According to CipherTrace CEO Dave Jevans, until now the lack of regulatory guidance for cryptocurrencies has hindered the broader adoption of both the currencies and their underlying blockchain technology. "Now we are seeing the big guys coming together asking for cryptocurrency anti money laundering regulation - it is inevitable, it will be unified, and it will be global", Mr Jevans said.

Source: CipherTrace

Source: CipherTrace

The phenomenal growth in the value of cryptocurrencies like Bitcoin over recent years has attracted a range of investors and stakeholders - along with speculators and thieves.

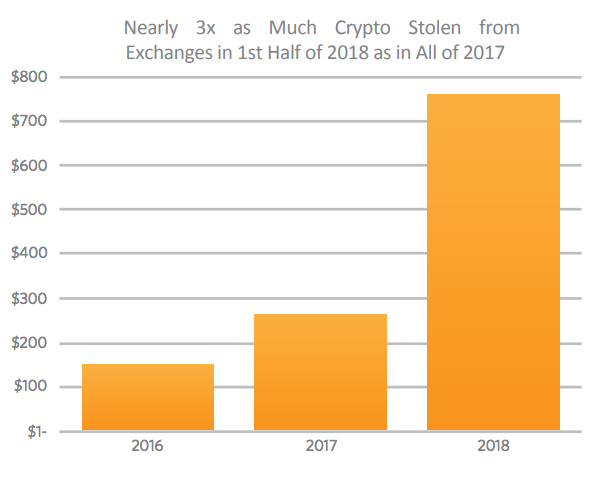

"In the last two years alone, some of the best and brightest criminal minds made off with USD1.21 billion in cryptocurrency from exchanges", CipherTrace warns, and the FBI has reported an almost sixfold increase in the value of virtual currency in complaints from 2015 to 2017.

USD761 million has already been laundered with cryptocurrency thus far in 2018. The growing theft of cryptocurrencies and their increasing use by terrorists, extortionists, identity thieves, drug dealers, weapons dealers and human traffickers has ushered in a new era of high tech virtual money laundering. However, unlike laundering cash, getting this dirty crypto money clean is a little more complicated.

The first step in the cleansing process is called layering, according to CipherTrace. In the traditional money laundering world this would be likened to purchasing expensive items such as gold bars, cars, jewellery or real estate and then reselling them.

In the virtual world it involves moving money into the cryptocurrency system and moving it around by using mixers, tumblers and "chain hopping". The more compromised crypto money that goes into the systems and the more it moves around, the harder it becomes for investigators to see through the web of action and trace a path back to the source. Additionally, the pseudo-anonymous nature of virtual currencies makes it exponentially more difficult to trace these funds as compared with cash. As one caveat, criminals will lose a percentage off the top to move the funds, but in the end the funds appear legitimate, making the loss worthwhile.

CipherTrace nonchalantly cites almost 20 well known crypto money laundering services, and these can be easily found with a basic Google search. They typically charge between 1% and 3% per transaction for their services. The launderers take in funds from multiple customers, mix those funds together, and then output the mixed funds.

How will the blockchain and cryptocurrency community address these issues?

The key to addressing the rampant and ongoing money laundering in the cryptocurrency industry is adopting progressive regulation.

The Financial Action Task Force (FATF) on Money Laundering, an inter-governmental body established in 1989, has recently turned its eye to the cryptocurrency space. FATF has stated that policy responses to cryptocurrencies currently "vary considerably, with some countries embracing this new technology and others severely or totally limiting its legitimate use". FATF lists the following risks associated with crypto transactions:

- The anonymity provided and limited identification and verification of participants;

- The lack of clarity regarding the responsibility for compliance with anti money laundering and counter financing of terrorism, as well as supervision and enforcement for these transactions, which are segmented across several countries;

- The lack of a central oversight body.

On an individual company basis, CipherTrace has also introduced a new sophisticated technology that is capable of tracking cryptocurrencies through blockchain ecosystems, thus addressing the issues posed by crypto mixing companies. The technology calculates risk scores for transactions based on whether the funds have travelled through dark markets, money mixers or gambling sites, or are associated with known criminals. This transaction risk rating also simplifies compliance efforts by rapidly identifying and highlighting risky transactions for further scrutiny or action.

With the unrelenting rate of expansion currently being experienced by the cryptocurrency sector, only joint cooperation can produce a framework to minimise the ensuing misconduct, which is commonly seen today.

With Governments such as that of Malta employing open regulatory regimes to the technology, this cooperation is needed sooner rather than later.