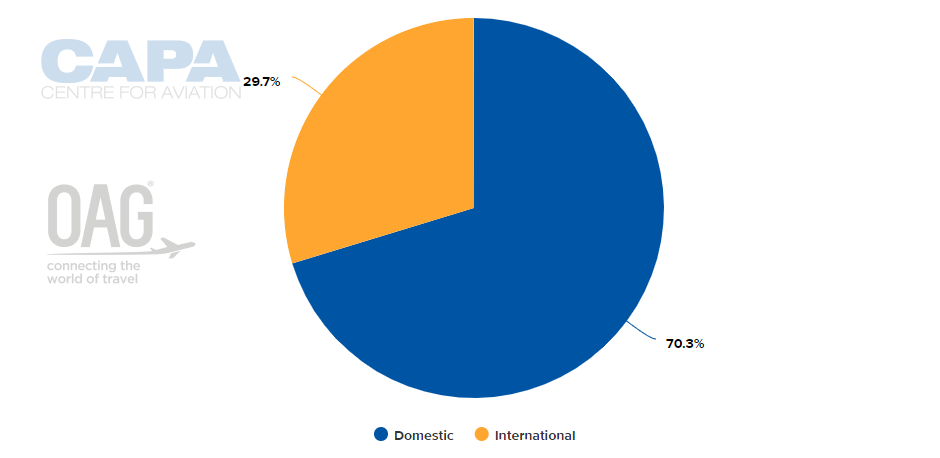

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 22-Jun-2020)

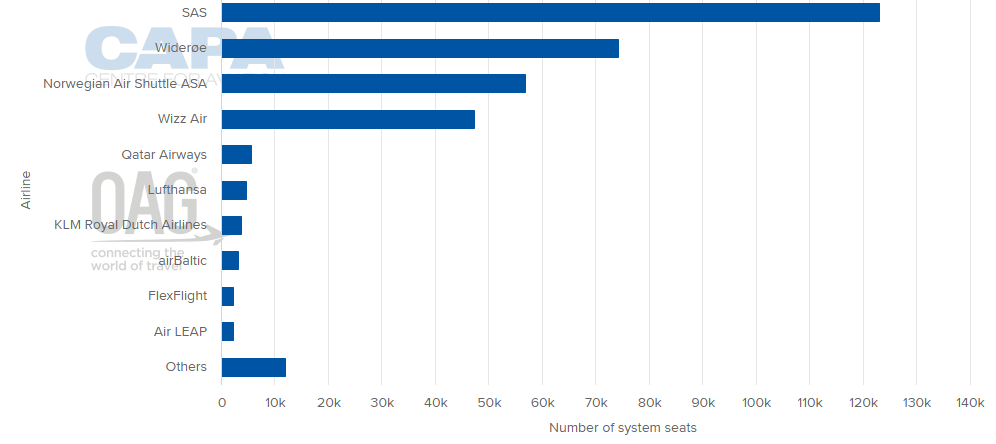

LARGEST AIRLINES BY CAPACITY (w/c 22-Jun-2020)

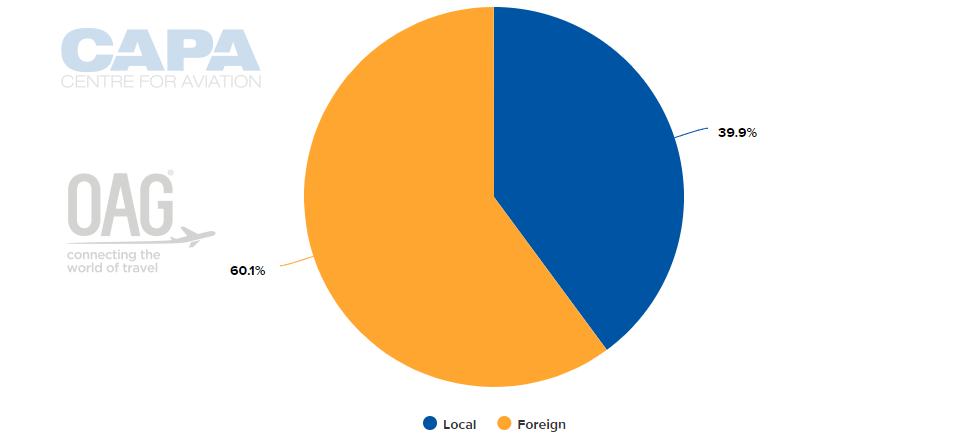

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 22-Jun-2020)

