The carrier has been slowly resuming and adding routes as India has permitted the return of flights, but continues to operate just a limited network. To support its resumption and meet traveller concerns over the safety of the travel experience and maintain physical distancing it has deployed some new ticketing options.

These comprise 'GoMore', a fare option permitting passengers to purchase a seat in the first two rows and ensure the middle seat remains vacant and 'GoFlyPrivate', a fare option permitting passengers to "book multiple rows and create your own private zone" on domestic services. The airline's managing director Jeh Wadia describes the latter as a concept that will cost "a fraction of a full-fledged private charter flight" but will provide "the same sense of privacy that the customer would otherwise feel in a private charter".

ABOUT

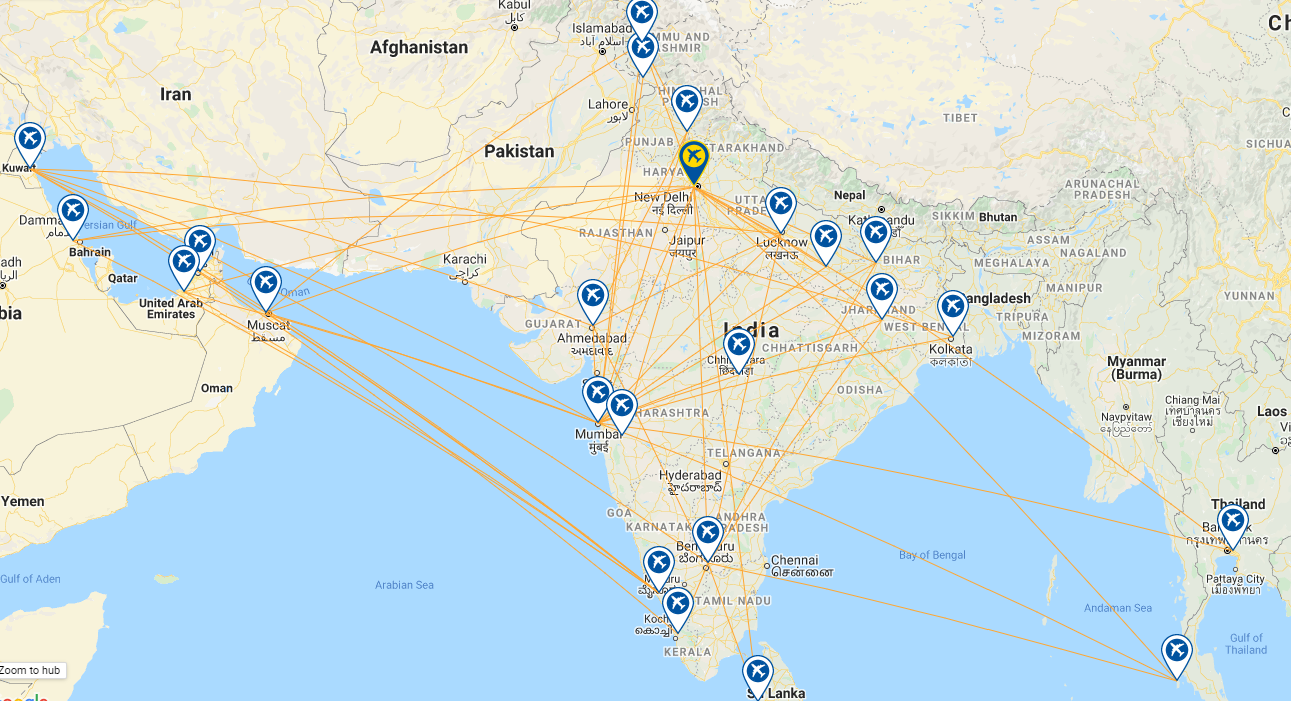

Established in 2005 and wholly-owned by the Wadia Group, GoAir is a low-cost carrier based at Chhatrapati Shivaji International Airport in Mumbai with a secondary hub at Indira Gandhi International Airport. The carrier operates an extensive network of domestic services within India using Airbus A320 family aircraft.

