While, this may have complicated international air access in the past and involved long flights to get almost anywhere, it has meant that alongside a pro-active protective stance against the coronavirus spread, it has now effectively eliminated the virus. It has still been impacted with just under 1,500 confirmed cases and 19 fatalities, but recording new cases in single figures for several days it seems to have ended community transmission of Covid-19.

This has allowed the country to remove some of its social restrictions and this week some non-essential business, healthcare and education activity has been allowed to resume. Most people will still be required to remain at home at all times and avoid all social interactions by entertaining social distancing, but it marks an important step forward.

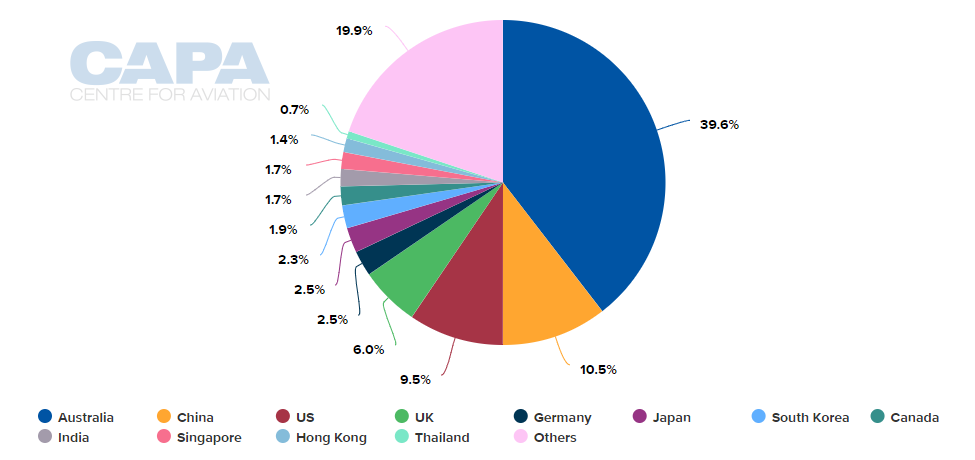

There are even reports this week the New Zealand and Australian governments could strike a deal to ease Trans-Tasman travel restrictions in the second half of the year to revive the flow of tourists and business travellers. New Zealand is Australia's second largest inbound market for visitor arrivals, while Australia is New Zealand's largest international visitor market, accounting for almost half of all international visitor arrivals.

This would represent a logical and important step forward in starting to rebuild international air travel and global economies and an example for others to learn from and follow. However, right now the same message that we are all hearing around the world remains the biggest hurdle.. fear! Government officials confirm restrictions will only be lifted "when it's safe to do so".

