The Asia Pacific region is the largest business travel market in the world, and is growing at the fastest rate, owing to improvements in living standards, rise in disposable income, and development of the tourism industry.

India has emerged as one of the world's fastest growing markets with annual spend now touching USD50 billion, a figure many predicted could double through the 2020s as India's burgeoning middle class and solid economic growth will see demand for travel to surge throughout the decade.

India's aviation sector has undergone rapid transformation since the liberalisation drive that began in 2003. Strong GDP growth, a young population and the expansion of India's vibrant middle class sees India achieve some of the fastest growth of any aviation market in the world.

The collapse of Jet Airways may have diluted this development in 2019, but if costs can be continually brought down and competition remains strong, low fares should further stimulate new demand and draw millions of passengers away from the extensive rail network to faster and more comfortable air services.

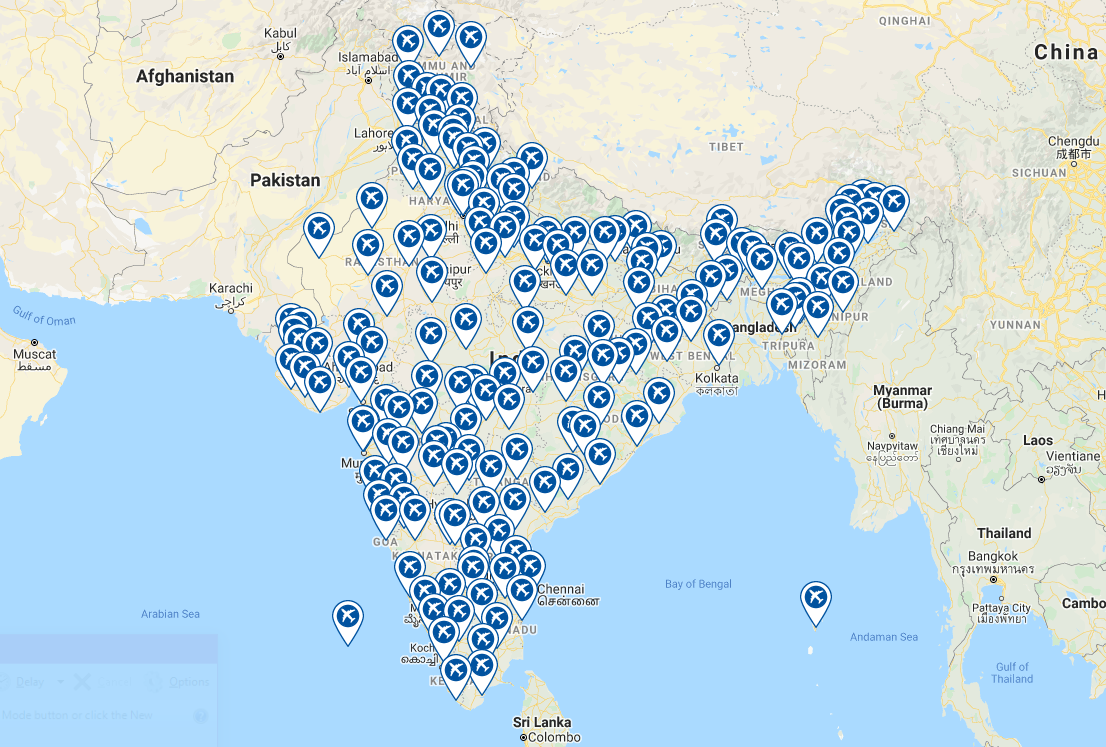

AIRPORTS IN THE COUNTRY

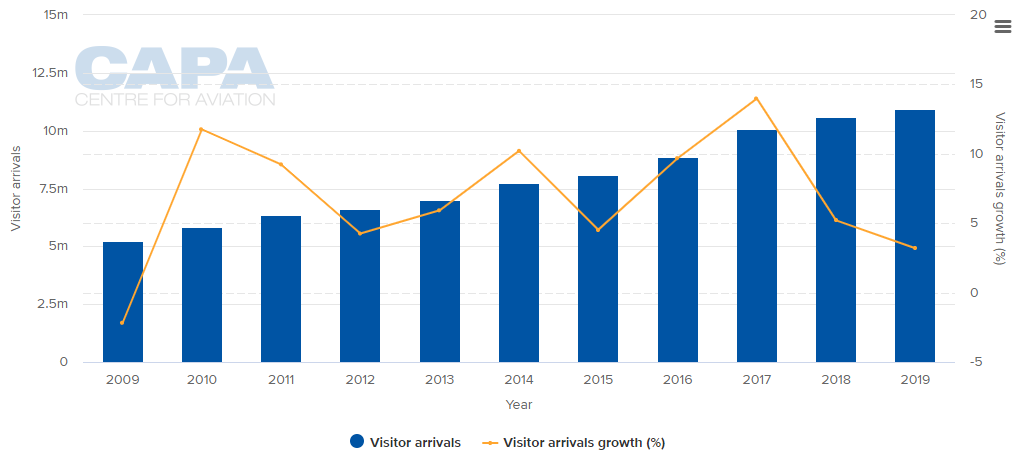

ANNUAL VISITOR ARRIVALS (2009 - 2019)

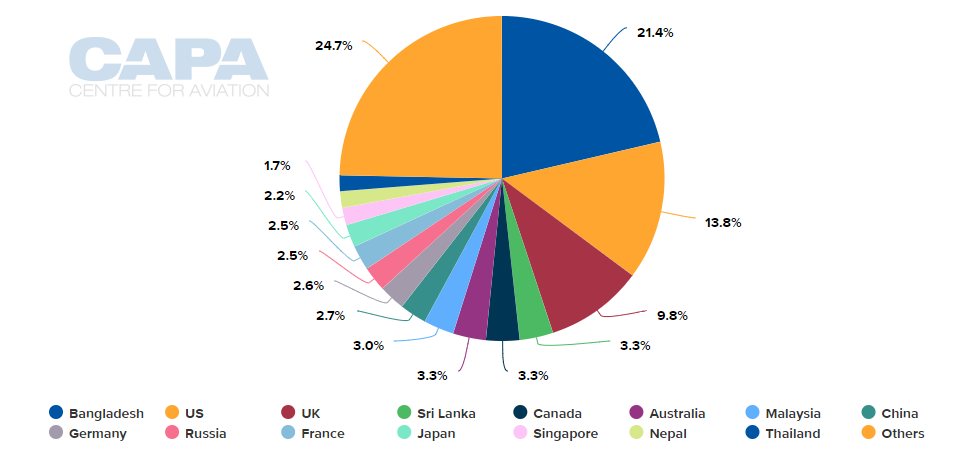

VISITOR ARRIVALS BY MARKET (2018)

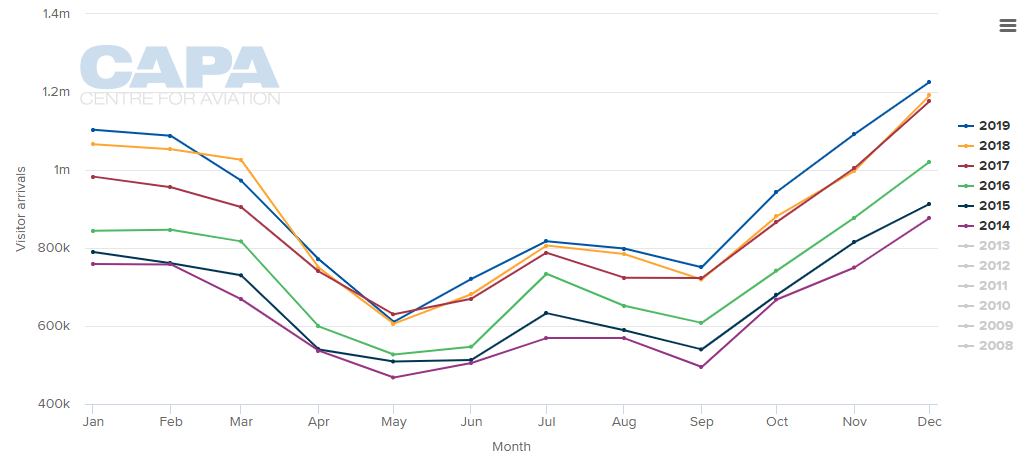

MONTHLY VISITOR ARRIVALS AND SEASONALITY IN DEMAND (2014 - 2019)

