Air Canada reduced capacity by -92% year-on-year in 2Q2020 and its president and CEO Calin Rovinescu says these declines in revenue of nearly 90% and in passengers of over 96%, should "reinforce the tremendous urgency for governments in Canada to take reasonable steps to safely reopen our country and restore economic activity".

He adds that other jurisdictions globally are showing "it is possible to safely and responsibly manage the complementary priorities of public health, economic recovery and job preservation and creation".

The carrier expects capacity to fall by approximately -80% in 3Q2020, compared to previous estimations of 75% with the movement attributed directly to the continued extension of blanket travel restrictions in Canada.

The "devastating and unprecedented effects of the Covid-19 pandemic and government-imposed travel and border restrictions and quarantine requirements" is clear to see in Air Canada's financial performance acknowledges Mr Rovinescu. The airline recently announced a net loss of CAD1.752 billion (USD1.31 billion) in 2Q2020, compared to a net income of CAD343 million (USD255.81 million) in 2Q2019.

The impact on airline operations is further evident with the news this week that Air Transat plans to suspend nearly all services from Western Canada through the winter 2020/2021 schedule "Since the current situation does not allow us to foresee resuming routes from western Canada in the near future," it says.

The airline plans to suspend all services from Winnipeg, Calgary, Edmonton, Vancouver and Victoria in winter 2020, with the exception of service from Vancouver to Toronto and Montreal and some connecting services via Toronto to Europe from 01-Nov-2020 to 30-Apr-2021.

