The government support that CAPA suggested has come from many - but not all - governments and has provided a parachute to avoid a much bigger catastrophe. But many embattled carriers remain on life-support from a virus that has left what will be a long lasting impact on global air travel.

The recovery has now started and for the week commencing 25-May-2020, The Blue Swan Daily analysis of OAG schedule data shows that global flight frequencies are up +2.2% on last week. This is down from the +5.0% growth recorded for the week commencing 18-May-2020, but in line with the +2.0% recorded in the week commencing 11-May-2020. Total frequencies for the week are up from just over 245,000 to above 250,000, a third consecutive rise in weekly air services.

This week has seen the rise of India's domestic market where flights resumed on 25-May-2020, while large jumps are evident in schedules for the big European markets that have faced the largest impact from Covid-19, namely Spain (+76.2%), Italy (+64.2%) the United Kingdom (+48.2%) and to a lesser extent Germany (+38.0%) and France (+37.2%).

The world's largest aviation markets of China and United States of America (USA) have both grown compared to last week, albeit at rates of +2.7% and +1.5%. However, the huge scale of both markets means this equates to over 2,500 flights. This growth in just one week is a similar number to the total frequencies offered (and capacity) from the world's current 14th largest aviation economy, Germany.

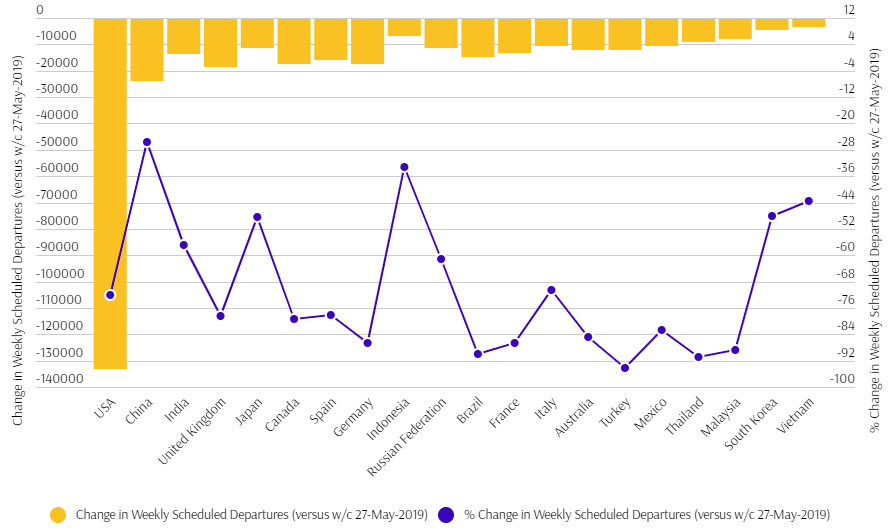

Comparing this week's schedules with the comparable week last year (week commencing 27-May-2019), global flight frequencies are down two-thirds, shrinking -66.7%, while global seat capacity is down -68.9%. While the pre-mentioned European countries have seen a boost in frequencies, they remain down more than -70% compared to last year.

A positive trend is the falling number of top 20 aviation economies with a reduction in flight frequencies of more than -90%, down from eight in week commencing 11-May-2020 to four in the week commencing 18-May-2020, to just two this week - Thailand and Turkey. The growth in China's domestic market mean that frequencies are now down just a quarter year-on-year (-25.8%).

CHART - The reduction in the number of weekly flight departures from each of the 20 largest aviation markets in the world remains significant when compared to the same week last year Source: The Blue Swan Daily and OAG (data: 26-May-2020)

Source: The Blue Swan Daily and OAG (data: 26-May-2020)

A sign of the growing industry is that this week there are 41 countries across the world will see an average of more than 100 flights per day this week (a total of 700 weekly departures), this is up from 36 countries last week. New arrivals into this list for the week commencing 25-May-2020 include Kazakhstan, the Netherlands, Nigeria, Portugal and Turkey.

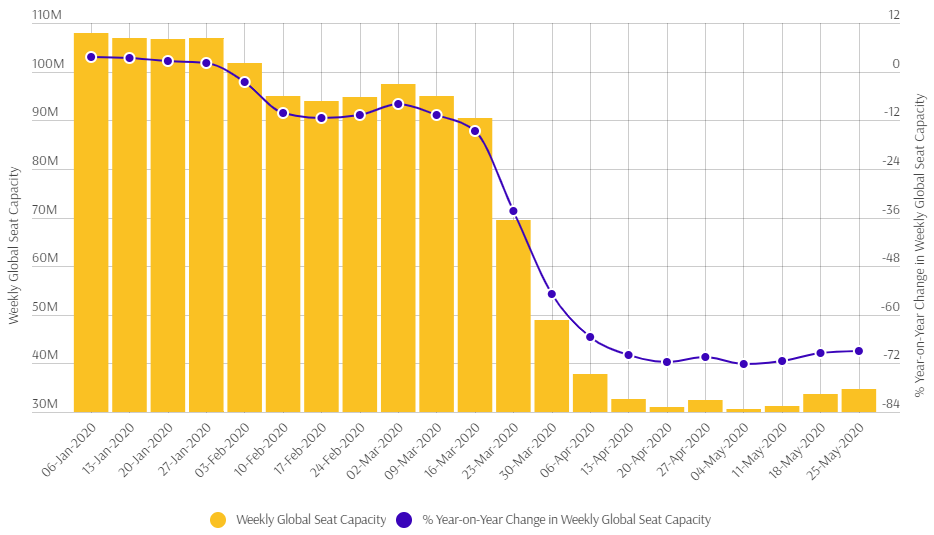

While this week's schedules are heading in the right direction, they also highlight that it could be a long road to recovery. Recently files schedules suggest that a steeper rate of growth will be seen as we move into Jun-2020 and Jul-2020, but right now there is little movement away from the -70% capacity level that has been the global average since late Apr-2020 and the bottom of the curve.

Having seen year-on-year capacity declines exceed -70% each week since 20-Apr-2020, It was encouraging to see it return to the other side of that figure with capacity down -69.4% in the week commencing 18-May-2020 (compared with the week commencing 20-May-2019). This week that number has edged up slightly to -68.9%.

CHART - Global air capacity has collapsed as the Covid-19 pandemic has spread across the world Source: The Blue Swan Daily and OAG (data: 26-May-2020)

Source: The Blue Swan Daily and OAG (data: 26-May-2020)

Where next? We anticipate that we will start to see more of an upturn as we move into Jun-2020, and then further from Jul-2020, but how far we climb is still uncertain. Right now we remain on track for a 'U' recovery and government rhetoric would suggest the world will increasingly start to open. But, things can change quickly and the threat of a second wave of infections means that 'U' or even a rising 'L' could quickly become a 'W' and that would cause further pain for an already embattled industry.