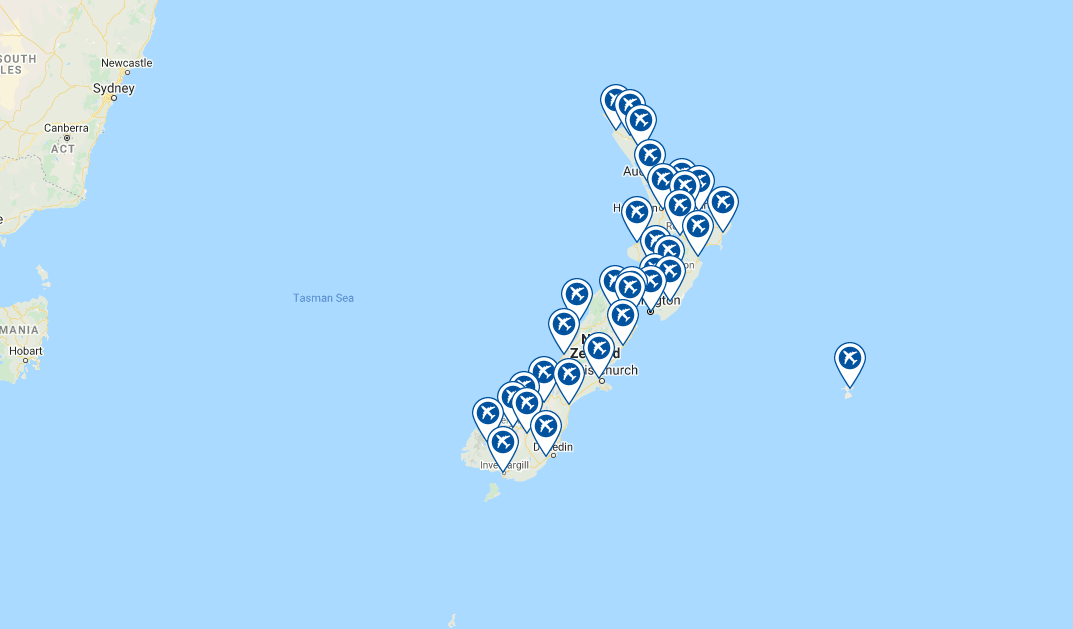

AIRPORTS IN THE COUNTRY

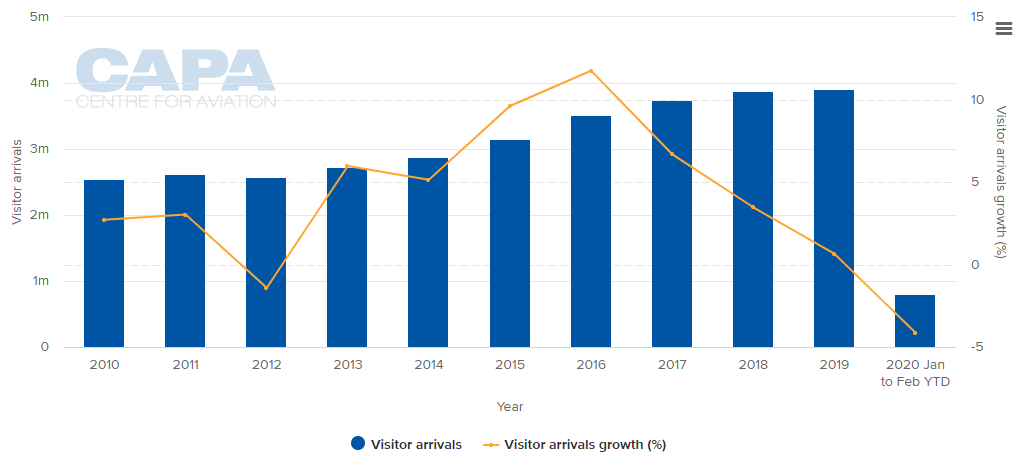

ANNUAL VISITOR ARRIVALS (2010 - 2020YTD)

VISITOR ARRIVALS BY MARKET (2019)

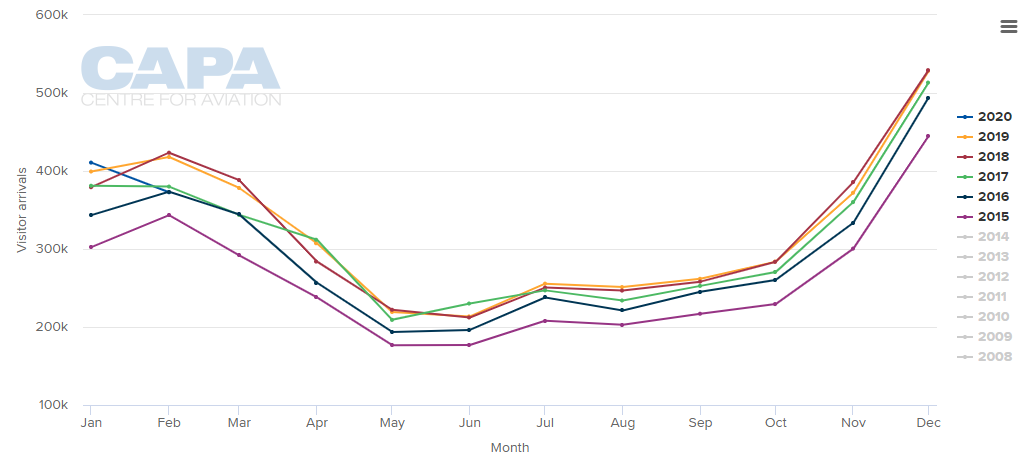

MONTHLY VISITOR ARRIVALS AND SEASONALITY IN DEMAND (2015 - 2020YTD)