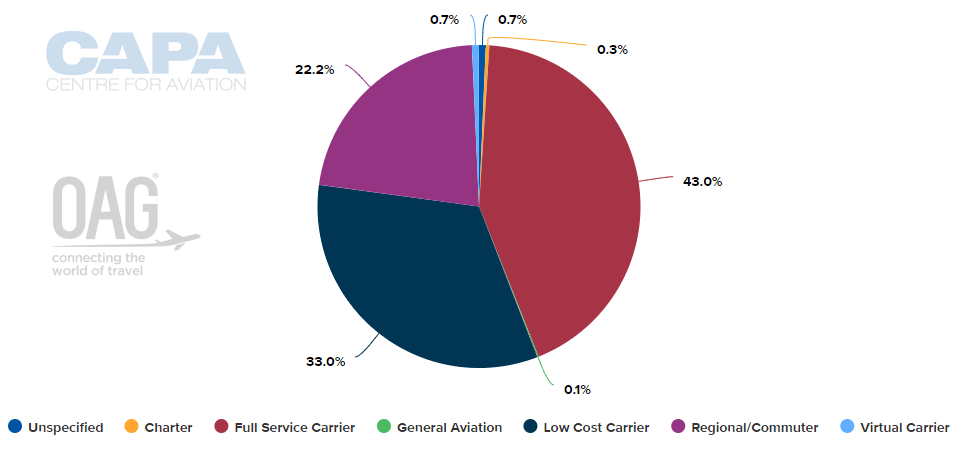

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 22-Jun-2020)

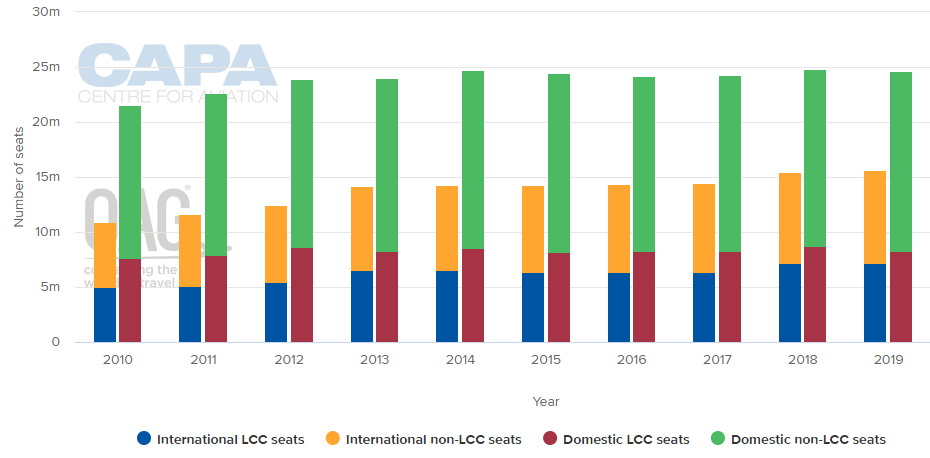

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

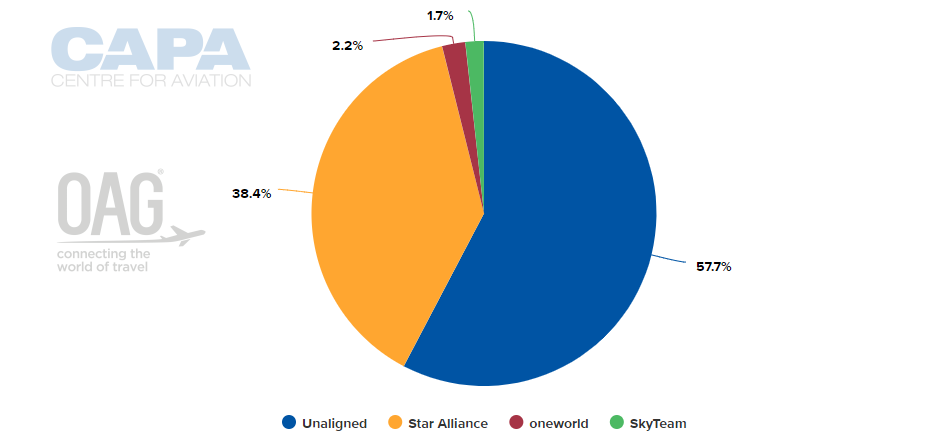

ALLIANCE CAPACITY SPLIT (w/c 22-Jun-2020)

