As the home of Etihad Airways, Abu Dhabi International has become an important global hub, but one that never quite met the levels seen elsewhere in the United Arab Emirates (UAE) in Dubai, or in Doha, Qatar. Its largest carrier has undergone a significant restructuring to meet demand and that means the role of the airport has also changed. While, Etihad's hub network may have shrunk, it remains the focus, but a growing point-to-point network from new LCCs in the Emirate means a changing outlook.

These new arrivals comprise Air Arabia Abu Dhabi - a JV between established LCC operator Air Arabia and Etihad Airways - which plans to launch in the first half of this year and and Wizz Air Abu Dhabi, developed in partnership with the Abu Dhabi Development Holding Company (ADDH), which will launch flights in autumn 2020.

While working as a hub, Abu Dhabi International Airport was handling passengers travelling via the Emirate. Now, it will see increasing arrivals in and out of the country and boosting business and tourism.

ABOUT

Operated by Abu Dhabi Airports Corporation, Abu Dhabi International Airport is a major international gateway to the United Arab Emirates and one of the fastest growing airports in the region. The major hub for hub for national carrier Etihad Airways, the airport is served by over 30 international and regional airlines.

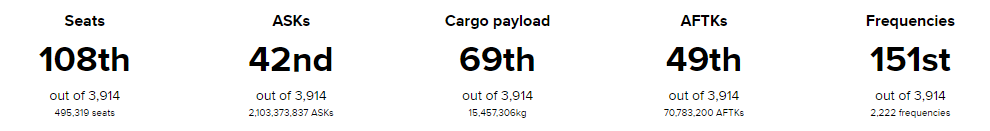

GLOBAL RANKING (as at 02-Mar-2020)

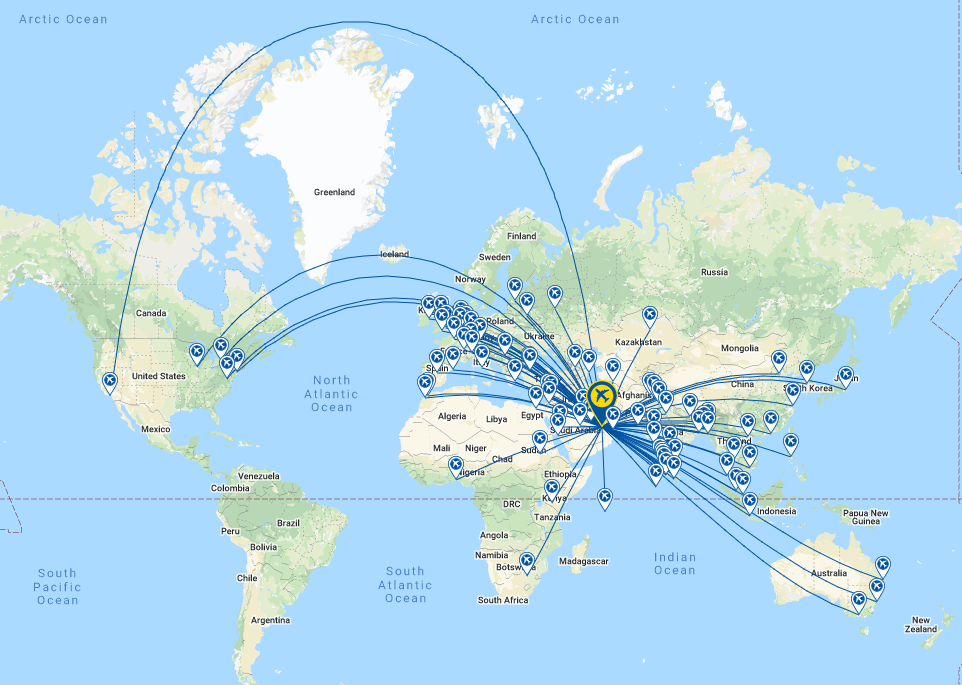

NETWORK MAP (as at 02-Mar-2020)