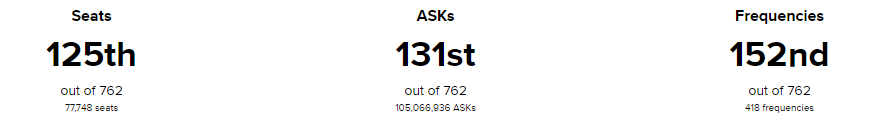

GLOBAL RANKING (as at 27-Jul-2020)

NETWORK MAP (as at 27-Jul-2020)

DESTINATIONS (as at 27-Jul-2020)

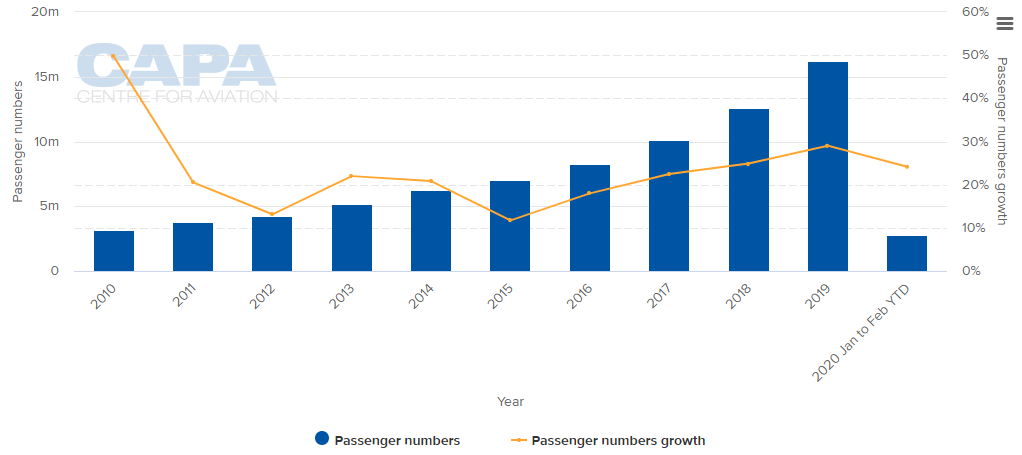

ANNUAL PASSENGER TRAFFIC (2010 - 2020YTD)

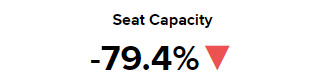

CAPACITY SNAPSHOT (versus same week last year)