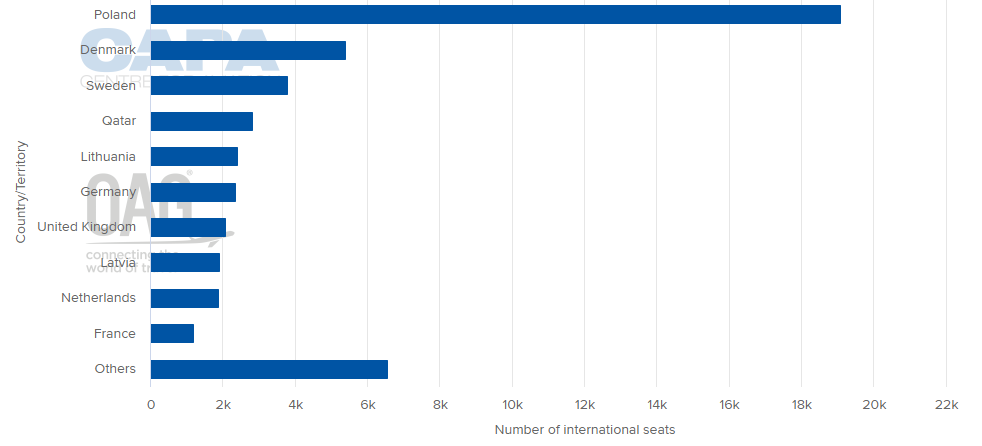

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 22-Jun-2020)

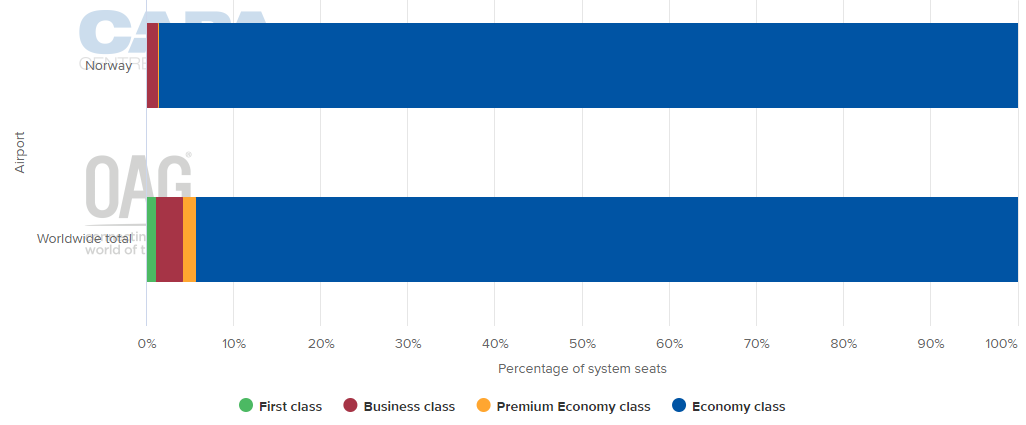

DEPARTING SYSTEM SEATS BY CLASS (w/c 22-Jun-2020)