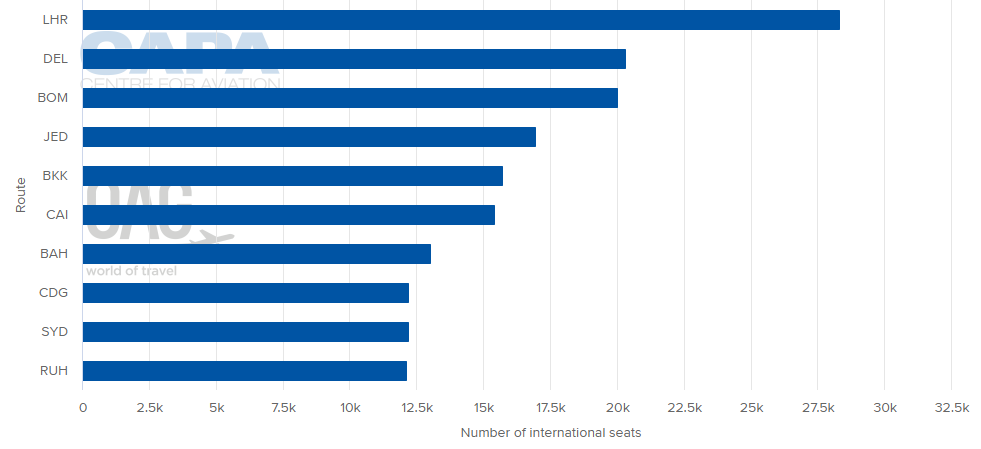

DESTINATIONS (as at 02-Mar-2020)

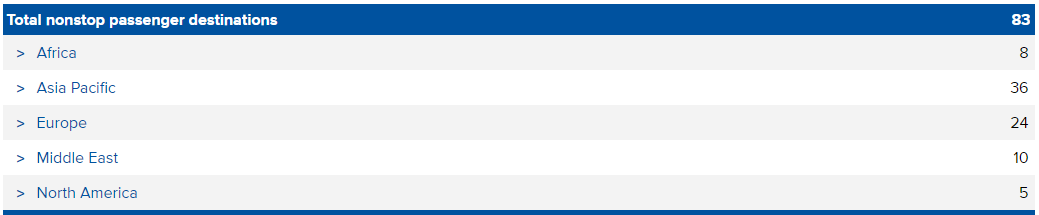

ANNUAL PASSENGER TRAFFIC (2010 - 2018)

