This is a +4.9% rise and brings a little stability after last week's significant +17.2% rise as we entered July. A high single-digit rise is expected next week as we pass the 15-Jul-2020 date that will see a likely phased rise in many airlines' schedules.

While the number of flights that are planned continues to grow there remains notable churn and short-notice cancellations continue. At the beginning of last week the planned flight levels for the current week stood at just over 390,000 meaning that 37,000 departures have been removed from schedules in just a seven day period, a -9.4% change.

This week's schedules see a readjustment in the significant growth in domestic capacity added last week in India and the removal of almost 7,500 flights, a -45.1% change. This means that in reality the weekly growth figures over the last two weeks are in reality a lot closer than the figures recorded.

Among the world's largest aviation economies the stand-out nations this week include the United States of America where frequencies are up +23.5%, a significant 18,000+ rise. To put that in perspective that gain is more than the weekly flight offering of any other country, with the exception of China.

Others seeing strong frequency growth include Spain (+25.4% and currently the world's seven largest market by flights); Canada (+17.8%); Italy (+19.4%); France (+18.8%); United Kingdom (+16.3%); and New Zealand (+22.7%).

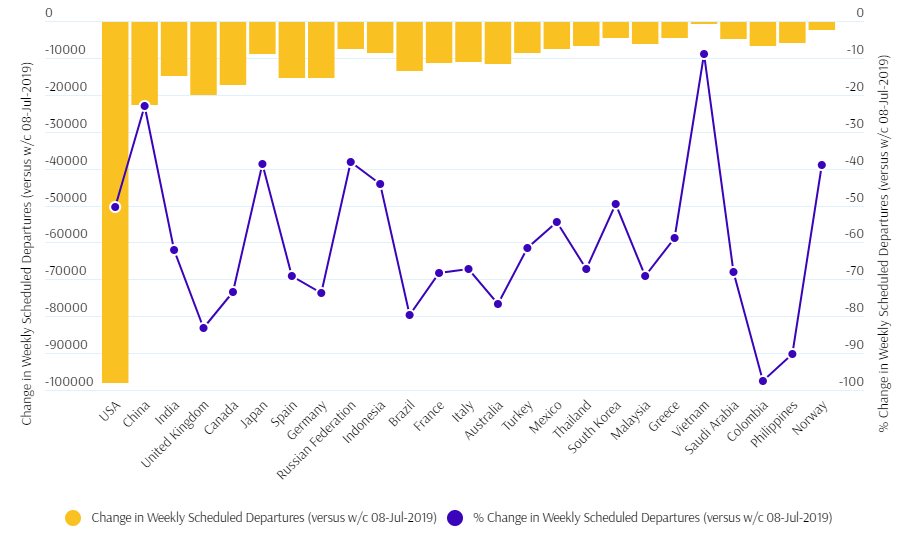

CHART - The reduction in the number of weekly flight departures from each of the 25 largest aviation markets in the world is starting to show some significant improvements, but still remains a long way down on levels seen last year Source: The Blue Swan Daily and OAG (data: 06-Jul-2020)

Source: The Blue Swan Daily and OAG (data: 06-Jul-2020)

The chart, above, follows a similar design to previous weeks, but there are some notable changes. The reduction in US flights is now into five digits, Europe's hardest hit markets of the United Kingdom, Spain, Italy, France and Germany continue to see increases in departures, while the Philippines joins Colombia with cuts of over 90%.

There are two further positive stories. In Norway, where domestic regional flying is essential for connectivity, flight levels are now down less than -40% when compared to last year. In Vietnam, which has been leading the recovery in air connections, flight levels are now down less than -10% on the comparable week last year.

On a global level, comparing this week's schedules with the comparable week last year (week commencing 08-Jul-2019), global flight frequencies are down -55.4%, a 1.1 percentage point improvement on last week. Global seat capacity also remains above 40% of the levels seen at the same time last year, down -58.2%, a 0.4 percentage point decline on last week.

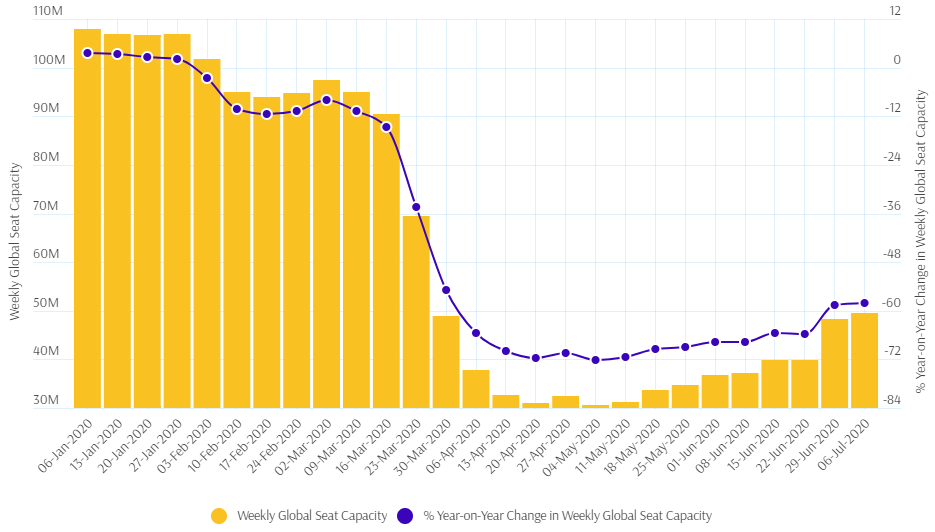

CHART - Global air capacity has collapsed as the Covid-19 pandemic has spread across the world and this week's offering highlights that we have now passed the stabilisation stage and are taking the first steps in the recovery phase Source: The Blue Swan Daily and OAG (data: 06-Jul-2020)

Source: The Blue Swan Daily and OAG (data: 06-Jul-2020)

There is another saying that "every mountain top is within reach if you just keep climbing". While that 2019 peak is visible in the distance it will certainly be a number of years until we reach it. Just a couple of months ago when the Covid-19 spread was still in its infancy there were suggestions it could occur as early as 2021. Now, 2024 and even 2025 are being suggested. As this year has already shown, a lot can change in six months. Looking four or five years ahead seems an eternity.