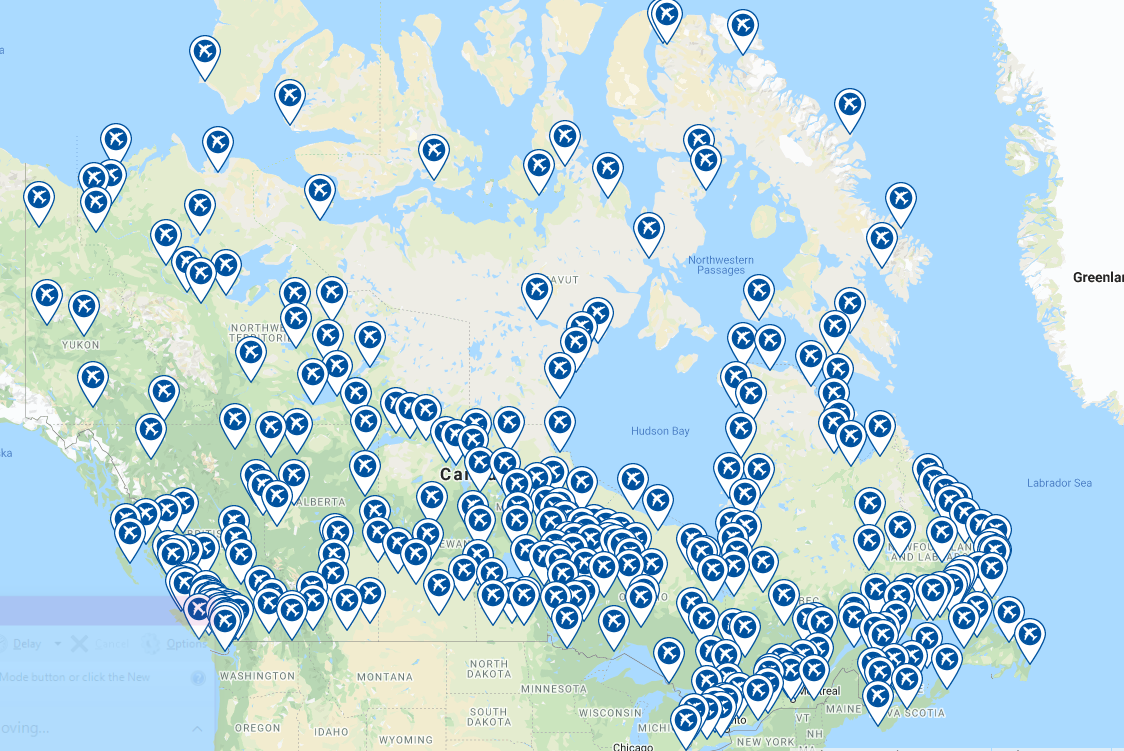

AIRPORTS IN THE COUNTRY

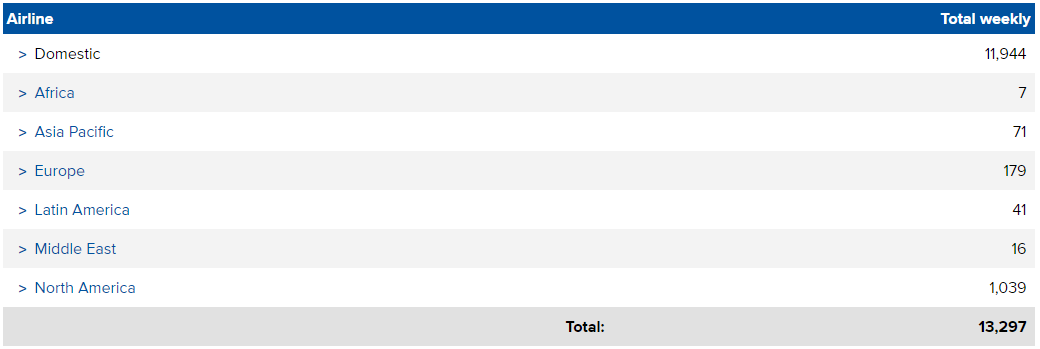

SCHEDULE MOVEMENT SUMMARY (w/c 03-Aug-2020)

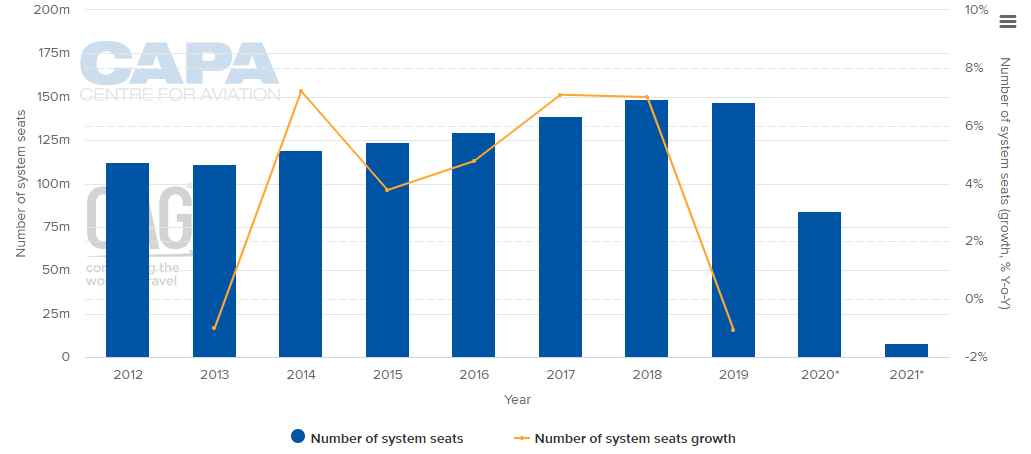

ANNUAL CAPACITY (2012 - 2021*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