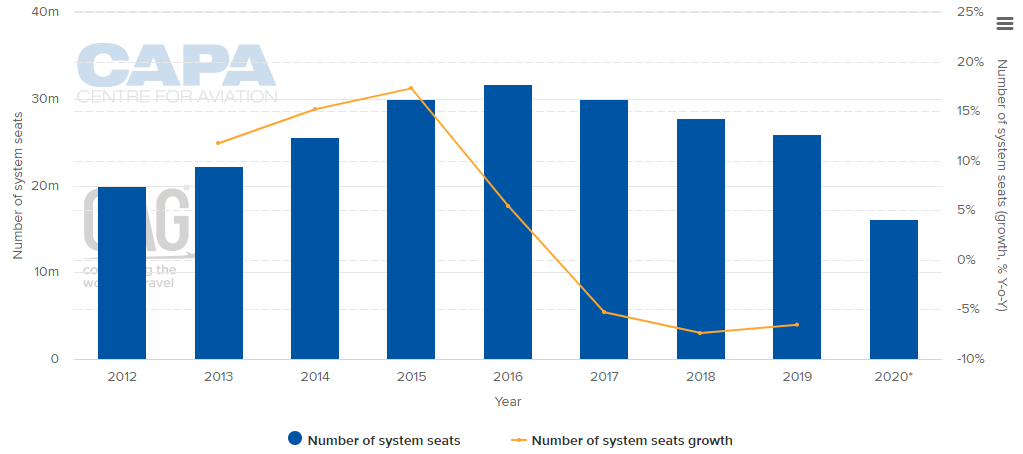

ANNUAL CAPACITY (2012-2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

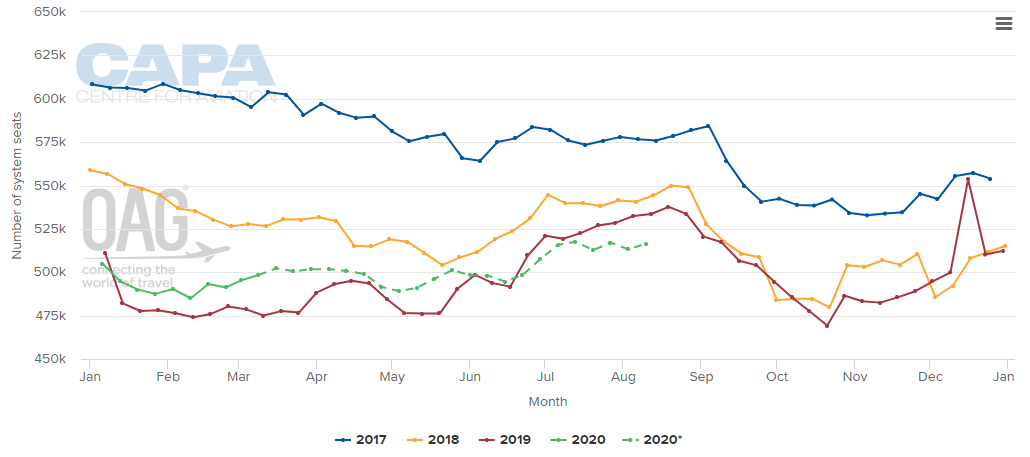

MONTHLY CAPACITY AND SEASONALITY IN SUPPLY (2017 - 2020YTD)

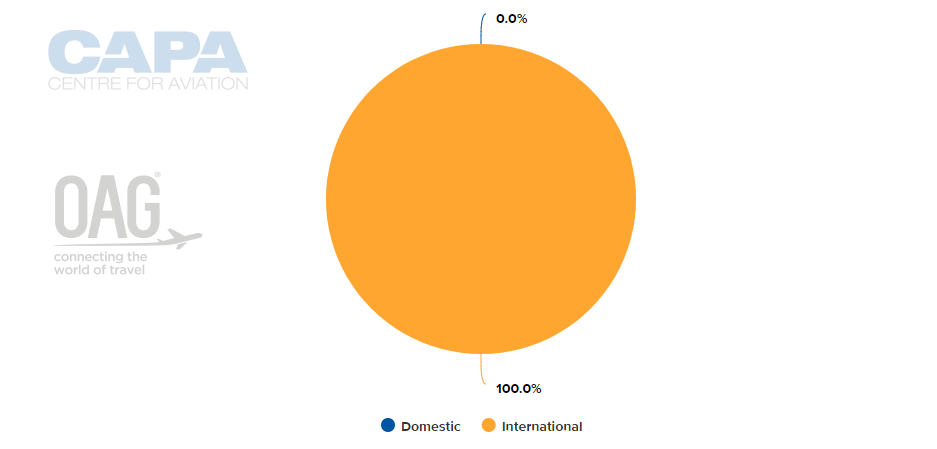

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 02-Mar-2020)

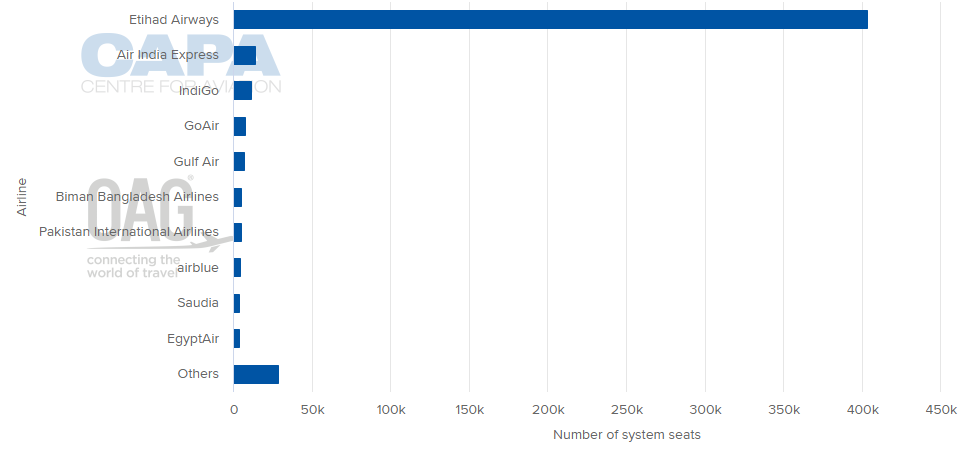

LARGEST AIRLINES BY CAPACITY (w/c 02-Mar-2020)

LARGEST INTERNATIONAL DESTINATION MARKETS (w/c 02-Mar-2020)

