The strength for the carrier is its strong position at Franjo Tuđman Airport the main gateway to the country's capital city, Zagreb, where it continues to dominate operations, supported by its Star Alliance airline partners. But elsewhere, increasing LCC pressure in increasingly popular leisure markets of Dubrovnik and Split is putting pressure on a carrier which is estimated to have among the highest cost structures in Europe.

Croatia has enjoyed healthy growth in its aviation market in recent years, driven by strong inbound tourist traffic. However, Croatia Airlines' growth is not keeping pace. A report by CAPA - Centre for Aviation highlights that it remains the biggest airline in this market, but its seat share has halved since 2008 and analysis shows a three percentage point drop in 2017 is matched by a similar gain by its largest international rivals.

While a restructuring at the start of the decade has helped reposition the carrier, its cost structure remains high compared with other national entities. This could be due to more than half of its fleet being regional aircraft and which therefore deliver a unit cost structure more a kin to a regional operator.

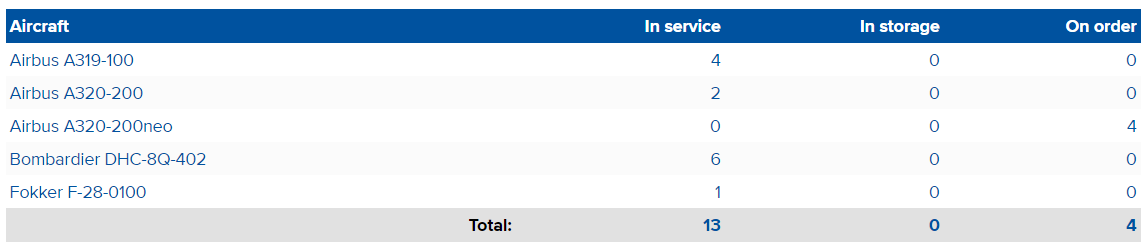

TABLE - Croatia Airlines Fleet Summary Source: CAPA - Centre for Aviation Fleets Database

Source: CAPA - Centre for Aviation Fleets Database

According to CAPA calculations, and after adjusting for average trip length, Croatia Airlines' CASK is 10% to 20% above that of full-service carriers, 45% to 50% higher than that of LCCs, and more than double that of ultra-LCCs.

The airline's main defence mechanism is its Star Alliance membership and the important links that provides with partner airlines. The increasingly competitive landscape in Croatia is partly offset by codeshares with 12 other Star Alliance members: Air Canada, Air India, Austrian Airlines, Brussels Airlines, LOT Polish, Lufthansa, SAS Scandinavian Airlines, Singapore Airlines, SWISS, TAP Portugal, Turkish Airlines and United Airlines. It also has a (more limited) codeshare with KLM.

These codeshare agreements help to feed Croatia Airlines' network and enable it to offer its passengers long-haul connections. However, on the point-to-point, predominantly leisure routes that are increasingly the domain of LCCs, their potency as a defence against competition is probably limited.

Croatia is on the up in terms of popularity as a destination. Last year there was an 8.7% rise in arrivals and 9.0% growth in overnight stays versus 2015, according to the National Bureau of Statistics, and that growth shows no sign of slowing in 2017 with reports of record-breaking arrival levels during the start to the summer season. That market strength and recent profitability will certainly catch investors eye if the Government does proceed with the planned sale of its 97% shareholding in Croatia Airlines.

CAPA - Centre for Aviation delivers insightful industry analysis. Visit Croatia Airlines: Zagreb hub strength, but growing LCC competition & high CASK a challenge to find out more on this story.