The Middle East is experiencing rapid and significant change, with established operators and new entrants challenging the seemingly endless market dominance of the big three Gulf carriers: Emirates Airline, Etihad Airways and Qatar Airways. The arrival of long haul narrowbody aircraft in particular are supporting a balance shift, as smaller gateways become available for direct service.

AIRPORTS IN THE COUNTRY

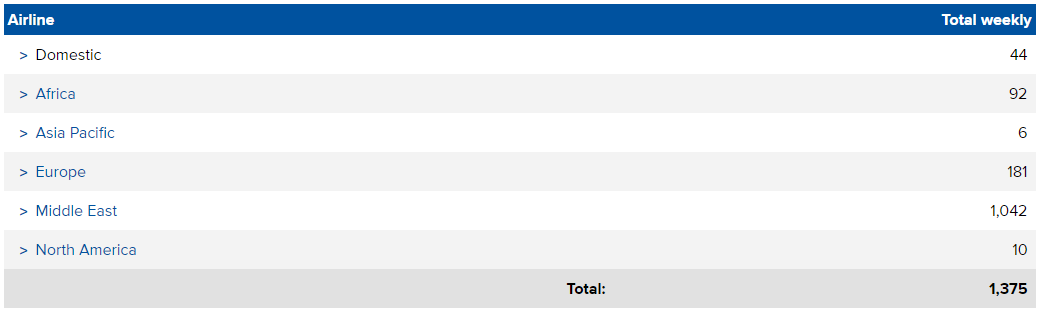

SCHEDULE MOVEMENT SUMMARY (w/c 17-Feb-2020)