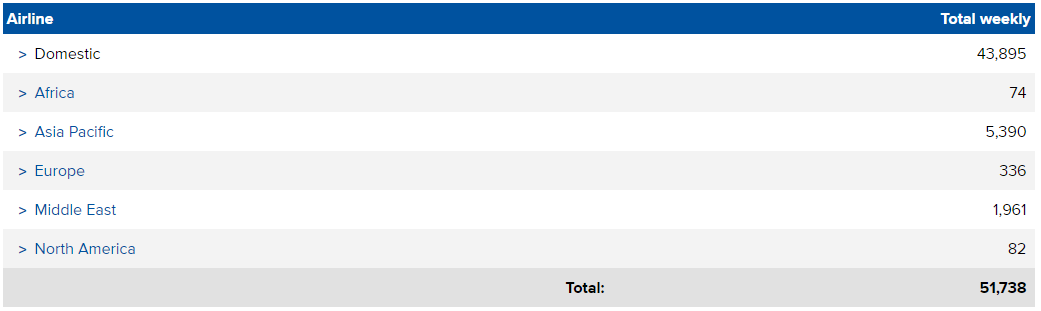

SCHEDULE MOVEMENT SUMMARY (w/c 10-Feb-2020)

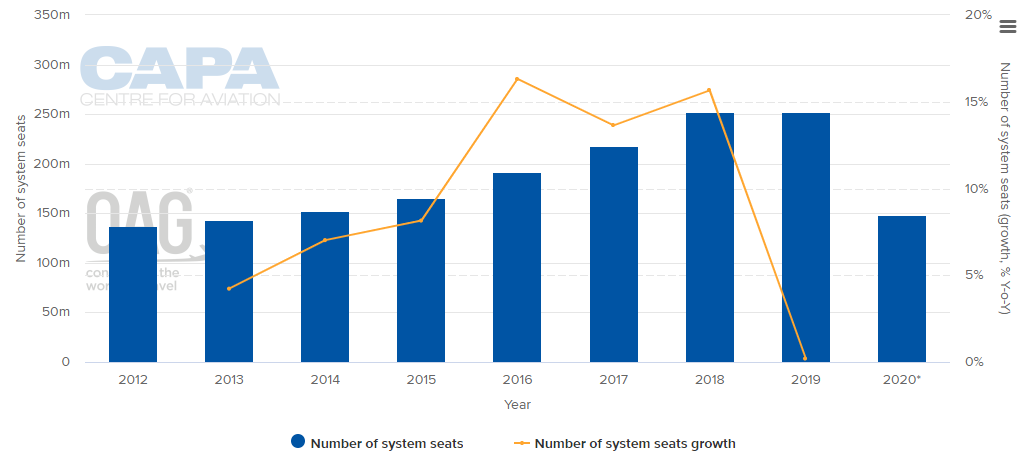

ANNUAL CAPACITY (2012 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

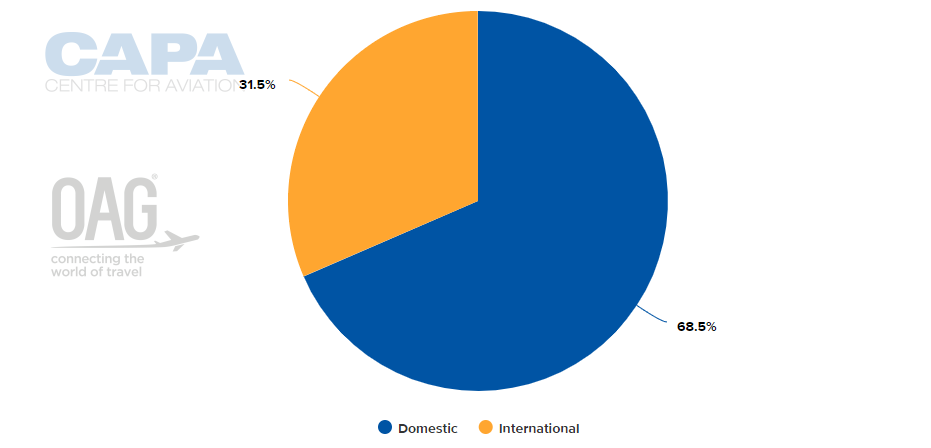