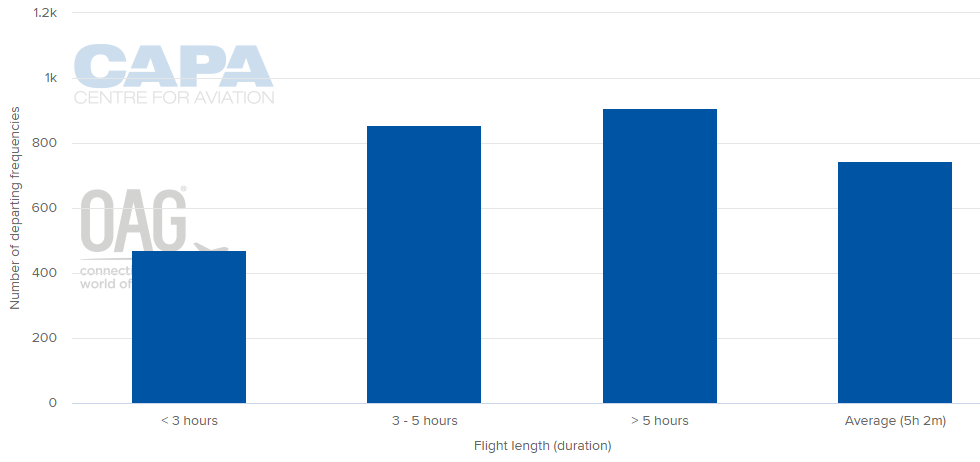

AVERAGE FLIGHT LENGTH (w/c 02-Mar-2020)

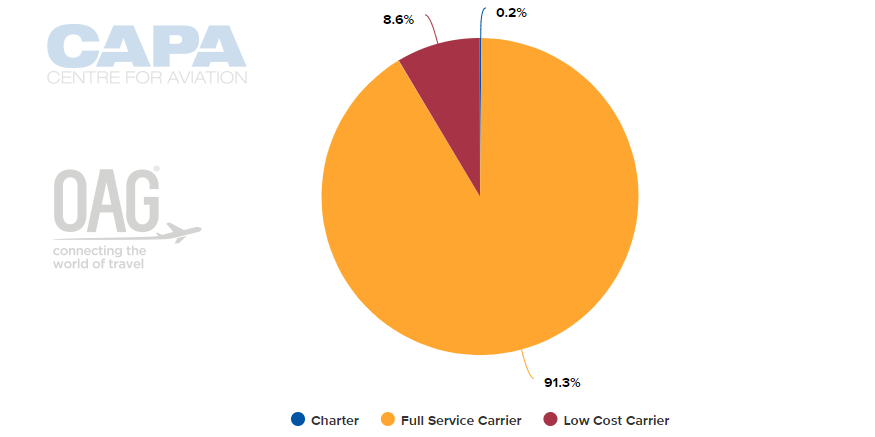

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 02-Mar-2020)

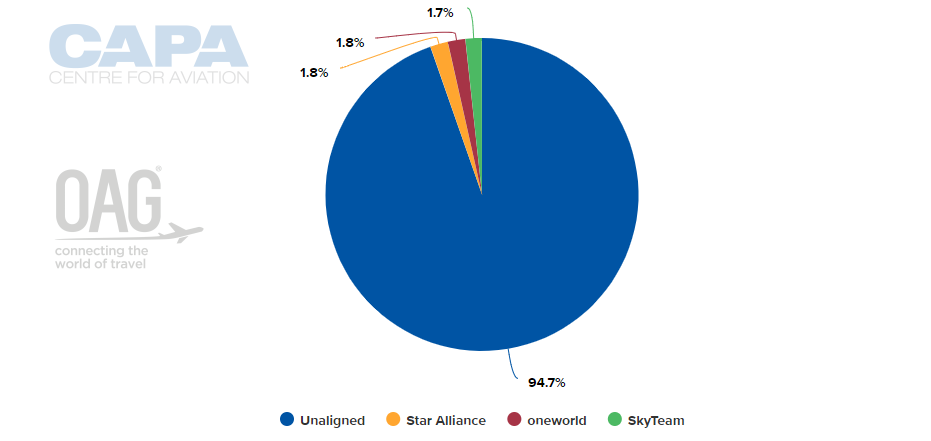

ALLIANCE CAPACITY SPLIT (w/c 02-Mar-2020)