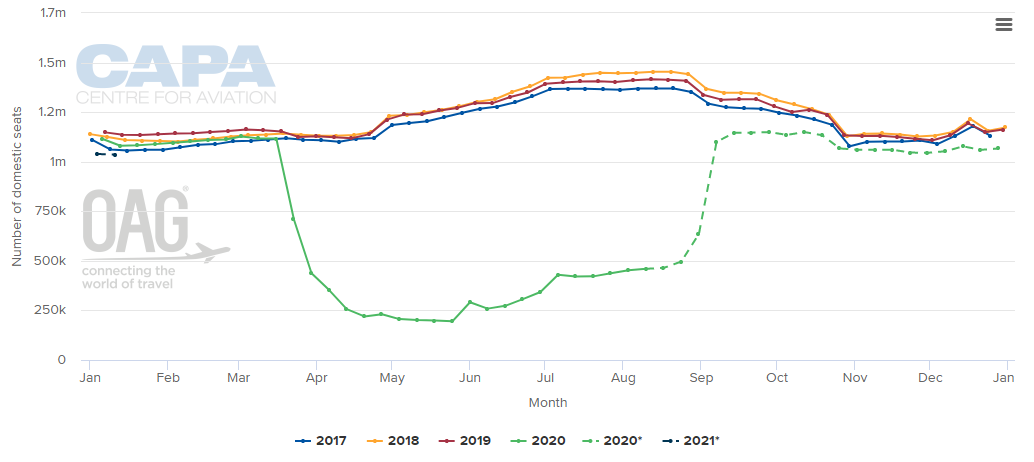

WEEKLY DOMESTIC CAPACITY (2017 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

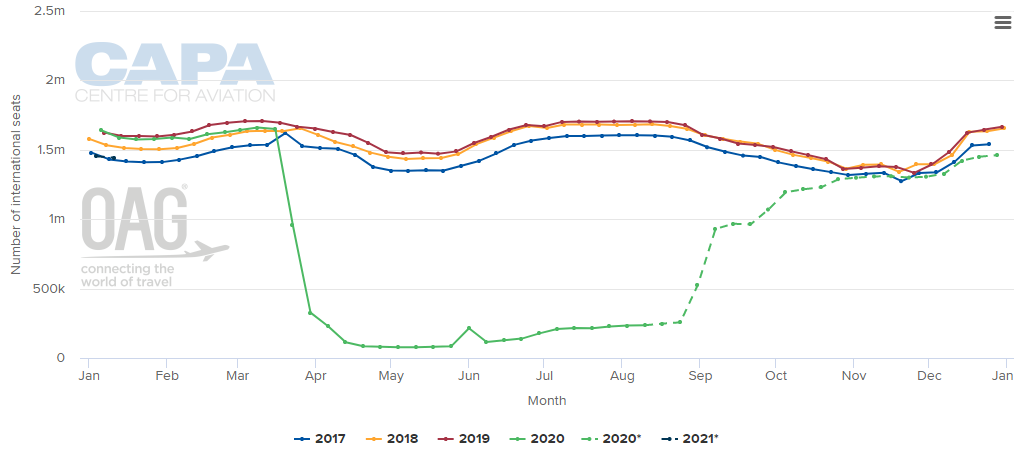

WEEKLY INTERNATIONAL CAPACITY (2017-2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

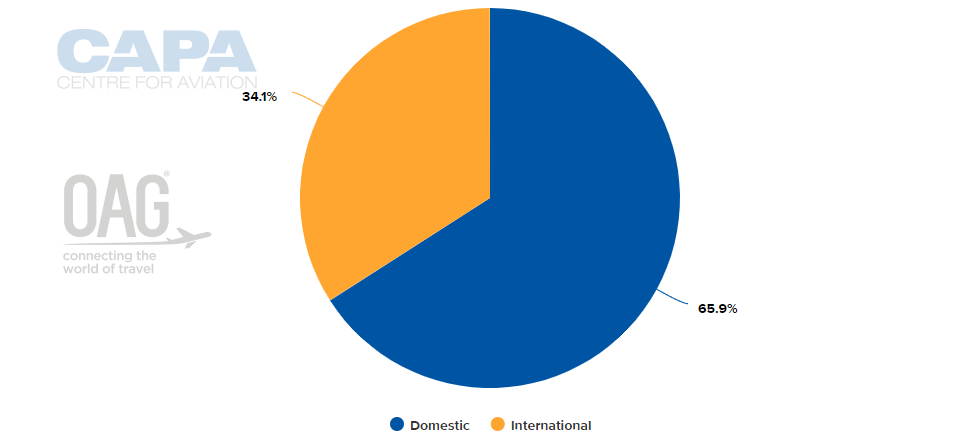

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 27-Jul-2020)