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 10-Feb-2020)

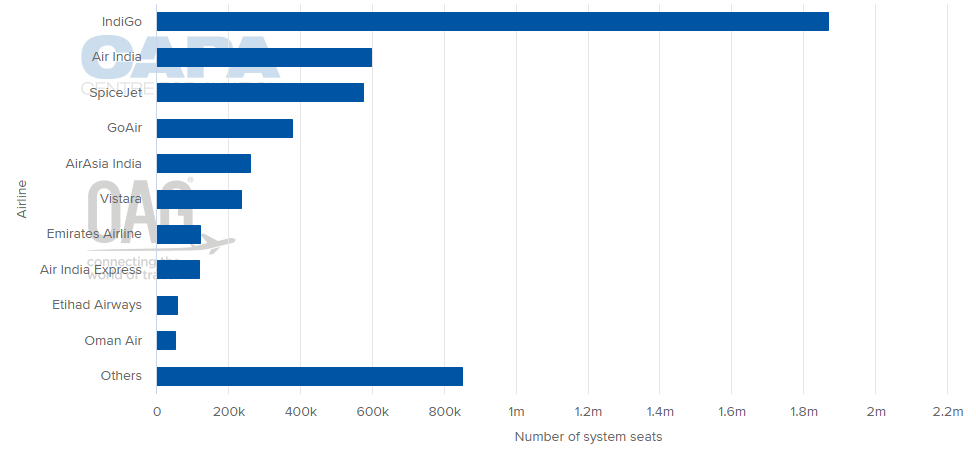

LARGEST AIRLINES BY CAPACITY (w/c 10-Feb-2020)

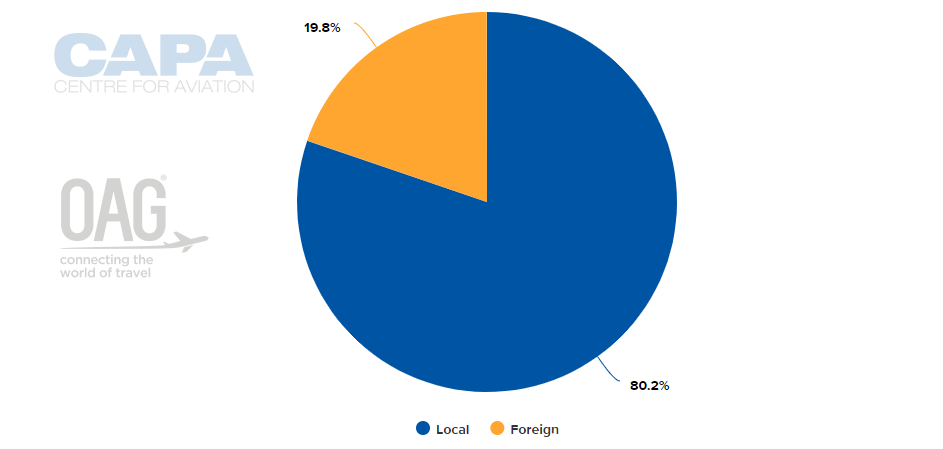

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 10-Feb-2020)