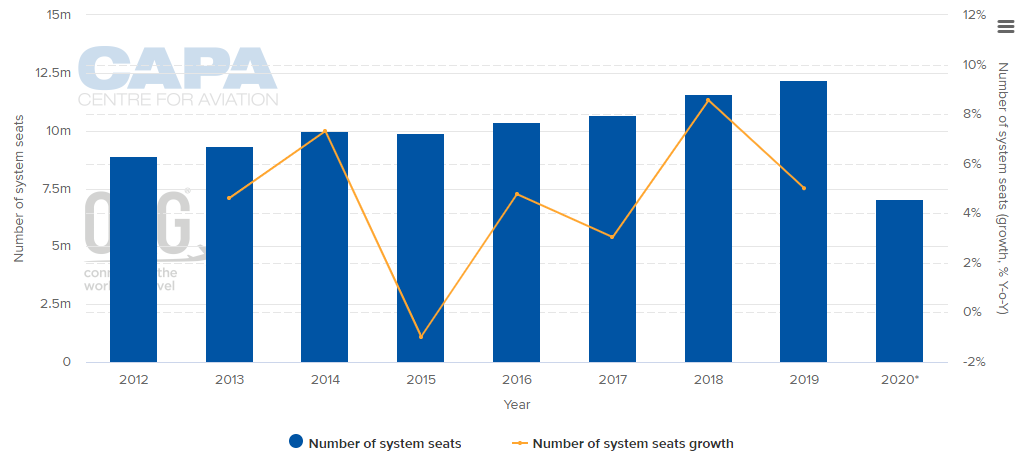

ANNUAL CAPACITY (2012 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

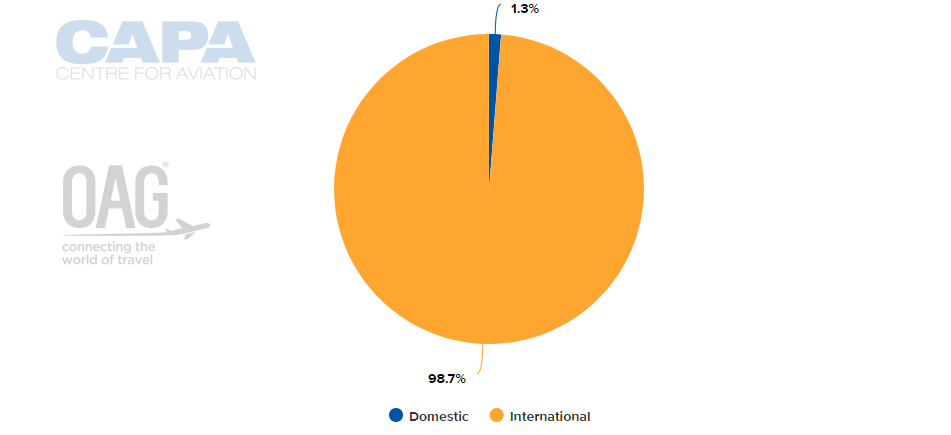

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 17-Feb-2020)

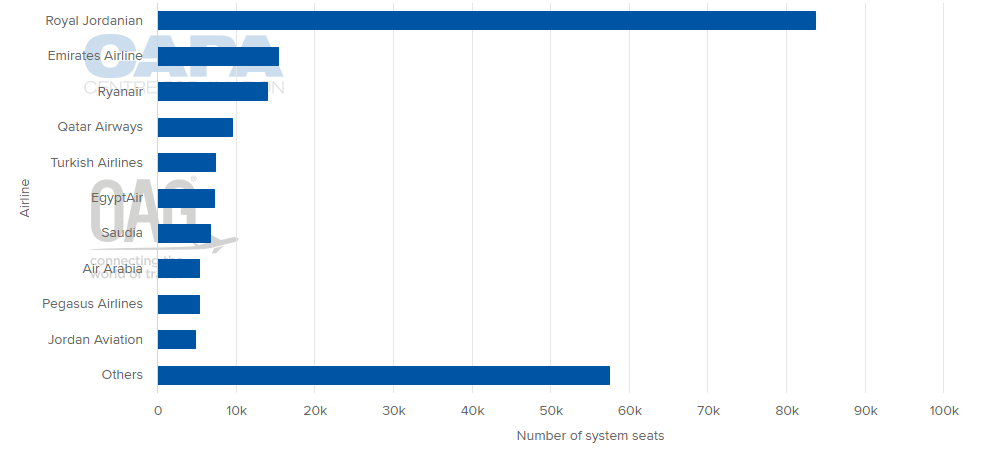

LARGEST AIRLINES BY CAPACITY (w/c 17-Feb-2020)

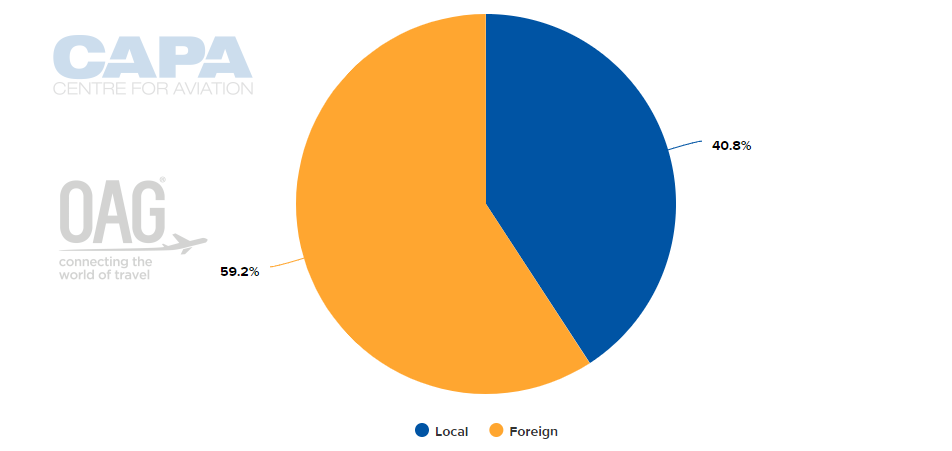

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 17-Feb-2020)