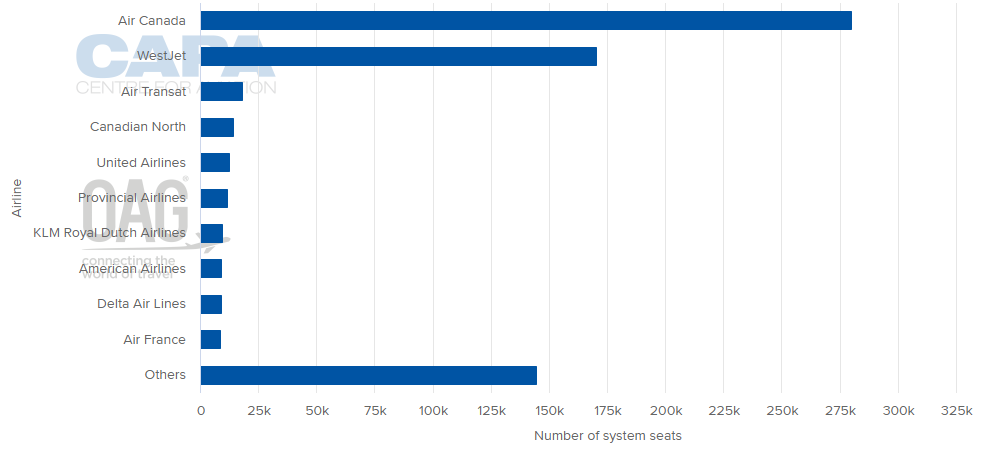

LARGEST AIRLINES BY CAPACITY (w/c 03-Aug-2020)

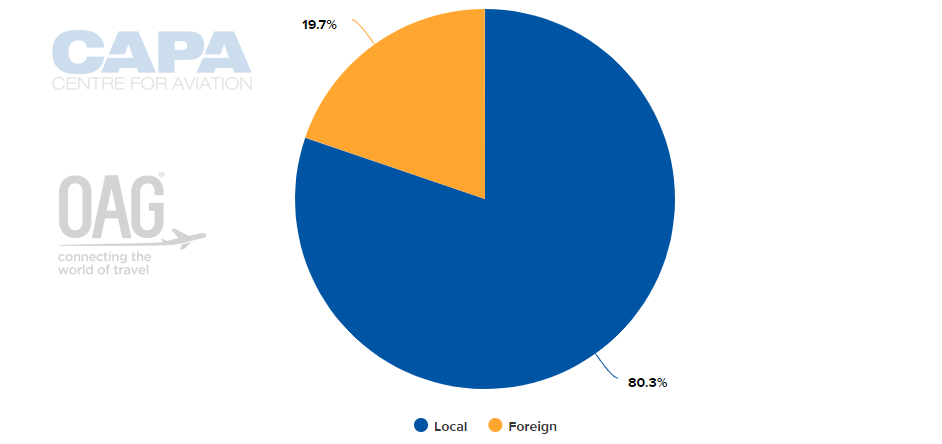

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 03-Aug-2020)