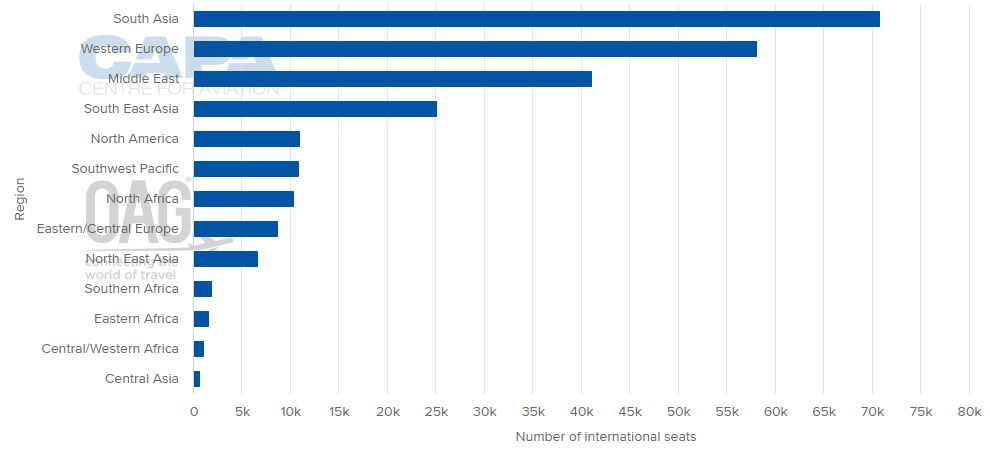

INTERNATIONAL MARKET CAPACITY BREAKDOWN BY REGION (w/c 02-Mar-2020)

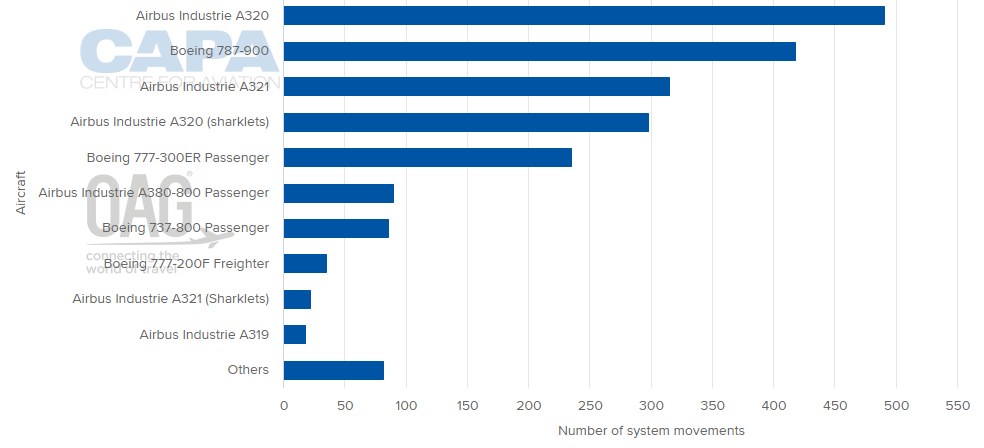

AIRCRAFT OPERATIONS BY MOVEMENTS (w/c 02-Mar-2020)

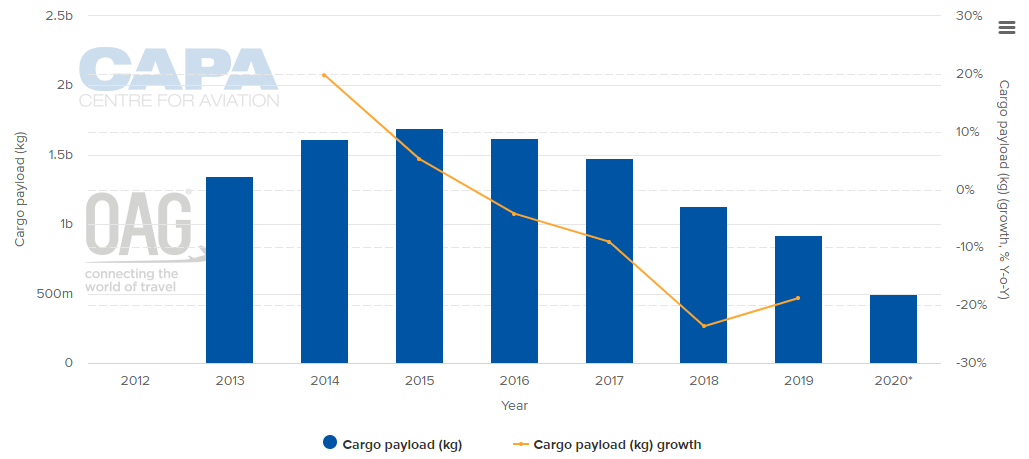

SYSTEM CARGO PAYLOAD (2013 - 2020*) (NOTE: The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE: The values for this year are at least partly predictive up to 6 months and may be subject to change)

MORE INSIGHTS...

Etihad leads Gulf 3 & THY on Europe codeshare; Qatar Airways closing

Etihad Airways withdraws 777-200LRs and A330Fs, but has bigger strategic decisions to make