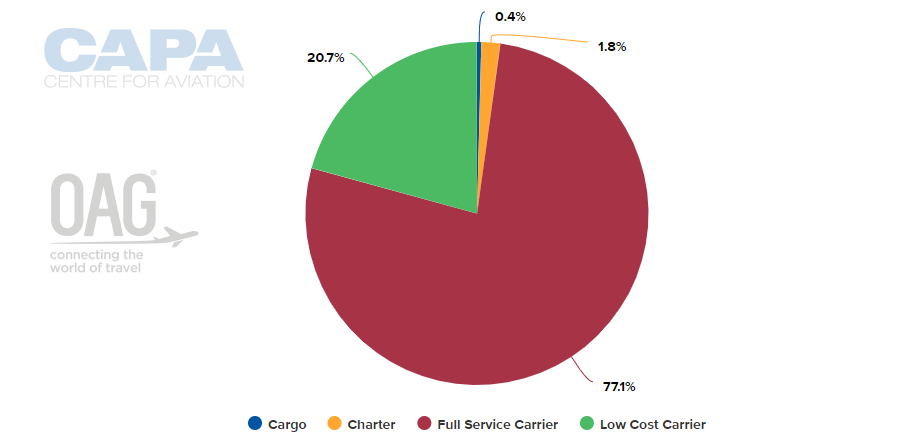

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 17-Feb-2020)

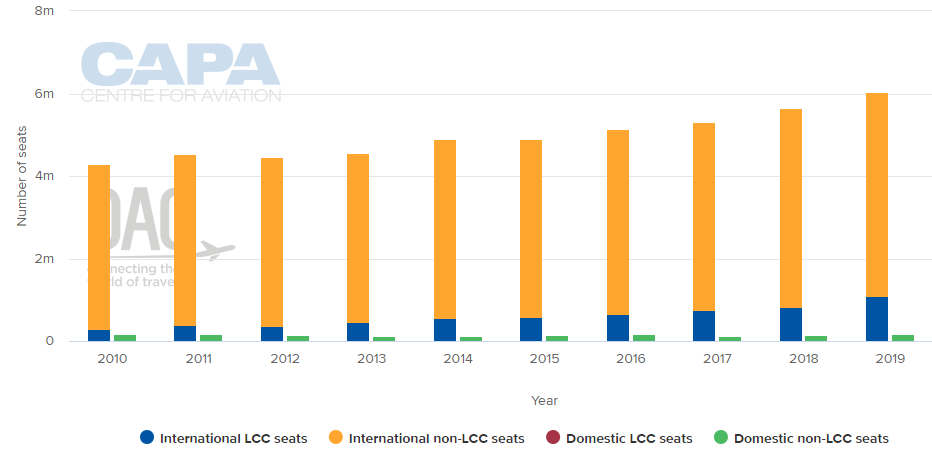

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

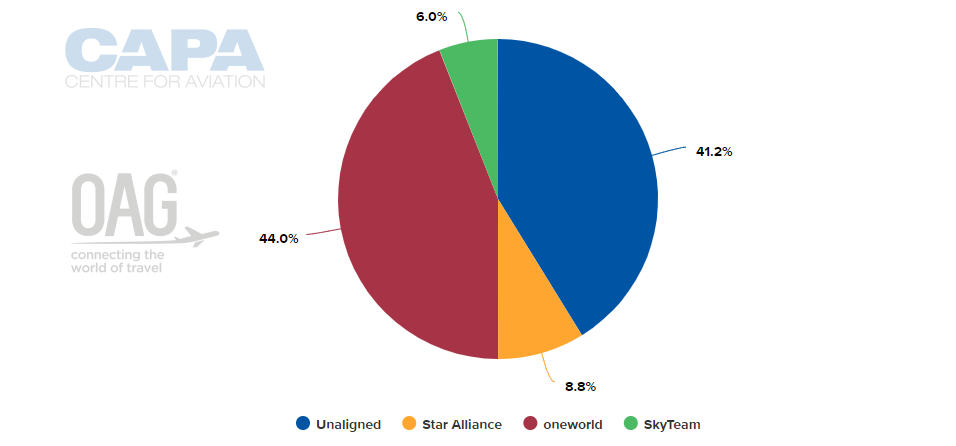

ALLIANCE CAPACITY SPLIT (w/c 17-Feb-2020)