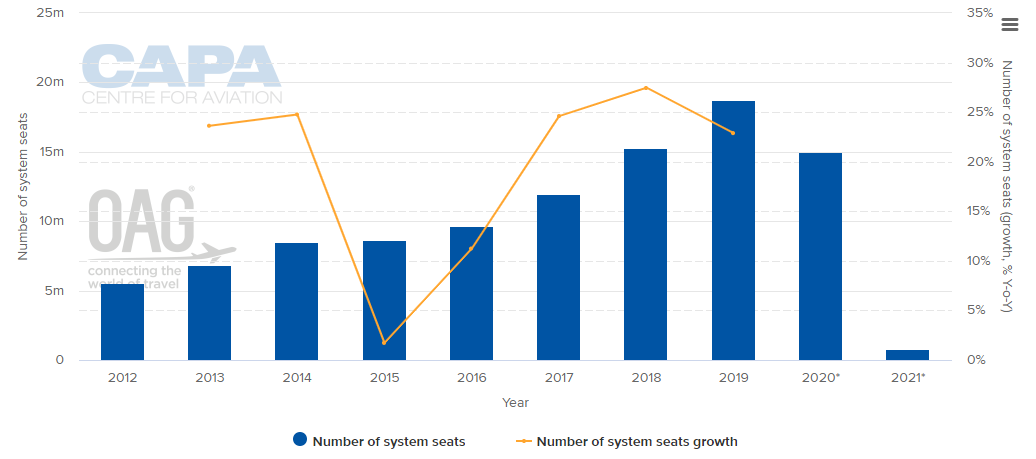

ANNUAL CAPACITY (2012-2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

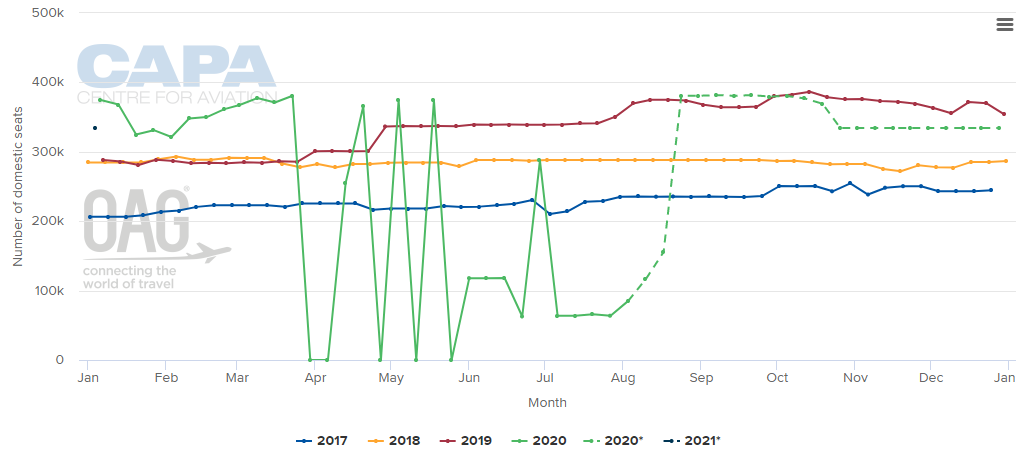

WEEKLY DOMESTIC CAPACITY (2017 - 2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

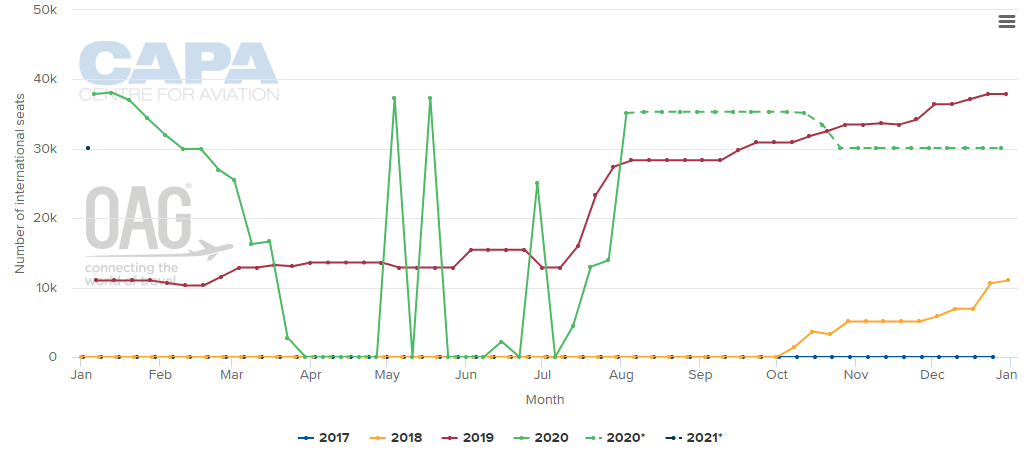

WEEKLY INTERNATIONAL CAPACITY (2017 - 2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