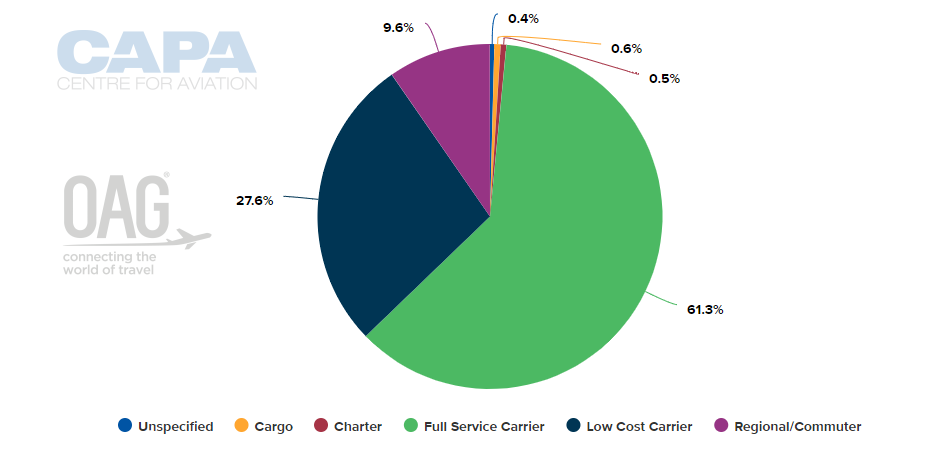

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 03-Aug-2020)

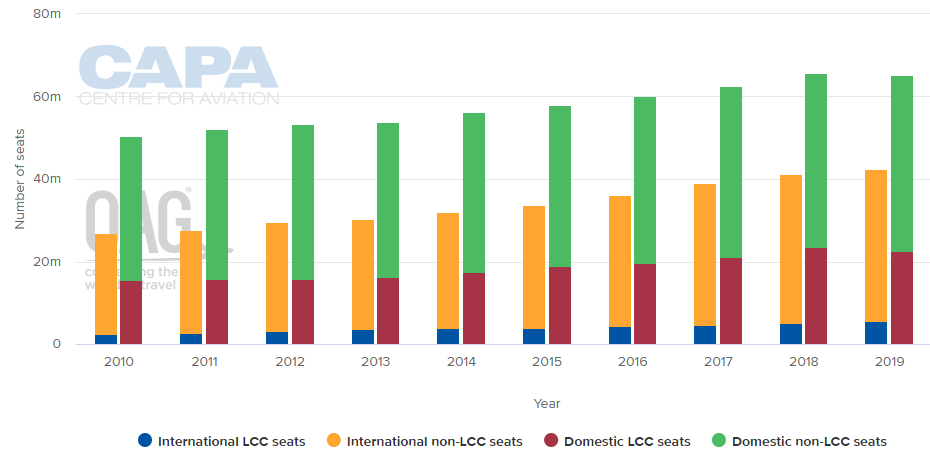

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

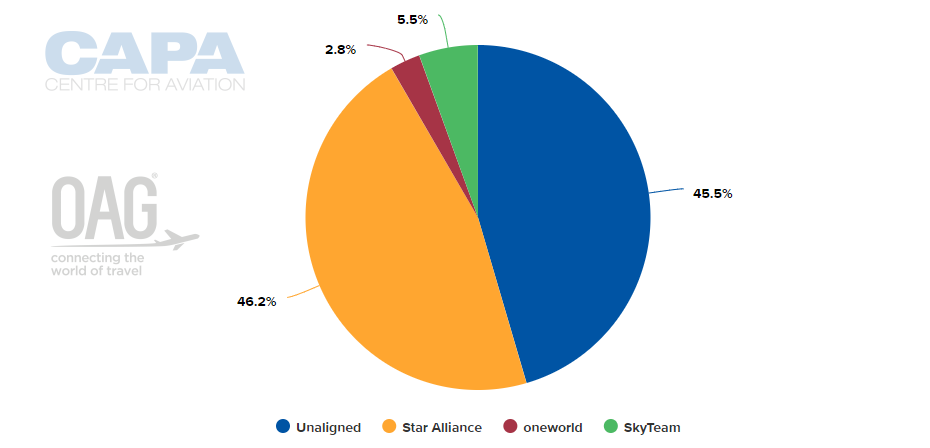

ALLIANCE CAPACITY SPLIT (w/c 03-Aug-2020)