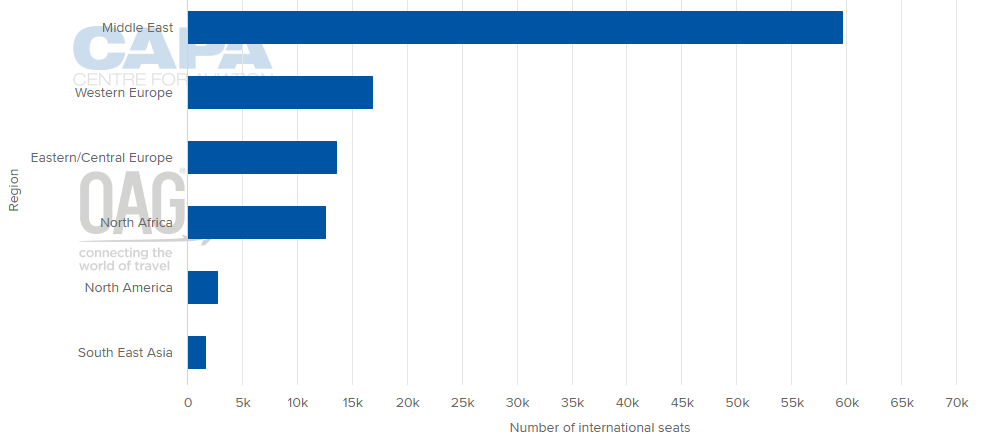

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 17-Feb-2020)

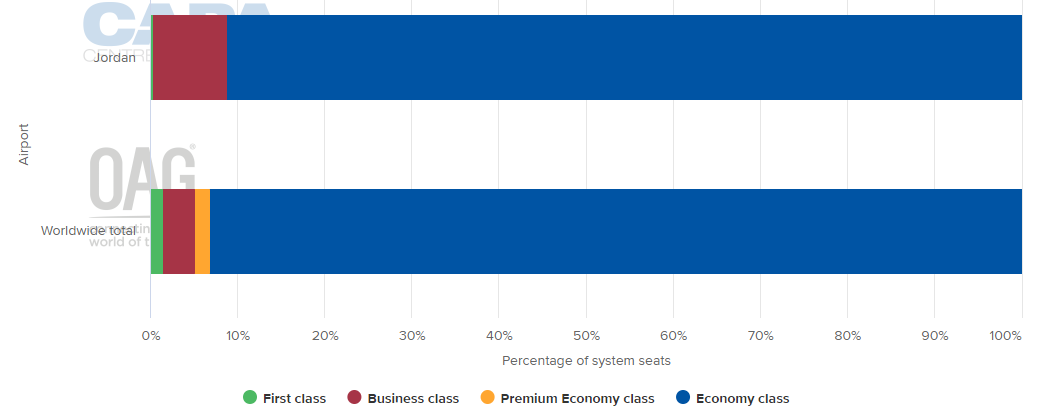

DEPARTING SYSTEM SEATS BY CLASS (w/c 17-Feb-2020)