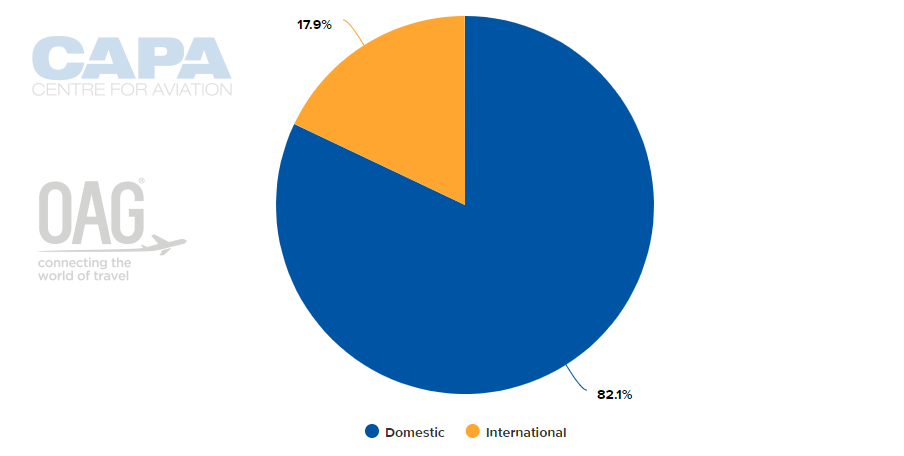

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 27-Jul-2020)

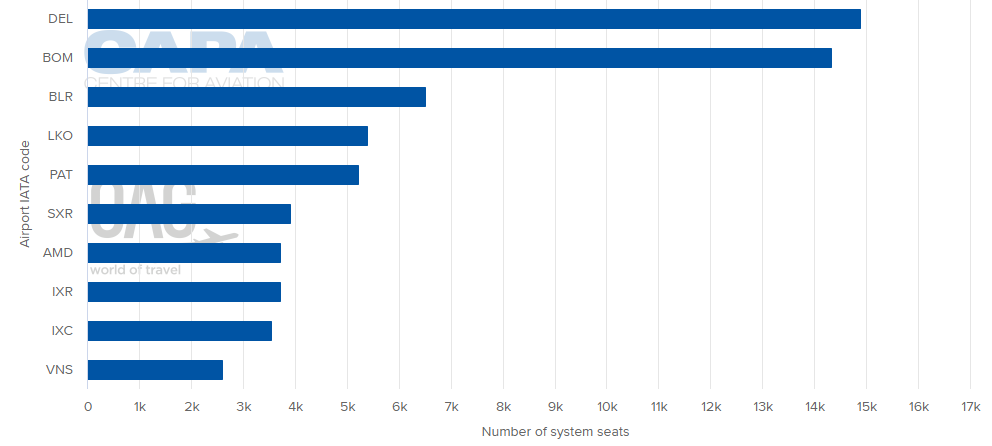

LARGEST NETWORK POINT (w/c 27-Jul-2020)

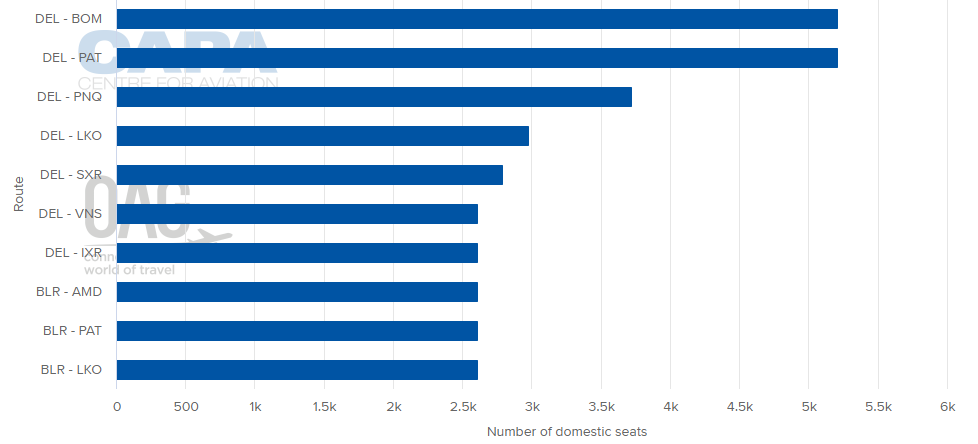

BUSIEST DOMESTIC ROUTES BY CAPACITY (w/c 27-Jul-2020)