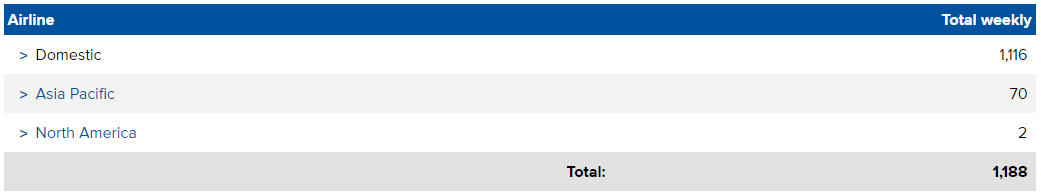

SCHEDULE MOVEMENT SUMMARY (w/c 27-Apr-2020)

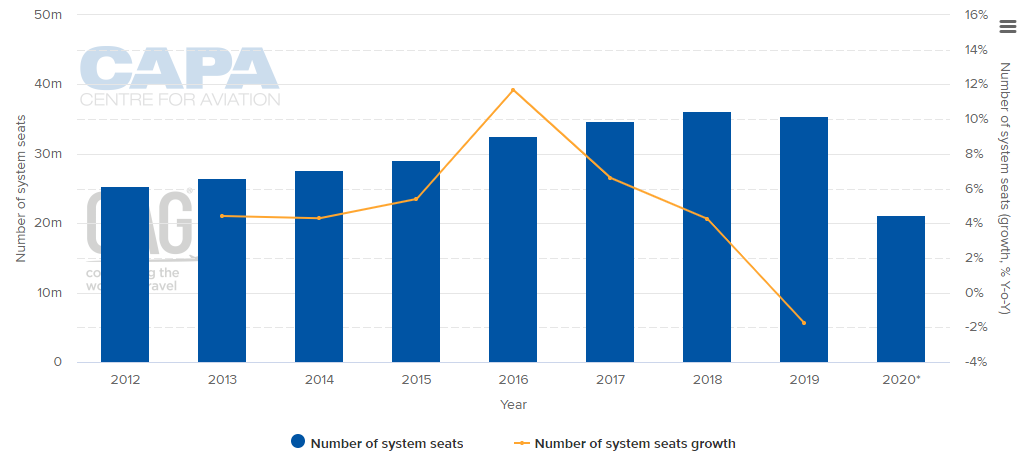

ANNUAL CAPACITY (2012 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

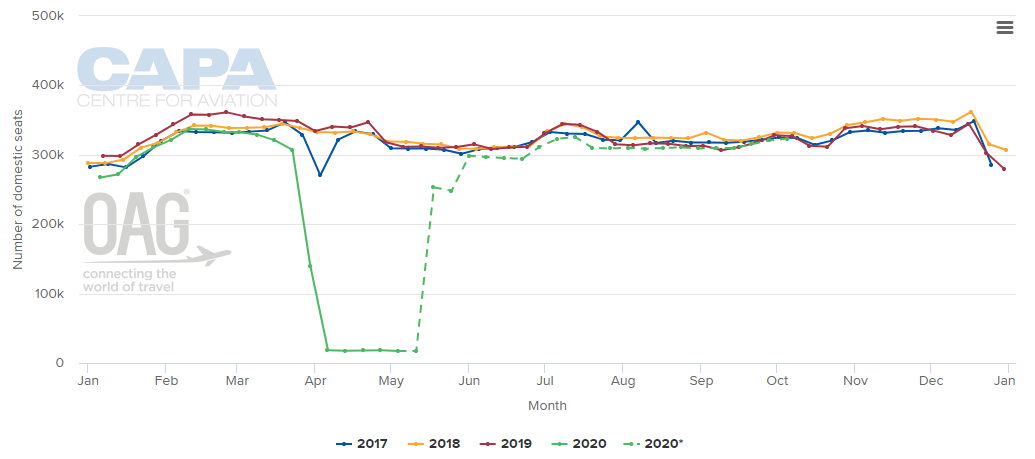

WEEKLY DOMESTIC CAPACITY (2017 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