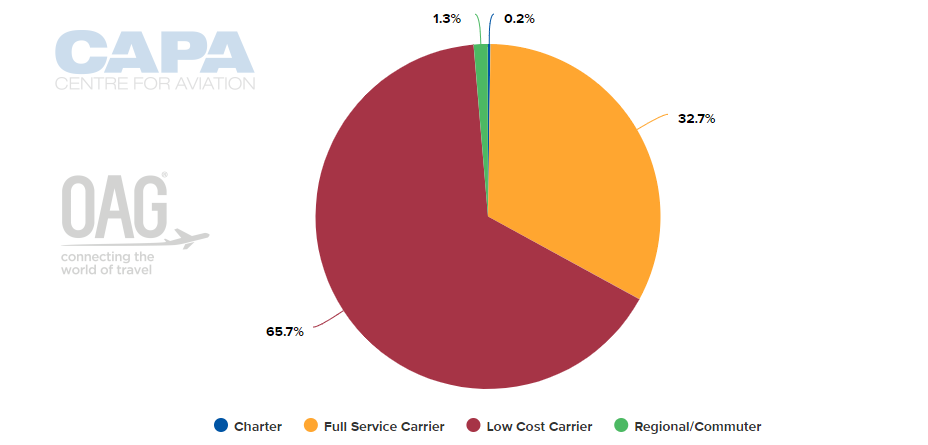

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 10-Feb-2020)

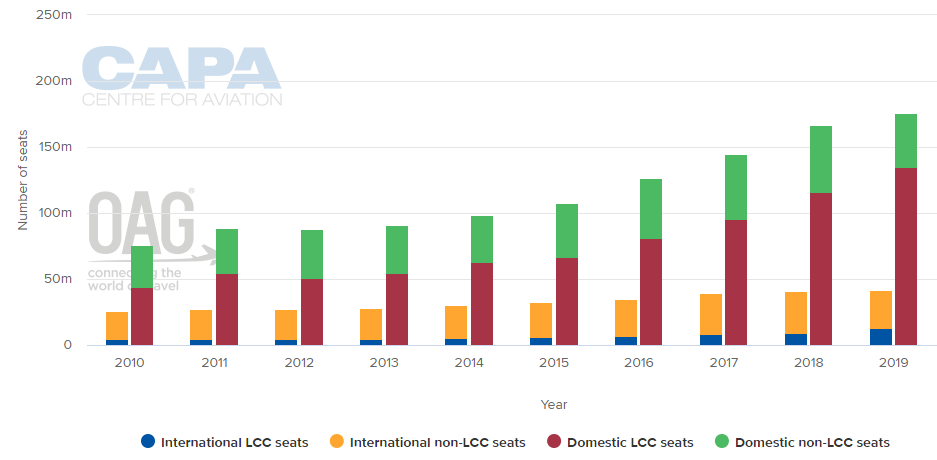

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

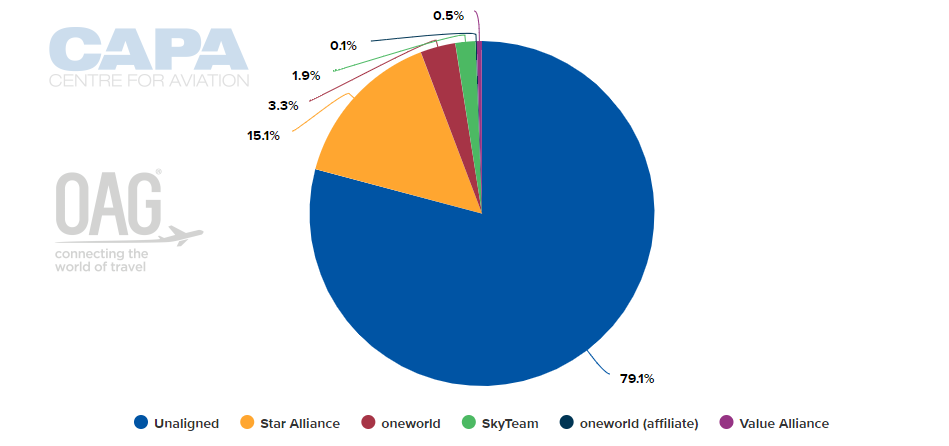

ALLIANCE CAPACITY SPLIT (w/c 10-Feb-2020)