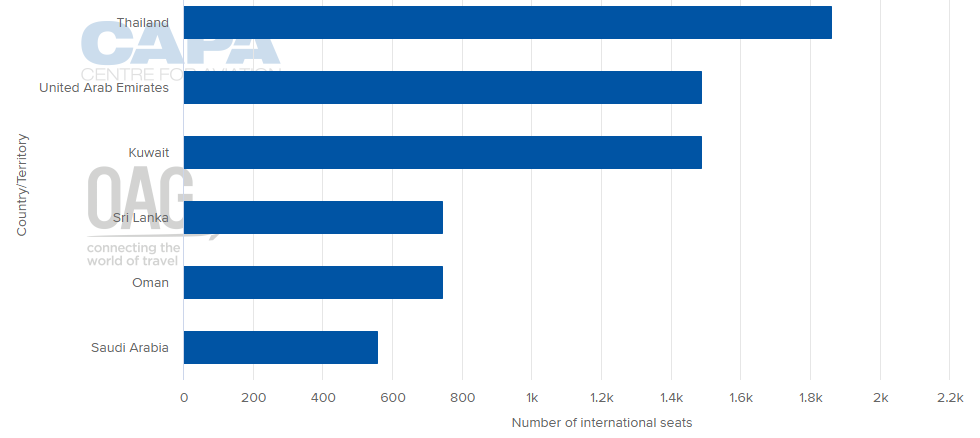

LARGEST INTERNATIONAL MARKETS BY COUNTRY (w/c 27-Jul-2020)

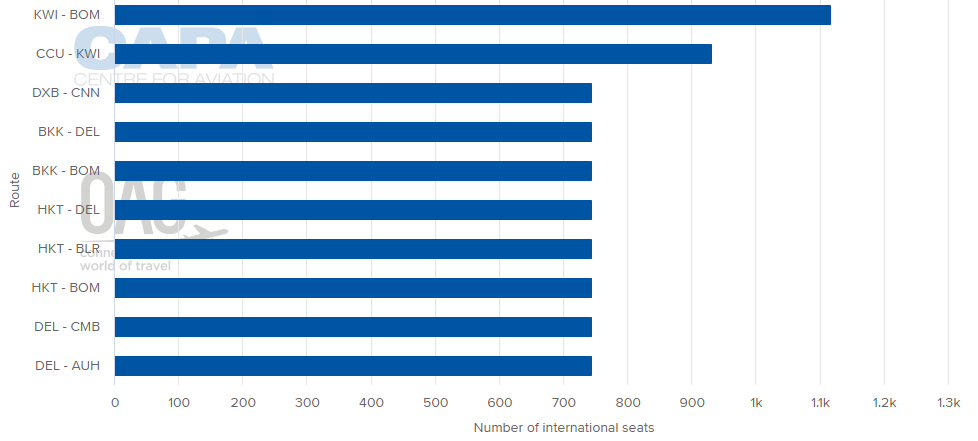

BUSIEST INTERNATIONAL ROUTES BY CAPACITY (w/c 27-Jul-2020)

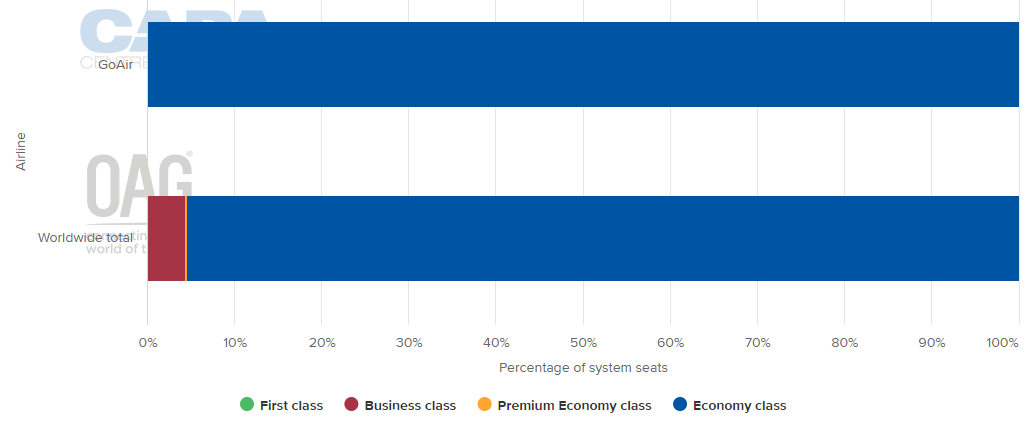

DEPARTING SYSTEM SEATS BY CLASS (w/c 27-Jul-2020)