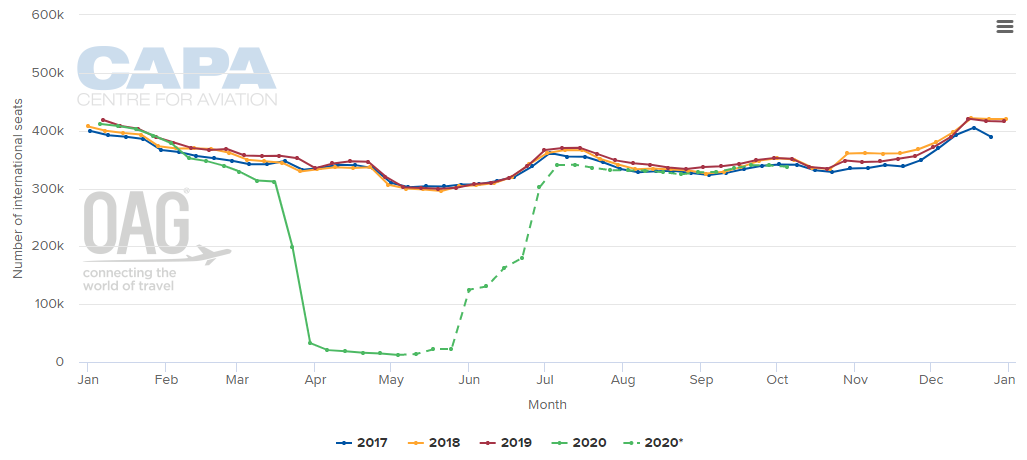

WEEKLY INTERNATIONAL CAPACITY (2017-2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

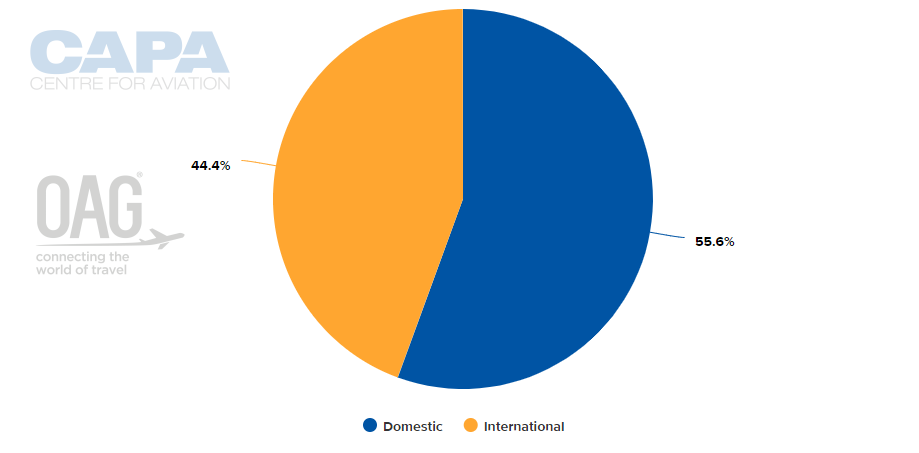

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 27-Apr-2020)

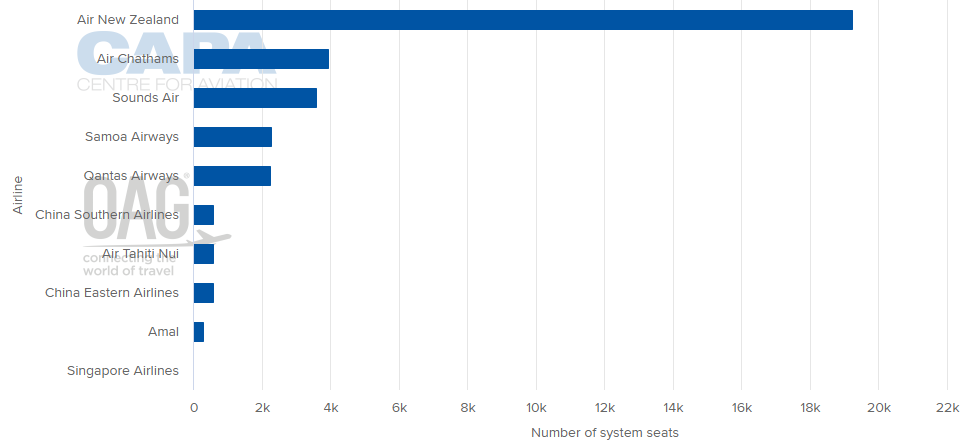

LARGEST AIRLINES BY CAPACITY (w/c 27-Apr-2020)

