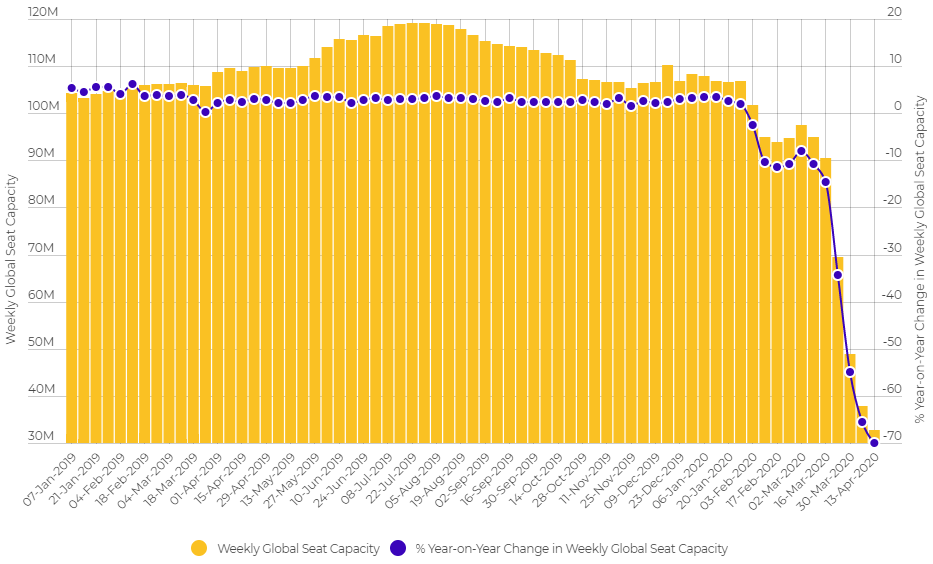

That is down from the 288,000 planned at the start of last week, a -12.2% reduction. This is the lowest weekly cut since the Coronavirus began its global spread and suggests we may be coming to the bottom of the curve, in terms of flight frequencies, at least.

When compared to the flight schedules filed by airlines as at the start of this year, the number of one-way flights removed during the week commencing 13-Apr-2020 is just over 442,000 departures, a -63.6% reduction.

This continues a trend which saw just under 400,000 departures removed in the week commencing 06-Apr-2020, a 58.1% reduction. Previously, 217,000 departures were removed in the week commencing 23-Mar-2020, a -29.6% reduction and 347,000 departures removed in the week commencing 30-Mar-2020, a -50.1% reduction on what we had expected.

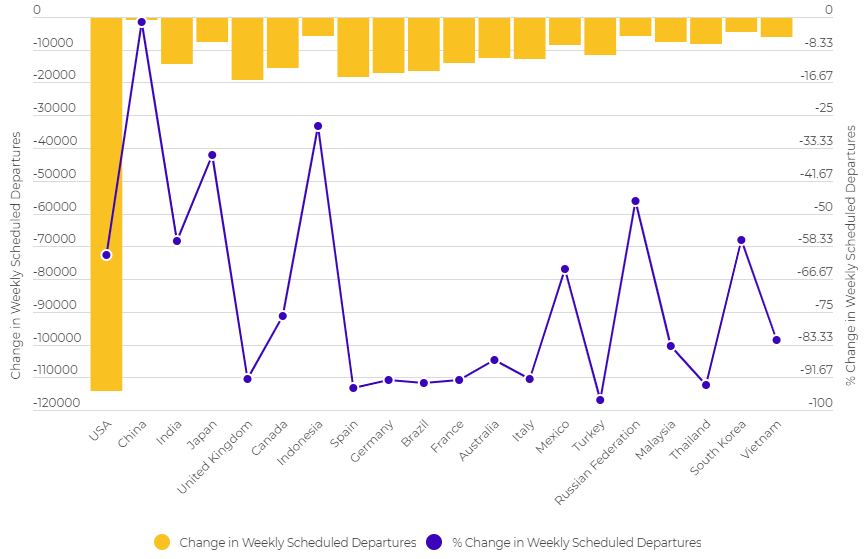

CHART - The reduction in the number of weekly flight departures from each of the world's 20 largest aviation markets is significant Source: The Blue Swan Daily and OAG (Data: w/c 13-Apr-2020)

Source: The Blue Swan Daily and OAG (Data: w/c 13-Apr-2020)

This week's chart highlights the further cuts in the domestic skies of the United States of America (USA), the world's largest aviation market. It also sees an increase in nations seeing frequency cuts of over 90%, most notably with Turkey were frequencies are down over-97% on those planned at the start of the year.

The metric comparing this week's flight schedules with those planned at the start of the year is not as powerful as it had been previously as we move further into the year. It is now over four months since the benchmark and across parts of the world some airlines only publish full schedules up to three months ahead. This would perhaps explain why despite there being an obvious renaissance in domestic capacity in China, total flight frequencies are only down by just -1%, an unlikely comparison.