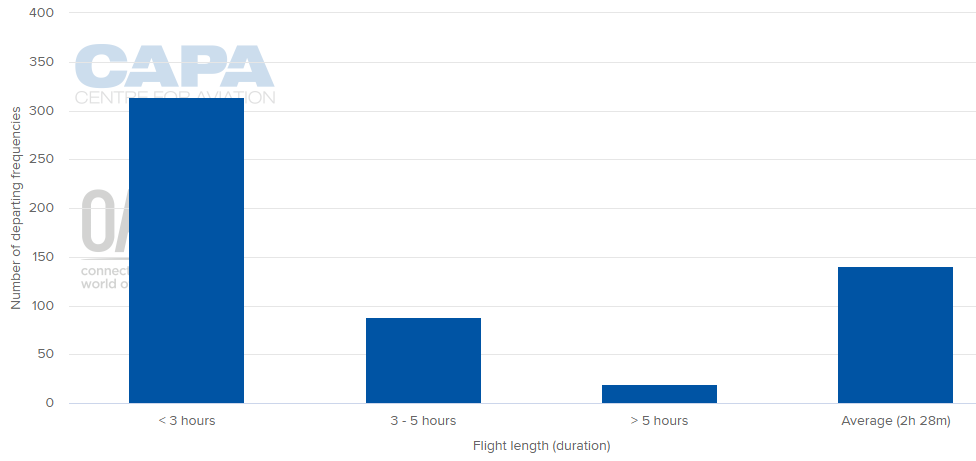

AVERAGE FLIGHT LENGTH (w/c 27-Jul-2020)

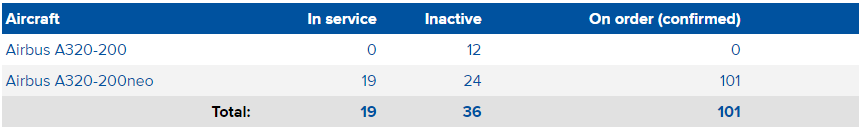

FLEET SUMMARY (as at 27-Jul-2020)

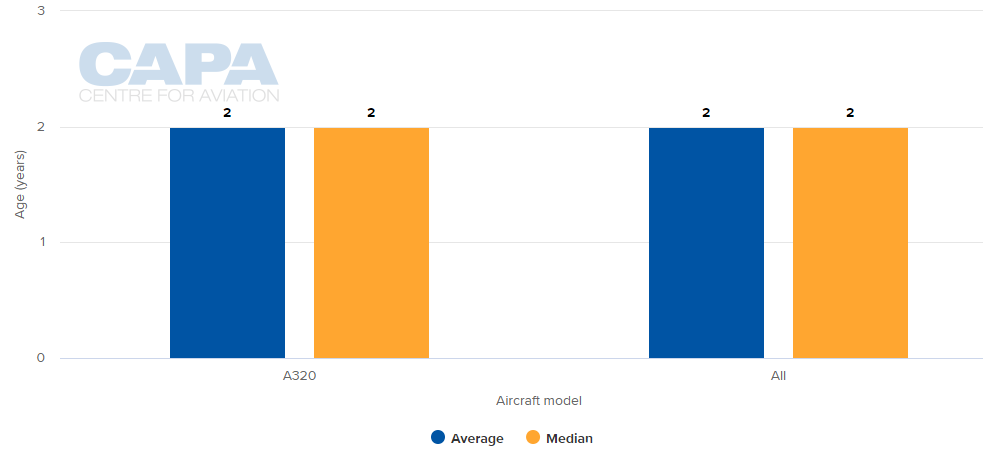

AVERAGE FLEET AGE (as at 27-Jul-2020)

MORE INSIGHT...

Indian government adds six more AAI airport privatisations

Flughafen Zurich returns as preferred bidder for new Delhi airport