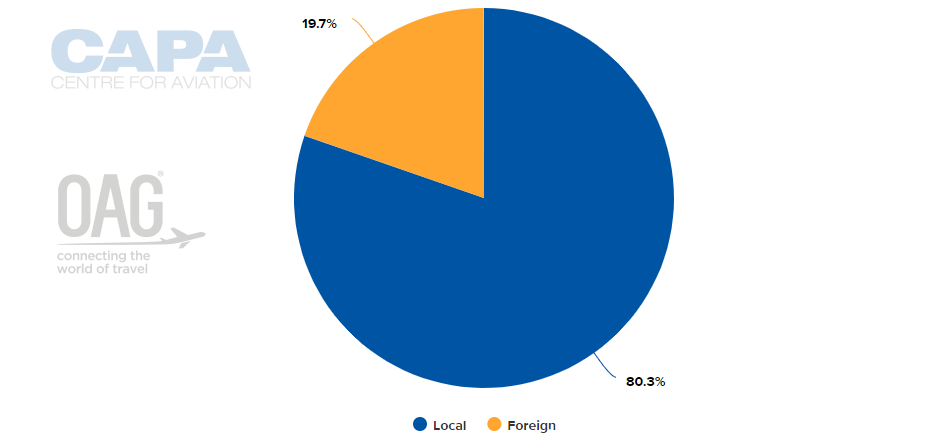

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 27-Apr-2020)

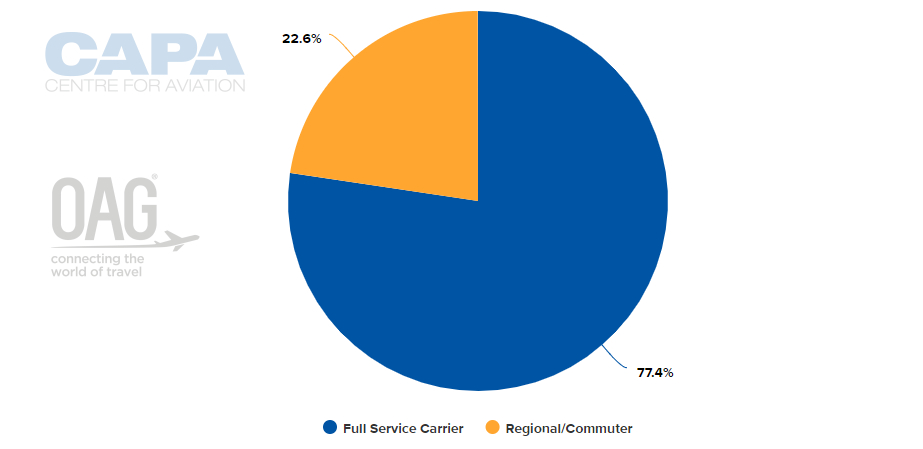

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 27-Apr-2020)