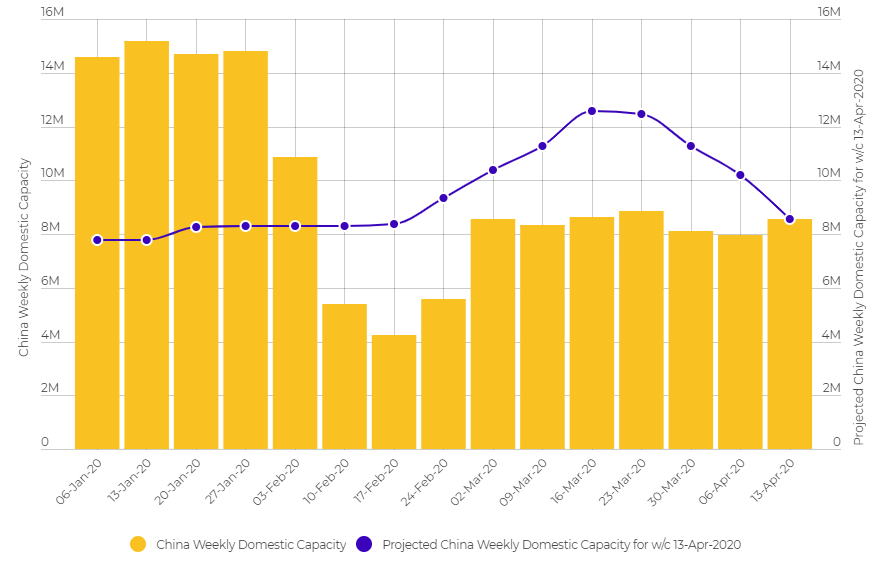

CHART - Growth in domestic capacity in China remains fairly flat and - based on this week alone - is much lower than the levels planned over the past few weeks Source: The Blue Swan Daily and OAG (data: weekly schedule snapshots)

Source: The Blue Swan Daily and OAG (data: weekly schedule snapshots)

While international operations remain severely limited from China as the nation attempts to block a potential second wave of the virus from returning citizens, the chart above highlights domestic flights have been added over Mar-2020 and Apr-2020.

However, when you look at actual capacity for the current week you see that it has been consistently revised downwards from the projected capacity from previous weeks. This would perhaps suggest that the predicted speed and level of recovery was a lot more optimistic than demand levels have perhaps proved.

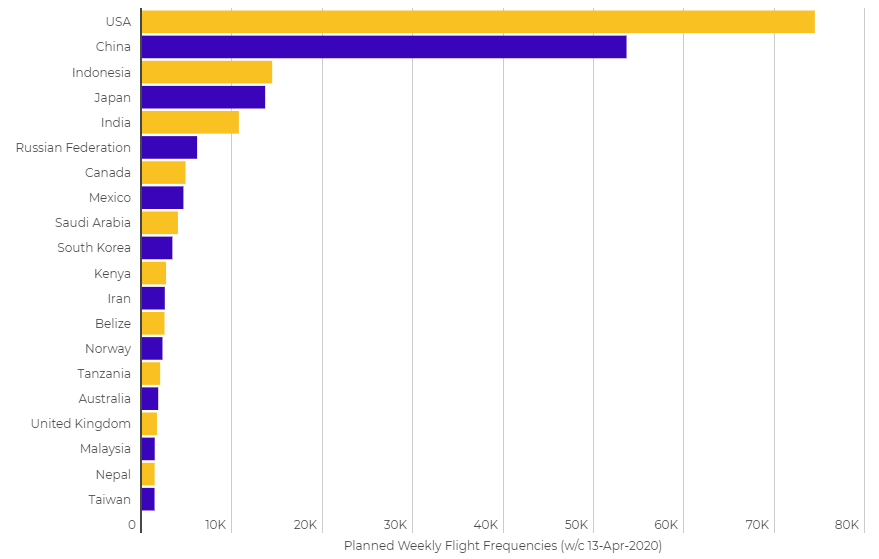

Based on this week's schedule alone, Russia, Mexico, Saudi Arabia and South Korea, have all jumped into the world's top ten country markets by flight departures, while Indonesia and Japan have moved up the rankings. Canada has slipped down the ranking and the United Kingdom, Spain, Germany and Brazil have fallen out of the top ten. Spain, which is now not even in the top 25 country markets this week, according to the latest data from schedules provider OAG, has this week started to ease its domestic mobility restrictions.

CHART - The new aviation world order sees Russia, Mexico, Saudi Arabia and South Korea enter the top ten markets by frequency Source: The Blue Swan Daily and OAG (Data: w/c 13-Apr-2020)

Source: The Blue Swan Daily and OAG (Data: w/c 13-Apr-2020)

The best first step to recovery is stability and that may be the best we can hope for right now. Our insights here show it will be a bumpy ride - literally! - as capacity is tweaked along this unchartered path to meet actual demand. But, what will the path to recovery look like and what will this new normal look like? In China's domestic market that is currently just over half the capacity levels seen pre-COVID-19.

CHART - Global air capacity has collapsed as the COVID-19 pandemic has spread across the world - the year-on-year decline highlights just how far it has fallen Source: The Blue Swan Daily and OAG (data: w/c 13-Apr-2020)

Source: The Blue Swan Daily and OAG (data: w/c 13-Apr-2020)