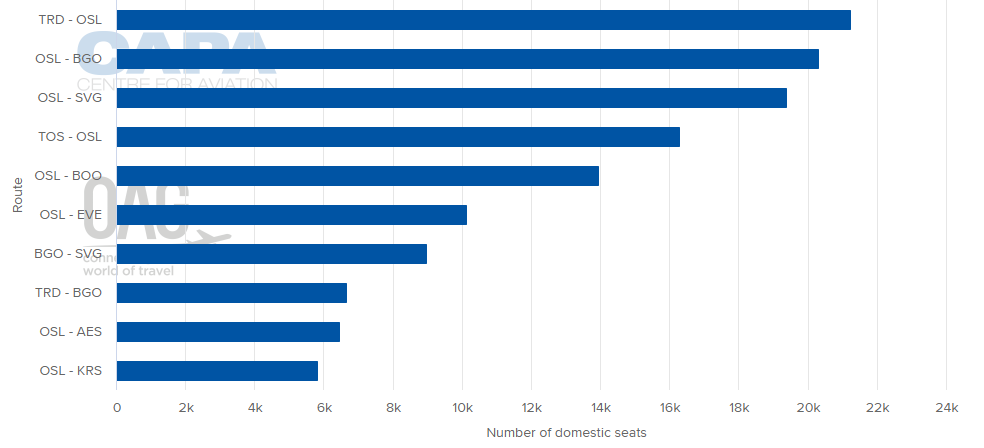

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 22-Jun-2020)

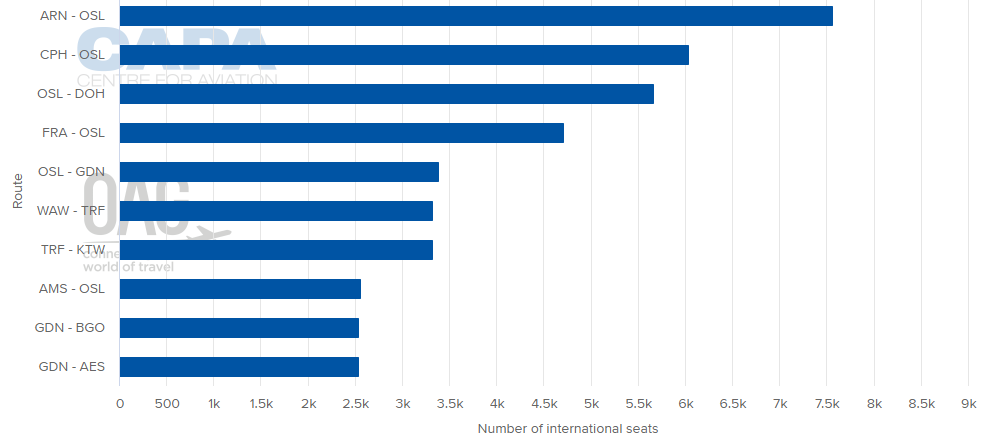

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 22-Jun-2020)

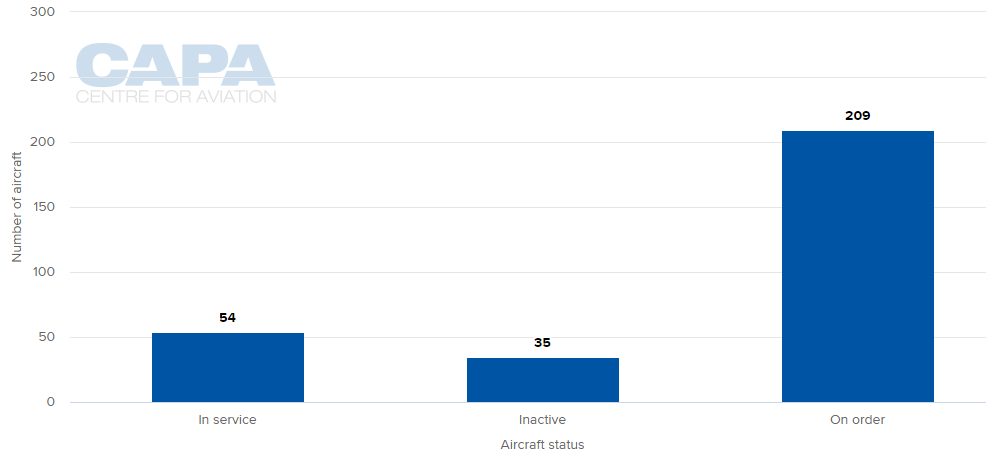

LOCAL AIRLINES' AIRCRAFT FLEET (as at 22-Jun-2020)

MORE INSIGHTS:

Europe's airline capacity climbs, but the schedules outlook is fiction

CityJet insolvency highlights Europe's regional airlines' vital role

Norwegian Air's exodus not a body blow to Oakland Airport

Norwegian airports: Avinor looks to cut costs after its 1Q2019 loss