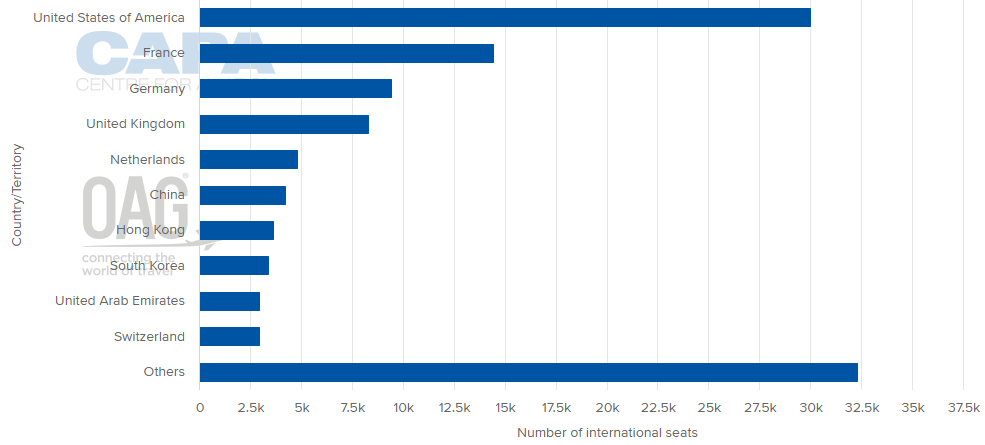

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 03-Aug-2020)

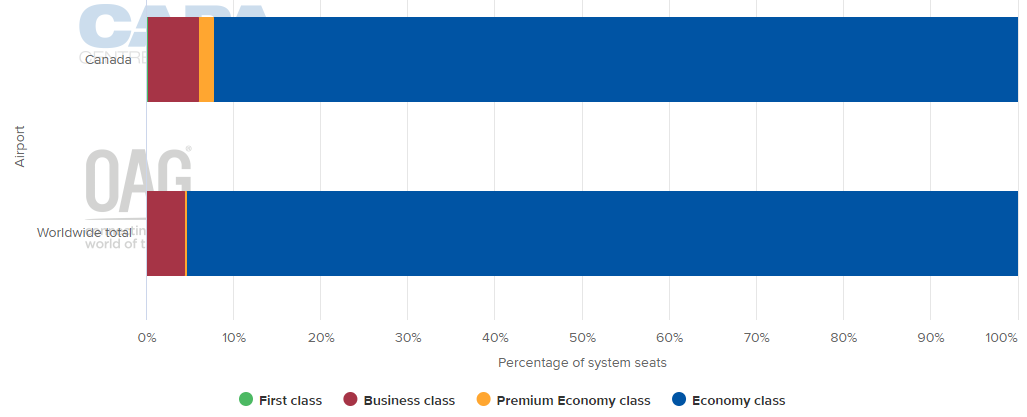

DEPARTING SYSTEM SEATS BY CLASS (w/c 03-Aug-2020)

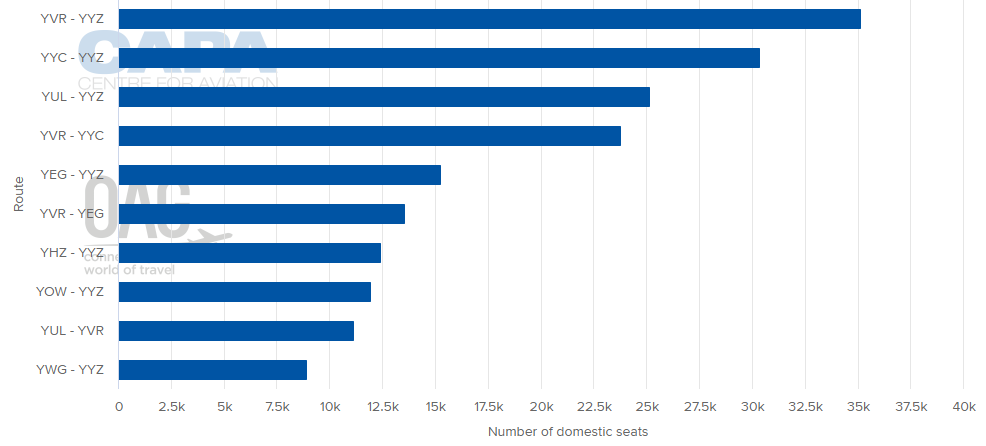

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 03-Aug-2020)