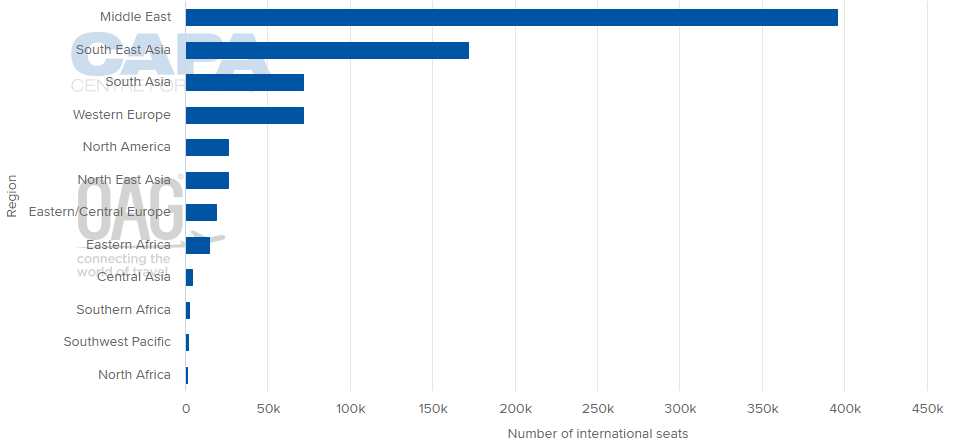

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 10-Feb-2020)

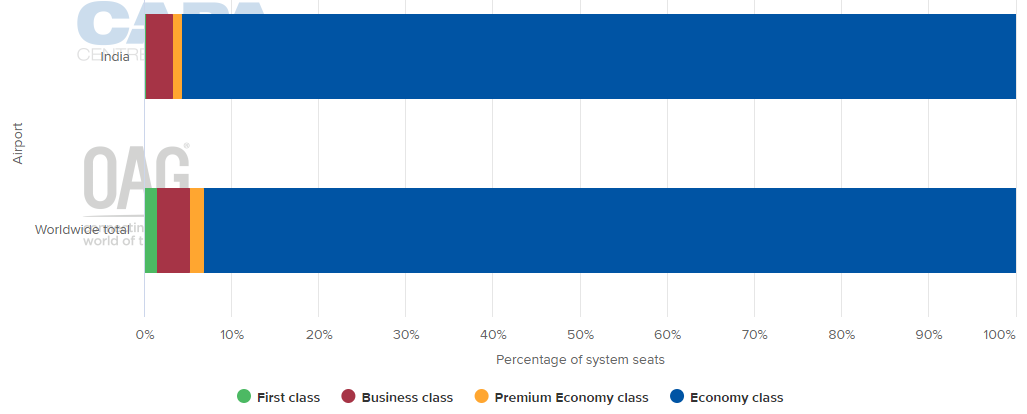

DEPARTING SYSTEM SEATS BY CLASS (w/c 10-Feb-2020)