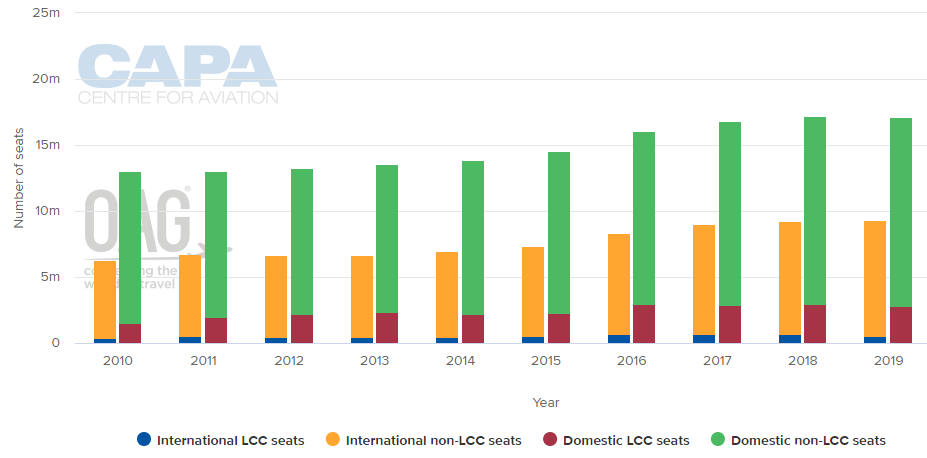

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

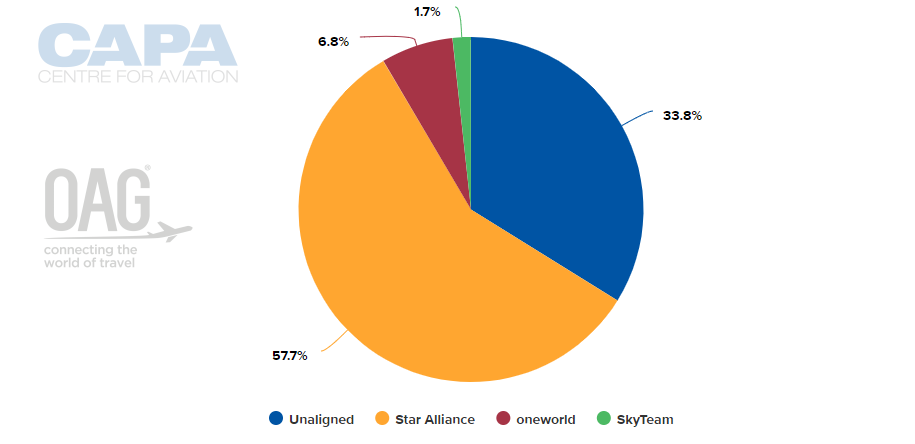

ALLIANCE CAPACITY SPLIT (w/c 27-Apr-2020)

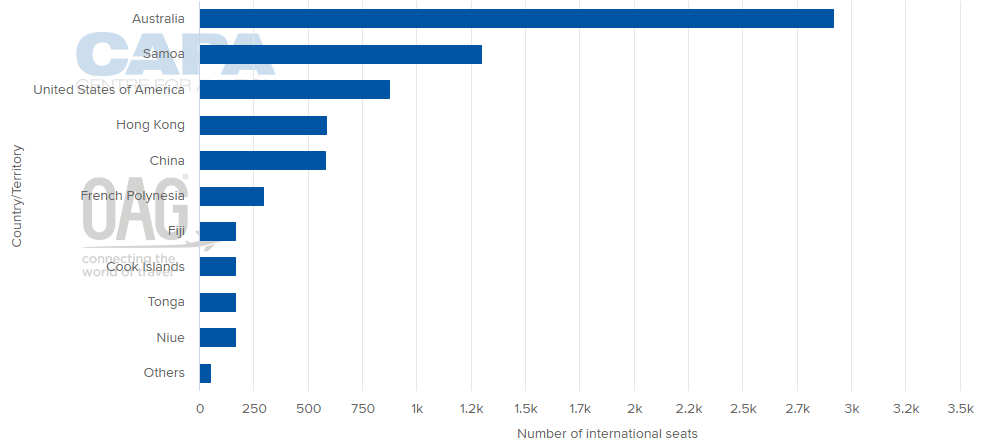

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 27-Apr-2020)

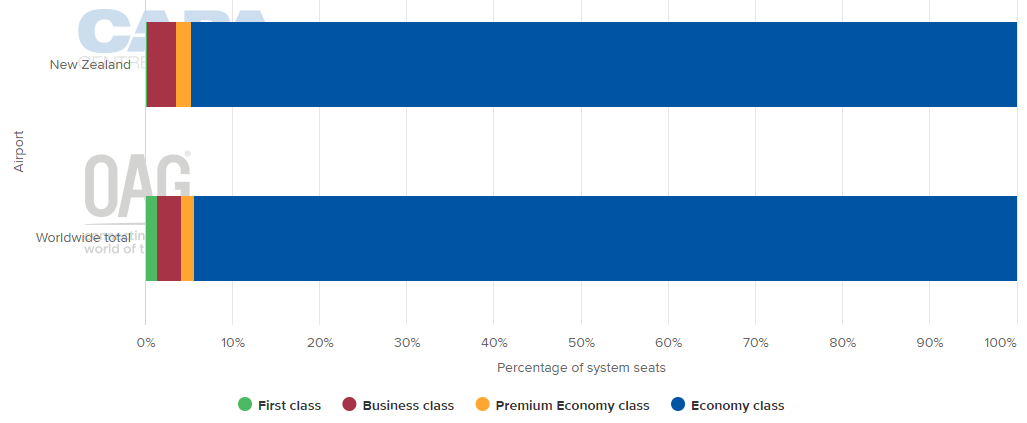

DEPARTING SYSTEM SEATS BY CLASS (w/c 27-Apr-2020)

