This year saw considerable changes in Chinese tourists' payment methods while abroad. In 2017, 65% of Chinese tourists used mobile payment, a figure that was 25 and 17 percentage points lower, respectively, than the traditional payment options of cash (90%) and bank card (82%).

In 2018, the usage rate of mobile payment rose to 69%, while the two traditional payment methods registered lower use rate. As a result, mobile payment greatly narrowed the gap with cash and bank card payments.

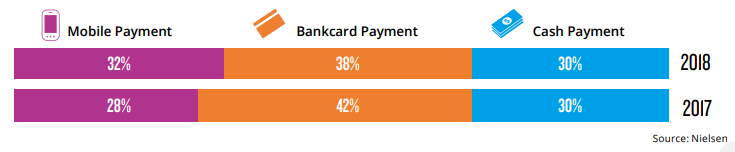

Mobile payment transactions account for 32% of all transactions, overtaking cash for the first time

The proliferation of smartphones has driven the utilisation of mobile payment. Although the bank card is still the most popular payment method among Chinese tourists, this year saw an increase in the share of mobile payment transactions. On their most recent travels overseas, Chinese tourists surveyed paid for 32% of transactions with mobile phones, overtaking cash for the first time, which was used only 30% of transactions.

The proportion of payment transactions by Chinese tourists traveling overseas

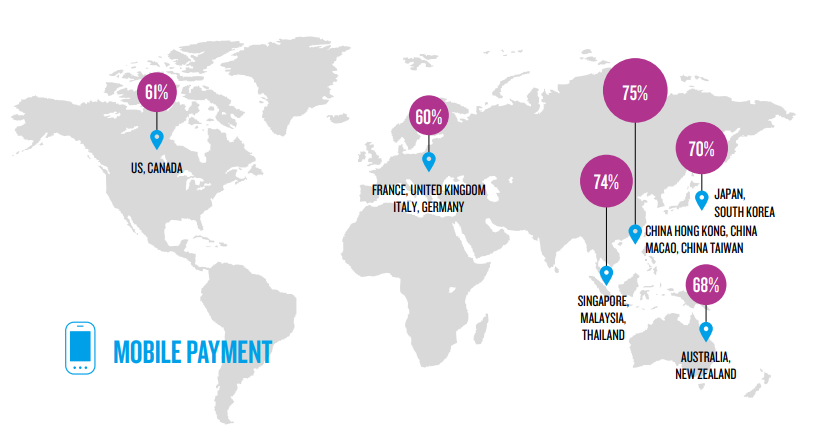

Chinese tourists are using mobile payment all over the world

The application of Chinese mobile payment has followed in the footsteps of Chinese tourists, expanding to both short-haul destinations such as Japan, South Korea and Southeast Asia and to attractions further afield in Australia, New Zealand, Europe and North America. In 2018, about three-quarters of respondents used mobile payment on their most recent trips to Singapore, Thailand or Malaysia; 61% to the United States or Canada; and 60% to the United Kingdom, France, Italy or Germany.

Source: Nielsen

Source: Nielsen

For outbound Chinese tourists, the application of mobile payment has become increasingly diverse, from shopping and dining to spending at tourist attractions, as well as paying for accommodation, transportation, and recreational activities. Of all the shopping use cases, department stores, large supermarkets and duty-free shops are locations where mobile payment is most frequently used by Chinese tourists.

The average number of mobile-paid product categories per person rose to 3.0 from 2.4 in the previous year, with local specialties and food accounting for a much higher proportion. Chinese tourists to Australia and the US are more enthusiastic about paying with mobile payment, and they pay for an average of 3.2 product categories per person. Chinese tourists to Australia tend to use mobile payment to purchase souvenirs, arts and crafts, food, and cosmetics, and Chinese tourists to the US purchase local specialties, clothing, shoes and hats, handbags, suitcases, and digital products.

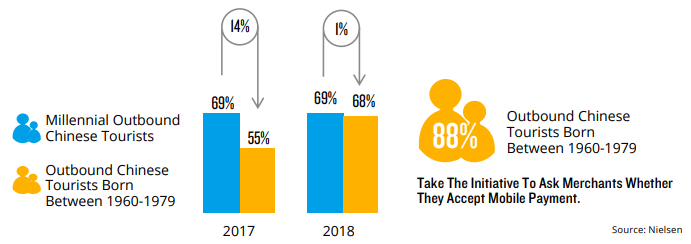

Using mobile payment abroad is not exclusive to the millennial generation

In 2017, 55% of Chinese tourists born between 1960-1979 used mobile payment while traveling overseas-significantly lower than the proportion of millennial tourists, or those born between 1980- 1999. In 2018, the usage rate rose to 68%, almost equaling their younger peers.

In fact, tourists born between 1960-1979 have become more willing to use mobile payment when making purchases overseas. The survey shows that 88% of older Chinese tourists will ask merchants whether they accept mobile payment, an increase of 14 percentage points from the previous year.

The usage rate of mobile payment during overseas travel by different Chinese tourist groups