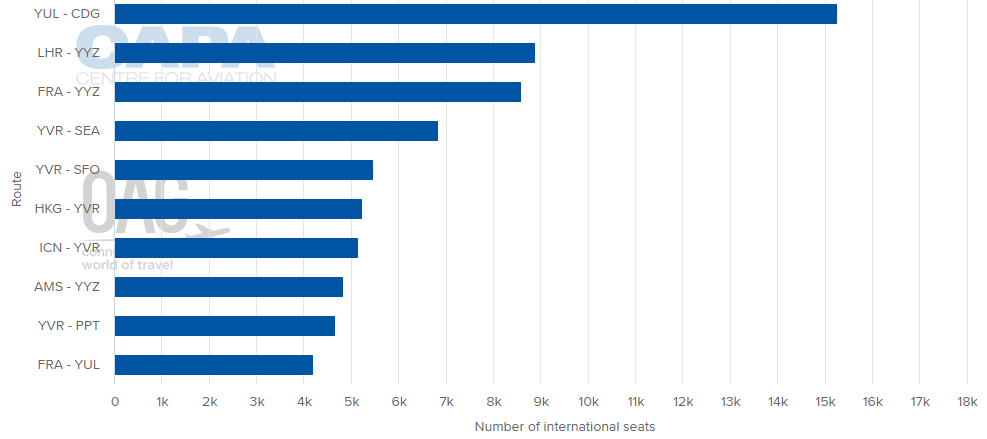

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 03-Aug-2020)

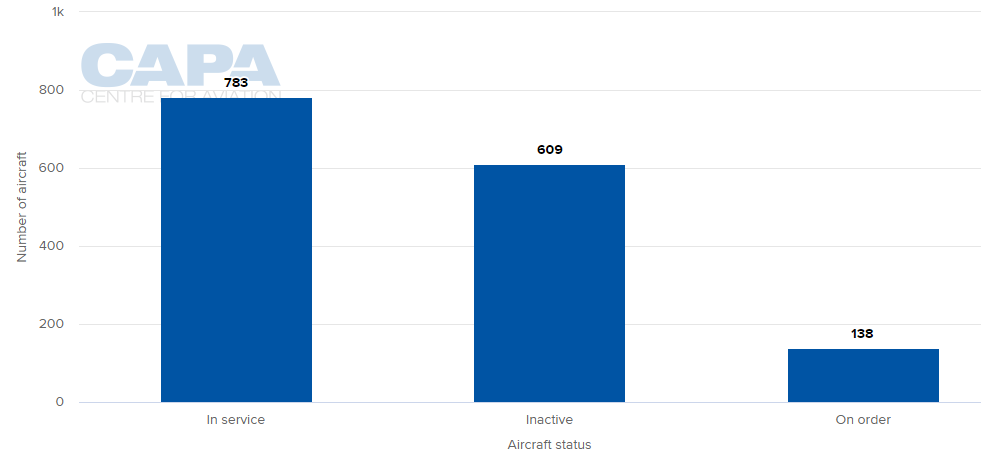

LOCAL AIRLINES' AIRCRAFT FLEET (as at 03-Aug-2020)

MORE INSIGHTS:

COVID 19: Canada's WestJet and Onex work to weather the storm

COVID 19: Canadian airlines urge the lifting of restrictions

COVID-19: Canada's airlines start the long slog to recovery

COVID-19: Canada's major airlines better positioned for survival

Canadian ULCC start-ups still carving out positions in the market