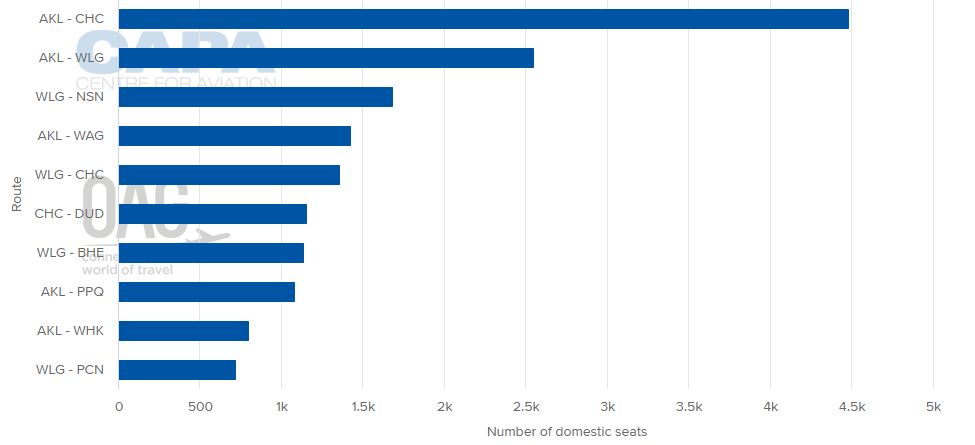

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 27-Apr-2020)

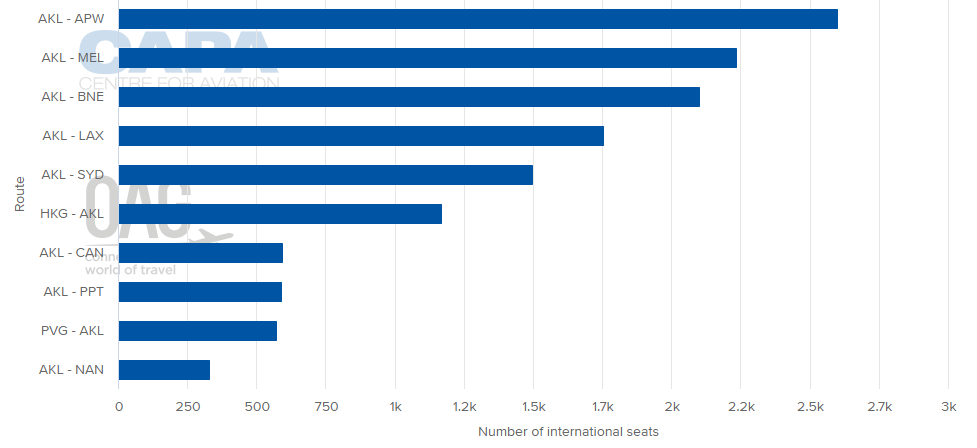

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 27-Apr-2020)

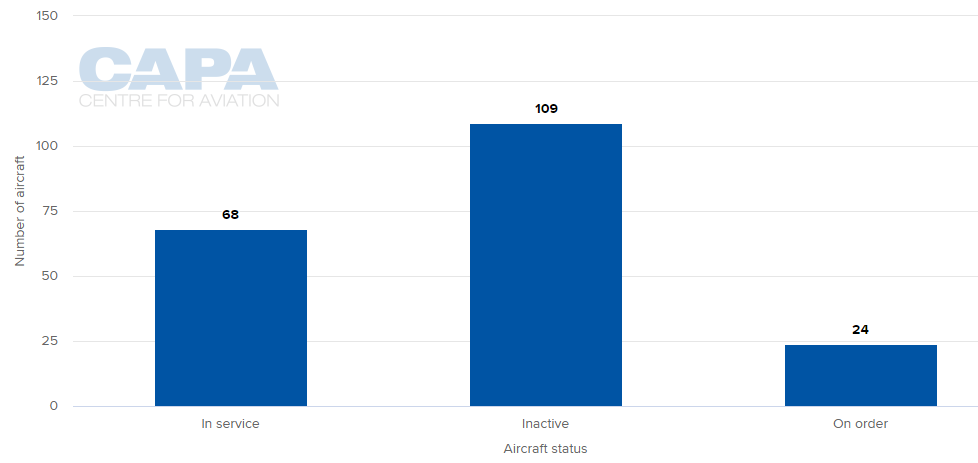

LOCAL AIRLINES' AIRCRAFT FLEET (as at 27-Apr-2020)

MORE INSIGHTS:

Domestic airline networks to lead post-COVID-19 AsiaPac rebound

COVID-19: Island nations' serious loss of air services. Part 2

Trans-Tasman aviation impacted by Coronavirus COVID-19

South Pacific Airline Outlook 2020s: New long haul opportunities