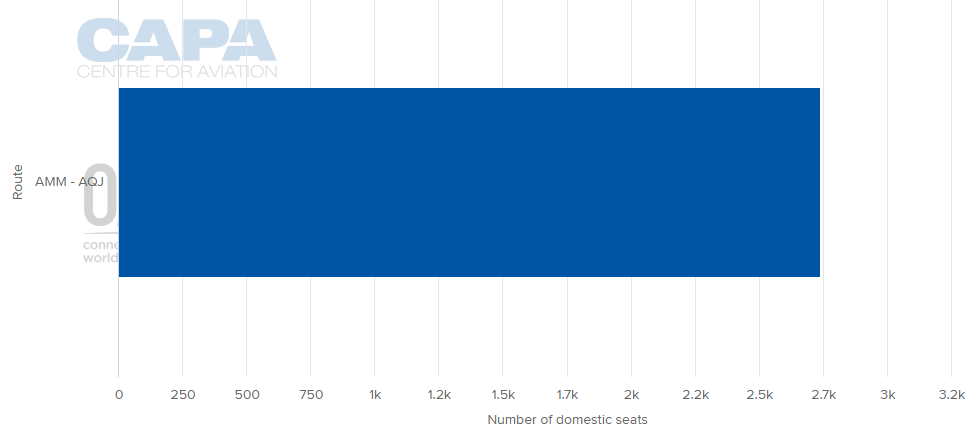

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 17-Feb-2020)

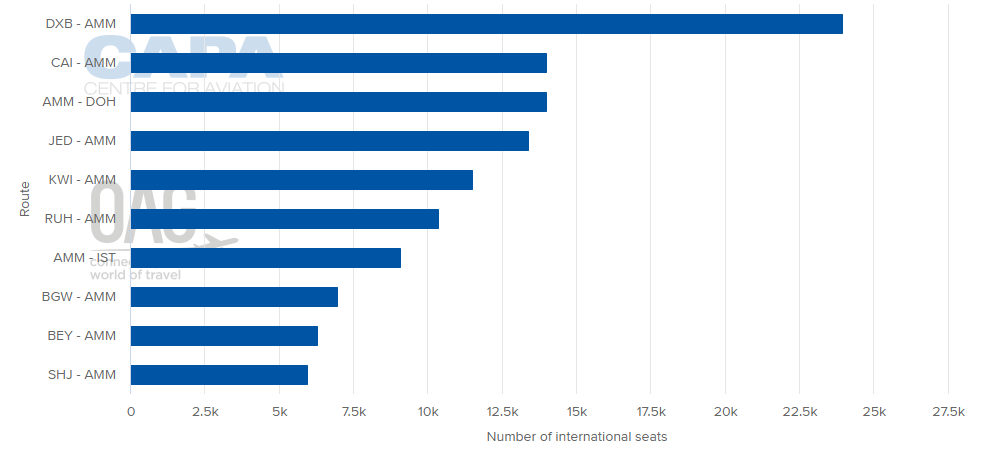

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 17-Feb-2020)

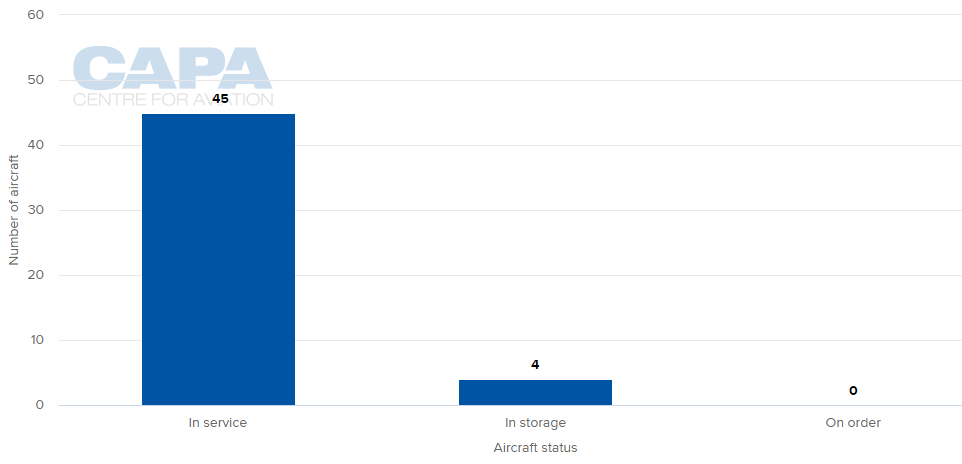

LOCAL AIRLINES' AIRCRAFT FLEET (as at 17-Feb-2020)

MORE INSIGHTS:

Royal Jordanian Airlines: narrowbody fleet renewal, market share down

W/Europe-M/East capacity: only British Airways exploits opportunities