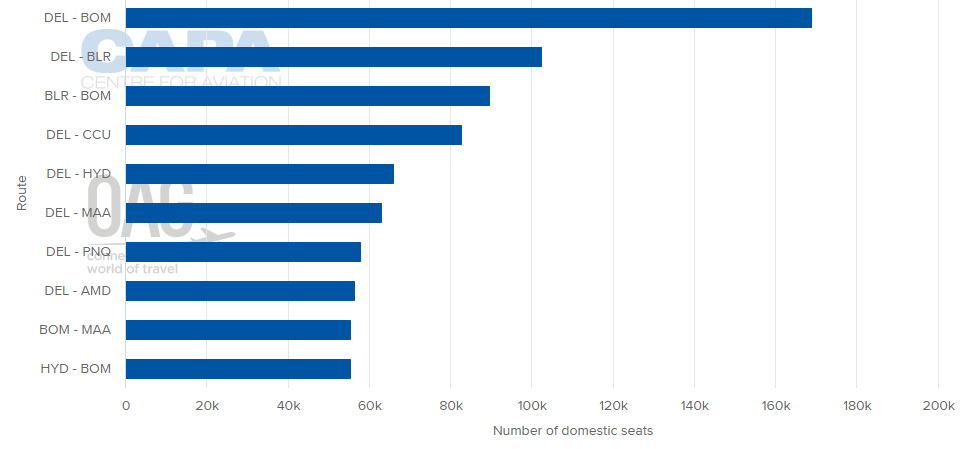

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 10-Feb-2020)

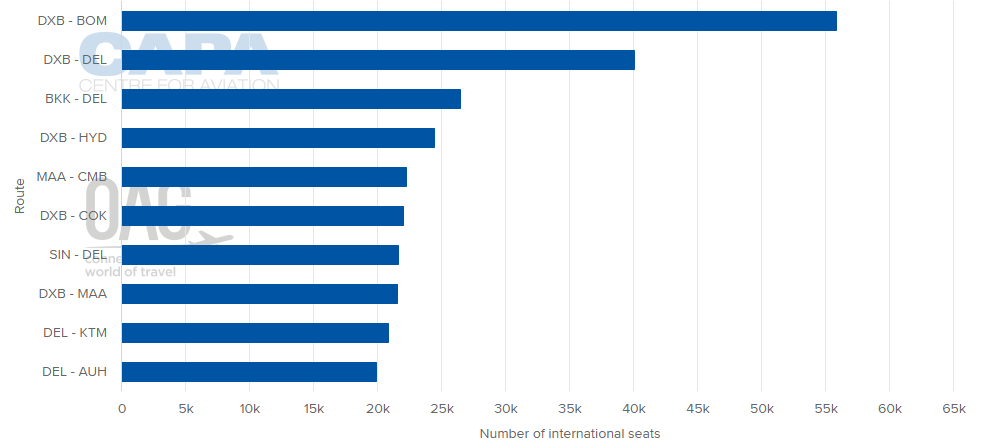

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 10-Feb-2020)

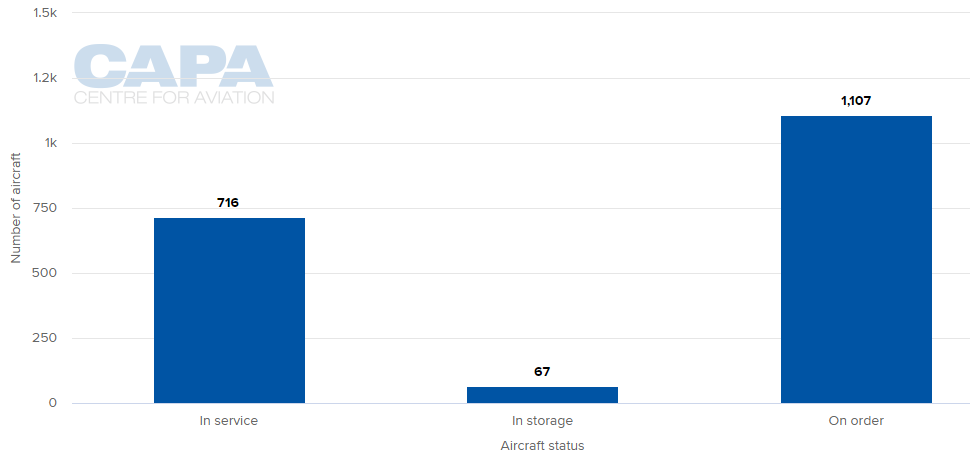

LOCAL AIRLINES' AIRCRAFT FLEET (as at 10-Feb-2020)

MORE INSIGHTS:

Turkish Airlines and IndiGo may grow their codeshare

Air India & Virgin Atlantic help offset Jet Airways' exit

Europe-India airlines not yet filling the Jet Airways gap

GMR Airports: GMR Infrastructure finally gets fresh investment