Advanced schedules published on OAG for the remainder of the month project weekly growth rates of +11.6%, +25.6%, +4.8% and +36.8% as we enter into the second half of the year. These partly remain a work of fiction, include historical filings and remain subject to short-term change, but they do provide some significant positive hope on the recovery of the embattled airline sector and will distinguish between a 'U' and 'L' shaped path.

Key developments this week has seen the return of scheduled operations in Saudi Arabia and Turkey with frequencies growing five-fold and more than quadrupling. Mexico has also seen a doubling of frequencies compared to the week commencing 25-May-2020, while Qatar, Kuwait, Bahrain, Philippines, Afghanistan, Colombia and Thailand are among the nation's to record three-digit percentage rises week-on-week.

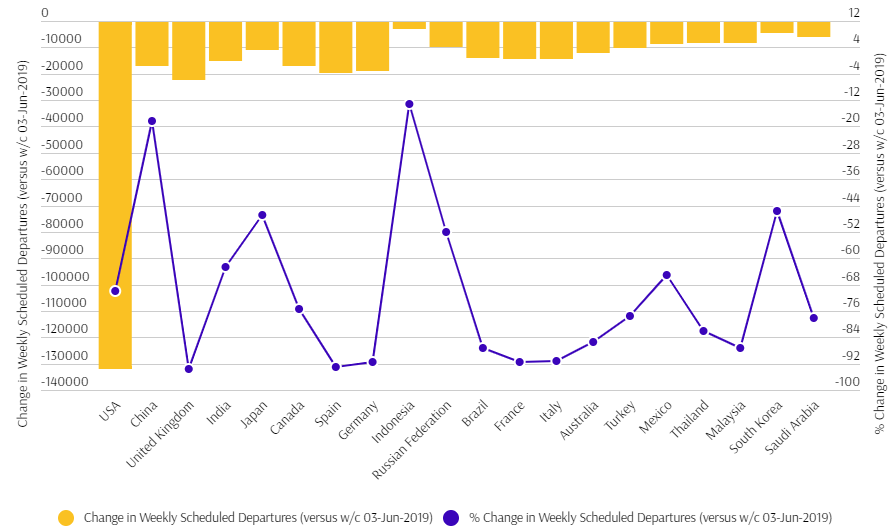

Noticeably, the world's largest aviation markets of China and United States of America (USA) are both showing stronger rates of growth compared to last week, at rates of +8.6% and +10.6%. The huge scale of both markets means this equates to over 11,300 flights.

For comparison, this growth in just one week is a similar number to the total frequencies offered from any other country, with the exceptions of themselves, India and Japan. This illustrates how the recovery of the air transport sectors in both China and USA will significantly influence the global figures.

CHART - The reduction in the number of weekly flight departures from each of the 20 largest aviation markets in the world is showing improvements, but still remains significant when compared to the same week last year Source: The Blue Swan Daily and OAG (data: 01-Jun-2020)

Source: The Blue Swan Daily and OAG (data: 01-Jun-2020)

There remains a question of how demand will recover as airlines start to reintroduce capacity. The signs appear favourable if airline reports are to believed. Latvian carrier airBaltic says it received 13,000 new reservations in the first week after it reopened bookings and carried 4,315 passengers on its first week of flights.

Peter Foster, CEO of Air Astana says that initial indications from the Kazakhstan carrier's recently-restarted limited domestic flights are "that there is pent-up demand for these routes". Similarly, Ryanair Holdings CEO Michael O'Leary says the LCC has seen "seen a big surge in bookings on our flights out of Ireland and the UK to Spain, Portugal and Italy over the weekend, and that seems to be continuing this week".

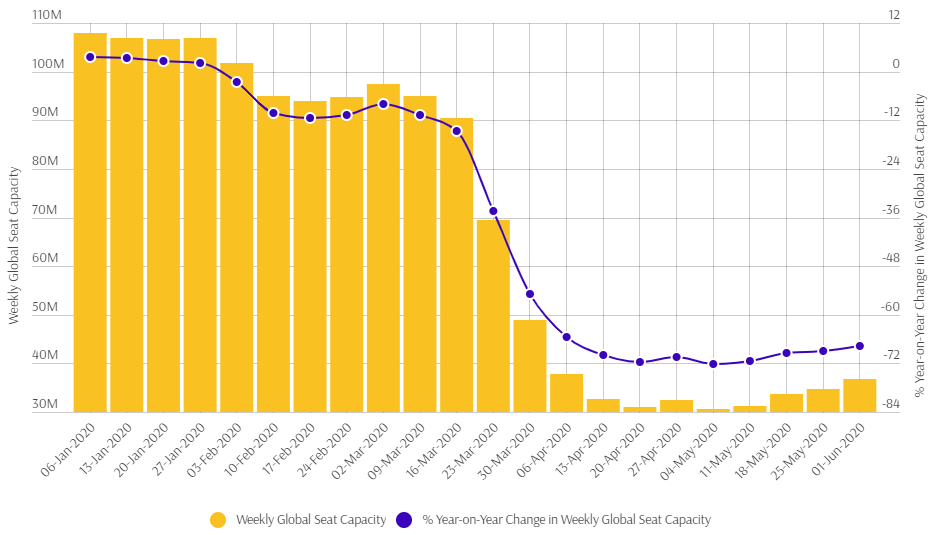

Comparing this week's schedules with the comparable week last year (week commencing 03-Jun-2019), global flight frequencies are now down less than two-thirds, shrinking -65.1%, while global seat capacity is down -67.7%.

CHART - Global air capacity has collapsed as the Covid-19 pandemic has spread across the world, but while capacity has risen in five of the last six weeks, this has been more about stabilisation than recovery Source: The Blue Swan Daily and OAG (data: 01-Jun-2020)

Source: The Blue Swan Daily and OAG (data: 01-Jun-2020)

We have seemingly turned the corner during May-2020, but looking back at last month does not make positive viewing. You have to go quite a way back into the realms of history to find a comparable year with a similar level of flight numbers. The annualised equivalent of May-2020's frequency decline of two-thirds year-on-year takes the industry back to 1986 levels.

That year was not remembered fondly as we faced the nuclear crisis following the explosion of a nuclear reactor at Chernobyl, then part of the Soviet Union that saw the release of radioactive material across much of Europe. We also saw the Space Shuttle Challenger explode in mid air just over a minute after take-off from Cape Canaveral in Florida, USA and also the first case of Bovine Spongiform Encephalopathy (BSE), more commonly known as Mad Cow Disease.

It seems such a long time ago! Then again it seems forever since we entered this current crisis, and that has been a matter of just weeks or months. Growth is expected to return, but according to IATA, RPKs will grow by only 20% from 2019 to 2025.

Remarkably, this would be the lowest ever six-year growth period in the history of global aviation. That shows how the industry has evolved despite previous major hurdles, but likewise, also how far it has fallen over the first half of 2020.